Press Release: Q4 sales growth of 10.3%, 2024 business EPS guidance exceeded, and strong business EPS rebound expected in 2025

30 Januar 2025 - 7:30AM

UK Regulatory

Press Release: Q4 sales growth of 10.3%, 2024 business EPS guidance

exceeded, and strong business EPS rebound expected in 2025

Sanofi: Q4 sales growth of 10.3%, 2024 business EPS guidance

exceeded, and strong business EPS rebound expected in 2025

Paris, January 30, 2025

Q4: sales growth of 10.3% at

CER1 and business

EPS2 of

€1.31

- Pharma launches

up 56.5%, reaching sales of €0.8 billion, 8% of total sales, led by

ALTUVIIIO

- Dupixent sales

up 16.0% to €3.5 billion

- Vaccines sales

up 10.8% to €2.2 billion, driven by Beyfortus sales in Europe

- Business EPS of

€1.31, -11.0% at CER and -14.9% reported; IFRS EPS of €0.54

FY: double-digit sales growth and business EPS guidance

exceeded

- Sales totaled

€41.1 billion, an increase of 11.3% at CER

- Sales targets

exceeded: Dupixent >€13 billion and Beyfortus blockbuster status

(€1.7 billion) in its first full year

- Research and

Development expenses reached €7.4 billion, up 14.6%, in line with

commitments

- Business EPS of

€7.12, +4.1% at CER, above guidance, and -1.8% reported; IFRS EPS

of €4.59

- The Board of

Directors met on January 29, 2025; proposes a dividend of €3.92 for

2024, 30th year of consecutive increases

Pipeline: increased investment and progress

- Q4: four

regulatory approvals: Dupixent EoE (children) (EU), Kevzara PMR

(EU), Cerdelga GD1 (children) (EU), Efluelda flu

(JP)3

- FY: 14

regulatory approvals of medicines and vaccines, 21 regulatory

submission acceptances, and eight positive phase 3 readouts

emphasize a positive and improving pipeline momentum

Further progress towards a focused biopharma

business

- Intention to

sell a controlling stake in Opella consumer health at an attractive

valuation; closing in Q2 2025 at the earliest4

Guidance

- In 2025, sales

are anticipated to grow by a mid-to-high single-digit percentage at

CER5. Sanofi confirms the expectation of a strong

rebound in business EPS with growth at a low double-digit

percentage at CER (before share buyback).6

- Sanofi intends

to execute a share buyback program in 2025 of €5 billion. Shares

will be purchased preferably through block trades and in the open

market with the purpose of cancellation.

Paul Hudson, Chief Executive Officer:

“We achieved double-digit sales growth in 2024 while pursuing

the transformation of the company. Innovation was a key driver of

our growth as launches already contributed 11 percent of sales,

with Beyfortus becoming a blockbuster in its first full year of

sales. We exceeded our business EPS guidance. In 2024, we announced

an intention to sell a controlling stake in Opella consumer health,

which will make Sanofi a focused, science-driven biopharma company.

We increased R&D investments and achieved significant progress

with our pipeline in 2024, including positive phase 3 study results

for new medicines such as rilzabrutinib in rare diseases and

tolebrutinib in multiple sclerosis. As we enter 2025, we expect

continued, solid growth in sales and a strong rebound in earnings.

We are also confident in the mid to long-term growth prospects of

Sanofi, supported by ongoing launches, Dupixent (currently expected

to reach sales of around €22 billion in

20307, in line with the current

ambition), and expected future launches from our

pipeline.”

|

|

Q4 2024 |

Change |

Change

at CER |

FY 2024 |

Change |

Change

at CER |

|

IFRS net sales reported |

€10,564m |

+9.1% |

+10.3% |

€41,081m |

+8.6% |

+11.3% |

| IFRS net income

reported |

€683m |

— |

— |

€5,744m |

+6.4% |

— |

| IFRS EPS

reported |

€0.54 |

— |

— |

€4.59 |

+6.5% |

— |

| Free cash

flow8 |

€2,340m |

-25.5% |

— |

€5,955m |

-19.6% |

— |

| Business

operating income |

€2,078m |

-11.8% |

-7.7 % |

€11,343m |

+1.5% |

+7.6% |

| Business net

income |

€1,642m |

-15.1% |

-11.2 % |

€8,912m |

-1.8% |

+4.1% |

|

Business EPS |

€1.31 |

-14.9% |

-11.0% |

€7.12 |

-1.8% |

+4.1% |

1 Changes in net sales are at constant

exchange rates (CER) unless stated otherwise (definition in

Appendix 9).

2 To facilitate an understanding of operational performance,

Sanofi comments on the business net income statement which is a

non-IFRS financial

measure (definition in Appendix 9). The income statement is in

Appendix 3 and a reconciliation of reported IFRS to business net

income is in Appendix 4.

3 For the definition of medical and scientific terms, please

see the first use of the word in the Pipeline update

section.

4 Subject to finalization of definitive agreements and subject

to obtaining regulatory approvals from the competent

authorities.

5 In 2025, sales growth will exclude any impact from

hyperinflation. In 2024, it is estimated that sales growth

benefited by 1.8 percentage points.

6 Applying average January 2025 exchange rates, the currency

impacts are estimated between +2% and +3% on sales and +2% and +3%

on business EPS.

7 At CER.

8 Free cash flow is a non-IFRS financial measure (definition in

Appendix 9).

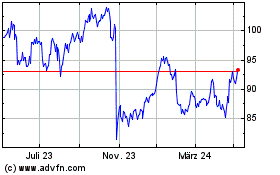

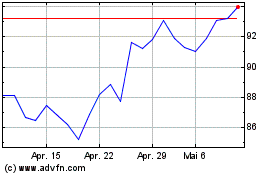

Sanofi (EU:SAN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Sanofi (EU:SAN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025