2024 Q4 Revenue

- €994.6 million in total revenue for 2024, down -5.9%,

reflecting the Group’s strategic orientations

- Prioritizing margins over revenue growth

- Managed decrease in the most mature markets

- Focus on the Group’s profitable growth drivers, primarily in

Germany and in Energy activities

- Q4: €251.8 million in revenue, down -12.4%

- Q4 2023 comparison basis particularly high

- Impact of selectivity measures implemented in Q2 in the telecom

sector in France and Spain

- Fiber activity in Belgium remains low as negotiations continue

between telco service providers seeking to pool their

investments.

- Strong growth in Germany, the group’s future third pillar:

+51%

- Strong growth in Energy activities: +30%

- 2024 full-year margin outlook confirmed

- Improvement of the Group’s adjusted EBITDA margin

- Increase in adjusted EBITDA despite the revenue decline,

demonstrating the relevance of the Group’s reinforced selectivity

strategy

|

|

12 months |

Q4 |

|

In millions of euros (unaudited) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|

Group |

994.6 |

1,057.0 |

-5.9% |

251.8 |

287.3 |

-12.4% |

|

Benelux |

371.6 |

381.6 |

-2.6% |

92.7 |

112.0 |

-17.2% |

|

France |

360.6 |

403.3 |

-10.6% |

90.5 |

105.6 |

-14.3% |

|

Other Countries |

262.4 |

272.1 |

-3.6% |

68.6 |

69.7 |

-1.6% |

Gianbeppi Fortis, Chief Executive Officer of

Solutions30, stated: “As previously announced, Solutions30’s

2024 revenue trends reflect the Group’s strategic priorities, with

a stronger focus on margins over revenue growth in a mixed market

environment. In the fourth quarter, we continued to selectively

scale back our revenue in our most mature segments, particularly in

telecoms in France and Spain, in order to enhance operating

margins. Meanwhile, fiber activity in Belgium remained

temporarily subdued due to ongoing negotiations between service

providers. At the same time, our key growth drivers - primarily

Germany and energy transition-related services - continued to

expand. Notably, energy services now represent nearly 20% of our

fourth-quarter revenue. We confirm our objective of increasing the

Group’s adjusted EBITDA for the full year 2024, despite the revenue

decrease. This demonstrates our ability to significantly improve

operating margins and highlights the effectiveness of our

selectivity strategy in the market environment we faced in

2024.”

Consolidated revenue

In 2024, Solutions30’s consolidated revenue

stood at €994.6 million, down -5.9% compared to 2023. This

includes an organic contraction of -6.5%, a +0.2% impact from

acquisitions, and a +0.4% favorable exchange rate effect.

It also reflects the Group’s strategic

objectives, as outlined during the Capital Markets Day on September

26, 2024, in a context where Solutions30 operates across markets

and business segments at different stages of maturity. The Group

has chosen to increasingly prioritize margins over revenue growth,

leading to a scaling down in the French and Spanish telecom

sectors, where certain contracts no longer met profitability

requirements. At the same time, Solutions30 is accelerating the

expansion of its profitable growth drivers in Germany and in the

energy sector.

Q4 consolidated revenue stood at

€251.8 million, down -12.4% (-12.9% organically) compared to

Q4 2023, which represented a particularly high basis for comparison

(€287.3 million). Trends in Q4 remained in line with those observed

in Q3, with: (i) the impact of selectivity measures implemented in

Q2 in the French and Spanish telecom sectors, (ii) continued low

levels of activity in Benelux, largely due to ongoing negotiations

between Belgian service providers seeking to pool their fiber

roll-out investments, and (iii) continued strong momentum in the

Group’s key growth drivers: Germany, where fiber deployments are

accelerating rapidly, and Energy services, a business the Group is

successfully expanding.

Benelux

2024 Q4 revenue in Benelux stood at €92.7

million, down -17.2% (-17.6% organically) from a particularly high

comparison basis (+61% in Q4 of 2023). Connectivity activities

posted revenue of €67.3 million in Q4, down

-26%. In Belgium, fiber optic deployment remained hindered by

ongoing negotiations between telecom service providers seeking to

streamline nationwide deployment. These negotiations continued to

cause delays in activity for Solutions30, with the impact further

amplified in Q4 by the merger of two of its local clients, Proximus

and Fiberklaar, which led to discussions on adapting operational

processes.

Revenue from Energy activities reached

€16.4 million in Q4, posting a modest 1.8% increase. While the

roll-out of smart meters in Flanders has reached a plateau, further

roll-outs in Wallonia and growth in network services are expected

to drive momentum in the coming quarters. Meanwhile, Energy

services in the Netherlands have slowed down due to electrical grid

congestion, which is expected to prompt additional infrastructure

investments.

Technology Solutions remained strong, generating

€9.0 million in revenue, up +67%, driven by the launch of a

new IT support

contract.

2024 annual revenue in Benelux reached

€371.6 million, down slightly by -2.6% (-2.8% organically),

after extremely strong growth (+72%) in 2023.

France

In France, 2024 Q4 revenue was €90.5 million,

down -14.3% on an organic basis. This decrease is primarily

attributable to Connectivity activities, which contracted by -38.2%

to €45.2 million, following the selectivity measures implemented

since the second quarter. As part of its strategic focus on

profitability, the Group has significantly reduced its exposure to

certain contracts that no longer met its profitability standards,

with the impact further amplified by the slowdown in the fiber

deployment market observed since the beginning of the year.

The Group continues to successfully expand its

Energy business, which posted strong growth of +54% in the fourth

quarter, reaching €26.0 million in revenue, or 29% of the total.

Supported by highly favorable structural trends, this segment is

gradually establishing itself as a major growth driver for

Solutions30, particularly in the photovoltaic sector, where the

Group is achieving significant commercial and operational

successes, recording a +72% increase in the fourth quarter.

Momentum also remains strong in energy network services, which grew

by +61% over the period.

Technology activities sustain a strong momentum,

generating €19.3 million in revenue in Q4, up +24%. Following

an exceptional surge in business during the 2024 Paris Olympics in

Q2, IT support services continued to grow strongly, driven by the

expansion of Internet of Things solutions, particularly the

installation of smart thermostats.

Annual revenue for France in 2024 stood at

€360.6 million, down -10.6%, including a -11% organic

contraction and a +0.4% contribution from recent acquisitions.

Other Countries

In Other countries, the group generated

€68.6 million in revenue in Q4 2024, down slightly by -1.6%.

This includes an organic decline of -3.4% and a positive currency

impact of +1.8%, reflecting the appreciation of the zloty and pound

sterling against the euro during this period.

In Germany, Solutions30 is capitalizing on

exceptional market momentum, with 2024 Q4 revenue increasing by

+51.3% to €24.6 million. Coaxial network services remain

strong while fiber growth is picking up speed. Firmly established

with the leading national telecom operators, the Group has the

organization, expertise, and resources required to play a key role

in accelerating roll-outs in the coming quarters.

Solutions30 has continued to grow in Poland,

with +6.4% revenue growth in Q4, reaching €15.1 million. While

it has, until now, focused on Connectivity activities in this

country, the Group recently won two electric vehicle charging

infrastructure contracts with two major players, Ekoenergetyka and

Inbalance Grid (see press release dated January 8, 2025).

In Italy, Q4 revenue totaled €14.5 million.

Business has returned to growth, posting a +6.2% increase over the

period. However, this growth is offset by the positive impact of

2023 negotiations with the Group’s main Italian client, which was

fully accounted for in Q4 2023, despite covering the entire fiscal

year. This distorts the comparison, resulting in an apparent -10.6%

decline in Q4 2024.

In Spain, revenue amounted to €7.3 million,

down -44.1% due to steps taken in Q2 to reduce the Group’s exposure

to the mature telecoms market. The restructuring of the

Connectivity business and the refocus on the Energy and Technology

activities are ongoing.

Finally, In the United Kingdom, revenue came in

at €7.2 million, down -28.4% compared to Q4 2023. The Group

continues to shift its focus toward the fiber and energy services

markets, driven by a newly appointed local management team.

In 2024, annual revenue for Other Countries was

€262.4 million, down -3.6%, including a -5.0% organic

contraction and a positive exchange rate effect of +1.4%.

2024 full-year margin outlook

confirmed

For the whole of 2024, Solutions30 confirms its

outlook for an improvement in its adjusted EBITDA margin, as well

as an increase in adjusted EBITDA in absolute terms, despite the

decline in revenue. This demonstrates the effectiveness of the

selectivity strategy implemented by the Group in 2024.

Governance

Today the Supervisory Board appointed Mrs. Paola

Bruno as Vice Chair of the Supervisory Board. A valued member of

the Supervisory Board since 2023, Paola Bruno will continue to

bring her extensive experience in corporate finance and strategy to

this leadership role and to Solutions30 organization as a

whole.

Webcast for Investors and

Analysts

Date: Wednesday, January 29, 2025

6:30 PM (CET) – 5:30 PM (GMT)

Speakers

Gianbeppi Fortis, Chief Executive Officer

Amaury Boilot, Group General Secretary

Connection Details

Webcast in French:

https://channel.royalcast.com/landingpage/solutions30-fr/20250129_1/

Upcoming Events

2024 Earnings

Report

March 31, 2025

About Solutions30 SE

Solutions30 provides consumers and businesses

with access to the key technological advancements that are shaping

our everyday lives, especially those driving the digital

transformation and energy transition. With its network of more than

16,000 technicians, Solutions30 has completed over

65 million call-outs since its inception and led over 500

renewable energy projects with a combined maximum output surpassing

1600 MWp. Every day, Solutions30 is doing its part to build a

more connected and sustainable world. Solutions30 has become an

industry leader in Europe with operations in 10 countries:

France, Italy, Germany, the Netherlands, Belgium, Luxembourg,

Spain, Portugal, the United Kingdom, and Poland.

The capital of Solutions30 SE consists of

107,127,984 shares, equal to the number of theoretical votes

that can be exercised. Solutions30 SE is listed on the

Euronext Paris exchange (ISIN FR0013379484- code S30).

Indices : CAC Mid & Small | CAC Small | CAC Technology | Euro

Stoxx Total Market Technology | Euronext Tech Croissance.

Visit our website for more information: www.solutions30.com.

Contact

Individual Shareholders:

Tel: +33 (0)1 86 86 00 63 – shareholders@solutions30.com

Analysts/Investors:

investor.relations@solutions30.com

Press - Image 7:

Charlotte Le Barbier - Tel: +33 6 78 37 27 60 -

clebarbier@image7.fr

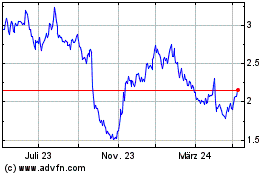

Solutions 30 (EU:S30)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Solutions 30 (EU:S30)

Historical Stock Chart

Von Feb 2024 bis Feb 2025