Nextensa: Half-year financial report 2023

17 August 2023 - 5:40PM

Nextensa: Half-year financial report 2023

REGULATED INFORMATIONBrussels, 17 August 20235:40 PM

NEXTENSA: HALF-YEAR FINANCIAL REPORT

2023HIGHLIGHTS

For the first half of the financial year 2023, we note the

following key information:• Result: Net result (group share)

amounts to €17.1M or €1.71 per share compared to €30.8M or €3.08

per share as at 30 June 2022. This difference is largely

attributable to a substantially lower revaluation result on the

financial assets and liabilities and to the (one-off) gain on the

sale of the Monnet building in H1 of 2022.• Strong investment

portfolio: Nevertheless, rental income continues to increase with

€1.9M in the first half of 2023 compared to the first half of 2022,

despite the sales of several buildings in 2022. This increase is

mainly due to the signing of new leases for vacant spaces in

Belgium and Luxembourg, indexation in Belgium, Luxembourg and

Austria, the 100% occupancy in Austria and the many events taking

place at the Tour & Taxis site. These effects produced

like-for-like rental growth of 13%. Only a slight devaluation by

0.43% of fair value was recorded.• Successful sale of Treesquare:

The Treesquare building located on the De Meeûssquare in the

European district of Brussels was sold in early Q2 to the German

KGAL Investment Management for a net price of €43.7 million,

representing a capital gain of €2M and a yield of 4.23%.• Rotation

of investment portfolio: The portfolio was expanded with a building

located at Avenue Monterey 18 in Luxembourg City, the neighbour of

Nextensa’s office building Monterey 20. A sustainable redevelopment

of both buildings into a wooden office building of about 3,000 m2 -

inspired by the Monteco building in Brussels - is being prepared.•

Innovative developments: The operating result of the development

projects amounts to €9.6 M, being only €2.2 M lower compared to H1

2022, despite the difficult market conditions. Of the 346

apartments of Park Lane phase II at Tour & Taxis, half have

already been reserved or sold. Some 100 deeds have already been

passed. Despite a decline in the sale of apartments in Luxembourg,

the developments at Cloche d’Or make a positive contribution of €

8.0M.• Active financial management: Only limited increase in

financial costs (+ €1.9 M) given the active hedging strategy (hedge

ratio of 71% on 30/06/2023). By reducing the debt ratio to 44.09%,

the rising interest rates have less negative impact on the results.

Several expired credit lines were successfully extended or will be

extended. • Active internal management: Decrease in overhead

costs by €0.5M or 9% compared to H1 2022, against the background of

a nonetheless inflationary environment.FOR MORE

INFORMATION Michel Van Geyte | Chief Executive

OfficerGare Maritime, Rue Picard 11, B505, 1000 Brussels+32 2 882

10 08 | investor.relations@nextensa.euwww.nextensa.euABOUT

NEXTENSA Nextensa is a mixed-use real estate investor

and developer.The company’s investment portfolio is divided between

the Grand Duchy of Luxembourg (44%), Belgium (41%) and Austria

(15%); its total value as of 30/06/2023 was approximately € 1.27

billion.As a developer, Nextensa is primarily active in shaping

large urban developments. At Tour & Taxis (development of over

350,000 sqm) in Brussels, Nextensa is building a mixed

neighbourhood consisting of a revaluation of iconic buildings and

new constructions. In Luxembourg (Cloche d’Or), it is working in

partnership on a major urban extension of more than 400,000 sqm

consisting of offices, retail and residential buildings.The company

is listed on Euronext Brussels and has a market capitalization of

€442.1 million (value 30/06/2023).

- SEMI-AR 2023_ENG_V3.3_DEF

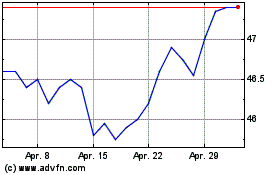

Nextensa (EU:NEXTA)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Nextensa (EU:NEXTA)

Historical Stock Chart

Von Mär 2024 bis Mär 2025