Heineken N.V. reports on 2024 third-quarter trading

23 Oktober 2024 - 8:00AM

UK Regulatory

Heineken N.V. reports on 2024 third-quarter trading

Heineken N.V. reports on 2024

third-quarter trading

Amsterdam, 23 October 2024 – Heineken N.V. (HEIA;

HEINY) publishes its third quarter 2024 trading update.

- Revenue €9,072

million for the quarter, €26,895 million year to date

- Net revenue (beia)

organic growth 3.3% for the quarter, 5.1% year to date

- Beer volume organic

growth 0.7% for the quarter, 1.6% year to date

- Premium beer volume

organic growth 4.5% for the quarter, 4.9% year to date

- Heineken®

volume growth 8.7% for the quarter, 9.0% year to date

- 2024 full year

expectations of 4% to 8% operating profit (beia) organic growth

confirmed and reiterated

Dolf van den Brink, Chairman of the Executive Board /

CEO, commented:

"We delivered a solid quarter of balanced growth, organically

growing beer volume 0.7% and net revenue (beia) 3.3%. Our business

continues to deliver in line with our plan in aggregate, despite

some markets navigating challenging consumer and industry

trends.

Our EverGreen strategy continues to shape our business. Premium

volume grew 4.5%, led by Heineken® up 8.7%, with further

significant contributions from Kingfisher Ultra in India and

Savanna in Southern Africa. Non-alcoholic beer & cider grew

11.0% as we further reinforced global leadership in the segment. As

planned, we are materially stepping up our marketing investments in

the second half of the year. Our €0.5 billion gross savings target

for 2024 is on track.

We confirm and reiterate our full year outlook to grow operating

profit (beia) organically in the range of 4% to 8%, reflecting our

confidence in delivery and commitment to invest behind growth and

to future-proof our business."

Throughout this report figures refer to quarterly performance

unless otherwise indicated.

Revenue in the quarter was €9.1 billion (YTD:

€26.9 billion). Net revenue (beia) increased

organically by 3.3% (YTD: up 5.1%). Total consolidated volume

increased by 0.7% (YTD: up 1.3%) and net revenue (beia) per

hectolitre was up 2.6% (YTD: up 3.7%). Price-mix on a constant

geographic basis was up 3.0% (YTD: up 4.3%), led by pricing to

mitigate inflationary pressures and portfolio premiumisation.

Currency translation reduced net revenue (beia) by €471 million

(YTD: €1,097 million), mainly from the devaluation of the Nigerian

Naira, Mexican Peso, Brazilian Real, and Ethiopian Birr.

Consolidation effects reduced net revenue (beia) by €132 million

(YTD: €81 million), mainly from the disposal of Russia and

Vrumona.

In our business-to-business digital (eB2B)

platforms, we captured €9.3 billion in gross merchandise

value year to date, an organic increase of 26% versus last year. We

are now connecting 683 thousand active customers in fragmented,

traditional channels.

|

IFRS Measures |

€ million |

Total growth |

|

BEIA Measures1 |

€ million |

Organic growth |

|

Revenue |

9,072 |

-5.5% |

|

Revenue (beia) |

9,234 |

3.5% |

| Net

revenue |

7,557 |

-6.1% |

|

Net

revenue (beia) |

7,679 |

3.3% |

Beer volume increased organically by 0.7% (YTD:

up 1.6%), with growth in Europe and Africa & Middle East more

than compensating for slight declines in the Americas and Asia

Pacific. We are gaining or holding volume market share in more than

half of our markets year to date.

|

Beer volume |

|

|

3Q24 |

|

Organic

growth |

|

|

|

YTD 3Q24 |

|

Organic

growth |

| (in

mhl) |

3Q23 |

|

|

|

YTD 3Q23 |

|

|

| Heineken N.V. |

63.2 |

|

61.9 |

|

0.7 % |

|

183.3 |

|

180.1 |

|

1.6 % |

| Africa & Middle East |

8.3 |

|

6.9 |

|

6.4 % |

|

26.9 |

|

21.4 |

|

3.0 % |

| Americas |

22.4 |

|

22.1 |

|

-1.3 % |

|

64.5 |

|

64.8 |

|

0.3 % |

| Asia Pacific |

10.7 |

|

10.7 |

|

-1.2 % |

|

32.0 |

|

33.7 |

|

4.2 % |

|

Europe |

21.8 |

|

22.2 |

|

1.4 % |

|

59.8 |

|

60.3 |

|

0.9 % |

Driving premiumisation at scale, led by

Heineken®

Premium beer volume increased by 4.5% led by

Brazil, South Africa, and India.

Heineken® continued

its favourable momentum and grew volume 8.7% with double-digit

growth in 30 markets.

Heineken®

0.0 grew 3.4%, led by Brazil, USA, and Vietnam.

Heineken®

Silver grew in the high-twenties, with continued

strong growth in China and Vietnam.

|

Heineken® volume |

|

|

|

3Q24 |

|

Organic

growth |

|

YTD 3Q23 |

|

YTD 3Q24 |

|

Organic

growth |

| (in

mhl) |

|

3Q23 |

|

|

|

|

|

| Heineken N.V. |

|

14.6 |

|

15.8 |

|

8.7 % |

|

40.9 |

|

44.5 |

|

9.0 % |

| Africa & Middle East |

|

1.2 |

|

1.3 |

|

18.5 % |

|

3.9 |

|

3.9 |

|

5.3 % |

| Americas |

|

5.9 |

|

6.3 |

|

6.1 % |

|

16.9 |

|

17.9 |

|

6.1 % |

| Asia Pacific |

|

3.1 |

|

3.8 |

|

20.6 % |

|

8.0 |

|

10.2 |

|

26.6 % |

|

Europe |

|

4.3 |

|

4.4 |

|

1.0 % |

|

12.1 |

|

12.6 |

|

2.7 % |

HEINEKEN confirms and reiterates the key financial indicators of

our 2024 guidance, including our full year expectations of 4% to 8%

operating profit (beia) organic growth. As communicated at the

first half year results, we are materially stepping up investments

in our brands focused on our greatest opportunities for long-term

sustainable growth.

|

Media |

|

Investors |

| Christiaan

Prins |

|

Tristan van

Strien |

| Global Communications

Director |

|

Investor Relations

Director |

| Marlie

Paauw |

|

Lennart Scholtus /

Chris Steyn |

| Corporate & Financial

Communication Manager |

|

Investor Relations Manager /

Senior Analyst |

| E-mail:

pressoffice.heineken@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel: +31-20-5239355 |

|

Tel: +31-20-5239590 |

HEINEKEN will host an analyst and investor conference call with

Harold van den Broek, Chief Financial Officer, in relation to its

Third Quarter 2024 Trading Update today at 14:00 CET/13:00 GMT. The

call will be audio cast live via the company’s website:

www.theheinekencompany.com. An audio replay service will also be

made available after the conference call at the above web address.

Analysts and investors can dial-in using the following telephone

numbers:

United Kingdom (Local): 020 3936 2999

Netherlands (Local): 085 888 7233

USA (Local): 646 664 1960

For the full list of dial in numbers, please refer to the

following link: Global Dial-In Numbers

Participation password for all countries: 702767

1Consolidated figures are used throughout this

report, unless otherwise stated. Please refer to the Glossary for

an explanation of non-GAAP measures and other terms. Page 5

includes a reconciliation versus IFRS metrics. These non-GAAP

measures are included in internal management reports that are

reviewed by the Executive Board of HEINEKEN, as management believes

that this measurement is the most relevant in evaluating the

results and in performance management.

- Q3 2024 Trading Update_Final

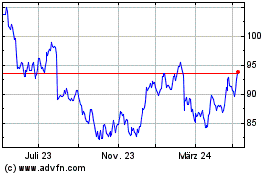

Heineken (EU:HEIA)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

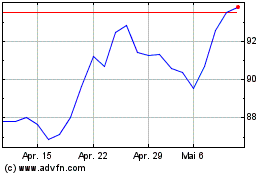

Heineken (EU:HEIA)

Historical Stock Chart

Von Mär 2024 bis Mär 2025