Societe Generale confirms the launch of a Global Employee Share Ownership Programme

23 Mai 2023 - 10:03AM

Societe Generale confirms the launch of a Global Employee Share

Ownership Programme

SOCIETE

GENERALE CONFIRMS

THE LAUNCH

OF A GLOBAL

EMPLOYEE SHARE

OWNERSHIP

PROGRAMME

Press release

Paris, 23 May 2023

Societe Generale confirms the launch of a new

global employee share ownership programme allowing eligible current

employees and retired former employees of the Group to subscribe

for a capital increase reserved for them on preferential terms. The

subscription period for the share offer will take place from June

1st to 15th (inclusive).

The settlement-delivery of the shares should take place on 24

July 2023.

The terms of this transaction are described in

the information document provided below.

This transaction implements the 21st resolution

of the General Meeting held on 17 May 2022. The principle of this

operation, approved by the Board of Directors on 7 February 2023,

was made public in page 14 of the Board of Directors' report

published the 17 April 2023 on the resolutions submitted to the

General Meeting of 23 May 2023 and, before that, in the table of

financial authorisations provided in section 3.1.7 of the Universal

Registration Document dated 13 March 2023 which has been updated,

on page 33 of its first amendment dated 12 May 2023.

Press contacts:

Jean-Baptiste Froville_+33 1 58 98 68 00_

jean-baptiste.froville@socgen.comFanny

Rouby_+33 1 57 29 11 12_

fanny.rouby@socgen.com

23 May

2023

INFORMATION DOCUMENT

PROVIDED

FOR CURRENT EMPLOYEES AND

RETIRED FORMER EMPLOYEES

OF THE SOCIETE GENERALE GROUP PERTAINING

TO A CAPITAL INCREASE IN CASH TARGETING A MAXIMUM

OF

12,556,800

SHARES RESERVED FOR ELIGIBLE CURRENT EMPLOYEES AND

RETIRED FORMER EMPLOYEES PARTICIPATING IN

SOCIETE GENERALE GROUP COMPANY OR GROUP SAVINGS PLANS

2023

GROUP EMPLOYEE SHARE OWNERSHIP

PROGRAMME

|

This information document is available at Societe Generale’s

administrative office (17 cours Valmy - 92972 Paris-La Défense

Cedex), on its website and its intranet site, and was covered by a

press release dated 23 May 2023 distributed and published as

regulated information.This document is prepared in accordance with

the prospectus publication exemptions provided for in Article

1.4(i) and Article 1.5°(h) of Prospectus Regulation (EU) No.

2017/1129. It constitutes the document required to meet the

conditions for exemption from publication of a prospectus as

defined by said Prospectus Regulation, directly applicable in the

domestic law of each Member State of the European Union. |

MAIN CHARACTERISTICS OF THE CAPITAL

INCREASE IN CASH RESERVED FOR ELIGIBLE CURRENT EMPLOYEES

AND RETIRED FORMER EMPLOYEES

PARTICIPATING IN SOCIETE GENERALE GROUP

COMPANY OR GROUP SAVINGS PLANS

|

ISSUER |

Societe Generale, French public limited company (société

anonyme),Share capital: EUR 1,010,261,206.25Registered office: 29,

boulevard Haussmann - 75009 PARISParis Trade and Companies Register

No. 552 120 222 Euronext Paris - Compartment AOrdinary share ISIN

code: FR0000130809Share admitted to Deferred Settlement Service

. |

| Securities

offered |

The maximum overall nominal amount of the capital increase is set

at EUR 15,696,000, corresponding to the issue of 12,556,800

shares available for subscription in cash.The capital increase is

sub-divided into two (2) tranches using separate investment

vehicles, respectively accessible to separate entities or groups of

entities.The Societe Generale shares to be issued will be of the

same class and will be equivalent to Societe Generale shares

already admitted to trading on Euronext Paris (Compartment A). |

| Reasons for

the offer |

The 2023 Group Employee Share Ownership Programme falls within the

scope of the Societe Generale Group employee share ownership

policy, both in France and internationally, allowing beneficiaries

to become involved in the Group’s operations by participating,

through this investment, in the development of Societe Generale, by

expressing their voting rights and participating in the General

Meeting. |

| Terms of

subscription |

The shares will be available for subscription through employee

mutual fund (“FCPE”) in France and directly via the acquisition of

registered shares outside France.Method for determining the

subscription priceThe subscription price of EUR 17.63 is equal to

the arithmetic average of the 20 (twenty) volume-weighted average

prices recorded each day on the Euronext Paris regulated stock

market at the end of each of the 20 (twenty) trading sessions

preceding the morning of 23 May 2023 (date of the decision of the

Chief Executive Officer, setting the subscription period

and the subscription price and acting on the sub-delegation of

the Board of Directors at its meeting of 7 February 2023 using the

authorization granted to the Board by the twenty-first resolution

of the Combined General Meeting of 17 May 2022, with the

application of a 20% haircut. Duration of subscription periodThe

subscription period will begin on Thursday 1st June 2023 at

10:00 a.m. (Paris time) and will end on Thursday 15 June 2023

at 11:59 p.m. (Paris time). |

| |

Terms of subscription for sharesThe first tranche is subscribed

through the Employee Mutual Funds under Company or Group Savings

Plans. The second (2nd) tranche is directly subscribed by employees

under the International Group Savings Plan.Beneficiaries of the

offerThis offer is reserved for employees with seniority of at

least three (3) months, holding an employment contract in effect at

the end of the subscription period, broken down as follows:

- for the 1st

tranche, the beneficiaries of the Societe Generale Company Savings

Plan and the Group Savings Plan;

- for the 2nd

tranche, the beneficiaries of the International Group Savings

Plan.

|

| |

As regards the first tranche, former employees having left their

company after retiring, with this category including pre-retirees,

and having retained assets in the Company or Group Savings Plans,

may also take part in this reserved capital increase. |

| |

Subscription limitIn accordance with Article L. 3332-10 of the

French Labour Code, the total amount of payments made by

Beneficiaries (including payments into other Savings Plans) may not

exceed 25% of their gross annual remuneration received during the

year of subscription or, for Beneficiaries whose employment

contract is suspended and who received no remuneration for the year

of subscription, 25% of the annual limit provided for in Article L.

241-3 of the French Social Security Code. At its meeting of 7

February 2023, the Board of Directors decided that the total amount

of a given Beneficiary’s individual subscription (which may consist

of a voluntary payment, including the transfer of available assets,

as well as the net amounts of profit-sharing, incentive bonuses and

employer matching contribution (not applicable to retirees)) may

not exceed EUR 20,000.Employer matching contribution Employer

matching contribution rules are specific to each Company or Group

Savings Plan and each participating entity. |

| Transaction

timetable |

Subscription will be open from Thursday 1st June 2023 at 10:00 a.m.

(Paris time) to Thursday 15 June 2023 at 11:59 p.m. (Paris time).

The capital increase is scheduled for 24 July 2023. |

| Listing of

new shares |

Listing marketSociete Generale shares are listed on Euronext Paris

(deferred settlement service, continuous trading group A, ISIN code

FR0000130809). |

| |

Listing of new sharesThe listing of the new shares on Euronext

Paris will be requested immediately after the completion of the

capital increase (the listing should be effective on or around 26

July 2023). |

| General

information on new shares subject to a request for

admission to trading |

Rights attached to

shares issuedAs soon as they are created, the new shares will be

subject to all the provisions of the Issuer’s Articles of

Association and will bear dividends rights as of 1 January 2023. As

a result, they will be fully assimilated with the existing shares

and will entitle the shareholders of a public limited company to

the associated legal prerogatives. In particular, they will entitle

shareholders to ownership of the company’s assets and the

liquidation surplus, in a proportion equal to the percentage of

share capital they represent. Similarly, the dividend is

distributed to shareholders in proportion to their shareholding. A

double voting right, in proportion to the capital represented, is

allocated to all fully paid-up shares registered in the name of the

same shareholder, for at least two years, as well as to new

registered shares granted free of charge to a shareholder, in the

event of a capital increase through the incorporation of reserves,

profits or issue premiums, in respect of shares entitled thereto.In

accordance with Article L. 214-165 II, paragraph 3, of the French

Monetary and Financial Code, the voting rights attached to Societe

Generale shares subscribed via the FCPE will be exclusively

exercised individually by the unitholders of said FCPE and, for

fractional units, by the supervisory board of said FCPE.In the

event of a public purchase or exchange offer, the supervisory board

of the FCPE decide, based on the relative majority of the votes

cast, whether or not to tender Societe Generale shares to the

offer. If there is no relative majority, the decision is put to the

vote of the unitholders, who decide based on the relative majority

of the votes cast.Marketability of sharesNo clauses in the Articles

of Association limit the free marketability of the shares

comprising Societe Generale's capital.Only the rules below

governing the unavailability of shares under a Company or Group

Savings Plan will limit the marketability of said shares. |

| |

|

|

Unavailability |

Shares held directly by the Beneficiaries and units of the employee

mutual fund, as applicable, will be unavailable for a period of 5

years, barring cases of early release subject to the conditions

applicable to the Company or Group Savings Plan in question. As

regards the 2nd tranche, in some countries, depending on local

legislation, some cases of early release will not be open to

employees. |

| Specific

disclaimer for international subscriptions |

This document constitutes neither an offer to sell nor a

solicitation to subscribe for Societe Generale shares. The Societe

Generale share offer reserved for eligible current employees and

retired former employees participating in Societe Generale Group

Company or Group Savings Plans will only be implemented in

countries where such an offer has been registered with the relevant

local authorities and/or with the approval of a prospectus by the

competent local authorities, or in consideration of an exemption

from the obligation to establish a prospectus or register the

offer. More generally, the offer will only be made in countries

where all required registration procedures and/or notifications

have been made and the proper authorisations obtained, except for

the exemptions mentioned above. This document is not intended for

countries in which such a prospectus would not have been approved

or such an exemption would not be available, or in which all

required registration and/or notification procedures have not yet

been made or the proper authorisations obtained, and copies of this

document should not be sent in such countries.With respect to the

United States of America in particular, the shares referred to in

this document have not been and will not be registered under the

U.S. Securities Act of 1933 (the “Securities Act”)

and may not be offered or sold in the United States without

registration or exemption from registration in accordance with the

Securities Act. Societe Generale does not intend to register the

offer, in part or in whole, in the United States, or to make public

share offers in the United States. The shares will be offered only

for transactions benefiting from an exemption from registration.Due

to the sanctions imposed by the European Union, this offer is not

open to citizens or residents of Russia who do not have a residence

permit in or are not nationals of a European Union country, of a

country member of the European Economic Area or of Switzerland, or

to citizens or residents or Belarus who do not have a residence

permit in or are not nationals of a European Union

country. . |

Employee contact

Beneficiaries may address any questions relating

to this offer to the contact indicated in the subscription

application provided to them.

Societe GeneraleSociete

Generale is one of the leading European financial services groups.

Based on a diversified and integrated banking model, the Group

combines financial strength and proven expertise in innovation with

a strategy of sustainable growth. Committed to the positive

transformations of the world’s societies and economies, Societe

Generale and its teams seek to build, day after day, together with

its clients, a better and sustainable future through responsible

and innovative financial solutions.Active in the real economy for

over 150 years, with a solid position in Europe and connected to

the rest of the world, Societe Generale has over 117,000 members of

staff in 66 countries and supports on a daily basis 25 million

individual clients, businesses and institutional investors around

the world by offering a wide range of advisory services and

tailored financial solutions. The Group is built on three

complementary core businesses:

- French Retail

Banking with the SG bank, resulting from the merger of the

two Societe Generale and Crédit du Nord networks, and Boursorama.

Each offers a full range of financial services with omnichannel

products at the cutting edge of digital innovation;

- International

Retail Banking, Insurance and Financial Services, with

networks in Africa, Central and Eastern Europe and specialised

businesses that are leaders in their markets;

- Global Banking and Investor

Solutions, which offers recognised expertise, key

international locations and integrated solutions.

Societe Generale is included in the principal socially

responsible investment indices: DJSI (Europe), FTSE4Good (Global

and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity

and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX

Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index

(World and Europe). In case of doubt regarding the authenticity of

this press release, please go to the end of Societe Generale’s

newsroom page where official Press Releases sent by Societe

Generale can be certified using blockchain technology. A link will

allow you to check the document’s legitimacy directly on the web

page. For more information, you can follow us on Twitter

@societegenerale or visit our website societegenerale.com.

- Societe-Generale-Information-Document-GESOP-2023

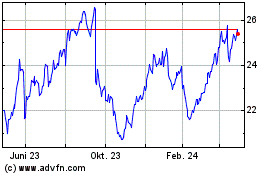

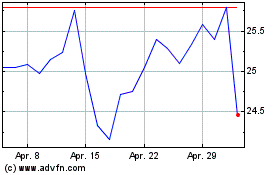

Societe Generale (EU:GLE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Societe Generale (EU:GLE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024