WINFARM : Q3 2023 revenue.

09 November 2023 - 6:00PM

WINFARM : Q3 2023 revenue.

PRESS RELEASE Loudéac, 09 November

2023

Q3 2023 revenue

Stable despite the sharp drop in sales

prices in H1 2023

Revenue growth of +11.5% at 30 September

2023

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), the number-one French distance seller of goods and

solutions and provider of advisory and other services for the

farming and breeding industry, today published its revenue for

third-quarter 2023 and the first nine months of the year.

|

|

Q3 |

|

9 months |

|

in €m, unaudited |

2022 |

2023 |

Chg. |

Chg. organic |

|

2022 |

2023 |

Chg. |

Chg. organic1 |

|

Farming Supplies |

29.8 |

31.3 |

+5.0% |

+1.5% |

|

85.0 |

96.9 |

+14.0% |

+1.0% |

|

Farming Production |

3.5 |

2.9 |

-17.6% |

-17.6% |

|

9.0 |

7.6 |

-15.8% |

-15.8% |

|

Other |

5.6 |

7.6 |

+35.7% |

+35.7% |

|

1.4 |

1.8 |

+28.6% |

+28.6% |

|

TOTAL |

33.9 |

35.0 |

+3.0% |

stable |

|

95.4 |

106.3 |

11.5% |

-0.1% |

Sales prices return to

normal

After falling sharply since the beginning of the

year, particularly in the nutrition and hygiene markets, sales

prices returned to normal in Q3 2023, enabling WINFARM to post

consolidated revenue of €35.0m, up 3% compared with Q3 2022 and

stable at constant scope.

Consolidated revenue year-to-date at 30

September 2023 came out at €106.3m, up 11.5% compared with revenue

at 30 September 2022. At constant scope, sales were stable,

reflecting the new market share gained by the Group, despite an

unfavourable price effect of around 20%.

The Farming Supplies business

(91% of revenue at 30 September 2023), whose products are marketed

under the Vital Concept brand, posted revenue of €96.9m at 30

September 2023, up 14.0% (+1.0% like-for-like). The business

benefited from a €11.1m contribution from Kabelis Group companies,

the business activity of which has been consolidated in the Group’s

scope since August 2022. BTN de Haas, acquired in the Netherlands

in July 2021, continues to post excellent performances,

demonstrating the successful the integration of the company into

WINFARM.

Farming Production:

revenue still down in some export countries making a modest margin

contribution

The Farming Production business

(7% of revenue at 30 September 2023), marketed under the Alphatech

brand, generated revenue of €7.6m at 30 September 2023, down 15.8%.

Despite signs of a recovery at the end of the first half, business

activity in the Middle East (Pakistan, Egypt, Iraq, Saudi Arabia,

UAE), accounting for 17% of Farming Production revenue, remained

weak over the period. Given the sluggishness of these export

markets, the Group has decided to redirect its production towards

more profitable countries with more sustainable growth, in Europe

and Asia.

“Other activities”, which include consulting and

training services, marketed under the Agritech brand, and the

operating activities of the Bel-Orient pilot farm increased sales

by 35.7%.

EBITDA margin expected to improve in H2

2023

The financial discipline measures taken by the

Group in the first half of the financial year, combined with the

more favourable market trend in the last months of the year, should

enable the Group to post a significantly higher EBITDA margin in H2

2023 than in H1 2023.

In the longer term, WINFARM is confirming its

confidence in the target of revenue of around €200m and an EBITDA

margin of around 6.5% by 2025.

Next release:2023 annual

revenue, on 1st February 2024, after market close.

A propos de WINFARM

Fondé à Loudéac, au cœur de la Bretagne, au

début des années 90, le groupe WINFARM est aujourd’hui le premier

acteur français proposant aux marchés de l’agriculture, de

l’élevage, du cheval et du paysage, un ensemble de prestations de

conseil, de service, et de vente à distance de produits et de

solutions globales, uniques et intégrées, pour les aider à répondre

aux nouveaux défis technologiques, économiques, environnementaux et

sociaux de l’agriculture nouvelle génération.

Fort d’un un large catalogue de plus de 35 000

références (semences, produits d’hygiène et de récolte, …),

dont deux-tiers sont composés de marques propres, WINFARM compte

plus de 45 000 clients en France, en Belgique et aux

Pays-Bas.

A l’horizon 2025, WINFARM vise un objectif de

chiffre d’affaires de l’ordre de 200 M€ et une marge EBITDA

d’environ 6,5%.

Pour plus d’information sur la société :

www.winfarm-group.com

Contacts :

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

SEITOSEI.ACTIFINCommunication

financièreBenjamin LEHARI+33 (0) 1 56 88 11

11winfarm@actifin.fr |

Relations presse financièreJennifer JULLIA+33 (0)1

56 88 11 19jjullia@actifin.fr |

- WINFARM_PR_SALES_Q3_2023_09_11_2023_ENG_vdef

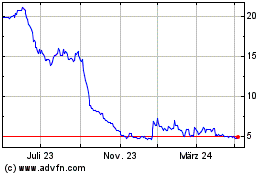

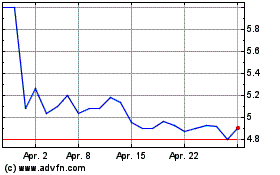

Winfarm (EU:ALWF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Winfarm (EU:ALWF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024