ALSTOM SA: Alstom’s first quarter 2024/25: deleveraging plan

delivered, Q1 orders and sales in line with FY 2024/25 trajectory,

outlook confirmed

Alstom’s first quarter 2024/25:

deleveraging plan delivered, Q1 orders and sales in line with FY

2024/25 trajectory, outlook confirmed

- Hybrid issuance and rights

issue fully executed, closing of North American conventional

signalling business disposal expected in Q2

- Order intake at €3.6

billion

- Sales at €4.4 billion, up

5.1% vs. last year, of which 5.3% organic

- Fiscal year 2024/25 outlook and mid to long-term

ambitions confirmed

23 July 2024 – Over the first

quarter of 2024/25 (from 1 April to 30 June 2024), Alstom booked

€3.6 billion of orders. The Group’s sales reached €4.4 billion in

the quarter, up 5.1% vs. last year, in line with announced growth

trajectory.

The backlog, as of 30 June 2024, settled at

€91.8 billion, providing strong visibility on future sales.

Key figures

Reported figures

(in € million) |

2023/24

Q1

|

2024/25

Q1 |

% Change

Reported |

% Change

Organic |

|

Orders received1 |

3,875 |

3,645 |

(5.9)% |

(5.7)% |

|

Sales |

4,175 |

4,389 |

+5.1% |

+5.3% |

Geographic and product breakdowns of reported orders and

sales are provided in Appendix 1.

“Alstom swiftly executed its deleveraging

plan, resulting in the upgrade by Moody’s of the outlook of its

credit rating. As expected, order volume was soft in the first

quarter, however we secured significant contract wins in Europe,

notably the Hamburg metro, together with robust margin on order

intake. The market is dynamic with a strong pipeline of

opportunities for the next three years. We see solid growth across

all product lines, with strong performance in Services during this

quarter, and we confirm our short and mid-term ambitions.”

said Henri Poupart-Lafarge, Chief Executive

Officer of Alstom.

***

Detailed review

During the first quarter of 2024/25

(from 1 April to 30 June 2024), Alstom recorded €3,645 million

in orders, compared to €3,875 million over the same period

last fiscal year.

Over three months, orders for Services, Signalling and Systems

reached 61% of the total order intake.

On a regional level, Europe accounted for 70% of the Group total

order intake. In Germany, Alstom signed a framework agreement with

Hamburger Hochbahn AG worth up to €2.8 billion. The first call-off

under this framework agreement comprises 48 metro trains and the

CBTC equipment for the first section of the U5 line, including five

of the 23 new metro stations. The call-off, booked during this

first quarter, has a volume of around €670 million.

In Italy, Alstom signed a contract with

Mercitalia Rail, a company of the Polo Logistica FS for the supply

of 70 Traxx Universal locomotives, along with 12 years of full

maintenance services. The contract is valued at over €323 million

and includes the option to supply an additional 30 locomotives and

an extension of the maintenance services.

In the United Kingdom, Alstom signed a contract

worth around €430 million for 10 new nine-car Aventra trains for

Transport for London’s Elizabeth line, along with associated

maintenance until 2046.

In the AMECA region, Alstom has announced a new

Services contract from an undisclosed customer worth approximately

€400 million. The order, received in June 2024, includes a

technical support and spares supply agreement for 12 years.

Sales were €4,389 million in Q1 2024/25

(from 1 April to 30 June 2024) versus €4,175 million in Q1 2023/24

(up 5.1% on a reported basis and 5.3% on an organic

basis).

Rolling Stock sales reached €2,338 million,

representing an increase of 2% on a reported basis and 2% on an

organic basis, driven by a ramp-up of projects in Italy, key

project deliveries in France, and strong execution performance in

the US and India, compensating for a lower cars production (965

cars versus 1,122 for the same period last fiscal year) notably due

to the end of the production of legacy projects in UK (Aventra) and

Germany.

Services delivered a sustained strong

performance and reported €1,073 million of sales, up 12% on a

reported basis and 13% on an organic basis, benefiting from an

important ramp-up of Services project in the UK, Germany and

Australia, and consistent performance in North America.

Signalling sales stood at €637 million, up 6% on

a reported basis and 6% on an organic basis, led by a consistent

execution across all regions, mainly in the US, Germany and

Australia.

In Systems, Alstom reported €341 million sales,

up 4% on a reported basis and 5% on an organic basis, on the back

of a good performance of Turnkey projects in Mexico, France and

Canada.

The book-to-bill ratio is 0.83 over the

quarter.

***

Key project deliveries

During the first quarter of 2024/25, Alstom's employees

mobilized effectively to meet the deadline for the entry into

commercial service of 3 metro lines, 2 tramway lines and RER line

extensions in the Île-de-France region, in the run-up of the sport

events organised in Paris this summer 2024.

***

Progress on the €2 billion inorganic

deleveraging plan

The hybrid bond issuance for €750 million and

the rights issue for €1 billion euros have been fully executed

during this quarter.

The preparation for the sale of the North

American conventional signalling business to Knorr-Bremse AG is

progressing well and closing is expected to take place during the

second quarter of FY 2024/25.

***

Assumptions for rest of FY

2024/25

Following execution of the deleveraging plan,

outlook for FY 2024/25 is based on following main assumptions:

- Supportive market demand

- FY 2024/25 downpayments consistent

with FY 2023/24

- End of the Bombardier

Transportation integration program in FY 2024/25

Outlook for FY 2024/25

- Book to bill above 1

- Sales organic growth: around

5%

- aEBIT margin around 6.5 %

- Free Cash Flow generation within

the €300 million to €500 million range

- Seasonality driving:

- negative FCF within a range of

€(300)m to €(500)m in H1 2024/25

- margin improvement to be more H2

weighted

***

Mid to long-term ambitions are confirmed as per

the May 8, 2024, full year announcement.

***

Financial calendar

| 13 November

2024 |

2024/25

Half-Year Results |

***

Analysts Conference Call

Alstom is pleased to invite the analysts to a

conference call presenting its first quarter orders and sales for

the fiscal year 2024/25 on Tuesday 23 July at 6:30 pm (Paris time),

hosted by Bernard Delpit, EVP and CFO.

A live audiocast will also be available on

Alstom’s website: Alstom’s first quarter orders and sales for FY

2024/25.

To participate in the Q&A session (audio

only), please use the dial-in numbers below:

- France: +33 (0) 1

7037 7166

- UK: +44 (0) 33 0551

0200

- USA: +1 786 697

3501

- Canada: 1 866 378

3566 (toll free)

Quote ALSTOM to the operator to

be transferred to the appropriate conference.

***

Alstom™, Aventra™, Coradia™, Coradia Stream™,

Traxx™ and Traxx Universal™ are protected trademarks of the Alstom

Group.

1 Non - GAAP. See definition in the

appendix.

|

About Alstom

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 64 countries and a talent base of over 84,700 people from 184

nationalities, the company focuses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €17.6 billion

for the fiscal year ending on 31 March 2024.

For more information, please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:

Philippe MOLITOR - Tel. : +33 (0)7 76 00 97 79

philippe.molitor@alstomgroup.com

Thomas ANTOINE - Tel.: +33 (0) 6 11 47 28 60

thomas.antoine@alstomgroup.com

Investor relations:

Martin VAUJOUR – Tel.: +33 (0) 6 88 40 17 57

martin.vaujour@alstomgroup.com

Estelle MATURELL ANDINO – Tel.: +33 (0)6 71 37 47 56

estelle.maturell@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause reported results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or

form part of a prospectus or any offer or invitation for the sale

or issue of, or any offer or inducement to purchase or subscribe

for, or any solicitation of any offer to purchase or subscribe for

any shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the approval from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient, or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Joint Global Coordinators, their

affiliates, shareholders, and their respective directors, officers,

advisers, employees or representatives undertake no obligation to

provide the recipient with access to any additional

information.

APPENDIX 1A – GEOGRAPHIC

BREAKDOWN

|

Reported figures |

2023/24 |

% |

2024/25 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Europe |

1,850 |

48% |

2,570 |

70% |

|

Americas |

848 |

22% |

318 |

9% |

|

Asia / Pacific |

1,168 |

30% |

237 |

7% |

|

Middle East / Africa |

9 |

0% |

520 |

14% |

|

Orders by destination |

3,875 |

100% |

3,645 |

100% |

|

Reported figures |

2023/24 |

% |

2024/25 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Europe |

2,516 |

60% |

2,494 |

57% |

|

Americas |

772 |

19% |

894 |

20% |

|

Asia / Pacific |

546 |

13% |

624 |

14% |

|

Middle East / Africa |

341 |

8% |

377 |

9% |

|

Sales by destination |

4,175 |

100% |

4,389 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Reported figures |

2023/24 |

% |

2024/25 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Rolling stock |

1,387 |

36% |

1,410 |

39% |

|

Services |

554 |

14% |

1,199 |

33% |

|

Systems |

1,465 |

38% |

119 |

3% |

|

Signalling |

469 |

12% |

917 |

25% |

|

Orders by product line |

3,875 |

100% |

3,645 |

100% |

|

Reported figures |

2023/24 |

% |

2024/25 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Rolling stock |

2,294 |

55% |

2,338 |

53% |

|

Services |

956 |

23% |

1,073 |

24% |

|

Systems |

326 |

8% |

341 |

8% |

|

Signalling |

599 |

14% |

637 |

15% |

|

Sales by product line |

4,175 |

100% |

4,389 |

100% |

APPENDIX 2 - NON-GAAP FINANCIAL

INDICATORS DEFINITIONS

This section presents financial indicators used by the Group that

are not defined by accounting standard setters.

Orders received

A new order is recognised as an order received only when the

contract creates enforceable obligations between the Group and its

customer. When this condition is met, the order is recognised

at the contract value. If the contract is denominated in a currency

other than the functional currency of the reporting unit, the Group

requires the immediate elimination of currency exposure using

forward currency sales. Orders are then measured using the spot

rate at inception of hedging instruments.

Book-to-Bill

The book-to-bill ratio is the ratio of orders received to the

amount of sales traded for a specific period.

Gross margin % on backlog

Gross Margin % on backlog is a KPI that presents the expected

performance level of firm contracts in backlog. It represents the

difference between the sales not yet recognized and the cost of

sales not yet incurred from the contracts in backlog. This % is an

average of the portfolio of contracts in backlog and is meaningful

to project mid- and long-term profitability.

Adjusted Gross Margin before

PPA

Adjusted Gross Margin before PPA is a KPI that presents the level

of recurring operational performance. It represents the sales minus

the cost of sales, adjusted to exclude the impact of amortisation

of assets exclusively valued when determining the PPA in the

context of business combination as well as significant,

non-recurring “one off” items that are not expected to occur again

in subsequent years.

EBIT before PPA

Following the Bombardier Transportation acquisition and with effect

from the fiscal year 2021/22 condensed consolidated financial

statements, Alstom decided to introduce the “EBIT before PPA” KPI

aimed at restating its Earnings Before Interest and Taxes (“EBIT”)

to exclude the impact of amortisation of assets exclusively valued

when determining the PPA in the context of business combination.

This KPI is also aligned with market practice.

Adjusted EBIT

Adjusted EBIT (“aEBIT”) is the Key Performance Indicator to present

the level of recurring operational performance. This indicator is

also aligned with market practice and comparable to direct

competitors.

Starting September 2019, Alstom has opted for the inclusion of the

share in net income of the equity-accounted investments into the

aEBIT when these are considered to be part of the operating

activities of the Group (because there are significant operational

flows and/or common project execution with these entities). This

mainly includes Chinese joint-ventures, namely CASCO joint-venture

for Alstom as well as, following the integration of Bombardier

Transportation, Alstom Sifang (Qingdao) Transportation Ltd.

(formerly Bombardier Sifang), Bombardier NUG Propulsion System Co.

Ltd and Changchun Changke Alstom Railway Vehicles Company Ltd

(formerly Changchun Bombardier).

aEBIT corresponds to Earning Before Interests and Tax adjusted for

the following elements:

- net

restructuring expenses (including rationalization costs)

- tangibles and

intangibles impairment

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity

- any other

non-recurring items, such as some costs incurred to realize

business combinations and amortization of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business

- and including

the share in net income of the operational equity-accounted

investments

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.

Adjusted EBIT margin corresponds to Adjusted EBIT expressed as a

percentage of sales.

EBITDA before PPA + JV

dividends

EBITDA before PPA plus dividends from joint ventures is the EBIT

before PPA, before depreciation and amortisation, with the addition

of the dividends received from joint ventures.

Adjusted net profit

The “Adjusted Net Profit” KPI restates Alstom’s net profit from

continued operations (Group share) to exclude the impact of

amortisation of assets exclusively valued when determining the PPA

in the context of business combination, net of the corresponding

tax effect. This indicator is also aligned with market

practice.

Free cash flow

Free Cash Flow is defined as net cash provided by operating

activities less capital expenditures including capitalised

development costs, net of proceeds from disposals of tangible and

intangible assets. Free Cash Flow does not include any proceeds

from disposals of activity.

The most directly comparable financial measure to Free Cash Flow

calculated and presented in accordance with IFRS is net cash

provided by operating activities.

Funds from Operations

Funds from Operations “FFO” in the EBIT to FCF statement refers to

the Free Cash Flow generated by Operations, before Working Capital

variations.

Contract and Trade Working

Capital

Contract Working Capital is the sum of:

- Contract Assets & Liabilities,

which includes the Customer Down-Payments

- Current provisions, which includes

Risks on contracts and Warranties

Trade Working Capital is the Working Capital that is not

strictly related to contract. It includes all the elements of the

working capital but

- Income Tax receivables and

payables

- Restructuring provisions

Net cash/(debt)

The net cash/(debt) is defined as cash and cash equivalents,

marketable securities and other current financial asset, less

borrowings.

Pay-out ratio

The pay-out ratio is calculated by dividing the amount of the

overall dividend with the “Adjusted Net profit from continuing

operations attributable to equity holders of the parent, Group

share” as presented in the management report in the consolidated

financial statements.

Organic basis

This press release includes performance indicators presented on a

reported basis and on an organic basis. Figures given on an organic

basis eliminate the impact of changes in scope of consolidation and

changes resulting from the translation of the accounts into Euro

following the variation of foreign currencies against the Euro.

The Group uses figures prepared on an organic basis both for

internal analysis and for external communication, as it believes

they provide means to analyse and explain variations from one

period to another. However, these figures are not measurements of

performance under IFRS.

| |

Q1 2023/24 |

|

Q1 2024/25 |

|

|

|

|

|

(in € million) |

Reported

figures |

Exchange

rate and scope impact |

Comparable

Figures |

|

Reported

figures |

|

|

% Var Act. |

% Var Org. |

|

Orders |

3,875 |

11 |

3,864 |

|

3,645 |

|

|

(5.9)% |

(5.7)% |

|

Sales |

4,175 |

7 |

4,168 |

|

4,389 |

|

|

5.1% |

5.3% |

- PR Alstom Q1 2024-25 Results- EN - Final

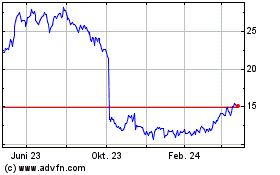

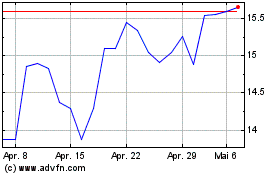

Alstom (EU:ALO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Alstom (EU:ALO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025