Q2 2023 Financial Results

xx

July 28, 2023

|

Strong Q2 Operating Margin at 9.6%

Positive adjusted operating free cash flow at €0.6

billion |

-

Group capacity at 92% compared to 2019 with load factor at 88%

-

Group revenues at €7.6bn, an improvement of €0.9bn compared to last

year

-

Operating result at €0.7bn with an operating margin at 9.6%

-

Positive adjusted operating free cash flow at €0.6bn and cash at

hand at €10bn

-

Net debt down by €1.4bn euros, compared to end of 2022 leading to a

Net debt/EBITDA ratio of 1.2x

-

Net income at €0.6bn supporting equity restoration

-

Post quarter, €0.5bn quasi-equity financing for Air France’s

Engineering and Maintenance (MRO) components activity

Commenting on the results, Mr. Benjamin

Smith, Group CEO, said:

“We have again delivered a strong set of results

during the Second Quarter of 2023. In spite of the inflationary

context, we posted double-digit growth in our revenues and a record

operating margin. The rollout of new award-winning products across

our airlines continued unabated, which serves as a testament of the

commitment of our employees, whom I would like to thank. We

were also busy throughout the quarter, actively preparing for the

summer. I am very glad to see that the situation at airports is

much better, including at KLM’s hub at Amsterdam Schiphol Airport.

This season notably serves as a test run for 2024, when France will

host the Olympic and Paralympic Games, of which Air France is an

official partner. Lastly, we have also continued delivering on our

strategic roadmap, and secured ambitious partnerships in the field

of sustainability, preparing for our medium to long-term

future.”

Operating result improved compared to 2022 driven by

strong revenue growth

| |

Current quarter |

Year to date |

|

|

2023 |

change |

changeconstant currency |

2023 |

change |

changeconstant currency |

|

Revenues (€m) |

7,624 |

+13.7 % |

+14.1% |

13,953 |

+25.1 % |

+24.8% |

| EBITDA (€m) |

1,328 |

397 |

405 |

1,614 |

462 |

488 |

| Operating result

(€m) |

733 |

347 |

355 |

426 |

390 |

418 |

| Operating margin

(%) |

9.6 % |

+3.9pt |

+4.0pt |

3.1 % |

+2.7pt |

+3.0pt |

| Net income –

Group part (€m) |

604 |

280 |

|

260 |

488 |

|

|

Adj. operating free cash flow (€m) |

557 |

(975) |

|

1,240 |

(923) |

|

|

|

30 June 2023 |

31 Dec 2022 |

|

Net Debt |

4,900 |

6,337 |

| EBITDA trailing

12 months |

4,077 |

3,615 |

|

Net Debt/EBITDA ratio |

1.2x |

1.8x |

In Q2 2023, revenues were up +14.1% compared to

Q2 2022, driven by a higher capacity (+8%), a higher passenger load

factor (+3 pt) and a higher passenger yield (+9%). The operating

result improved compared to last year by €347 million while last

year the operating result was supported by €42 million furlough

contribution. A lower jet fuel price and a higher yield

compensating inflation accelerated the growth in operating result

and translated into a margin at 9.6%.

As a result, compared to last year, net income

strongly grew by €280 million, amounting to €604 million,

supporting the equity restoration.

The adjusted operating free cash flow in the

second quarter amounted to €557 million, a reduction of €975

million compared to last year. This different pattern is explained

by a catch up in summer ticket sales in Q2 2022. The net debt ended

at €4.9 billion, an improvement compared to year end 2022 of €1.4

billion.

Increase in Group unit revenue driven by passenger unit

revenue

| |

Current quarter |

Year to date |

|

|

2023 |

change |

changeconstant currency |

2023 |

change |

changeconstant currency |

|

Passengers (thousands) |

24,664 |

+8.2% |

|

44,315 |

+18.7% |

|

| Capacity (ASK

m) |

78,144 |

+8.3% |

|

147,727 |

+13.5% |

|

| Traffic (RPK

m) |

68,498 |

+11.6% |

|

128,418 |

+22.9% |

|

| Passenger load

factor |

87.7% |

+2.6pt |

|

86.9% |

+6.7pt |

|

| Passenger unit

revenue per ASK (€ cts) |

8.32 |

+12.3% |

+12.6% |

7.87 |

+21.0% |

+20.7% |

| Group unit

revenue per ASK (€ cts) |

8.94 |

+4.9% |

+5.4% |

8.59 |

+11.1% |

+10.9% |

|

Group unit cost per ASK (€ cts) at constant fuel1 |

8.00 |

+0.2% |

+6.4% |

8.31 |

+7.8% |

+5.9% |

In the second quarter 2023, Air France-KLM

welcomed 24.7 million passengers which is 8.2% above previous year.

As capacity increased by 8.3% and traffic grew by 11.6%, the load

factor increased by 2.6 points compared to last year.

The Group reached a very strong group passenger

unit revenue per ASK, up +12.3% compared to last year. This

increase was driven by load factor increase especially on the long

haul network (North America, Africa, Asia & Middle East and

Transavia) and yield on the full network except Asia.

Group unit cost per ASK at constant fuel and

constant currency is up 6.4% versus last year (5.6% excluding

furlough). The inflation related to salary increases started last

year in the third quarter and especially in the fourth quarter. The

increase in the second quarter is mainly coming from higher

salaries including profit sharing, but also from an increase in ATC

charges, airport charges, ETS and higher cost due to a higher load

factor.

Equity restoration

Air France-KLM and Apollo Global Management

announced post-quarter that they have signed a definitive agreement

for Apollo-managed funds and entities (“Apollo”) to raise a €500

million financing into an operating affiliate of Air France that

will own a pool of components dedicated to Air France’s Engineering

and Maintenance activities.

Under this agreement and subject to customary

closing conditions, Apollo will subscribe to perpetual bonds issued

by this ad hoc operating affiliate and this financing will be

accounted as equity under IFRS. The financing’s proceeds will be

allocated to general corporate purposes and support future

components expenditures related to the maintenance activity.

The perpetual bonds will bear an interest rate

of 6.9% for the first 3 years and gradual step ups and caps will be

applied thereafter. Air France will have the ability to redeem them

at any time after 3 years.

On July 27, 2023, Air France-KLM announced that

it has entered into exclusive discussions with Apollo Global

Management regarding the potential financing of €1.5bn to a

dedicated operating affiliate of Air France-KLM. This entity will

hold the trademark and most of the commercial partner contracts

related to Air France and KLM’s joint loyalty program (Flying

Blue), and will become the exclusive issuer of miles for the

airlines and partners.

This financing would be accounted as equity

under IFRS, allowing Air France-KLM to make a further step towards

its commitment to restore its equity and strengthen its balance

sheet, aside from net profit generation and/or straight hybrid

bonds.

OUTLOOK

Capacity

The Group expects the capacity in Available Seat

Kilometers for Air France-KLM Group including Transavia at an index

of:

-

Circa 95% for the third quarter of 2023

-

Above 95% for the fourth quarter of 2023

-

Circa 95% for the Full Year 2023

All indices compared to the respective period of

2019.

Unit cost2

Due to the inflationary pressure, mainly driven

by CLA increases, profit sharing, load factor impact and a decrease

in the forecasted capacity, the Group expects from now on for 2023

a low single digit increase of the unit cost increase compared to

2022.

Capex

Full year 2023 net capex is estimated at 3.0

billion euros.

MEDIUM TERM OUTLOOK3

The Group continues its swift transformation

initiatives and confirms its medium-term financial ambition with

the long-term focus of achieving increased competitiveness. To do

this, the Group remains agile in optimizing fleet, workforce,

network, costs and continues its sustainability efforts. The Group

expects capacity in Available Seat Kilometers back to 2019 levels

as from 2024.

The transformation efforts of the Group,

including FTE reduction, fleet renewal and spend optimization, will

compensate the inflationary pressure on cost. Therefore, the Group

expects to decrease its unit cost in the period 2024-2026 year over

year against a constant fuel price, constant currency and excluding

Emission Trading Scheme costs (ETS).

The Adjusted Operating Free Cash Flow excluding

exceptionals is expected to remain positive. Exceptionals include

the payment of the air-freight litigation and the deferrals of

social charges, pensions and wage taxes accumulated during the

Covid 19 period.

The Net Debt/EBITDA target ratio is expected to

remain between 1.5x and 2.0x.

The Group’s medium-term financial ambition is to

reach an Operating Margin of 7% to 8%.

Business review

Network: Operating result more than doubled

|

Network |

Current quarter |

Year to date |

|

2023 |

change |

changeconstant currency |

2023 |

change |

changeconstant currency |

|

Traffic revenues (€m) |

6,257 |

+13.1% |

+13.6% |

11,585 |

+25.8% |

+25.6% |

| Total revenues

(€m) |

6,520 |

+13.3% |

+13.8% |

12,095 |

+25.4% |

+25.2% |

| Operating result

(€m) |

692 |

+340 |

+342 |

542 |

+499 |

+519 |

|

Operating margin (%) |

10.6% |

4.5 pt |

|

4.5% |

4.0 pt |

|

Compared to the second quarter 2022, total

revenues increased by +13.3% to €6,520 million. The operating

result improved by €340 million and amounted to €692 million. The

increase in revenues was driven by the network passenger business

while the Cargo revenues declined compared to a strong second

quarter last year and a further softening of the market.

Robust growth in unit revenue

|

Passenger network |

Current quarter |

Year to date |

|

2023 |

change |

changeconstant currency |

2023 |

change |

changeconstant currency |

|

Passengers (thousands) |

18,743 |

+6.8% |

|

34,530 |

+17.1% |

|

| Capacity (ASK

m) |

66,714 |

+8.1% |

|

128,690 |

+12.6% |

|

| Traffic (RPK

m) |

58,319 |

+11.1% |

|

111,284 |

+21.8% |

|

| Load factor |

87.4% |

2.4pt |

|

86.5% |

6.5pt |

|

| Total passenger

revenues (€m) |

5,913 |

+22.3% |

+22.6% |

10,816 |

+38.3% |

+38.0% |

| Traffic passenger

revenues (€m) |

5,770 |

+21.9% |

+22.3% |

10,522 |

+38.3% |

+37.9% |

|

Unit revenue per ASK (€ cts) |

8.65 |

+12.8% |

+13.1% |

8.18 |

+22.8% |

+22.4% |

Second quarter 2023 capacity in Available Seat

Kilometers (ASK) was 8.1% higher than last year and at 88% of 2019

level, which is in line with the Group’s guidance provided during

the first quarter 2023 results presentation (c.90% versus

2019).

Unit revenue per ASK increased by 13.1% at a

constant currency thanks to strong demand which resulted in an

increase in load factor of 2.4 points and a yield increase of 10%

compared to last year at constant currency.

During the second quarter we observed per area

the following trends:

North AtlanticDemand recovery continued to be

driven by Point of Origin North America. Yield increased by 13% at

a slightly higher capacity of 2% while the load factor increased 4

points compared to last year.

Latin AmericaVery strong yield performance, 12%

up compared to 2022, mainly driven by strong yields close in.

Asia & Middle EastCapacity in the second

quarter has significantly increased vs 2022 by 56%, mainly driven

by China’s reopening. Nevertheless, this is still -34% below 2019

levels. Yields are stable compared to 2022 which is lower than the

other areas, but this is mainly driven by the exceptional yields in

2022 due to the low capacity.

Caribbean & Indian OceanThe second quarter

showed significant capacity reductions compared to 2022 (-16%) due

to redeployment of fleet to other long haul areas. The reduction in

capacity resulted in very good performance on yield, 22% up versus

2022.

AfricaStrong traffic dynamics

with load factor up 3 points compared to 2022. Robust yield at 6%

above 2022.

Short and Medium-haulIn April the domestic

network was impacted by ATC strikes. Yield improved by 10% compared

to last year while capacity grew 4%. Load factor slightly up by 1

point.

Cargo: demand continued to soften resulting in pressure

on unit revenues

|

Cargo business |

Current quarter |

Year to date |

|

2023 |

change |

changeconstant currency |

2023 |

change |

changeconstant currency |

|

Tons (thousands) |

213 |

-10.0% |

|

421 |

-10.8% |

|

| Capacity (ATK

m) |

3,557 |

+6.5% |

|

6,845 |

+8.4% |

|

| Traffic (RTK

m) |

1,585 |

-8.5% |

|

3,143 |

-10.2% |

|

| Load factor |

44.6% |

-7.3pt |

|

45.9% |

-9.5pt |

|

| Total Cargo

revenues (€m) |

606 |

-33.9% |

-33.0% |

1,279 |

-30.0% |

-29.7% |

| Traffic Cargo

revenues (€m) |

487 |

-39.1% |

-38.4% |

1,063 |

-33.4% |

-33.1% |

|

Unit revenue per ATK (€ cts) |

13.70 |

-42.8% |

-42.1% |

15.53 |

-38.6% |

-38.3% |

Total revenues dropped by -33.9% compared to

last year. The resumption of the passenger travel resulted in an

increase in Available Ton Kilometers of 6.5% versus the second

quarter of 2022. Last year, the second quarter still showed a

strong demand and therefore the traffic decreased year over year by

-8.5%. As global economic growth is slowing down, container prices

for sea freight declined and therefore demand for air cargo

softened. The load factor was 7.3 points below 2022 and due to the

increased belly capacity, the yield declined as well resulting in a

decrease in unit revenue per Available Ton Kilometer of -42.1%

against a constant currency.

Transavia: Encouraging unit revenue development

resulting in a break-even result

|

Transavia |

Current quarter |

Year to date |

|

2023 |

change |

2023 |

change |

|

Passengers (thousands) |

5,921 |

+12.8% |

9,785 |

+25.0% |

| Capacity (ASK

m) |

11,429 |

+9.6% |

19,037 |

+19.5% |

| Traffic (RPK

m) |

10,179 |

+14.5% |

17,134 |

+30.3% |

| Load factor |

89.1% |

+3.9pt |

90.0% |

+7.4pt |

| Total Passenger

revenues (€m) |

712 |

+18.4% |

1,089 |

+28.2% |

| Unit revenue per

ASK (€ cts) |

6.38 |

+8.8% |

5.83 |

+7.6% |

| Unit cost per ASK

(€ cts) |

6.38 |

+5.6% |

6.73 |

+10.2% |

|

Operating result (€m) |

0 |

+18 |

-172 |

-62 |

Compared to the second quarter 2022, the demand

in leisure traffic continued to grow, despite operational

disruptions due to ATC strikes in France and fleet issues in the

Netherlands. The capacity increased by 9.6%, traffic increased by

14.5%, and the number of passengers increased by 12.8% resulting in

a load factor 3.9 points above 2022. Transavia is still expanding

its network, with a capacity growth in available seat kilometers of

+20% compared to 2019 and the routes are yet to mature further.

Transavia was able to improve further in the second quarter to a

break-even operating result, which is promising for the Q3 peak

season for which strong bookings are already visible.

Maintenance business: continued growth on third party

revenues despite supply chain

|

Maintenance |

Current quarter |

Year to date |

|

2023 |

change |

changeconstant currency |

2023 |

change |

changeconstant currency |

|

Total revenues (€m) |

1,055 |

+15.8% |

|

1,981 |

+13.7% |

|

| Third party

revenues (€m) |

384 |

+11.3% |

+12.0% |

753 |

+17.3% |

+14.2% |

| Operating result

(€m) |

46 |

-11 |

-10 |

62 |

-39 |

-42 |

|

Operating margin (%) |

4.4% |

-1.9pt |

-1.8pt |

3.1% |

-2.7pt |

-2.8pt |

Total revenues increased by 15.8% compared with

the same quarter last year while third party revenues increased by

12.0% at constant currency, showing a robust recovery. Due to the

tight labour market and supply chain disruptions, the average time

for maintenance increased, resulting in less growth opportunities

for third party revenues impacting the profitability. The operating

margin in the second quarter stood at 4.4%, which is 1.9 points

lower than in 2022.

Fleet

Compared to the end of 2022 the group added

three B787-10, fifteen B737-800, nine A220-300 and two Embraer

195-E2. The following aircraft left the fleet, three B737-700, two

A321, four A319 and two CRJ-1000, as a result the fleet increased

by eighteen aircraft.

The Group will continue to invest in new

generation aircraft in order to improve its economic performance

and will decrease its C02 emission and reduce noise.

Acceleration in revenue generation for both

airlines

Air France Group

|

|

Current quarter |

Year to date |

|

2023 |

change |

2023 |

change |

|

Revenue (in €m) |

4,667 |

+14.9% |

8,591 |

+27.4% |

| EBITDA (in

€m) |

845 |

+400 |

1,058 |

+637 |

| Operating result

(in €m) |

482 |

+349 |

301 |

+531 |

|

Operating margin (%) |

10.3% |

+7.1pt |

3.5% |

+6.9pt |

Air France performance is stemming from a strong

performance of long-haul and a high load factor resulting in an

increase of revenue of +14.9%. Operating result up +349 million

euros compared to last year.

KLM Group

|

|

Current quarter |

Year-to-date |

|

2023 |

change |

2023 |

change |

|

Revenue (in €m) |

3,111 |

+11.8% |

5,632 |

+20.2% |

| EBITDA (in

€m) |

489 |

-6 |

559 |

-171 |

| Operating result

(in €m) |

257 |

-5 |

129 |

-136 |

|

Operating margin (%) |

8.3% |

-1.2pt |

2.3% |

-3.4pt |

KLM operations stabilized despite supply chain,

tight labor market and fleet issues at KLM Cityhopper and Transavia

the Netherlands. Revenue grew by +11.8% compared to last year.

Nb: Sum of individual airline results does not

add up to AF-KLM total due to intercompany eliminations at Group

level.

******

The external auditors carried out limited review

procedures. Their limited review report was issued following the

Board meeting.

The results presentation is available at

www.airfranceklm.com on July 28, 2023 from 7:15 am

CET.

A conference call hosted by Mr. Smith (CEO) and

Mr. Zaat (CFO) will be held on July 28, 2023 at 08.30 am CET.

To connect to the webcast, please use below

link:

https://channel.royalcast.com/landingpage/airfranceklm/20230728_2/

|

Investor Relations |

|

Press |

|

Michiel Klinkers |

Marouane Mami |

+33 1 41 56 56 00 |

|

Michiel.klinkers@airfranceklm.com |

mamami@airfranceklm.com |

|

Income statement

| |

Current Quarter |

Year to Date |

| in € million |

2023 |

2022 |

Variation |

2023 |

2022 |

Variation |

| |

|

restated * |

|

|

restated * |

|

|

Revenues from ordinary activities |

7,624 |

6,707 |

14% |

13,953 |

11,152 |

25 % |

|

Aircraft fuel |

(1,662) |

(1,863) |

-11 % |

(3,442) |

(2,858) |

20 % |

| Carbon

emission |

(50) |

(15) |

233 % |

(81) |

(27) |

200 % |

| Chartering

costs |

(153) |

(93) |

65 % |

(243) |

(193) |

26 % |

| Landing fees and

air routes charges |

(506) |

(436) |

16 % |

(919) |

(784) |

17 % |

| Catering |

(207) |

(176) |

18 % |

(393) |

(319) |

23 % |

| Handling charges

and other operating costs |

(468) |

(401) |

17 % |

(894) |

(722) |

24 % |

| Aircraft

maintenance costs |

(597) |

(603) |

-1 % |

(1,245) |

(1,118) |

11 % |

| Commercial and

distribution costs |

(259) |

(230) |

13 % |

(516) |

(384) |

34% |

| Other external

expenses |

(458) |

(368) |

24 % |

(916) |

(702) |

30 % |

| Salaries and

related costs |

(2,156) |

(1,820) |

18 % |

(4,164) |

(3,343) |

25 % |

| Taxes other than

income taxes |

(38) |

(34) |

12 % |

(93) |

(80) |

16 % |

| Other income and

expenses |

258 |

263 |

-2 % |

567 |

530 |

7 % |

|

EBITDA |

1,328 |

931 |

43% |

1,614 |

1,152 |

40% |

|

Amortization, depreciation and provisions |

(595) |

(545) |

9 % |

(1,188) |

(1,116) |

6 % |

|

Income from current operations |

733 |

386 |

90 % |

426 |

36 |

nm |

|

Sales of aircraft equipment |

23 |

39 |

-41 % |

28 |

39 |

-28 % |

|

Other non-current income and expenses |

17 |

(10) |

nm |

15 |

(15) |

nm |

|

Income from operating activities |

773 |

415 |

86% |

469 |

60 |

nm |

|

Cost of financial debt |

(138) |

(136) |

1 % |

(296) |

(277) |

7 % |

|

Income from cash & cash equivalent |

59 |

1 |

nm |

108 |

– |

nm |

|

Net cost of financial debt |

(79) |

(135) |

-41 % |

(188) |

(277) |

-32 % |

|

Other financial income and expenses |

(22) |

(238) |

-91 % |

14 |

(286) |

nm |

|

Income before tax |

672 |

42 |

nm |

295 |

(503) |

nm |

|

Income taxes |

(61) |

283 |

nm |

(21) |

278 |

nm |

|

Net income of consolidated companies |

611 |

325 |

88% |

274 |

(225) |

nm |

|

Share of profits (losses) of associates |

1 |

– |

nm |

1 |

(1) |

nm |

|

Net Income for the period |

612 |

325 |

88% |

275 |

(226) |

nm |

|

Non-controlling interests |

8 |

1 |

nm |

15 |

2 |

nm |

|

Net Income for the period - Equity holders |

604 |

324 |

86% |

260 |

(228) |

nm |

* Restated figures include the change in accounting principles

for CO2 quotas

Consolidated balance sheet

|

Assets |

June 30, 2023 |

December 31, 2022 |

|

(in € million) |

|

restated * |

|

Goodwill |

225 |

225 |

| Intangible

assets |

1,114 |

1,127 |

| Flight

equipment |

10,957 |

10,614 |

| Other property,

plant and equipment |

1,389 |

1,375 |

| Right-of-use

assets |

5,480 |

5,428 |

| Investments in

equity associates |

121 |

120 |

| Pension

assets |

83 |

39 |

| Other non-current

financial assets |

1,443 |

1,184 |

| Non-current

derivative financial assets |

159 |

262 |

| Deferred tax

assets |

714 |

714 |

|

Other non-current assets |

76 |

78 |

|

Total non-current assets |

21,761 |

21,166 |

|

Other current financial assets |

621 |

620 |

| Current

derivative financial assets |

214 |

327 |

| Inventories |

754 |

723 |

| Trade

receivables |

1,983 |

1,785 |

| Other current

assets |

1,132 |

979 |

| Cash and cash

equivalents |

6,169 |

6,626 |

|

Assets held for sale |

82 |

79 |

|

Total current assets |

10,955 |

11,139 |

|

Total assets |

32,716 |

32,305 |

* Restated figures include the change in accounting principles

for CO2 quotas

| Liabilities

and equity |

June 30, 2023 |

December 31, 2022 |

|

(in € million) |

|

|

|

Issued capital |

2,571 |

2,571 |

| Additional

paid-in capital |

5,217 |

5,217 |

| Treasury

shares |

(25) |

(25) |

| Perpetual |

1,048 |

933 |

|

Reserves and retained earnings |

(11,582) |

(11,700) |

|

Equity attributable to equity holders of Air

France-KLM |

(2,771) |

(3,004) |

|

Perpetual |

524 |

510 |

|

Reserves and retained earnings |

16 |

14 |

|

Equity attributable Non-controlling interests |

540 |

524 |

|

Total equity |

(2,231) |

(2,480) |

|

Pension provisions |

1,661 |

1,634 |

| Non-current

return obligation liabilities and provisions for leased aircrafts

and other provisions |

3,885 |

4,149 |

| Non-current

financial liabilities |

8,225 |

9,657 |

| Non-current lease

debt |

3,227 |

3,318 |

| Non-current

derivative financial liabilities |

39 |

21 |

| Deferred tax

liabilities |

9 |

1 |

|

Other non-current liabilities |

1,696 |

2,343 |

|

Total non-current liabilities |

18,742 |

21,123 |

|

Current return obligation liabilities and provisions for leased

aircrafts and other provisions |

847 |

740 |

| Current financial

liabilities |

675 |

896 |

| Current lease

debt |

819 |

834 |

| Current

derivative financial liabilities |

143 |

83 |

| Trade

payables |

2,576 |

2,424 |

| Deferred revenue

on ticket sales |

5,500 |

3,725 |

| Frequent flyer

programs |

884 |

900 |

| Other current

liabilities |

4,755 |

4,057 |

|

Bank overdrafts |

6 |

3 |

|

Total current liabilities |

16,205 |

13,662 |

|

Total liabilities |

34,947 |

34,785 |

|

Total equity and liabilities |

32,716 |

32,305 |

Statement of Consolidated Cash Flows from January 1

until June 30

| Period

from January 1 to June 30 |

2023 |

2022 |

|

(in € million) |

|

restated * |

|

Net income |

275 |

(226) |

| Amortization,

depreciation and operating provisions |

1,188 |

1,116 |

| Financial

provisions |

100 |

69 |

| Loss (gain) on

disposals of tangible and intangible assets |

(49) |

(40) |

| Derivatives – non

monetary result |

(5) |

(20) |

| Unrealized

foreign exchange gains and losses, net |

(73) |

240 |

| Share of

(profits) losses of associates |

(1) |

1 |

| Deferred

taxes |

19 |

(282) |

| Impairment |

2 |

17 |

|

Other non-monetary items |

(152) |

(117) |

|

Financial capacity |

1,304 |

758 |

|

(Increase) / decrease in inventories |

(33) |

(79) |

| (Increase) /

decrease in trade receivables |

(167) |

(437) |

| Increase /

(decrease) in trade payables |

115 |

971 |

| Increase /

(decrease) in advanced ticket sales |

1,757 |

2,276 |

|

Change in other assets and liabilities |

(130) |

97 |

|

Change in working capital requirement |

1,542 |

2,828 |

|

Net cash flow from operating activities |

2,846 |

3,586 |

|

Acquisition of subsidiaries, of shares in non-controlled

entities |

(2) |

– |

| Purchase of

property plant and equipment and intangible assets |

(1,396) |

(1,457) |

| Proceeds on

disposal of property plant and equipment and intangible assets |

211 |

476 |

| Dividends

received |

2 |

1 |

| Decrease

(increase) in net investments, more than 3 months |

(52) |

6 |

|

Net cash flow used in investing activities |

(1,237) |

(974) |

|

Increase of equity |

– |

1,551 |

| Payments to

acquire treasury shares |

(1) |

– |

| Issuance of

perpetual |

728 |

– |

| Repayment on

perpetual |

(595) |

(993) |

| Coupons on

perpetual |

(52) |

(229) |

| Issuance of

debt |

1,558 |

552 |

| Repayment on

debt |

(2,969) |

(1,415) |

| Payments on lease

debts |

(421) |

(442) |

| New loans |

(306) |

(175) |

| Repayment on

loans |

104 |

16 |

| Dividends

paid |

(90) |

– |

|

Net cash flow from financing activities |

(2,044) |

(1,135) |

|

Effect of exchange rate on cash and cash equivalents and bank

overdrafts (net of cash acquired or sold) |

(25) |

40 |

|

Change in cash and cash equivalents and bank

overdrafts |

(460) |

1,517 |

|

Cash and cash equivalents and bank overdrafts at beginning of

period |

6,623 |

6,654 |

|

Cash and cash equivalents and bank overdrafts at end of period |

6,163 |

8,171 |

* Restated figures include the change in accounting principles

for CO2 quotas

Return on capital employed (ROCE)

| In € million |

Jun 30,2023 |

Mar 31,2023 |

Dec 31,2022 |

Sep 30,2022 |

Jun 30,2022 |

Mar 31,2022 |

Dec 31,2021 |

Sep 30,2021 |

|

|

|

|

restated * |

restated * |

restated * |

restated * |

restated * |

restated * |

|

Goodwill and intangible assets |

1,339 |

1,351 |

1,352 |

1,350 |

1 361 |

1 363 |

1 380 |

1 384 |

|

Flight equipment |

10,957 |

10,954 |

10,614 |

10,298 |

10 521 |

10 537 |

10 466 |

10 478 |

|

Other property, plant and equipment |

1,389 |

1,372 |

1,375 |

1,349 |

1 358 |

1 378 |

1 402 |

1 418 |

|

Right of use assets |

5,480 |

5,304 |

5,428 |

5,536 |

5 439 |

5 205 |

5 148 |

5 061 |

|

Investments in equity associates |

121 |

122 |

120 |

111 |

108 |

107 |

109 |

172 |

|

Financial assets excluding marketable securities and financial

deposits |

190 |

169 |

169 |

164 |

162 |

158 |

157 |

147 |

|

Provisions, excluding pension, cargo litigation and

restructuring |

(4,248) |

(4,255) |

(4,347) |

(4,792) |

(4 473) |

(4 240) |

(4 180) |

(4 180) |

|

WCR, excluding market value of derivatives |

(11,467) |

(11,313) |

(9,882) |

(10,359) |

(11 080) |

(9 480) |

(8 185) |

(7 923) |

|

Capital employed |

3,761 |

3,704 |

4,829 |

3,657 |

3 396 |

5 028 |

6 297 |

6 557 |

|

Average capital employed (A) |

3,988 |

5,320 |

|

Adjusted results from current operations |

1,584 |

344 |

|

- Dividends received |

(2) |

– |

|

- Share of profits (losses) of associates |

15 |

(12) |

|

- Normative income tax |

(412) |

(80) |

|

Adjusted result from current operations after tax

(B) |

1,185 |

252 |

|

ROCE, trailing 12 months (B/A) |

29.7% |

4,7% |

* Restated figures include the change in accounting principles

for CO2 quotas

The ROCE is positively impacted by high working

capital due to payment deferral of social charges and salary

taxes.

Net debt

|

(in € million) |

June 30, 2023 |

December 31, 2022 |

|

Current and non-current financial liabilities |

8,900 |

10,553 |

| Current and

non-current lease debt |

4,046 |

4,152 |

| Accrued

interest |

(55) |

(127) |

| Deposits related

to financial liabilities |

(102) |

(101) |

| Deposits related

to lease debt |

(100) |

(99) |

|

Derivatives impact on debt |

(15) |

(35) |

|

Gross financial liabilities (I) |

12,674 |

14,343 |

|

Cash and cash equivalents |

6,169 |

6,626 |

| Marketable

securities > 3 months |

624 |

572 |

| Bonds |

987 |

811 |

|

Bank overdrafts |

(6) |

(3) |

|

Net cash (II) |

7,774 |

8,006 |

|

Net debt (I-II) |

4,900 |

6,337 |

Adjusted operating free cash flow

| |

Current Quarter |

Year to Date |

| |

2023 |

2022 |

2023 |

2022 |

|

(in € million) |

|

restated * |

|

restated * |

|

Net cash flow from operating activities |

1,296 |

2,237 |

2,846 |

3,586 |

| Purchase of

property plant and equipment and intangible assets |

(617) |

(785) |

(1,396) |

(1,457) |

| Proceeds on

disposal of property plant and equipment and intangible assets |

80 |

305 |

211 |

476 |

|

Operating free cash flow |

759 |

1,757 |

1,661 |

2,605 |

|

Payments on lease debts |

(202) |

(225) |

(421) |

(442) |

|

Operating free cash flow adjusted |

557 |

1,532 |

1,240 |

2,163 |

* Restated figures include the change in accounting principles

for CO2 quotas

Bridge from EBITDA to Self-financing

capacity

| |

Current Quarter |

Year to Date |

| |

2023 |

2022 |

2023 |

2022 |

|

(in € million) |

|

restated * |

|

restated * |

|

EBITDA |

1,328 |

931 |

1,614 |

1,152 |

|

Provisions (risk and other) |

(1) |

(13) |

(9) |

(13) |

| Correction of

spare parts inventory |

2 |

1 |

2 |

3 |

| Addition to

pension provisions |

38 |

33 |

71 |

65 |

| Reversal to

pension provisions (cash-out) |

(17) |

(19) |

(31) |

(32) |

|

Sales of tangible and intangible assets (excluding

aeronauticals) |

– |

1 |

(2) |

1 |

|

Income from operating activities - cash

impact |

1,350 |

934 |

1,645 |

1,176 |

|

Restructuring costs |

(31) |

(68) |

(66) |

(125) |

| Other non-current

income and expenses |

(1) |

– |

(3) |

(2) |

| Cost of financial

liability |

(139) |

(139) |

(402) |

(283) |

| Financial

income |

54 |

(3) |

98 |

(8) |

| Realized foreign

exchanges gain/loss |

2 |

(11) |

40 |

3 |

| Settlement of

forwards derivatives - cash |

(1) |

– |

(1) |

– |

| Other financial

charges & expenses - cash |

(4) |

– |

(4) |

– |

| Current income

tax |

(4) |

– |

(2) |

(4) |

|

Other elements |

(2) |

– |

(1) |

1 |

|

Self-financing capacity |

1,224 |

713 |

1,304 |

758 |

* Restated figures include the change in accounting principles

for CO2 quotas

Unit cost: net cost per ASK

| |

Current Quarter |

Year to date |

| |

2023 |

2022 |

2023 |

2022 |

| Total operating

expenses (in €m) |

6,891 |

6,321 |

13,526 |

11,116 |

| Total other

revenues (in €m) |

(637) |

(563) |

(1,256) |

(1,082) |

|

Net cost (in €m) |

6,253 |

5,758 |

12,270 |

10,034 |

|

Capacity produced, reported in ASK* |

78,144 |

72,127 |

147,727 |

130,192 |

|

Net cost per ASK (in € cents per ASK) |

8.00 |

7.98 |

8.31 |

7.71 |

|

Gross change |

|

0.2 % |

|

7.8 % |

| Currency effect

on net costs (in €m) |

|

(17) |

|

43 |

| Change at

constant currency |

|

0.5 % |

|

7.3 % |

|

Fuel price effect (in €m) |

|

-319 |

|

134 |

|

Net cost per ASK on a constant currency and constant fuel

price (in € cents per ASK) |

8.00 |

7.52 |

8.31 |

7.84 |

|

Change at constant currency and constant fuel

price |

|

6.4 % |

|

5.9 % |

|

Furlough |

|

+42 |

|

+253 |

|

|

8.0 |

7.6 |

8.3 |

8.0 |

|

Change at constant currency and constant fuel price

excluding furlough |

|

5.6 % |

|

3.3 % |

Group fleet at 30 June 2023

| Aircraft

type |

AF (incl. HOP)4 |

KL (incl. KLC & MP)4 |

Transavia |

Owned |

Finance lease |

Operating lease |

Total |

In operation |

Change vs 31/12/22 |

| B777-300 |

43 |

16 |

|

20 |

15 |

24 |

59 |

59 |

|

| B777-200 |

18 |

15 |

|

28 |

1 |

4 |

33 |

33 |

|

| B787-9 |

10 |

13 |

|

4 |

7 |

12 |

23 |

23 |

|

| B787-10 |

|

10 |

|

2 |

8 |

|

10 |

10 |

3 |

| A380-800 |

4 |

|

|

2 |

1 |

1 |

4 |

|

|

| A350-900 |

20 |

|

|

3 |

7 |

10 |

20 |

20 |

|

| A330-300 |

|

5 |

|

|

|

5 |

5 |

5 |

|

|

A330-200 |

15 |

6 |

|

11 |

|

10 |

21 |

21 |

|

|

Total Long-Haul |

110 |

65 |

0 |

70 |

39 |

66 |

175 |

171 |

3 |

|

B737-900 |

|

5 |

|

5 |

|

|

5 |

5 |

|

| B737-800 |

|

31 |

110 |

34 |

8 |

99 |

141 |

135 |

10 |

| B737-700 |

|

6 |

4 |

7 |

|

3 |

10 |

10 |

|

| A321 |

16 |

|

|

9 |

|

7 |

16 |

16 |

-2 |

| A320 |

39 |

|

|

4 |

3 |

32 |

39 |

37 |

-2 |

| A319 |

15 |

|

|

10 |

|

5 |

15 |

14 |

-3 |

| A318 |

9 |

|

|

5 |

|

4 |

9 |

7 |

-2 |

|

A220-300 |

25 |

|

|

17 |

|

8 |

25 |

25 |

10 |

|

Total Medium-Haul |

104 |

42 |

114 |

91 |

11 |

158 |

260 |

249 |

11 |

|

Canadair Jet 1000 |

4 |

|

|

4 |

|

|

4 |

|

|

| Canadair Jet

700 |

|

|

|

|

|

|

|

|

|

| Embraer 195

E2 |

|

16 |

|

|

|

16 |

16 |

16 |

2 |

| Embraer 190 |

19 |

30 |

|

17 |

4 |

28 |

49 |

49 |

|

| Embraer 175 |

|

17 |

|

3 |

14 |

|

17 |

17 |

|

| Embraer 170 |

13 |

|

|

10 |

|

3 |

13 |

13 |

|

|

Embraer 145 |

|

|

|

|

|

|

|

|

|

|

Total Regional |

36 |

63 |

0 |

34 |

18 |

47 |

99 |

95 |

2 |

|

B747-400ERF |

|

3 |

|

3 |

|

|

3 |

3 |

|

| B747-400BCF |

|

1 |

|

1 |

|

|

1 |

1 |

|

|

B777-F |

2 |

|

|

|

|

2 |

2 |

2 |

|

|

Total Cargo |

2 |

4 |

0 |

4 |

0 |

2 |

6 |

6 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

252 |

174 |

114 |

199 |

68 |

273 |

540 |

521 |

16 |

2023 TRAFFIC

Passenger network activity

| |

Current quarter |

Year to date |

|

Total network airlines |

2023 |

2022 |

variation |

2023 |

2022 |

variation |

|

Passengers carried (‘000s) |

18,743 |

17,556 |

7% |

34,530 |

29,498 |

17% |

| Revenue

pax-kilometers (m RPK) |

58,319 |

52,479 |

11% |

111,284 |

91,346 |

22% |

| Available

seat-kilometers (m ASK) |

66,714 |

61,697 |

8% |

128,690 |

114,268 |

13% |

|

Load factor (%) |

87% |

85% |

2pt |

86% |

80% |

7pt |

|

|

|

|

|

|

|

|

|

Long-haul |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

6,370 |

5,765 |

10% |

12,309 |

10,145 |

21% |

| Revenue

pax-kilometers (m RPK) |

47,373 |

42,070 |

13% |

91,882 |

74,396 |

24% |

| Available

seat-kilometers (m ASK) |

53,792 |

49,285 |

9% |

105,331 |

92,525 |

14% |

|

Load factor (%) |

88% |

85% |

3pt |

87% |

80% |

7pt |

|

|

|

|

|

|

|

|

|

North America |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

2,459 |

2,282 |

8% |

4,244 |

3,520 |

21% |

| Revenue

pax-kilometers (m RPK) |

17,457 |

16,330 |

7% |

30,308 |

25,386 |

19% |

| Available

seat-kilometers (m ASK) |

19,481 |

19,139 |

2% |

35,096 |

32,291 |

9% |

|

Load factor (%) |

90% |

85% |

4pt |

86% |

79% |

8pt |

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

859 |

767 |

12% |

1,751 |

1,442 |

21% |

| Revenue

pax-kilometers (m RPK) |

8,130 |

7,215 |

13% |

16,623 |

13,726 |

21% |

| Available

seat-kilometers (m ASK) |

9,103 |

8,144 |

12% |

18,493 |

15,801 |

17% |

|

Load factor (%) |

89% |

89% |

1pt |

90% |

87% |

3pt |

|

|

|

|

|

|

|

|

|

Asia / Middle East |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

1,280 |

859 |

49% |

2,485 |

1,493 |

66% |

| Revenue

pax-kilometers (m RPK) |

10,019 |

6,117 |

64% |

19,230 |

10,508 |

83% |

| Available

seat-kilometers (m ASK) |

11,557 |

7,390 |

56% |

22,163 |

14,610 |

52% |

|

Load factor (%) |

87% |

83% |

4pt |

87% |

72% |

15pt |

|

|

|

|

|

|

|

|

|

Africa |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

994 |

936 |

6% |

2,035 |

1,751 |

16% |

| Revenue

pax-kilometers (m RPK) |

6,039 |

5,568 |

8% |

12,481 |

10,360 |

20% |

| Available

seat-kilometers (m ASK) |

7,145 |

6,839 |

4% |

14,744 |

13,137 |

12% |

|

Load factor (%) |

85% |

81% |

3pt |

85% |

79% |

6pt |

|

|

|

|

|

|

|

|

|

Caribbean / Indian Ocean |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

778 |

920 |

(15)% |

1,794 |

1,939 |

(7)% |

| Revenue

pax-kilometers (m RPK) |

5,728 |

6,840 |

(16)% |

13,240 |

14,415 |

(8)% |

| Available

seat-kilometers (m ASK) |

6,506 |

7,773 |

(16)% |

14,835 |

16,687 |

(11)% |

|

Load factor (%) |

88% |

88% |

0pt |

89% |

86% |

3pt |

|

|

|

|

|

|

|

|

|

Short and Medium-haul |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

12,373 |

11,791 |

5% |

22,221 |

19,353 |

15% |

| Revenue

pax-kilometers (m RPK) |

10,945 |

10,409 |

5% |

19,402 |

16,950 |

14% |

| Available

seat-kilometers (m ASK) |

12,923 |

12,412 |

4% |

23,359 |

21,743 |

7% |

|

Load factor (%) |

85% |

84% |

1pt |

83% |

78% |

5pt |

Transavia activity

| |

Current quarter |

Year to date |

|

Transavia |

2023 |

2022 |

variation |

2023 |

2022 |

variation |

|

Passengers carried (‘000s) |

5,921 |

5,247 |

13% |

9,785 |

7,828 |

25% |

| Revenue

seat-kilometers (m RSK) |

10,179 |

8,886 |

15% |

17,134 |

13,154 |

30% |

| Available

seat-kilometers (m ASK) |

11,429 |

10,430 |

10% |

19,037 |

15,924 |

20% |

|

Load factor (%) |

89% |

85% |

4pt |

90% |

83% |

7pt |

Total Group passenger

activity

| |

Current quarter |

Year to date |

|

Total Group |

2023 |

2022 |

variation |

2023 |

2022 |

variation |

|

Passengers carried (‘000s) |

24,664 |

22,804 |

8% |

44,315 |

37,326 |

19% |

| Revenue

pax-kilometers (m RPK) |

68,498 |

61,365 |

12% |

128,418 |

104,499 |

23% |

| Available

seat-kilometers (m ASK) |

78,144 |

72,127 |

8% |

147,727 |

130,192 |

13% |

|

Load factor (%) |

88% |

85% |

3pt |

87% |

80% |

7pt |

Cargo activity

| |

Current quarter |

Year to date |

|

Cargo |

2023 |

2022 |

variation |

2023 |

2022 |

variation |

|

Revenue tonne-km (m RTK) |

1,585 |

1,732 |

(8)% |

3,143 |

3,498 |

(10)% |

| Available

tonne-km (m ATK) |

3,557 |

3,342 |

6% |

6,845 |

6,316 |

8% |

|

Load factor (%) |

45% |

52% |

(7)pt |

46% |

55% |

(9)pt |

Air France activity

| |

Current quarter |

Year to date |

|

Total Passenger network activity |

2023 |

2022 |

variation |

2023 |

2022 |

variation |

|

Passengers carried (‘000s) |

10,832 |

10,344 |

5% |

20,289 |

17,449 |

16% |

| Revenue

pax-kilometers (m RPK) |

34,434 |

30,995 |

11% |

66,415 |

54,082 |

23% |

| Available

seat-kilometers (m ASK) |

39,424 |

36,621 |

8% |

76,736 |

67,491 |

14% |

|

Load factor (%) |

87% |

85% |

3pt |

87% |

80% |

6pt |

|

|

|

|

|

|

|

|

|

Long-haul |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

3,888 |

3,556 |

9% |

7,584 |

6,322 |

20% |

| Revenue

pax-kilometers (m RPK) |

28,190 |

25,065 |

12% |

55,151 |

44,517 |

24% |

| Available

seat-kilometers (m ASK) |

32,027 |

29,458 |

9% |

63,174 |

55,192 |

14% |

|

Load factor (%) |

88% |

85% |

3pt |

87% |

81% |

7pt |

|

|

|

|

|

|

|

|

|

Short and Medium-haul |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

6,944 |

6,788 |

2% |

12,704 |

11,127 |

14% |

| Revenue

pax-kilometers (m RPK) |

6,243 |

5,930 |

5% |

11,264 |

9,565 |

18% |

| Available

seat-kilometers (m ASK) |

7,397 |

7,162 |

3% |

13,562 |

12,300 |

10% |

|

Load factor (%) |

84% |

83% |

2pt |

83% |

78% |

5pt |

|

|

|

|

|

|

|

|

|

Cargo activity |

|

|

|

|

|

|

|

Revenue tonne-km (m RTK) |

789 |

890 |

(11)% |

1,578 |

1,797 |

(12)% |

| Available

tonne-km (m ATK) |

1,977 |

1,861 |

6% |

3,837 |

3,519 |

9% |

|

Load factor (%) |

40% |

48% |

(8)pt |

41% |

51% |

(10)pt |

KLM activity

| |

Current quarter |

Year to date |

|

Total Passenger network activity |

2023 |

2022 |

variation |

2023 |

2022 |

variation |

|

Passengers carried (‘000s) |

7,911 |

7,212 |

10% |

14,241 |

12,049 |

18% |

| Revenue

pax-kilometers (m RPK) |

23,885 |

21,484 |

11% |

44,869 |

37,264 |

20% |

| Available

seat-kilometers (m ASK) |

27,290 |

25,077 |

9% |

51,954 |

46,777 |

11% |

|

Load factor (%) |

88% |

86% |

2pt |

86% |

80% |

7pt |

|

|

|

|

|

|

|

|

|

Long-haul |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

2,482 |

2,209 |

12% |

4,724 |

3,823 |

24% |

| Revenue

pax-kilometers (m RPK) |

19,183 |

17,005 |

13% |

36,731 |

29,878 |

23% |

| Available

seat-kilometers (m ASK) |

21,764 |

19,827 |

10% |

42,157 |

37,333 |

13% |

|

Load factor (%) |

88% |

86% |

2pt |

87% |

80% |

7pt |

|

|

|

|

|

|

|

|

|

Short and Medium-haul |

|

|

|

|

|

|

|

Passengers carried (‘000s) |

5,429 |

5,003 |

9% |

9,517 |

8,225 |

16% |

| Revenue

pax-kilometers (m RPK) |

4,702 |

4,479 |

5% |

8,138 |

7,385 |

10% |

| Available

seat-kilometers (m ASK) |

5,525 |

5,250 |

5% |

9,797 |

9,443 |

4% |

|

Load factor (%) |

85% |

85% |

–pt |

83% |

78% |

5pt |

|

|

|

|

|

|

|

|

|

Cargo activity |

|

|

|

|

|

|

|

Revenue tonne-km (m RTK) |

796 |

842 |

(5)% |

1,564 |

1,701 |

(8)% |

| Available

tonne-km (m ATK) |

1,581 |

1,480 |

7% |

3,008 |

2,797 |

8% |

|

Load factor (%) |

50% |

57% |

(7)pt |

52% |

61% |

(9)pt |

1 change is nominal and not corrected for fuel price2 against a

constant fuel price, constant currency and excluding furlough

contribution3 refers to 2024-2026 period4 Excluding Transavia

- Air France-KLM Q2 2023 Results press release

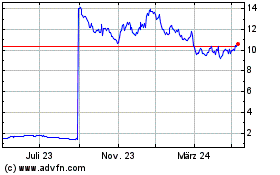

Air FranceKLM (EU:AF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

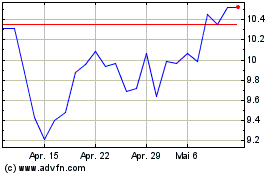

Air FranceKLM (EU:AF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025