Polkadot Rises In Popularity Among Futures Traders – A Bullish Turn For DOT Price?

11 April 2023 - 10:37AM

NEWSBTC

Polkadot (DOT) enthusiasts may be in for a bullish week as healthy

demand for the cryptocurrency is observed in the futures market,

according to a recent tweet by Huobi. With a 24-hour trading

volume of $162 million and a market capitalization of over $7.7

billion, Polkadot’s rally is showing no signs of slowing down. In

fact, the coin has gained 3.1% against the US dollar since

yesterday, indicating that the market is actively participating in

its upward momentum. With such promising developments, it’s

no wonder that Polkadot is quickly becoming one of the most

sought-after cryptocurrencies on the market. Related Reading:

Bitcoin Price Poised To Hit $50,000, This Crypto Expert Predicts

Huobi Sees Strong Demand For Polkadot The futures market kicked off

this week with some hiccups, as Binance experienced downtime in its

futures segment on Monday morning. However, Huobi, one of Binance’s

rivals, announced that it has been experiencing a healthy demand

for futures trading. #Huobi Top Trader Long Positions: 🔹 $HT

71% 🔹 $DOT 70% 🔹 #Bitcoin 64% 🔹 $ARB 62% 🔹 $ETH 55% What’s your

next long? — Huobi Futures (@HuobiFutures_) April 10, 2023 DOT

placed second in Huobi’s top trader ranking, surpassing Bitcoin and

Ethereum in terms of futures demand. The ranking is determined by

the ratio of executed longs to shorts for each asset. Despite

experiencing a minor setback in the past seven days, Polkadot’s

price remains strong at $6.45 according to Coingecko. Moreover, the

cryptocurrency’s recent 24-hour rally of 4.4% suggests that it will

continue to be a significant player in the crypto market.

Source: Coingecko With its impressive performance and growing

demand in the futures market, Polkadot could be a cryptocurrency to

watch in the coming weeks. Bullish Signals Despite Minor Setback

DOT faced resistance at the $6.45 mark but found support at $6.10,

which provided a much-needed boost to its bullish momentum. In

analyzing the derivatives market, it becomes clear that Polkadot’s

long positions are outweighing shorts, indicating that there may be

further bullish demand on the horizon. In addition, the sell wall

could hint at a possible bullish pivot as demand slowly but

steadily overcomes selling pressure. DOT total market cap now at

$7.5 billion on the daily chart at TradingView.com Related Reading:

Stacks (STX) Pulls Ahead Of Top 50 Altcoins With 10% Price Spike

With enough volume, Polkadot investors could expect a minimum of a

6% upside this week. Given its current ranking in the derivatives

market, it is possible that bullish demand could continue to grow

as the week progresses. Despite a slight decrease in value

over the past week, it is also worth noting that Polkadot has

maintained a healthy level of development activity since mid-March,

outperforming other leading blockchains in this aspect. This

impressive track record speaks to the network’s ongoing progress

and potential for further expansion. -Featured image from Forkast

News

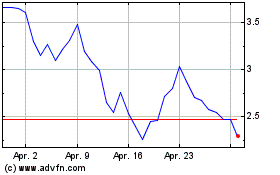

Stacks (COIN:STXUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Stacks (COIN:STXUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024