Lido (LDO) Poised For Explosive Surge To $17, Expert Forecasts ‘Massive Breakout’

14 Juni 2024 - 1:00AM

NEWSBTC

Lido Finance, the liquid staking protocol for the Ethereum (ETH)

network, has experienced significant price declines over the past

two weeks, largely influenced by the market’s downtrend and the

lack of bullish momentum. However, a notable breakout could be

in the making for the protocol’s native token, LDO, despite

negative financial metrics. Lido And Mellow Finance’s

Partnership Despite the challenging market conditions, Lido has

made notable strides within its ecosystem. Collaborating with

Mellow Finance as part of the Lido Alliance, the protocol has

introduced advanced decentralized finance (DeFi) strategies for

stETH holders. These strategies aim to leverage Mellow

Finance’s permissionless Liquid Restaking Token (LRT) creation,

enabling stETH holders to maximize asset utility through

decentralized restaking and accumulating various rewards.

Related Reading: Solana On-Chain Indicators Suggests A Return Of

Bullish Sentiment, Is It Time To Buy SOL? The newly launched vaults

also aim to secure and flexible means for engaging with Ethereum

staking and DeFi, increasing the liquidity and utility of

stETH. This partnership marks the initial phase of the Lido

Alliance’s efforts to expand the Ethereum staking ecosystem through

strategic collaborations with aligned projects. However, key

metrics indicate a decline in the price of LDO, potentially

following the footsteps of Ethereum, which has also seen a drop to

$3,480 from its March peak of $3,990. Negative Financial

Metrics Lido’s Total Value Locked (TVL) experienced a 1.70%

decrease, amounting to $35.39 billion, primarily influenced by

ETH’s price decline. The amount of ETH staked witnessed a

mild increase of 0.26%, with a net increase of 19,392 ETH staked

over the past week. Similarly, the quantity of (w)stETH in lending

pools saw a moderate increase of 1.46%, reaching 2.66 million

stETH, while the amount of w(stETH) in liquidity pools decreased by

3.13% to 89.3k stETH. Moreover, the 7-day trading volume for

(w)stETH stood at $1.03 billion, down by 19.7% compared to the

previous week. Additionally, the total amount of wstETH bridged to

Layer 2 solutions decreased by 2.86% to 136,893 wstETH. Analyzing

the bridging statistics, the distribution of wstETH among various

Layer 2 networks is as follows: Arbitrum: 69,676 wstETH (-6.07%)

Optimism: 28,906 wstETH (+0.44%) Base: 15,429 wstETH (-6.35%)

Scroll: 10,329 wstETH (+9.48%) Polygon: 8,522 wstETH (+0.07%)

Linea: 2,928 wstETH (+20.59%) zkSync: 1,093 wstETH (-0.49%) LDO

Price Targets Ranging From $6 To $17 Despite these metrics, crypto

analyst Alex Clay remains optimistic about LDO’s future. Clay

recently shared bullish predictions for LDO, envisioning

significant breakouts if the bullish momentum resumes. In a

recent post on social media site X, Clay emphasized LDO’s 756 days

of ascending accumulation, suggesting a potentially “massive

breakout.” The analyst further outlined exciting price targets for

bullish investors, ranging from $6.3 to $17.2. Related Reading:

Dogecoin Under Pressure And ‘Going To Zero’, Analyst Says – Here’s

Why LDO is trading at $1.88, representing a 3.5% decrease within

the 24-hour timeframe and a decline of over 20% in the past two

weeks. Notably, the token has witnessed a 74% decrease from its

all-time high of $7.30 in June 2021. It remains to be seen whether

positive developments within the Lido protocol and increased

staking activity can help mitigate the losses. Additionally,

Ethereum’s potential price recovery may impact LDO’s trajectory,

potentially leading to a new uptrend aimed at reclaiming previously

lost levels. Featured image from DALL-E, chart from TradingView.com

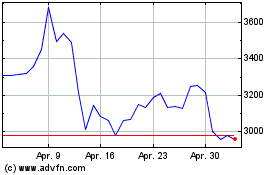

stETH (COIN:STETHUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024