The Bullish Bitcoin Crossover No One Is Paying Attention To

04 August 2021 - 9:00PM

NEWSBTC

The Bitcoin 20 DMA seems to have just crossed with the 50 DMA, here

is how it might be bullish for the cryptocurrency. The Bitcoin

Bullish Crossover As pointed out by a BTC technical analyst on

Twitter, two important indicators of the cryptocurrency have just

had a crossover. The two metrics are the 20 daily-moving average

(DMA) and the 50 DMA. Before looking at the data, it’s best to

first get a grasp of both these indicators. Moving averages (MA)

help smooth out the price data for Bitcoin as they take averages of

the price over a specific period and constantly update or “move”

forward. The indicator “smooths out” the price as it mitigates

effects of small fluctuations on the price, giving a smoother

curve. The 20 daily moving average (DMA) averages the daily price

over 20 days, while the 50 DMA uses data of the past 50 days.

Related Reading | On-Chain Data Shows Bitcoin Daily Transaction

Volumes Are Up 94%, Rally Might Not Be Over Just Yet Now, here is

the chart that shows the variations in the 20 DMA and 50 DMA for

BTC: The BTC 20 and 50 DMA have their first crossover since May As

the above graph displays, the Bitcoin 20 and 50 DMA indicators are

having a crossover right now where the 20 DMA curve seems to be

shooting above the 50 DMA. The last time this type of crossover

happened was in October 2020, right before the massive bull run

where BTC set a new all-time-high (ATH). However, these two

crossovers aren’t the only ones on the graph. There is another,

different type of crossover where the 50 DMA line flies above the

20 DMA curve. This one occurred in May, right at the top of the

rally. From these observations, it looks like when the 50 DMA

overtakes the 20 DMA, a bullish trend might ensue. But if the

reverse happens, a bull run could be there. BTC Price At the time

of writing, BTC’s price is moving around $39.3k, up 1% in the last

7 days. Over the past month, the crypto’s value has increased by

16%. Below is a chart that shows the trend in the price of Bitcoin

over the last 6 months: BTC's price seems to be going back up after

a dip After enjoying a couple of weeks of uptrend after a period of

little volatility, BTC again seemed to be going down. However,

today the coin has taken a reversal for the better as the coin

seems to be quickly climbing back up. Related Reading | Trend Line

Touch Could Send Bitcoin On A Tear It’s hard to say how far the

crypto will go this time as the $40k resistance will again prove to

be a challenge. BTC could get stuck in a rangebound market below

the $40k mark and slowly lose its volatility again. Though if the

DMA crossover is anything to go by, a bull market might be ahead.

Featured image from Pexels.com, charts from TradingView.com

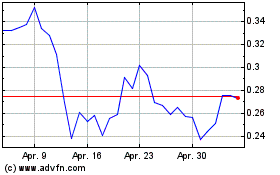

Graph Token (COIN:GRTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Graph Token (COIN:GRTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024