Bitcoin May Rally In Q1 2025 Driven By US Fed’s Money Printing, Predicts Arthur Hayes

09 Januar 2025 - 10:00AM

NEWSBTC

In a recent blog post, serial crypto entrepreneur and commentator

Arthur Hayes predicted that fresh liquidity injections into the US

economy following President-elect Donald Trump’s inauguration could

spur a Bitcoin (BTC) rally in Q1 2025. Money Printing To Propel

Bitcoin? Despite surging past $100,000 on January 6, BTC faced a

sharp decline to as low as $94,543 earlier today, casting doubt on

the so-called “Trump rally” that many expected to last until

Trump’s inauguration on January 20. Related Reading: Bitcoin May

Surge To $200,000 By Mid-2025 Amid ‘Mild’ Price Pullbacks: Report

Recent market action aligns with Hayes’ December forecast, in which

he warned of a potential “harrowing dump” in the cryptocurrency

market around Trump’s inauguration. At the time, Hayes attributed

this predicted sell-off to perceived regulatory disappointments

from the incoming Trump administration. However, in his latest

post, Hayes suggested that the US Federal Reserve’s (Fed) plan to

inject $612 billion of fresh liquidity into the economy could make

up for the lack of regulatory progress and ignite new bullish

momentum for BTC. The BitMex co-founder remarked: A letdown by team

Trump on his proposed pro-crypto and pro-business legislation can

be covered by an extremely positive dollar liquidity environment,

an increase of up to $612 billion in the first quarter. Hayes

explained that the Fed is expected to ramp up money printing after

Trump’s inauguration, likely driving BTC and other digital assets

to a local top before a subsequent pullback. He added that market

disappointment over lagging crypto regulation under Trump’s

administration would exacerbate the correction. The crypto

entrepreneur advised selling towards the end of Q1 2025 and waiting

for favorable liquidity conditions to return in Q3 2025. Once fresh

liquidity enters the market, Hayes suggested it would be time for

risk-seeking investors to “turn the risk dial to degen.” Opinion

Split On BTC Price Action While Hayes anticipates a BTC rally later

this quarter, other analysts and market commentators remain

cautious. For instance, a recent report by 10x Research noted that

the Fed’s delay in cutting interest rates could dampen BTC’s

bullish momentum. Similarly, technical analysis suggests that BTC

may be forming a bearish head-and-shoulders pattern on the weekly

chart, raising fears of a drawdown to as low as $80,000.

Yesterday’s failure to decisively reclaim the $100,000 price level

has further unsettled the bulls. On the other hand, the CEO of

Bitcoin mining firm MARA recently advocated a long-term “invest and

forget” strategy for BTC. He suggested that a US strategic Bitcoin

reserve could spark a global race among nations to accumulate BTC,

driving up its price. Institutional interest in BTC is already on

the rise, as evident from record inflows received by US spot

Bitcoin exchange-traded funds (ETF). At press time, BTC trades at

$95,154, down 3.6% in the past 24 hours. Featured image from

Unsplash, Chart from TradingView.com

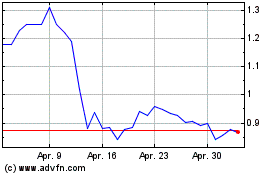

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025