Bitcoin Closing In On $100K: The Case For A Future Valuation Of $1 Million

20 November 2024 - 8:30AM

NEWSBTC

Since November 5, the day President-elect Donald Trump secured

another term in office, Bitcoin has experienced a remarkable

uptrend, reaching a new all-time high of $93,300. Since then,

BTC has been trading within a narrow range between $89,000 and

$92,000, positioning for a potential move toward the $100,000

milestone. This raises an intriguing question whether a price of $1

million per coin is feasible over the next decade. A Long-Term

Vision For Investors Market expert VirtualBacon has conducted an

in-depth analysis of these possibilities, delving into the numbers,

trends, and catalysts that could propel Bitcoin to experience a

surge of nearly 1,000% from its current price levels. Within

the current market cycle, the expert forecasts that Bitcoin could

hit $200,000 in the next one to two years. However, he notes that

while this milestone is significant, altcoins may offer higher

returns at a greater risk, often crashing by 80% to 90% in bear

markets. In contrast to altcoins, which face increasing regulatory

scrutiny, Bitcoin stands out as a safer long-term investment.

VirtualBacon argues that Bitcoin’s potential is not just confined

to the next few years but spans a decade or more. Related

Reading: Bitcoin Price Forecast: Fundstrat Sees BTC ‘Comfortably’

Over $100,000 This Year To understand why Bitcoin’s price could

reach $1 million, VirtualBacon asserts that investors need to

consider its fundamental utility as a store of value. Bitcoin’s

fixed supply of 21 million coins, its global accessibility, and its

resistance to censorship and manipulation make it a compelling

alternative to traditional financial assets. The expert

suggests that if Bitcoin is to become recognized as the digital

gold of the 21st century, reaching a market capitalization that

rivals gold’s estimated $13 trillion is not merely a theoretical

possibility but “a logical outcome.” Key drivers for this potential

growth include increasing participation from asset managers,

corporate treasuries, central banks, and wealthy individuals.

Recent data indicates that Bitcoin ETFs have seen record inflows,

with $1 billion invested last week, reflecting growing

institutional confidence. Additionally, discussions among

corporations, such as Microsoft considering Bitcoin reserves,

further enhance its strategic value. Wealthy individuals are also

beginning to adopt Bitcoin as a standard portfolio allocation, with

even a modest 1% investment becoming commonplace among

billionaires. What Does Bitcoin Need To Reach $1 Million? For

Bitcoin to reach the $1 million mark, two critical factors must be

analyzed: global wealth growth and portfolio allocation.

VirtualBacon notes that in 2022, total global wealth was estimated

at $454 trillion, and projections suggest this could grow to $750

trillion by 2034. Currently, gold holds approximately 3.9% of

global wealth, while Bitcoin is at a mere 0.35%. If Bitcoin’s

allocation in global portfolios rose to just 3%, still

significantly below gold’s share, its market cap could soar to $20

trillion, pushing the price to $1 million per coin. Historically,

gold’s market cap saw significant growth following the launch of

exchange-traded funds in 2004, with its portfolio allocation

increasing from 1.67% to 4.74% over the next decade. Related

Reading: Analyst Predicts Rapid Dogecoin Surge To $1: The Timing

May Surprise You If Bitcoin follows a similar trajectory, its

allocation could rise from 0.35% to 1.05% or more, translating to a

market cap of approximately $7.92 trillion, equating to about

$395,000 per Bitcoin. Therefore, reaching $1 million doesn’t

require Bitcoin to surpass gold; it must capture about 57% of

gold’s projected market cap by 2034. With gold representing 4.7% of

global portfolios compared to Bitcoin’s 0.35%, a modest increase in

Bitcoin’s share of global wealth to 3%—just 60% of gold’s

allocation—could “easily” result in a $20 trillion market cap and a

$1 million price point. At the time of writing, BTC is trading at

$92,240, up 7% every week. Featured image from DALL-E, chart

from TradingView.com

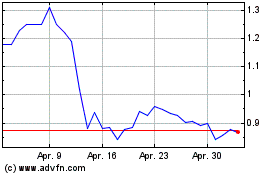

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024