Solid Start by illimity in the First Quarter of 2022, in line With the Growth Trajectory of Its Strategic Plan

11 Mai 2022 - 9:29AM

Solid Start by illimity in the First Quarter of 2022, in line With

the Growth Trajectory of Its Strategic Plan

Chaired by Rosalba Casiraghi, the Board of Directors of illimity

Bank S.p.A. (“

illimity” or the

“

Bank”) yesterday approved the illimity Group’s

results at 31 March 2022.

illimity continued its growth path also

in the first quarter of 2022, in line with the trajectory forecast

in its 2021-25 Strategic Plan, posting a net

profit of 15.7 million euro, representing an increase of

25% over the first quarter of 2021 (12.6 million euro).

More specifically, the quarter was characterised

by:

- the best ever first quarter

in terms of new business volumes, with loans and investments of

more than 330 million euro originated in the first quarter of

2022, more than double the figure for the first quarter of

the previous year. The Bank’s business divisions all displayed

great vivacity, contributing to the significant momentum in the

quarter;

- a robust upswing in revenue

to reach 78.5 million euro (+41% y/y, +1% q/q) in the

first quarter of 2022, increasingly diversified and well-balanced

between the net interest income and non-interest income components.

The Distressed Credit Division continued its position as the main

contributor, generating 69% of total revenues earned in the

quarter, while the Growth Credit Division posted revenue growth of

over 50% compared to the first quarter of 2021, taking its

contribution to consolidated revenues to around 19%;

- a continuous improvement in

operating leverage: the Cost income ratio stood at 57% in

the first quarter of 2022, a decrease of 8 percentage points over

the same period of the previous year and 5 percentage points over

the previous quarter;

- thanks to the above dynamics, an

operating profit of 33.5 million euro,

representing a significant rise on both an annual basis (+72% over

the figure of 19.5 million euro posted in the first quarter of

2021) and a quarterly basis (+14% over the figure of 29.4 million

euro for the fourth quarter of 2021);

- a pre-tax profit of 24.1

million euro, representing an increase of 26% on an annual

basis (and 98% on a quarterly basis), despite impairments to

organic credit based on an approach that remained prudent also in

the quarter and value adjustments to part of the existing portfolio

of the Distressed Credit Division, arising physiologically from the

regular review of the business plans of each loan and the relative

recovery strategies;

- the excellent quality of

organic loan book: at 31 March 2022 the ratio between

gross doubtful organic loans and total gross organic loans

originated since the start of illimity’s operations stood at 0.7%,

a figure becoming 2.3% if the loan portfolio of the former Banca

Interprovinciale is included. The annualised organic cost of risk2

for the quarter stood at 13 bps;

- a robust capital

base with ratios positioned at the top levels of the

system – a CET1 ratio of 17.7% (18.1% pro-forma with the inclusion

of the special shares), a Total Capital Ratio of 23.2% (23.6%

pro-forma) - and, despite the significant deployment of funds in

new loans and investments, a sound liquidity

position (of approximately 1 billion euro).

Two initiatives with high technological

features were launched in the first part of 2022, in

execution of the 2021-25 Strategic Plan:

- February saw the launch of

b-ilty, the first digital business store for credit and

financial services developed by illimity for SME having revenues of

between 2 and 10 million euro. Although currently at the

test phase (“beta”) for finalising the offer and the operating

platform, b-ilty can already count on around 100 active

relationships;

- the beginning of April saw the

launch of Quimmo, innovative proptech, a

development of neprix Sales, already a remarketing leader in the

judicial property sales market with 564 real estate properties sold

in the first quarter; the launch of Quimmo marks the entry in the

free property market with a new brand and an innovative

platform.

The possibilities of serving large markets and

creating future partnerships, together with the typical scalability

of such initiatives arising from their high technological content,

are all factors that will determine a strong growth potential for

the results of the two initiatives and lead to a significant

contribution to the illimity Group’s results.

Lastly, illimity reached an agreement for the

acquisition, through incorporation of a new

company, of 100% of Aurora Recovery Capital S.p.A.

(“Arec”), a company specialised in managing Unlikely to

Pay (“UTP”) loans with a focus on the corporate real estate

segment. The operation is subject to the approval of the

Supervisory Authority and illimity’s Shareholders’ Meeting, as well

as to the occurrence of standard conditions precedent for this kind

of transaction. With the subsequent integration of Arec in neprix,

the latter will further strengthen its market positioning and

significantly expand the number of its third party servicing

mandates, increasingly asserting itself as a market servicer and

being able to count on a consolidated experience, a brand and a

high level of reliability recognised by the market. This

transaction is expected to lead to significant synergies:

-

in servicing activities deriving from the further opening up of

neprix to third party asset management mandates;

-

in strengthening deal structuring expertise – which it is expected

will generate additional fees from complex transactions originated

by the illimity Group;

-

in terms of optimisation of management and subsequent

value-enhancement of the real estate assets under management –

which will translate into higher divestment values with positive

effects on the performance of managed loans;

-

in co-investment opportunities for illimity alongside other

investors in UTP positions identified on the market, including in

senior financing.

Management estimates that the acquisition and

potential synergies above mentioned will have a positive effect on

the illimity Group’s pre-tax profit of around 8 million euro in

2023 and around 11 million euro in 2025, incremental to the targets

included in the 2021-25 Strategic Plan. As of 2025, pre-tax profit

of the combined entity would therefore set at over 30 million euro.

For further information about the transaction, please refer to the

press release published today.

Corrado Passera,

CEO and Founder of

illimity, commented: “The solid results we have

achieved in the first quarter allow us to look ahead to the rest of

the year with great optimism.

In this respect a new growth phase has opened up

for illimity: our markets of reference - performing, restructuring

and distressed credit – will become even bigger in the current

scenario, and the significant generation of new investments and

loans in the first quarter, together with the robust pipeline,

indicate that this trend will continue.

We are proud to have launched two highly

technological initiatives over the past few months which are

capable of further supporting illimity’s growth path and can serve

enormous markets with unsatisfied needs: b-ilty, the first complete

digital platform for credit and financial services for SMEs, and

Quimmo, the extremely innovative proptech that will revolutionise

the free property market. If to these we add HYPE, which continues

to consolidate its leadership on the Italian fintech market, we can

truly say that illimity is increasing its technological component

even further and significantly, driving growth and value creation

for all our stakeholders.

In addition, the purchase of Arec enables us to

strengthen our positioning in UTP credit management with a

particular focus on the large ticket corporate real estate segment

and puts us in a position for grasping the key market opportunities

that will arise in the future.

Lastly, there is a very rich pipeline of new

business opportunities and, as forecast, 2022 will be the year when

the first significant synergies with the ION Group will start

materialising.

The first results for 2022 are in line with the

growth and earnings trajectory included in the 2021-25 Strategic

Plan (net profit exceeding 240 million euro in 2025), as

confirmation that our business model remains sound even in the

current macroeconomic situation.”

For more details view the entire announcement:

https://assets.ctfassets.net/0ei02du1nnrl/23UM8ZJlWJqTTKdXhzOyzW/f3c942cb2588f3c7e93dba0f40e8e7f0/illimity_1Q22_Results.pdf

For further information:

|

Investor RelationsSilvia Benzi: +39.349.7846537 -

+44.7741.464948 - silvia.benzi@illimity.com |

|

|

|

|

Press & Communication illimity |

|

|

Vittoria La Porta, Francesca D’Amico |

Sara Balzarotti, Ad Hoc Communication Advisors |

|

+39.393.4340394 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

|

|

|

|

Wire Service Contact:InvestorWire (IW)Los Angeles,

Californiawww.InvestorWire.comEditor@InvestorWire.com |

___________________________

1 Related to the business originated by

illimity, excluding the loan portfolio of the former Banca

Interprovinciale.2 Calculated as the ratio between loan loss

provisions and net organic loans to customers at 31 March 2022

(1,679 million euro) for the Factoring, Cross-over, Acquisition

Finance and Turnaround segments and for loans purchased as part of

investments in distressed credit portfolios that have undergone a

passage of accounting status subsequent to acquisition or

disbursement (excluding loans purchased as bad loans), the loan

portfolio of the former Banca Interprovinciale and Senior Financing

to non-financial investors in distressed loans.

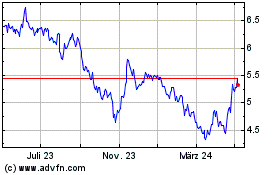

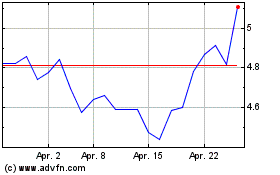

Illimity Bank (BIT:ILTY)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Illimity Bank (BIT:ILTY)

Historical Stock Chart

Von Feb 2024 bis Feb 2025