false

0000839470

0000839470

2023-12-11

2023-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 11, 2023

WESTWATER RESOURCES, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-33404 |

|

75-2212772 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

6950 S. Potomac Street, Suite 300

Centennial, Colorado |

|

80112 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 531-0516

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange

on Which Registered |

| Common

Stock, $0.001 par value |

|

WWR |

|

NYSE

American |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note

Westwater Resources, Inc. (the “Company”)

previously filed a Technical Report Summary (“TRS”), disclosing mineral resources, including an economic analysis, for the

Company’s Coosa graphite deposit in Alabama as Exhibit 96.1 to the Company’s Current Report on Form 8-K filed with

the Securities and Exchange Commission on December 13, 2023 (the “Original Filing”). The TRS was completed by SLR International

Corporation in compliance with Item 1300 of Regulation S-K and with an effective date of December 11, 2023.

The TRS filed with the Original Filing inadvertently

omitted Appendix 1 (at Section 27.0) and Appendix 2 (at Section 28.0) from the TRS. This Amendment No. 1 to the Original

Filing (this “Form 8-K/A”) is being filed to reflect the inclusion of Appendices 1 and 2 in the TRS. No other changes

have been made to the TRS, Original Filing, or any other exhibit thereto. A copy of the TRS, with the inclusion of the applicable appendices,

is filed as Exhibit 96.1 to this Form 8-K/A and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and

Exhibits. |

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Dated: October 9, 2024

| |

WESTWATER RESOURCES, INC. |

| |

|

|

| |

By: |

/s/ Steven M. Cates |

| |

Name: |

Steven M. Cates |

| |

Title: |

Senior Vice President-Finance and Chief Financial Officer |

Exhibit 23.1

| SLR International Corporation |

|

| 1658 Cole Blvd, Suite 100, Lakewood, Colorado, 80401 |

| |

October 9, 2024

Consent of Qualified Person

Re: Form 8-K/A of Westwater Resources, Inc. (the “Company”)

SLR International Corporation (“SLR”), in connection

with the Company’s Current Report on Form 8-K/A dated October 9, 2024 (the “Form 8-K/A”), consents

to:

| · | the incorporation by reference by the Company and use of

the technical report titled “Technical Report Summary on the Coosa Project, Coosa County, Alabama, USA” (the “Technical

Report Summary”), with an effective date of September 30, 2023 and dated December 11, 2023, that was prepared in accordance

with Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission (“S-K 1300”), as an

exhibit to and referenced in the Form 8-K/A; |

| · | the incorporation by reference of the Technical Report Summary

into the Company’s Registration Statements on Form S-1 No. 333-281980, Form S-3 Nos. 333-226926, 333-221687, 333-214657,

333-212845, 333-234236, 333-209024, 333-280685, and Form S-8 Nos. 333-276320, 333- 257421, 333-250866, 333-226927, 333-193075, 333-264958,

and 333-119661 (collectively, the “Registration Statements”); |

| · | the use of and references to

our name, including our status as an expert or “qualified person” (as defined in S-K 1300), in connection with the Form 8-K/A,

the Registration Statements and the Technical Report Summary; and |

| · | any extracts from or a summary of the Technical Report Summary

in the Form 8-K/A and incorporated by reference in the Registration Statements and the use of any information derived, summarized,

quoted, or referenced from the Technical Report Summary, or portions thereof, that was prepared by us, that we supervised the preparation

of, and/or that was reviewed and approved by us, that is included or incorporated by reference in the Form 8-K/A and the Registration

Statements. |

SLR is responsible for authoring, and this consent pertains to, the

Technical Report Summary. SLR certifies that it has read the Form 8-K/A and that it fairly and accurately represents the information

in the Technical Report Summary for which it is responsible.

SLR International Corporation

Per:

Grant A. Malensek, M.Eng., P.Eng.

Technical Director – U.S. Mining Advisory

Exhibit 96.1

Technical Report Summary on the Coosa

Project, Coosa County, Alabama, USA

S-K 1300 Report

Westwater Resources, Inc.

SLR Project No.: 138.20527.00002

Effective Date:

September 30, 2023

Signature Date:

December 11, 2023

Prepared by:

SLR International Corporation

Technical Report

Summary on the Coosa Project, Coosa County, Alabama, USA

SLR Project No.:

138.20527.00002

Prepared by

SLR International

Corporation

1658 Cole Blvd,

Suite 100

Lakewood, CO 80401

for

Westwater Resources, Inc.

6950 South Potomac

St., Suite 300

Centennial, CO 80112

Effective Date -

September 30, 2023

Signature Date -

December 11, 2023

| Distribution: |

1 copy - Westwater Resources, Inc. |

| |

1 copy - SLR International Corporation |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

Table of Contents

| 1.0 | Executive Summary |

1-1 |

| | |

|

| 1.1 | Summary |

1-1 |

| 1.2 | Economic Analysis |

1-6 |

| 1.3 | Technical Summary |

1-12 |

| | |

|

| 2.0 | Introduction |

2-1 |

| | |

|

| 2.1 | Site Visits |

2-1 |

| 2.2 | Sources of Information |

2-1 |

| 2.3 | List of Abbreviations |

2-2 |

| | |

|

| 3.0 | Property Description |

3-1 |

| | |

|

| 3.1 | Location |

3-1 |

| 3.2 | Land Tenure |

3-1 |

| 3.3 | Underlying Agreement |

3-11 |

| 3.4 | Encumbrances |

3-12 |

| 3.5 | Royalties |

3-12 |

| 3.6 | Required Permits and Status |

3-12 |

| 3.7 | Other Significant Factors and Risks |

3-12 |

| | |

|

| 4.0 | Accessibility, Climate, Local Resources, Infrastructure

and Physiography |

4-1 |

| | |

|

| 4.1 | Accessibility |

4-1 |

| 4.2 | Climate |

4-1 |

| 4.3 | Local Resources |

4-1 |

| 4.4 | Infrastructure |

4-1 |

| 4.5 | Physiography |

4-1 |

| | |

|

| 5.0 | History |

5-1 |

| | |

|

| 5.1 | Prior Ownership |

5-1 |

| 5.2 | Exploration and Development History |

5-1 |

| 5.3 | Historical Resource Estimates |

5-4 |

| 5.4 | Past Production |

5-4 |

| | |

|

| 6.0 | Geological Setting, Mineralization, and Deposit |

6-1 |

| | |

|

| 6.1 | Regional Geology |

6-1 |

| 6.2 | Local Geology |

6-4 |

| 6.3 | Property Geology |

6-4 |

| 6.4 | Mineralization |

6-15 |

| | i |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 6.5 | Deposit Types |

6-15 |

| | |

|

| 7.0 | Exploration |

7-1 |

| | |

|

| 7.1 | Exploration |

7-1 |

| 7.2 | Exploration Target |

7-5 |

| 7.3 | Drilling |

7-5 |

| 7.4 | Conclusions |

7-11 |

| | |

|

| 8.0 | Sample Preparation, Analyses, and Security |

8-1 |

| | |

|

| 8.1 | Sample Preparation and Analysis |

8-1 |

| 8.2 | Bulk Density |

8-3 |

| 8.3 | Quality Assurance and Quality Control |

8-5 |

| 8.4 | Sample Security |

8-29 |

| 8.5 | Conclusions |

8-30 |

| | |

|

| 9.0 | Data Verification |

9-1 |

| | |

|

| 10.0 | Mineral Processing and Metallurgical Testing |

10-1 |

| | |

|

| 10.1 | Introduction |

10-1 |

| 10.2 | 2013 Metallurgical Test Work |

10-1 |

| 10.3 | 2014 Metallurgical Test Work |

10-4 |

| 10.4 | 2014-2015 Metallurgical Test Work |

10-8 |

| 10.5 | 2015 Metallurgical Test Work |

10-15 |

| 10.6 | Proposed Flowsheet |

10-22 |

| 10.7 | Performance and Recovery Estimates |

10-23 |

| 10.8 | Qualified Person’s Opinion |

10-24 |

| | |

|

| 11.0 | Mineral Resource Estimates |

11-1 |

| | |

|

| 11.1 | Summary |

11-1 |

| 11.2 | Resource Database |

11-2 |

| 11.3 | Geological Interpretation |

11-3 |

| 11.4 | Statistical Analysis |

11-6 |

| 11.5 | Compositing |

11-8 |

| 11.6 | Variography |

11-10 |

| 11.7 | Bulk Density |

11-11 |

| 11.8 | Block Models |

11-12 |

| 11.9 | Search Strategy and Grade Interpolation Parameters |

11-12 |

| 11.10 | Cut-off Grade and Whittle Parameters |

11-13 |

| 11.11 | Classification |

11-13 |

| | ii |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 11.12 | Block Model Validation |

11-15 |

| 11.13 | Grade-Tonnage Sensitivity |

11-20 |

| 11.14 | Mineral Resource Reporting |

11-22 |

| | |

|

| 12.0 | Mineral Reserve Estimates |

12-1 |

| | |

|

| 13.0 | Mining Methods |

13-1 |

| | |

|

| 13.1 | Mine Design, Mining Method |

13-1 |

| 13.2 | Geomechanics, Ground Support |

13-1 |

| 13.3 | Dilution and Extraction |

13-1 |

| 13.4 | Cut-off Grade |

13-1 |

| 13.5 | Pit Optimization |

13-2 |

| 13.6 | Life of Mine Plan |

13-6 |

| 13.7 | Mine Equipment |

13-8 |

| | |

|

| 14.0 | Processing and Recovery Methods |

14-1 |

| | |

|

| 14.1 | Introduction |

14-1 |

| 14.2 | Process Flowsheet |

14-1 |

| 14.3 | Design Criteria |

14-1 |

| 14.4 | Process Description - Concentrator |

14-3 |

| | |

|

| 15.0 | Infrastructure |

15-1 |

| | |

|

| 15.1 | Access Roads |

15-1 |

| 15.2 | Power |

15-1 |

| 15.3 | Water |

15-1 |

| 15.4 | Accommodation Camp |

15-1 |

| 15.5 | Tailings Facility |

15-3 |

| | |

|

| 16.0 | Market Studies |

16-1 |

| | |

|

| 16.1 | Markets |

16-1 |

| 16.2 | Contracts |

16-2 |

| | |

|

| 17.0 | Environmental Studies, Permitting, and Plans, Negotiations,

or Agreements with Local Individuals or Groups |

17-1 |

| | |

|

| 17.1 | Summary |

17-1 |

| 17.2 | Environmental Studies |

17-1 |

| 17.3 | Environmental Permits |

17-1 |

| 17.4 | Closure |

17-2 |

| 17.5 | Conclusions and Recommendations |

17-2 |

| | |

|

| 18.0 | Capital and Operating Costs |

18-1 |

| | |

|

| 18.1 | Capital Costs |

18-1 |

| | iii |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 18.2 | Operating Costs |

18-6 |

| | |

|

| 19.0 | Economic Analysis |

19-1 |

| | |

|

| 19.1 | Base Case (Indicated and Inferred Mineral Resources) |

19-1 |

| 19.2 | Alternate Case (Indicated Mineral Resources Only) |

19-6 |

| | |

|

| 20.0 | Adjacent Properties |

20-1 |

| | |

|

| 21.0 | Other Relevant Data and Information |

21-1 |

| | |

|

| 22.0 | Interpretation and Conclusions |

22-1 |

| | |

|

| 22.1 | Geology and Mineral Resources |

22-1 |

| 22.2 | Mining |

22-1 |

| 22.3 | Mineral Processing and Metallurgical Testing |

22-2 |

| 22.4 | Environmental Studies, Permitting, and Plans, Negotiations,

or Agreements with Local Individuals or Groups |

22-2 |

| | |

|

| 23.0 | Recommendations |

23-1 |

| | |

|

| 23.1 | Exploration Drilling |

23-1 |

| 23.2 | Advancement of Coosa Graphite Mineral Resources |

23-1 |

| 23.3 | Environmental Studies, Permitting, and Plans, Negotiations,

or Agreements with Local Individuals or Groups |

23-2 |

| | |

|

| 24.0 | References |

24-1 |

| | |

|

| 25.0 | Reliance on Information Provided by the Registrant |

25-1 |

| | |

|

| 26.0 | Date and Signature Page |

26-1 |

| | |

|

| 27.1 | Zenith Quotation for 500 tph Graphite Line |

27-1 |

| | |

|

| 28.0 | Appendix 2 |

28-1 |

| | |

|

| 28.1 | SLR Cash Flow Summary Tables |

28-1 |

Tables

| Table 1-1: |

Summary of Carbon Graphite (Cg) Mineral Resources – Effective November 30, 2022 |

1-2 |

| Table 1-2: |

2024 Proposed Drilling Budget |

1-5 |

| Table 1-3: |

After-Tax Base Case Cash Flow Summary |

1-8 |

| Table 1-4: |

After-Tax Sensitivity Analyses |

1-9 |

| Table 1-5: |

Base Case LOM Capital Cost Estimate Summary |

1-18 |

| Table 3-1: |

Summary of Land Tenure Mineral Resources |

3-2 |

| Table 7-1: |

Summary of Drilling Parameters 2012-2022 |

7-6 |

| Table 8-1: |

Bulk Density Measurements |

8-4 |

| Table 8-2: |

List of CANMET CRM Used for Carbon by ALS Minerals 2012 |

8-7 |

| | iv |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| Table 8-3: |

AGC Coosa CRM Recommended Values 2015 |

8-11 |

| Table 8-4: |

Westwater Coosa CSRM Values 2021-2022 |

8-12 |

| Table 10-1: |

Head Assays for 2013 Coosa Deposit Metallurgical Samples |

10-1 |

| Table 10-2: |

Carbon Speciation and Sulphur Analysis of Coosa Deposit Samples |

10-5 |

| Table 10-3: |

Carbon Speciation and Sulphur Analysis of Two Coosa Deposit Samples |

10-9 |

| Table 10-4: |

Total Carbon and Graphitic Carbon Grades for Eight Trench Samples |

10-9 |

| Table 10-5: |

Bond Ball Mill Work Index Results - AGC-12B (0-8) and AGC-10C (100-150) Samples |

10-9 |

| Table 10-6: |

Carbon Speciation and Sulphur Analysis of Flowsheet Development Samples and Composite |

10-16 |

| Table 11-1: |

Summary of Carbon Graphite Mineral Resources – Effective November 30, 2022 |

11-1 |

| Table 11-2: |

Resource Drill Hole Database |

11-2 |

| Table 11-3: |

Descriptive Statistics of Resource Assay Grades and Lengths |

11-6 |

| Table 11-4: |

Descriptive Statistics of Composite Assay Grades and Lengths |

11-10 |

| Table 11-5: |

Block Model Definition |

11-12 |

| Table 11-6: |

Interpolation Parameters |

11-12 |

| Table 11-7: |

Resource Pit Parameters |

11-13 |

| Table 11-8: |

Comparison of Block and Composite Graphite and Vanadium Grades |

11-20 |

| Table 11-9: |

Carbon Graphite Block Model Sensitivity to Cut-Off Grade (% Cg) |

11-20 |

| Table 11-10: |

Summary of Carbon Graphite Mineral Resources – Effective November 30, 2022 |

11-22 |

| Table 13-1: |

Economic and Technical Parameters Used in Pit Optimization |

13-2 |

| Table 13-2: |

Coosa Project Conceptual Production Schedule |

13-7 |

| Table 13-3: |

Coosa Project – Primary Mine Equipment Planned |

13-8 |

| Table 14-1: |

Summary of Process Design Criteria |

14-3 |

| Table 17-1: |

Required or Potentially Required Environmental Permits |

17-2 |

| Table 18-1: |

Base Case LOM Capital Cost Estimate Summary |

18-1 |

| Table 18-2: |

Mining Initial Capital Cost Estimate |

18-2 |

| Table 18-3: |

Process Plant Initial Capital Cost Estimate |

18-3 |

| Table 18-4: |

Infrastructure Initial Capital Cost Estimate |

18-4 |

| Table 18-5: |

FTSF Initial Capital Cost Estimate |

18-4 |

| Table 18-6: |

FTSF Sustaining Capital Cost Estimate |

18-6 |

| Table 18-7: |

FTSF Closure/Reclamation Cost Estimate |

18-6 |

| Table 18-8: |

Mine Operating Cost Estimate Summary |

18-7 |

| Table 18-9: |

Process Operating Cost Estimate Summary |

18-7 |

| | v |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| Table 18-10: |

Project Headcount Estimate |

18-8 |

| Table 19-1: |

After-Tax Base Case Cash Flow Summary |

19-3 |

| Table 19-2: |

After-Tax Sensitivity Analyses |

19-4 |

| Table 23-1: |

2024 Proposed Drilling Budget |

23-2 |

Figures

| Figure 1-1: |

After-Tax NPV Sensitivity Analysis |

1-10 |

| Figure 1-2: |

After-Tax IRR Sensitivity Analysis |

1-11 |

| Figure 3-1: |

Location Map |

3-8 |

| Figure 3-2: |

Westwater Mineral Holdings Map |

3-9 |

| Figure 3-3: |

Target Areas |

3-10 |

| Figure 6-1: |

Regional Geology |

6-3 |

| Figure 6-2: |

Stratigraphic Column |

6-5 |

| Figure 6-3: |

Main Grid Area Showing Postulated Granitic Body |

6-11 |

| Figure 6-4: |

Main Grid Area with Conductivity Overlay |

6-12 |

| Figure 6-5: |

Main Grid Area with Conductivity Overlay and Amphibolite Outline |

6-13 |

| Figure 6-6: |

Conceptual Amphibolite Cross Section |

6-14 |

| Figure 7-1: |

Alabama Graphite 2012-2013 Channel Sample Location |

7-2 |

| Figure 7-2: |

TDEM Contour Map Showing Conductive Highs |

7-4 |

| Figure 7-3: |

Drilling Location Map |

7-8 |

| Figure 8-1: |

CRM NBM-1 2012 |

8-7 |

| Figure 8-2 : |

CRM MA-1b 2012 |

8-8 |

| Figure 8-3 : |

CRM DS-1 2012 |

8-9 |

| Figure 8-4: |

CRM STSD-3 2012 |

8-10 |

| Figure 8-5: |

Zscore Plot of CRM Standard A and Standard B 2015 |

8-11 |

| Figure 8-6: |

Zscore Plot of CSRM Std 1 through Std 4 2021 |

8-13 |

| Figure 8-7: |

Scatter Plot of Coarse Diorite Blanks 2012 |

8-14 |

| Figure 8-8: |

Scatter Plot of Coarse Diorite Blanks 2014 Trenching Program |

8-15 |

| Figure 8-9: |

Scatter Plot of Coarse Diorite Blanks 2015 |

8-16 |

| Figure 8-10: |

Scatter Plot of Granite Material Blanks 2021-2022 |

8-17 |

| Figure 8-11: |

Scatter Plot of Field Core Duplicates 2012 |

8-18 |

| Figure 8-12: |

Plot of Field Core Duplicate Mean versus Relative Difference 2012 |

8-19 |

| Figure 8-13: |

Scatter Plot of Field Core Duplicates 2014 Trenching Program |

8-20 |

| Figure 8-14: |

Scatter Plot of Field Core Duplicates 2015 |

8-21 |

| | vi |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| Figure 8-15: |

Plot of Field Core Duplicate Mean versus Relative Difference 2015 |

8-22 |

| Figure 8-16: |

Scatter Plot of Field Core Duplicates 2021 |

8-23 |

| Figure 8-17: |

Plot of Field Core Duplicate Mean versus Relative Difference 2021 |

8-24 |

| Figure 8-18: |

Scatter Plot of Replicate Analyses of Hole AGC-03C |

8-25 |

| Figure 8-19: |

Scatter Plot of Replicate Analyses of Cg for Whole Drill Program |

8-26 |

| Figure 8-20: |

Plot of Mean vs. Relative Difference of % Cg for Replicate Samples |

8-27 |

| Figure 8-21: |

2021 External Duplicate Sample Results for U3O8% (SGS vs. Actlabs) |

8-28 |

| Figure 8-22: |

Mean vs. Relative Difference (SGS vs. Actlabs) |

8-29 |

| Figure 10-1: |

Open Circuit Flowsheet for April 2013 Coosa Deposit Samples |

10-2 |

| Figure 10-2: |

Total Carbon Grade Versus Total Carbon Recovery - 2013 Coosa Deposit Samples |

10-3 |

| Figure 10-3: |

Mass Recovery into Different Flake Sizes - 2013 Coosa Deposit Samples |

10-4 |

| Figure 10-4: |

Carbon Grade Versus Carbon Recovery Curves |

10-6 |

| Figure 10-5: |

Carbon Grades of Concentrate Size Fractions |

10-7 |

| Figure 10-6: |

Mass Recovery into Concentrate Size Fractions |

10-8 |

| Figure 10-7: |

Total Carbon Grade versus Recovery Curves - AGC-09C and AGC-12A Samples |

10-10 |

| Figure 10-8: |

Mass Recovery into Size Fractions - AGC-09C and AGC-12A Samples |

10-11 |

| Figure 10-9: |

Carbon Grades of Concentrate Size Fractions - AGC-09C and AGC-12A Samples |

10-12 |

| Figure 10-10: |

Total Carbon Grade versus Recovery Curves - Trench Samples |

10-13 |

| Figure 10-11: |

Mass Recovery into Size Fractions - Trench Samples |

10-14 |

| Figure 10-12: |

Carbon Grades of Concentrate Size Fractions - Trench Samples |

10-15 |

| Figure 10-13: |

Total Carbon Recovery as a Function of Grind Size |

10-17 |

| Figure 10-14: |

Mass Recovery into Size Fractions - Cleaner Tests F4 to F7 |

10-18 |

| Figure 10-15: |

Total Carbon Grades of Size Fractions - Cleaner Tests F4 to F7 |

10-19 |

| Figure 10-16: |

Mass Recovery into Size Fractions - Cleaner Tests F8 to F11 |

10-20 |

| Figure 10-17: |

Total Carbon Grades of Size Fractions - Cleaner Tests F8 to F11 |

10-21 |

| Figure 10-18: |

Proposed Coosa Deposit Flowsheet with Pre-cleaning |

10-22 |

| Figure 10-19: |

Projected Flake Size Distribution |

10-23 |

| Figure 11-1: |

Plan View of Coosa Geologic Model |

11-4 |

| Figure 11-2: |

Plan View of Coosa Weathering Model |

11-5 |

| Figure 11-3: |

Grade % Cg Histogram by Lithology |

11-7 |

| Figure 11-4: |

Assay Length Histogram |

11-9 |

| Figure 11-5: |

Variograms for QGS Main Grid |

11-11 |

| | vii |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| Figure 11-6: |

QGS Swath Plot in X Direction |

11-16 |

| Figure 11-7: |

QGS Swath Plot in Y Direction |

11-17 |

| Figure 11-8: |

QGS Swath Plot in Z Direction |

11-18 |

| Figure 11-9: |

Cross Section Showing Block Grades and Composite Grades |

11-19 |

| Figure 11-10: |

Grade Tonnage Curve for Coosa Graphite |

11-21 |

| Figure 13-1: |

Whittle Optimization – Pit Shell Phases Layout |

13-4 |

| Figure 13-2: |

Coosa Project Pit-by-Pit Graph |

13-5 |

| Figure 14-1: |

Flowsheet for the Coosa Processing Plant |

14-2 |

| Figure 15-1: |

Infrastructure Layout General Schematic |

15-2 |

| Figure 15-2: |

Filtered Tailings Storage Facility Cross Section |

15-4 |

| Figure 16-1: |

Long Term Natural Flake Pricing Forecast |

16-2 |

| Figure 19-1: |

After-Tax NPV Sensitivity Analysis |

19-5 |

| Figure 19-2: |

After-Tax IRR Sensitivity Analysis |

19-6 |

Appendix Tables

| Table 28-1: |

Coosa IA Base Case Cash Flow Summary – US Customary Units |

28-2 |

| Table 28-2: |

Coosa IA Base Case Cash Flow Summary – Metric Units |

28-4 |

| | viii |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

SLR International Corporation (SLR)

was retained by Westwater Resources, Inc. (Westwater or the Company) to prepare an independent Technical Report Summary (TRS) on

the Coosa Graphite Project (the Project or Coosa), located in Coosa County, Alabama, USA. The purpose of this TRS is to disclose results

of an Initial Assessment (IA) of the Project, including an economic analysis, based on the Mineral Resource estimate with an effective

date of November 30, 2022. The Mineral Resource estimate was reported in the previous TRS dated December 1, 2022 and remains

unchanged as no additional work has been completed on the property since that time.

This TRS conforms to the United States

Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart

229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary.

SLR visited the Project on April 21-23, 2022 and September 5, 2023.

Westwater is a 45-year old public company

currently focused on developing battery-grade natural graphite. Originally incorporated in 1977 as Uranium Resources, Inc. to mine

uranium in Texas, the Company has been reborn as an energy materials and technology developer. Westwater is focused on battery-grade

natural graphite after its acquisition of Alabama Graphite Corp. (AGC) in April 2018. AGC acquired the Project in 2012 based on

the geological setting. On April 23, 2018, Westwater acquired a 100% interest in AGC as part of a strategic decision to refocus

the Company to supply battery manufacturers with low-cost, high-quality, and high-margin natural graphite products. As a result of that

business transaction, Westwater became the owner of the Project.

The Coosa graphite deposit is located

at the southern end of the Appalachian Mountain range, in Coosa County, Alabama. The deposit area is approximately 50 miles south-southeast

of the city of Birmingham and 23 miles south-southwest of the town of Sylacauga. The Project’s mineral tenure is comprised of approximately

41,965 acres of privately owned mineral rights that the Company holds under a long-term lease. The Project is located in the flake graphite

belt of central Alabama, also known as the Alabama Graphite Belt.

A Mineral Resource estimate for the

Project, based on 205 drill holes totaling 39,434 ft, was completed by SLR with an effective date of November 30, 2022. Table 1-1

summarizes the Coosa Mineral Resources at a 1.98% graphitic carbon (Cg) cut-off grade envisaging an open pit mining scenario. Indicated

Mineral Resources total 26.0 million short tons (Mst) at an average grade of 2.89% Cg for a total of 754,000 st Cg. Inferred Mineral

Resources total 97.0 Mst at an average grade of 3.08% Cg for a total of 3.0 Mst Cg.

| | 1-1 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

Table

1-1: Summary of Carbon Graphite (Cg) Mineral Resources – Effective November 30, 2022

| Classification |

Tonnage

(Mst) |

Grade Cg

(%) |

Contained Cg

(Mlb) |

Contained Cg

(000 st) |

Recovery

(%) |

| Indicated |

26 |

2.89 |

1,509 |

754 |

87.4 |

| Inferred |

97 |

3.08 |

5,996 |

2,998 |

87.4 |

Notes:

| 1. | The

S-K 1300 definitions were followed for Mineral Resources. |

| 2. | Mineral

Resources are constrained within a Whittle pit shell using a cut-off grade of 1.98% Cg. |

| 3. | Mineral

Resources are estimated using a long-term graphite concentrate price of US$1,100/st. |

| 4. | Bulk

density ranges from 1.68 t/m3 to 3.03 t/m3 (0.05 st/ft3

to 0.09 st/ft3). |

| 5. | Mining

dilution equals 5.0%. |

| 6. | Mineral

Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 7. | Numbers

may not add due to rounding. |

| 8. | Mineral

Resources are 100% attributable to Westwater. |

The Coosa graphite deposit is expected

to be mined by conventional small-scale open pit mining methods through several shallow pits (less than 100 ft deep each) that will be

developed over the life of the Project. At full-scale production, the mining rate will be approximately 3.33 million short tons per annum

(Mstpa), at an average grade of 3.21% Cg. Mine operations will employ small conventional loading and haulage equipment. The Coosa graphite

concentrator facilities are designed to process a nominal 3.2 Mstpa, or 8,770 tons per day (stpd) of run of mine (ROM) Cg ore to produce

an average of 99,000 stpa (90,000 tonnes per year) of flotation concentrate product grading 95% Cg.

An economic analysis was prepared with

a base case using Indicated and Inferred Mineral Resources (the latter being 89% of the total) which shows positive economics. The economic

analysis contained in this TRS is preliminary in nature and is based, in part, on Inferred Mineral Resources that are considered too

speculative geologically to have modifying factors applied to them that would enable them to be categorized as Mineral Reserves. There

is no certainty that economic forecasts on which this Initial Assessment is based will be realized.

In addition, since only 11% of the mineral

resources in the base case production schedule are Indicated Mineral Resources, the QP has determined that a stand alone alternative

case with only Indicated Resource tonnage is not economic using the assumptions and inputs outlined in the base case.

SLR offers the following interpretations

and conclusions on the Project:

| 1.1.1.1 | Geology

and Mineral Resources |

| · | Graphite

generally occurs as a result of metamorphism (regional or contact) of organic matter in sediments.

Flake graphite is assumed to be derived from fine-grained sediments rich in organic matter. |

| · | Graphite

ores mined historically were almost entirely from the weathered zone (60 ft to 100 ft), partly

because weathering is deep in this area and partly because the weathered rock could be gently

crushed without blasting. |

| | 1-2 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| · | The

sample preparation, analysis, and security procedures at Coosa are adequate for use in the

estimation of Mineral Resources. |

| · | The

quality assurance and quality control (QA/QC) programs as designed and implemented by Westwater

and its predecessor AGC meet current industry standard practice and the assay results within

the database are suitable for use in a Mineral Resource estimate. |

| · | No

significant database issues were identified and the SLR QP is of the opinion that the database

verification procedures for the Project comply with industry standards and are adequate for

the purposes of Mineral Resource estimation. |

| · | Relogging

of previously drilled holes in conjunction with new drilling information allowed for more

accurate interpretation and separation of lithologic units and improved understanding of

the geologic environment resulting in: |

| o | Improved

geologic model correlation to the 2014 Airborne Magnetic survey. |

| o | Identifying

widespread and strong vanadium (roscoelite) mineralization in very close association with

flake graphite mineralization. |

| · | The

Company has carried out an extensive geochemical sampling program to determine the presence

and intensity of vanadium mineralization at the Project. Vanadium potential tonnage and grade

are currently estimated to be 21.0 Mst to 67.0 Mst and 0.19% V2O5 to

0.13% V2O5, respectively. SLR notes that the potential quantity and

grade are conceptual in nature, there has been insufficient exploration to define a Mineral

Resource, and it is uncertain if further exploration will result in the target being delineated

as a Mineral Resource. |

| · | There

are no current Mineral Reserves at the Project. |

| · | Open

pit shovel and truck mining method is proposed for operations. |

| · | A

marginal cut-off grade of 2.1365% Cg is calculated based on a US$806/st graphite concentrate

price that results from applying a revenue factor of 0.8 to the Whittle pit shell parameters. |

| · | The

open pit optimization final pit selection is representative of a scenario that maximizes

net present value (NPV). |

| o | Selecting

a revenue factor of 0.80 essentially means that the base case graphite price has been scaled

down, resulting in a smaller pit shell, which means that lower mineralization tonnages at

higher grades are mined, leading to an improved NPV. |

| · | Total

mineralized material inventory for the Coosa Project is 72.7 Mst at a grade of 3.21% Cg. |

| · | A

conceptual production schedule based on optimized pit shells is developed with an annual

ore production of 3.33 Mst over a 22 year period with a waste to ore (W:O) stripping ratio

of 0.21:1. |

| · | Mining

costs and equipment are based on Infomine 2021 Edition for similar capacity surface mines,

and escalated based on the Mining Cost Service (MCS) indexes provided by Infomine April 2023

edition. |

| | 1-3 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 1.1.1.3 | Mineral

Processing and Metallurgical Testing |

| · | The

Coosa graphite concentrator facilities are designed to process a nominal 3.201 Mstpa, or

8,771 tons per day (stpd) of run of mine (ROM) Cg ore to produce an average of 99,207 stpa

(90,000 tonnes per year) of flotation concentrate product grading 95% Cg. The projected recovery

of Cg to concentrate is 92% into a concentrate mass of 3.1% of the feed tonnage. |

| · | The

proposed processing plant flowsheet consists of conventional crushing, rod milling and ball

milling, flash flotation, conventional rougher flotation, and two stages of polishing grinding,

cleaner column and conventional scavenger flotation circuits. The critical stages to achieve

the required high concentrate grades and coarse flake sizes are the multistage polishing

and cleaning flotation operations. |

| 1.1.1.4 | Environmental

Studies, Permitting, and Plans, Negotiations, or Agreements with Local Individuals or Groups |

| · | The

primary permits anticipated for the Project are a Plan of Operations (PoO) and associated

Record of Decision (ROD) issued by the United States Army Corps of Engineers (USACOE) and

the Surface Mining of Non-fuel Minerals Permit and Plan of Reclamation issued by the Alabama

Department of Labor. Baseline studies will be required to support these and other permitting

efforts. |

| · | Stakeholder

engagement, including regulatory agencies, tribal entities, and the community will also be

required to support the permitting efforts. |

Westwater is considering a program to

advance the Project, which includes an initial budget estimate of approximately US$1,600,000, as presented in Table 1-2. SLR concurs

with this program. The program consists of two consecutive phases: (1) updating Mineral Resources following completion of the proposed

delineation drilling programs, and (2) carrying out engineering studies to advance the Project to a Pre-Feasibility Study (PFS)

level. The PFS will cover the following activities:

| · | metallurgical

test work, pilot plant, product testing |

| · | preliminary

environmental testing to identify any major deleterious elements and quantify the acid-generating

potential of the Coosa mineralization. |

| · | geotechnical

and hydrogeological studies |

| · | tailings

management facility design, material characterization and site geotechnical |

| · | environmental

management studies and data collection |

| · | capital

and operating cost estimation |

| · | infrastructure

evaluation and costing |

| · | project

management and administration |

| | 1-4 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 1.1.2.1 | Exploration

Drilling |

| 1 | Complete

six-phase infill/delineation drilling activities in the NX, Fixico Mine, SW, Main Grid, Main

Grid/Fixico Mine and HS South areas of the Project to convert Inferred oxide resources to

the Indicated Mineral Resources category. This work is expected to require approximately

115 drill holes and 1,700 assays. The phased drilling programs are independent of each other

and can be conducted simultaneously or on an individual basis. The estimated cost to complete

the program is $936,000. |

| 2 | Drill

additional holes down dip and review the classification criteria as more data become available. |

| 1.1.2.2 | Advancement

of Coosa Graphite Mineral Resources |

| 1 | Complete

a PFS of the Project and update the S-K 1300 TRS accordingly after completion of the exploration

drilling program. |

| 2 | Revisit

and update mining and processing costs and recalculate cut-off grade. |

| 3 | Revisit

and update the Whittle pit with new cost parameters. |

| |

Table 1-2: |

2024 Proposed Drilling Budget |

| Category |

Item |

Number of Drill

Holes/Assay |

Total Feet

Drilled |

Unit Cost

(US$/ft) |

Budget

(US$) |

| Delineation Drilling |

Phase 1 - NX Area |

25 |

1,600 |

100 |

160,000 |

| |

Phase 2 - Fixico Mine Area |

35 |

2,300 |

100 |

230,000 |

| |

Phase 3 - SWX Area |

15 |

1,200 |

100 |

120,000 |

| |

Phase 4 - Main Grid Area |

15 |

1,200 |

100 |

120,000 |

| |

Phase 5 - Main Grid/Fixico Mine Area |

15 |

1,300 |

100 |

130,000 |

| |

Phase 6 - HS South Area |

10 |

700 |

100 |

70,000 |

| Laboratory Assay |

ActLabs (primary - 5ft interval) |

1,600 |

|

50 |

80,000 |

| |

SGS Labs (secondary - 25% primary) |

400 |

|

65 |

26,000 |

| Total Delineation Drilling |

|

|

|

|

936,000 |

| Advance Project |

PFS |

|

|

|

600,000 |

| Grand Total |

|

|

|

|

1,536,000 |

| | 1-5 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 1.1.2.3 | Environmental

Studies, Permitting, and Plans, Negotiations, or Agreements with Local Individuals or Groups |

| 1. | Complete

baseline studies required for the permitting of the Project. |

| 2. | Engage

stakeholders including federal, state and local regulatory agencies as well as non-regulatory

stakeholders such as adjacent property owners, tribal entities and local communities. |

The economic analysis contained in this

TRS is preliminary in nature and is based, in part, on Inferred Mineral Resources that are considered too speculative geologically to

have modifying factors applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic

forecasts on which this Initial Assessment is based will be realized.

| 1.2.1 | Base

Case (Indicated and Inferred Mineral Resources) |

The Project base case cash flow is based

on Indicated and Inferred Mineral Resources (the latter being 89% of the total).

An after-tax Cash Flow Projection has

been generated from the LOM production schedule and capital and operating cost estimates and is summarized in Table 1-3. A summary of

the key criteria is provided below.

Revenue

| · | Mineralized

Material Inventory used for LOM planning: 72.7 Mst at 3.21% Cg with 2.33 Mst of contained

Cg (65.9 million tonnes at 3.21% Cg with 2.11 million tonnes contained Cg), 100% attributable

to Westwater. |

| · | An

average of 9,100 st (8,200 tonnes) mill feed per day mining from open pit for 4 Mst (3 million

tonnes) per year. |

| · | Mill

recovery averaging 92%. |

| · | 95%

C concentrate grade at 100% payable. |

| · | Average

annual Cg concentrate sales: 103,000 stpa (93,000 tonnes per year) |

| · | Graphite

price (CIF Kellyton Plant): US$998/st ($1,100/tonne). |

| · | Transport

to Kellyton Plant (CIF): $10.69/st ($11.90/tonne) derived from 70 mile round trip at $0.17/ton-mile |

Costs

| · | Pre-production

period: 24 months |

| · | LOM

production plan as summarized in this report. |

| · | Mine

life capital totals $293 million, including $142 million of sustaining capital. |

| · | Final

end of mine reclamation and closure costs: $43 million |

| · | Average

operating cost over the mine life is $15.41/st milled ($16.99/tonne milled). |

| | 1-6 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

Taxation and Royalties

| · | Royalties:

Merchant 0.5% NSR up to a maximum of $150,000; Lessor 2% NSR. |

| · | Coosa

County Severance Tax: $5/st concentrate ($5.51/tonne) |

| · | 10

year Modified Accelerated Cost Recovery System (MACRS) depreciation method was used with

total allowance of $286.3 million taken during the LOM |

| · | Percentage

depletion method (14% for graphite) was used with total allowance of $305.4 million taken

during the LOM |

| · | Loss

Carry Forwards - Income tax losses may be carried forward indefinitely but may not be used

for prior tax years |

| · | Federal

tax rate of 21%, Alabama state income tax rate of 6.5% |

| 1.2.1.2 | Cash

Flow Analysis |

Table 1-3 presents a summary of the

Project Base Case economics at an Cg price of $998/st ($1,110/tonne). On a pre-tax basis, the undiscounted cash flow totals $714.1 million

over the mine life. The pre-tax net present value (NPV) at an 8% discount rate is $229.2 million and pre-tax Internal Rate of Return

(IRR) is 26.7%. On an after-tax basis for the base case, the undiscounted cash flow totals $608.2 million over the mine life. The after-tax

NPV at an 8% discount rate is $190.2 million and the after-tax IRR is 24.2%.

| | 1-7 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| |

Table 1-3: |

After-Tax Base Case Cash Flow Summary |

| Item |

Unit |

Value |

| Cg Price |

$/st |

998 |

| Cg Concentrate Sales |

Mst |

2.26 |

| Total Gross Revenue |

US$ M |

2,254 |

| Mining Costs |

US$ M |

(379) |

| Processing Costs |

US$ M |

(639) |

| G&A Costs |

US$ M |

(102) |

| Product Transport to Kellyton Plant Cost |

US$ M |

(28) |

| Production Taxes/Royalties |

US$ M |

(56) |

| Total Operating Costs |

US$ M |

(1,204) |

| Operating Margin |

US$ M |

1,050 |

| Operating Margin |

US$ M |

48% |

| Corporate Income Tax |

US$ M |

(139) |

| Operating Cash Flow |

US$ M |

911 |

| Development Capital |

US$ M |

(152) |

| Sustaining Capital |

US$ M |

(142) |

| Final Closure/Reclamation |

US$ M |

(43) |

| Total Capital |

US$ M |

(336) |

| |

|

|

| Pre-tax Free Cash Flow |

US$ M |

714.1 |

| Pre-tax NPV @ 8% |

US$ M |

229.2 |

| Pre-tax IRR |

% |

26.7 |

| |

|

|

| After-tax Free Cash Flow |

US$ M |

608.2 |

| After-tax NPV @ 8% |

US$ M |

190.2 |

| After-tax IRR |

% |

24.2 |

| | 1-8 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 1.2.1.3 | Sensitivity

Analysis |

Project risks can be identified in both

economic and non-economic terms. Key economic risks were examined by running cash flow sensitivities:

Pre-tax IRR sensitivity over the base

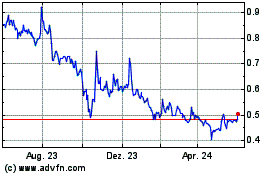

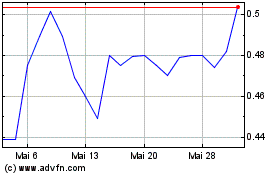

case has been calculated for -20% to +20% variations. The sensitivities are shown in Table 1-4 and Figure 1-1 and Figure 1-2. The Project

is most sensitive to head grade, graphite price, and recovery, and only slightly less sensitive to operating cost and capital cost. The

sensitivities to metallurgical recovery, head grade, and metal price are nearly identical.

| |

Table 1-4: |

After-Tax Sensitivity Analyses |

| Variance |

Head Grade

(% Cg) |

NPV at 8%

(US$ millions) |

IRR |

| 80% |

2.57% |

48 |

12.9% |

| 90% |

2.89% |

119 |

18.9% |

| 100% |

3.21% |

190 |

24.2% |

| 110% |

3.53% |

261 |

29.1% |

| 120% |

3.85% |

332 |

33.8% |

| Variance |

Recovery

(%) |

NPV at 8%

(US$ millions) |

IRR |

| 90% |

82.8% |

119 |

18.9% |

| 95% |

87.4% |

155 |

21.6% |

| 100% |

92.0% |

190 |

24.2% |

| 105% |

96.6% |

226 |

26.7% |

| 108% |

99.4% |

247 |

28.2% |

| Variance |

Metal Prices

(US$/st Cg Concentrate) |

NPV at 8%

(US$ millions) |

IRR |

| 80% |

$798 |

46 |

12.6% |

| 90% |

$898 |

118 |

18.8% |

| 100% |

$998 |

190 |

24.2% |

| 110% |

$1,097 |

262 |

29.2% |

| 120% |

$1,197 |

335 |

34.0% |

| | 1-9 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| Variance |

Operating Costs

(US$/st) |

NPV at 8%

(US$ millions) |

IRR |

| 90% |

14.40 |

226 |

26.7% |

| 95% |

15.18 |

208 |

25.5% |

| 100% |

15.96 |

190 |

24.2% |

| 115% |

18.29 |

136 |

20.2% |

| 130% |

20.63 |

83 |

15.9% |

| Variance |

Capital Costs

(US$ M) |

NPV at 8%

(US$ M) |

IRR |

| 90% |

302 |

209 |

27.3% |

| 95% |

286 |

219 |

29.1% |

| 100% |

336 |

190 |

24.2% |

| 115% |

386 |

161 |

20.4% |

| 130% |

437 |

132 |

17.3% |

| Figure 1-1: |

After-Tax NPV Sensitivity Analysis |

| | 1-10 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

|

Figure 1-2: |

After-Tax IRR Sensitivity Analysis |

| 1.2.2 | Alternate

Case (Indicated Mineral Resources Only) |

Only 7 million tons, or 11%, of the

72.7 million tons in the base case production schedule are Indicated Mineral Resources. The QP has determined that a stand alone alternative

case with only Indicated resource tonnage is not economic using the assumptions and inputs outlined in the base case.

| | 1-11 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 1.3.1 | Property

Description |

The Coosa graphite deposit is located

at the southern end of the Appalachian Mountain range, in the western part of Coosa County, Alabama, USA. The deposit area is approximately

50 miles (mi) south-southeast of the city of Birmingham and 23 mi south-southwest of the town of Sylacauga. The Project is located in

the Alabama Graphite Belt.

The Project consists of six primary

areas of interest: Northern Extension (NX), Main Grid, Southwest Extension (SW), Fixico Mine, HS-North, and HS-South. The approximate

geographical center of the target areas of interest is located at latitude 32°54’40.7”N and longitude 86°23’52.4”W.

Access to the Project site is via Highway US 280 for approximately 64 mi south from Birmingham, Alabama to State Highway AL-9S, then

approximately 10 miles west to State Highway AL-22 W, 12 mi west to Coosa County Road 29, and 12 mi north to the property.

The Coosa property mineral tenure is

comprised of approximately 41,965 acres of privately owned mineral rights held by Westwater under a long-term lease located in parts

of townships T. 21 N., T. 22 N., T. 23 N., and T. 24 N. and ranges R. 16 E., R. 17 E., R. 18 E., and R. 19 E. The western boundary is

approximately the Coosa River.

A 2% net smelter return (NSR) royalty

is payable by Westwater to the lessor from the commercial production and sale of graphite from the properties, as well as royalties for

any precious metals, mica, iron, magnetite, manganese, calcium carbonate, copper, tantalum, and rare earths commercially produced and

sold from the properties. An additional 0.5% NSR royalty is payable to Charles Merchant, an arm’s length party, who was engaged

as an independent contractor to assist AGC with establishing its graphite operations in Alabama.

The presence of graphitic schists in

Alabama was recognized before the Civil War (1861-1865) by M. Tuomey. Dr. Gessner, employed by the Confederate Government to recover

sulfur from the pyrite deposit at Pyriton, is credited with the first discovery of flake graphite in Alabama. The first commercial graphite

operation dates back to 1899 when the Allen Graphite Company built a mill near the Quenelda deposits in Clay County using a patented

oil flotation process and produced the first refined graphite in Alabama.

The mineral and surface rights of four

sections in the Fixico Mine area of the Project were acquired by the Fixico Mining Company (Fixico) in 1901-1902. The mine operated from

1902 to 1908. There is no record of the amount of graphite and grade produced.

AGC’s subsidiary, Alabama Graphite

Co. Inc. (Alabama Graphite), acquired the Project from Eugenia W. Dean (since 2014 the Estate of Eugenia W. Dean), Birmingham, Alabama

in 2012 and carried out exploration from 2012 to 2018, including channel sampling, trenching, airborne and ground geophysical surveys,

and four drilling programs.

Westwater acquired AGC on April 23,

2018. After acquisition, Westwater’s technical staff carried out a review of historical data and geologic information derived from

previous graphite exploration drilling and surface trenching programs at Coosa to determine the potential for the presence of substantial

vanadium mineralization at the Project. In late 2018, Company personnel carried out an extensive geochemical sampling program, collecting

nearly 2,000 samples from many previously completed drill holes and trenches, to determine the presence and intensity of vanadium mineralization

at Coosa. The laboratory analytical results of this sampling program outlined widespread and strong vanadium mineralization in very close

association with strong flake graphite mineralization at numerous localities within the Project area.

| | 1-12 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

| 1.3.4 | Geological

Setting, Mineralization, and Deposit |

The Project is located at the southern

end of the Appalachian Mountain range, a northeast trending belt of folded and metamorphosed rocks of Neoproterozoic to Lower Paleozoic

age. These are covered by the Coastal Plain Sediments of Cretaceous and younger age in the southern half of Alabama. The rocks of the

southwestern end of the Appalachians are generally separated into four physiographic and geologic provinces which are, from northwest

to southeast: the Interior Low Plateau province, the Appalachian Plateau province, the Valley and Ridge province, and the Piedmont province.

The Alabama Graphite Belt is located in the Northern Piedmont.

The Northern Piedmont has three structural

blocks: the Talladega Block on the northwestern side with low grade greenschist facies metasedimentary and metavolcanic rocks; the central

Coosa Block with high grade, upper greenschist to kyanite and sillimanite grade metamorphic rocks, and abundant pegmatite and small granitoid

bodies; and the Tallapoosa Block on the southeastern side of high grade, middle to upper amphibolite facies metasedimentary, metavolcanic,

and metamorphosed ultramafic and mafic rocks, with large areas of quartz diorite to granitic plutonic rocks.

The host of the Project is the Higgins

Ferry Formation in the Wedowee Group of the Coosa Block. The Higgins Ferry Formation is defined as an interbedded sequence of four major

lithologic units, from top to bottom: a quartz-graphite schist (QGS), a mixed QGS-quartz-muscovite-biotite-graphite schist unit (called

INT or intermediate unit), quartz muscovite biotite graphite schist (QMBGS), and a quartz-biotite-garnet schist (QBGS).

The Coosa graphite deposits are flake

graphite deposits in high grade metamorphic rocks. Graphite flakes occur as part of the rock forming minerals in the schists. They are

often associated with disseminated pyrrhotite and minor pyrite. In places, the green vanadium (V) bearing muscovite, roscoelite,

also occurs. Minor late stage, straight-sided veinlets of cubic pyrite up to 10 mm wide with smectite clay cross cut the schistosity

and pegmatites. The deposits are characterized by deep weathering.

The lithologic sequence at Coosa, from

top to bottom, is QGS overlying INT, overlying QMBGS, overlying QBGS. QGS generally grades downward into INT, then into QMBGS, which

in turn grades downward into QBGS. QMBGS is more highly metamorphosed than QGS and less metamorphosed than QBGS. All of the units are

moderately to well foliated, with the foliations probably representing paleo-bedding of the original sedimentary rocks. In addition,

several amphibolite intrusives occur on the Project, cutting the metamorphic units and intruding them.

QGS is the main host of graphite mineralization

at Coosa. QGS can be fine to coarse grained, with minor small biotites and small to medium muscovites, and is usually well foliated.

Graphite grades are typically in the order of 2% to 4%, occasionally up to 5% to 7%. QGS also generally contains the largest amount of

vanadium-rich muscovite (roscoelite for a field term). Pyrite and/or pyrrhotite can be present, generally averaging less than 1% to 2%,

are fine grained, and occur as either disseminated grains or thin (hairline to 1/8 in. thick) veinlets along foliations. Occasional hairline

to 1/4 in. thick late pyrite veinlets are found cutting the foliations at high angles. Outcrops of QGS can be light green-gray to dark

green, depending on the amount of weathering and oxidation. Roscoelite imparts the light to dark green color to the QGS.

| | 1-13 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

INT reflects a gradual increase in metamorphic

grade with depth and/or laterally from QGS towards QMBGS. Graphite ranges from 1% to 2%, occasionally up to 3%. In some places there

is a gradual increase in the grain size of muscovite and biotite as the QGS is metamorphosed to QMBGS. In other places, the INT unit

is marked by interlayers of QGS and QMBGS. These interlayers vary from several inches to several feet thick. Where there is a gradual

change from QGS to QMBGS, graphite grade decreases with increasing metamorphic grade. In areas with interlayers of QGS and QMBGS, the

QGS layers have higher graphite grade than the QMBGS layers. INT is rarely distinguishable in outcrop, due to limited vertical exposures

providing evidence of interlayering and due to the gradual grain size change from QGS to QMBGS. Roscoelite content in the INT decreases

with increasing metamorphism from QGS to QMBGS.

QMBGS is noticeable by its medium to

coarse grained nature and by the large biotites and muscovites that occur along foliations. Biotite can be honey colored to dark brown.

Pyrite and pyrrhotite can be present, usually less than 1% to 2% and fine to medium grained. QMBGS is well foliated, with the foliations

commonly moderately to strongly contorted. Outcrops can range from light to dark gray to grey-brown. Graphite assays are typically less

than 1% to 2%, with the graphite often being coarse grained due to recrystallization of the graphite grains.

Several surface exploration campaigns

were conducted between 2012 to 2015. Due to the lack of outcrop and dense vegetation, the exploration techniques used were rock sampling

in channels mainly along road cuttings, trenching, geophysics, and drilling. Since acquisition of the Project in 2018, Westwater has

completed in-fill/delineation diamond drilling for a total of 5,551 ft in 65 holes. The Company has also conducted a geochemical sampling

program using available core and trench material to determine the presence and intensity of vanadium mineralization at the Project.

To date, a total of 236 holes for 45,715

ft have been drilled at the Project, of which 205 holes totaling 39,434 ft were used in the Mineral Resource estimation. Since 2012,

most drilling was focused on the Main Grid and NX target areas of the Project.

| 1.3.6 | Mineral

Resource Estimate |

A Mineral Resource estimate was completed

by SLR using a conventional block modeling approach. The general workflow performed by SLR included the construction of a geological

or stratigraphic model representing the Higgins Ferry Group Graphitic Schist sequence in Seequent’s Leapfrog Geo (Leapfrog Geo)

from mapping, drill hole logging, and sampling data, which was used to define discrete domains and surfaces representing the upper contact

of each unit. The geologic model was then used to constrain resource estimation. The resource estimate used regularized block models,

the inverse distance squared (ID2) methodology, and length-weighted, 10 ft, uncapped composites to estimate the Cg and V in

a three-search pass approach, using hard boundaries between subunits, ellipsoidal search ranges, and search ellipse orientation informed

by geology. Average density values were assigned by lithological unit.

Estimates were validated using standard

industry techniques including statistical comparisons with composite samples and parallel nearest neighbor (NN) estimates, swath plots,

and visual reviews in cross-section and plan. A visual review comparing blocks to drill holes was completed after the block modeling

work was performed to ensure general lithologic and analytical conformance and was peer reviewed prior to finalization.

| | 1-14 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

Mineral Resources have been classified

in accordance with the definitions for Mineral Resources in S-K 1300. Mineral Resources estimated by SLR used all drill results available

as of March 17, 2022, and are summarized in Table 1-1 with an effective date of November 30, 2022. No additional drilling has

been completed since that date and the Mineral Resource estimate remains current.

To ensure that all Mineral Resource

statements satisfy the “reasonable prospects for economic extraction” (RPEE) requirement, factors significant to technical

feasibility and potential economic viability were considered. Mineral Resources were defined and constrained within an open-pit shell

prepared by SLR and based on a US$1,100/st graphite value.

The SLR QP is of the opinion that with

consideration of the recommendations summarized in this section of the TRS, any issues relating to all relevant technical and economic

factors likely to influence the prospect of economic extraction can be resolved with further work. There are no other known legal, social,

or other factors that would affect the development of the Mineral Resources.

The Coosa Project is proposed to be

operated as a conventional open pit mine with 20 ft bench heights, using drilling and blasting for rock breakage, and excavator and trucks

for material handling.

Production from the mines is planned

to be fed to the nearby processing plant with a nominal capacity of 3.2 Mstpa (approximately 3.0 million tonnes per year).

| 1.3.8 | Mineral

Processing and Metallurgical Testing |

The Coosa concentrator plant was designed

for a nominal 3.2 Mstpa of ROM feed based on preliminary design criteria.

Mine haul trucks will tip into a surge

bin feeding a primary jaw crusher designed for 86% availability. The primary crushed mill feed will be conveyed to a 5/8 in. (15 mm)

sizing screen, with the oversize reporting to the secondary crusher and the undersize fed forward to the rod mill circuit.

A

150 ton fine feed bin will provide surge capacity for the grinding circuit, to ensure a constant feed rate to the rod mill. The rod mill

will operate in closed circuit with a 10 mesh scalping screen. Undersize from the screen will be fed to a flash flotation cell, with

the flash cell tailing pulp gravitating to the ball mill classification screen. The screen separates at a P80 of 450 μm,

with the oversize reporting to the mill and the undersize going to the rougher flotation feed box.

The rougher flotation stage will consist

of a bank of six conventional (“trough”) cells in series. Each cell will have independent airflow control. The rougher concentrate

is combined with the flash concentrate and pumped to a pre-cleaner flotation circuit consisting of a bank of five trough cells in series.

The pre-cleaner concentrate will be

dewatered using a vibrating screen with 230 mesh openings, with the screen oversize reporting to the first of two polishing scrubbers.

The scrubber discharge is combined with the screen undersize (solution) to serve as feed to the first cleaner column flotation cell.

Two stages of conventional scavenger flotation cells are used to recover Cg from the first cleaner tail, returning Cg concentrate to

the 1st cleaner column feed and 1st polishing scrubber feed screen, respectively.

| | 1-15 |  |

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

First

cleaner flotation concentrate will be screened at 80 mesh (177 μm)

by the 2nd polishing scrubber feed screen, with the oversize reporting to the 2nd polishing scrubber ahead of 2nd column flotation

cells. The screen undersize will be thickened prior to attrition scrubbing and column flotation in a 3rd set of column flotation

cells. Final cleaner concentrate from both the 2nd and 3rd flotation column circuits are combined, thickened and

filtered in filter presses comprising the final concentrate product.

The slurry from the rougher and pre-cleaner

circuits will be pumped to the filtration facility near the tailings management facility. At the filtration plant, the slurry will be

thickened, filtered, and transported to the tailings management facility.

Reagents will be stored, mixed, and

distributed from a central reagents area. Frother, collector, and lime will be pumped from the reagents area to the flotation section

using peristaltic reagent pumps to accurately dose the process.

| 1.3.9 | Infrastructure

and Site Layout |

The Project infrastructure consists

of the following:

| · | Process

plant, mobile equipment and maintenance shops |

| · | Office/administration

area |

| · | Co-mingled

waste rock and Filtered Tailings Storage Facility (FTSF) |

This infrastructure is required to support

the final facility generating on average approximately 100,000 stpa of concentrate.

Office and dry facilities will be portable

offices located near the mill.

The site access road is approximately

3.4 miles from Coosa County Road 29. It will be upgraded to allow truck traffic to carry the flake concentrate from the mine to the purification

plant. This road will be maintained as a gravel road with the proper ditches and culverts for surface drainage.

Approximately 460,000 gal/d of fresh

water will be required to satisfy water demand for the process plant. This will come from water collection in the settling pond below

the FTSF as well as from a series of water wells.

Electrical power for the site will be

supplied by electrical grid power brought to the site. Access to the Alabama Power transmission line is possible with a 3.75 miles line

connecting to the west of the Project. The power line would follow existing roads to facilitate easy installation and periodic checks.

At full capacity, the plant will have

a connected load of 12.7 MW with an operating load of 11.6 MW. The mill will be serviced with a main substation and electrical power

distributed by a combination of cable ducts and aerial lines.

The FTSF will be located to the east

of the processing plant. The slurry material will be pumped to the filtration facility near the FTSF. After filtration, the solids will

be placed in the FTSF and compacted in place. The tailings from the oxidized zone are assumed to be non-acid generating, while the reduced

zone tailings are expected to be acid generating. These assumptions will need to be verified with material from the pilot plant test

work and further studies.

| | 1-16 |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

The waste rock will be mixed with the

filtered tailings to create a single dump platform for maintenance and reclamation purposes.

Based on the conceptual FTSF layout,

the tailings facility will provide storage for approximately 73 Mst (66 million tonnes) of tailings and 15 Mst (13.5 million tonnes)

of waste material, for a total capacity of 88 Mst (79.5 million tonnes).

For the economic analysis in this TRS,

the long term pricing forecast for natural flake graphite (North America Cost, Insurance, and Freight (CIF), 94-95% C, Real USD

basis) is a constant basket price of US$1,100 per tonne (US$998 per ton) delivered to Westwater’s Kellyton, AL plant. This represents

a conservative approach to pricing trends.

The Project is located on 2,667 acres

located in Coosa County, Alabama, approximately eight miles west of Rockford, Alabama. The Project area is forested with unpaved roads

throughout and the current land use is silviculture and recreational hunting. The southern border of the Project area is shared with

the Coosa Wildlife Management Area (WMA), and the Coosa WMA Shooting Range is located approximately one mile east.

The Project area is located within the

Mobile Bay watershed and the Coosa River water basin and includes multiple small tributaries to the Coosa River and Weogufka Creek.

| 1.3.12 | Capital

and Operating Costs |

The capital and operating cost estimates

for the Project are based on factored costs from other operations, the SLR QP’s judgment, and analogy. The change in the cost basis

for this TRS, due to the proposed increase in Cg production rates and the requirement for cost escalation, makes the accuracy, in the

SLR QP’s opinion, an American Association of Cost Engineers (AACE) International Class 5 cost estimate with an accuracy range

of -20% to -50% to +30% to +100%.

Table 18-1-5 summarizes the LOM capital

cost estimate for the 95,000 stpa to 105,000 stpa (86,000 to 95,000 tonnes per year) concentrate production schedule.

| | 1-17 |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

Table

1-5: Base Case LOM Capital Cost Estimate Summary

| Area |

(US$000) |

| Mining |

13,231 |

| Processing |

89,230 |

| Infrastructure |

17,180 |

| Tailings Facility |

31,919 |

| Total Development Capital |

151,559 |

| Mining |

22,284 |

| Processing/ Infrastructure |

6,786 |

| Tailings Facility |

112,636 |

| Total Sustaining Capital |

141,706 |

| Mine/Plant Closure/Reclamation |

8,736 |

| FTSF Closure/Reclamation |

33,975 |

| Total Closure/Reclamation |

42,711 |

| Grand Total |

335,977 |

The operating cost estimates in this

TRS were derived from MCS cost guides, a subscription-based cost database, that total $15.41/st mill feed ($16.99/tonne mill feed) as

follows:

| · | Mining:

$5.21/st mill feed, $4.33/st mined; ($5.75/tonne mill feed, $4.77/tonne mined) |

| · | Processing:

$8.80/st mill feed; ($9.70/tonne mill feed) |

| · | G&A:

$1.40/st mill feed; ($1.54/tonne mill feed) |

| · | Total:

$15.41/st mill feed ($16.99/tonne mill feed) |

| | 1-18 |  |

|

Westwater Resources, Inc. | Coosa Graphite Project

S-K 1300 Report |

December 11, 2023

SLR Project No.: 138.20527.00002 |

SLR International Corp. (SLR) was retained

by Westwater Resources, Inc. (Westwater or the Company) to prepare an independent Technical Report Summary (TRS) on the Coosa Graphite

Project (the Project or Coosa), located in Coosa County, Alabama, USA. The purpose of this TRS is to disclose results of an Initial Assessment

(IA) of the Project, including an economic analysis, based on the Mineral Resource estimate with an effective date of November 30,

2022. The Mineral Resource estimate was reported in the previous TRS dated December 1, 2022 and remains unchanged as no additional

work has been completed on the property since that time.

This TRS conforms to United States Securities

and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300

of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary.

Westwater is a 45-year old public company

currently focused on developing battery-grade natural graphite. Originally incorporated in 1977 as Uranium Resources, Inc. to mine

uranium in Texas, the Company has been reborn as an energy materials and technology developer. Westwater is focused on battery-grade

natural graphite after its acquisition of Alabama Graphite Corp. (AGC) in April 2018. AGC acquired the Project in 2012 based on

the geologic setting. On April 23, 2018, Westwater acquired a 100% interest in AGC as part of a strategic decision to refocus the

Company to supply battery manufacturers with low-cost, high-quality, and high-margin natural graphite products. As a result of that business

transaction, Westwater became the owner of the Project.

The Coosa graphite deposit is located

at the southern end of the Appalachian Mountain range, in Coosa County, Alabama. The deposit area is approximately 50 miles south-southeast

of the city of Birmingham and 23 miles south-southwest of the town of Sylacauga. The Project’s mineral tenure is comprised of approximately

41,965 acres of privately owned mineral rights that the Company holds under a long-term lease. The Project is located in the flake graphite

belt of central Alabama, also known as the Alabama Graphite Belt.

SLR’s Qualified Person (QP) for

Geology and Mineral Resources visited the Project on April 21-23, 2022. The SLR QP toured the Kellyton Graphite Plant offices, warehouses,

operational areas, and processing facility (currently under construction), located in Kellyton, Alabama. At the Project, the SLR QP also

toured drilling and trench site locations in the deposit area, reviewed drill core logging and sampling procedures, reviewed geologic

cross sections and previous modeling procedures with Westwater’s geologist and other staff, and discussed ongoing and future exploration

plans.

An SLR waste management engineer visited

the site on September 5, 2023, accompanied by a Westwater geologist, in order to review locations of the proposed processing plant,

filtration process, Filtered Tailings Storage Facility (FTSF), and other areas around the Project.

| 2.2 | Sources

of Information |

During the preparation of this TRS,

discussions were held with personnel from Westwater:

| · | Mr. Cevat

Er, Chief Technical Officer –Westwater |

| · | Mr. Ted

Wilton, PG, CPG, MAIG, Consulting Geologist, Westwater |

| · | Mr. David