0001001614FALSE00010016142023-08-072023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2023

Riley Exploration Permian, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-15555 | 87-0267438 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

29 E. Reno Avenue, Suite 500

Oklahoma City, Oklahoma 73104

Address of Principal Executive Offices, Including Zip Code)

405-415-8699

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | REPX | | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2023, Riley Exploration Permian, Inc. (the “Company”) announced its financial condition and results of operations for the second quarter ended June 30, 2023. In connection with this announcement, the Company issued an earnings press release. A copy of this document is furnished as Exhibit 99.1 to this Form 8-K and is available on the Company’s website at www.rileypermian.com.

In accordance with General Instructions B.2. of Form 8-K, the information described in this Item 2.02, including the matters discussed on the Company’s earnings conference call, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| Press Release dated August 7, 2023. |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RILEY EXPLORATION PERMIAN, INC. |

| | | |

| Date: | August 7, 2023 | By: | /s/ Philip Riley |

| | | Philip Riley |

| | | Chief Financial Officer |

Riley Permian Reports Second Quarter 2023 Results

OKLAHOMA CITY, August 7, 2023 -- Riley Exploration Permian, Inc. (NYSE American: REPX) (“Riley Permian” or the “Company”), today reported financial and operating results for the second quarter ended June 30, 2023.

SECOND QUARTER 2023 HIGHLIGHTS

•Closed on the acquisition of oil and natural gas assets in New Mexico and successfully transitioned operations to the Company

•Averaged oil production of 15.1 MBbls/d (21.2 MBoe/d total equivalent production), representing an increase of 80% as compared year-over-year to the second quarter 2022 and an increase of 52% as compared quarter-over-quarter to the first quarter of 2023

•Reported net income of $33 million, or $1.65 per diluted share, which includes $11 million of non-cash gain on derivative contracts and income from operations of $45 million

•Generated $66 million of Adjusted EBITDAX(1) and $56 million of operating cash flow

•Incurred total accrual (activity-based) capital expenditures before acquisitions of $39 million and total cash capital expenditures before acquisitions of $48 million

•Paid dividends of $0.34 per share in the second quarter for a total of $7 million

Bobby Riley, Chairman and CEO of Riley Permian, stated, “We’re pleased to report another successful quarter with record-high metrics across production and cash flow from operations. Production results exceeded the high-end of guidance while capital expenditures were materially below guidance. Results were driven by a combination of the closing of the New Mexico acquisition early in the quarter as well as continued execution with our legacy assets. Transition and integration efforts for the new assets have proceeded as planned, including initial drilling activity beginning in April.”

Mr. Riley continued, “Looking ahead to the second half of 2023, and based on the strength of production in the first half of 2023, we see the opportunity to reduce activity and capital expenditures from our previously released guidance levels, while maintaining full-year average production levels per previous guidance. We’re optimistic that this combination of factors may lead to materially increased Free Cash Flow(1) for the year, as compared to what we forecasted following the first quarter of 2023”.

___________________

(1)A non-GAAP financial measure as defined and reconciled in the supplemental financial tables available on the Company’s website at www.rileypermian.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Operating and Financial Data | | | | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | | June 30, 2023 | | June 30, 2022 | | | | |

| | |

| Select Financial Data (in thousands): | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Oil and natural gas sales, net | | $ | 99,312 | | | $ | 66,412 | | | $ | 87,781 | | | $ | 165,724 | | | $ | 154,426 | | | | | |

| Net income | | $ | 33,068 | | | $ | 31,851 | | | $ | 38,555 | | | $ | 64,919 | | | $ | 31,387 | | | | | |

Adjusted EBITDAX(1) | | $ | 66,265 | | | $ | 43,508 | | | $ | 44,797 | | | $ | 109,773 | | | $ | 79,280 | | | | | |

| | | | | | | | | | | | | | |

| Production Data, net: | | | | | | | | | | | | | | |

| Oil (MBbls) | | 1,370 | | 893 | | 761 | | 2,263 | | 1,435 | | | | |

| Natural gas (MMcf) | | 1,677 | | 949 | | 572 | | 2,626 | | 1,254 | | | | |

| Natural gas liquids (MBbls) | | 283 | | | 134 | | | 70 | | | 417 | | | 163 | | | | | |

| Total (MBoe) | | 1,933 | | | 1,185 | | | 926 | | | 3,118 | | | 1,807 | | | | | |

| | | | | | | | | | | | | | |

| Daily combined volumes (Boe/d) | | 21,236 | | 13,169 | | 10,176 | | 17,225 | | 9,983 | | | | |

| Daily oil volumes (Bbls/d) | | 15,055 | | 9,922 | | 8,363 | | 12,503 | | 7,926 | | | | |

| | | | | | | | | | | | | | |

| Average Realized Prices: | | | | | | | | | | | | | | |

| Oil ($ per Bbl) | | $ | 71.41 | | | $ | 72.76 | | | $ | 108.41 | | | $ | 71.94 | | | $ | 100.96 | | | | | |

| Natural gas ($ per Mcf) | | 0.02 | | | 0.55 | | | 4.98 | | | 0.21 | | | 3.70 | | | | | |

| Natural gas liquids ($ per Bbl) | | 5.10 | | | 6.83 | | | 34.71 | | | 5.65 | | | 30.12 | | | | | |

| Total average price ($ per Boe) | | $ | 51.38 | | | $ | 56.04 | | | $ | 94.80 | | | $ | 53.15 | | | $ | 85.46 | | | | | |

| | | | | | | | | | | | | | |

Average Realized Prices, including the effects of derivative settlements(2): | | | | | | | | | | | | | | |

| Oil ($ per Bbl) | | $ | 69.46 | | | $ | 67.06 | | | $ | 77.31 | | | $ | 68.51 | | | $ | 72.31 | | | | | |

| Natural gas ($ per Mcf) | | 0.24 | | 0.55 | | 1.29 | | 0.35 | | 1.27 | | | | |

Natural gas liquids ($ per Bbl)(3) | | 5.10 | | 6.83 | | 34.71 | | 5.65 | | 30.12 | | | | |

| Total average price ($ per Boe) | | $ | 50.19 | | | $ | 51.74 | | | $ | 66.97 | | | $ | 50.78 | | | $ | 61.02 | | | | | |

| | | | | | | | | | | | | | |

Cash Costs ($ per Boe)(1) | | $ | 21.17 | | | $ | 16.02 | | | $ | 19.63 | | | $ | 19.20 | | | $ | 18.09 | | | | | |

Cash Margin ($ per Boe)(1) | | $ | 30.21 | | | $ | 40.02 | | | $ | 75.17 | | | $ | 33.95 | | | $ | 67.37 | | | | | |

Cash Margin, including derivative settlements ($ per Boe)(1) | | $ | 29.02 | | | $ | 35.72 | | | $ | 47.34 | | | $ | 31.59 | | | $ | 42.93 | | | | | |

_____________________

(1)A non-GAAP financial measure as defined and reconciled in the supplemental financial tables available on the Company’s website at www.rileypermian.com.

(2)The Company's calculation of the effects of derivative settlements includes losses on the settlement of its commodity derivative contracts. These losses are included under other income (expense) on the Company’s condensed consolidated statements of operations.

(3)During the periods presented, the Company did not have any NGL derivative contracts in place.

OPERATIONS AND DEVELOPMENT ACTIVITY UPDATE

Riley Permian averaged oil production of 15.1 MBbls per day for the three months ended June 30, 2023, representing an increase of 80% as compared year-over-year to the second quarter 2022 and 52% increase compared to the first quarter of 2023. The Company averaged total equivalent production of 21.2 MBoe per day for the second quarter, an increase of 109% as compared to the same period in 2022 and 61% increase compared to the first quarter of 2023. The increase in production is attributable to the impact of the acquired assets as well as organic growth. The Company experienced some disruptions on gas processing which led to modestly lower gas sales and equivalent Boe production figures.

Consistent with prior guidance, the Company drilled 8 gross (6.9 net) horizontal wells during the second quarter, including 4 gross (3.6 net) wells in Texas and 4 gross (3.3 net) in New Mexico. The Company completed 5 gross (4.2 net) horizontal wells during the quarter, including 4 gross (3.2 net) wells in Texas and 1 gross (1 net) well in New Mexico. The Company turned to sales 6 gross (5.2 net) horizontal wells during the second quarter 2023. The Company incurred $39 million in total accrued capital expenditures before acquisitions for the second quarter, lower than the Company’s previously released guidance due primarily to deferred completion activity. On a cash basis, the Company had total capital expenditures before acquisitions of $48 million for the quarter.

The Company progressed with construction of its onsite power generation joint venture during the second quarter of 2023. The Company contributed its share of capital which corresponds to approximately $2 million during the second quarter of 2023. The onsite power generation facility is expected to be placed in service late in the third quarter or during the fourth quarter of 2023.

FINANCIAL RESULTS

For the three months ended June 30, 2023, the Company reported net income of $33 million, or $1.65 per diluted share, and Adjusted Net Income(1) of $27 million, or $1.37 per diluted share. The Company generated Adjusted EBITDAX(1) of $66 million, operating cash flow of $56 million and Free Cash Flow(1) of $3 million.

Second quarter 2023 average realized prices, before derivative settlements, were $71.41 per barrel of oil, $0.02 per Mcf of natural gas and $5.10 per barrel of natural gas liquids. Quarter-over-quarter, realized prices declined by 2% for oil, 96% for natural gas, and 25% for natural gas liquids. Oil represented 99% of second quarter revenue. Total oil and natural gas sales revenue, net of derivative settlements, was $97 million, an increase of $36 million or 58% over the first quarter of 2023. The Company reported a $9 million gain on derivatives, which includes a $2 million loss on settlements and a $11 million non-cash gain due to changes in the fair value of derivatives.

Riley Permian's total Cash Costs(1) for the second quarter of 2023 were $41 million, or $21.17 per Boe. Lease operating expense (“LOE”) was $18 million, or $9.06 per Boe, which is at the upper end of our guidance range and 21% above the first quarter 2023. On a per unit basis, certain increases in LOE costs were expected and were reflected in higher guidance ranges as compared to past results, while additional costs were incurred related to higher than anticipated workover activity on the newly acquired assets. Cash G&A expense(1) was $6 million, or $3.11 per Boe, near the low end of our guidance range and 26% below the first quarter 2023. Interest expense was $10 million or $5.26 per Boe, which reflects increased debt related to the financing for the New Mexico Acquisition.

During the second quarter 2023, the Company paid a cash dividend of $0.34 per share, or $7 million in total. Subsequent to the quarter end, the Company declared a cash dividend of $0.34 per share, payable in August 2023.

In April 2023 and in conjunction with the closing of the New Mexico Acquisition, the Company amended its credit facility to, among other things, increase the borrowing base to $325 million. The Company also issued $200 million of senior unsecured notes upon closing, whose net proceeds along with borrowings under the credit facility, were used to fund the closing of the New Mexico Acquisition and related expenses.

As of June 30, 2023, the Company had $394 million of total debt, including $215 million drawn on its credit facility and $179 million of senior unsecured notes; on a principal basis, the Company had $410 million of total debt, including $195 million principal value of senior unsecured notes.

________________

(1)A non-GAAP financial measure as defined and reconciled in the supplemental financial tables available on the Company’s website at www.rileypermian.com.

OUTLOOK AND GUIDANCE

Riley Permian is providing third quarter 2023 and updated full-year 2023 guidance based on currently scheduled development activity and current market conditions. The average working interest on gross operated wells drilled is subject to change and may have corresponding impacts on investing expenditures.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | |

| | | | |

| Activity and Investing Guidance | | Q3 2023 | | Updated

Full-Year 2023 |

| | |

| | | | |

| | | | |

| Texas Activity | | | | |

| Gross operated wells drilled | | 4 | | 13 |

| Average working interest on gross operated wells drilled | | 98% - 100% | | 98% - 100% |

| | | | |

| New Mexico Activity | | | | |

| Gross operated wells drilled | | 0 | | 4 |

| Average working interest on gross operated wells drilled | | NM | | 91% - 98% |

| | | | |

| Investing Expenditures by Category (Accrual, in millions) | | | | |

E&P(1) | | $35 - 45 | | $130 - 140 |

| Joint Venture investment | | $1 - 3 | | $10 - 12 |

| Total | | $36 -48 | | $140 - 152 |

| | | | |

| E&P Capital Expenditures by Region (Accrual) | | | | |

| Texas | | 63% - 73% | | 74% - 84% |

| New Mexico | | 37% - 27% | | 26% - 16% |

| | | | |

| | | | |

| | | | |

| | | | |

__________________

(1)Expenditures are before acquisitions.

OUTLOOK AND GUIDANCE, Continued

| | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | |

| | | | | | |

| Production, Realizations and Cost Guidance | | Q3 2023 | | Updated

Full-Year 2023 | | |

| | | | |

| | | | | | |

| | | | | | |

| Net Production | | | | | | |

| Total (MBoe/d) | | 18.6 - 19.8 | | 18.4 - 19.2 | | |

| Oil (MBbl/d) | | 13.0 - 14.0 | | 12.8 - 13.4 | | |

| | | | | | |

| Oil (%) | | 70% - 71% | | 70% - 71% | | |

| Natural gas (%) | | 16% - 14% | | 16% - 15% | | |

| NGL (%) | | 14% - 15% | | 14% | | |

| | | | | | |

| Basis Differentials and Fees | | | | | | |

| Oil ($ per Bbl) | | ($3.25) - (2.25) | | ($3.00) - (2.00) | | |

| Natural gas ($ per Mcf) | | ($2.70) - (2.10) | | ($2.70) - (2.10) | | |

| NGL (% of WTI) | | 5% - 9% | | 8% - 14% | | |

| | | | | | |

| Operating and Corporate Costs | | | | | | |

| Lease operating expense, including workover expense ($ per Boe) | | $8.50 - 9.50 | | $8.00 - 9.00 | | |

| Production tax (% of revenue) | | 6.0% - 8.0% | | 6.0% - 8.0% | | |

Cash G&A(1) ($ per Boe) | | $3.00 - 3.50 | | $3.00 - 3.50 | | |

| | | | | | |

| Cash payments for income taxes ($ in millions) | | $3.0 - 4.0 | | $8.0 - 10.0 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

_______________

(1)A non-GAAP financial measure as defined and reconciled in the supplemental financial tables available on the Company’s website at www.rileypermian.com.

CONFERENCE CALL

Riley Permian management will host a conference call for investors and analysts on August 8, 2023 at 10:00 a.m. CT to discuss the Company's results. Interested parties are invited to participate by calling:

•U.S./Canada Toll Free, (888) 330-2214

•International, +1 (646) 960-0161

•Conference ID number 5405646

An updated company presentation, which will include certain items to be discussed on the call, will be posted prior to the call on the Company's website (www.rileypermian.com). A replay of the call will be available until August 22, 2023 by calling:

•(800) 770-2030 or (647) 362-9199

•Conference ID number 5405646

About Riley Exploration Permian, Inc.

Riley Permian is a growth-oriented, independent oil and natural gas company focused on the acquisition, exploration, development and production of oil, natural gas and natural gas liquids. For more information, please visit www.rileypermian.com.

Investor Contact:

Rick D'Angelo

405-438-0126

IR@rileypermian.com

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The statements contained in this release that are not historical facts are forward-looking statements that represent management’s beliefs and assumptions based on currently available information. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, need for financing, competitive position and potential growth opportunities. Our forward-looking statements do not consider the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believes,” “intends,” “may,” “should,” “anticipates,” “expects,” “could,” “plans,” “estimates,” “projects,” “targets,” “forecasts” or comparable terminology or by discussions of strategy or trends. You should not place undue reliance on these forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this release are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved or occur, and actual results could differ materially and adversely from those anticipated or implied by the forward-looking statements.

Among the factors that could cause actual future results to differ materially are the risks and uncertainties the Company is exposed to. While it is not possible to identify all factors, we continue to face many risks and uncertainties including, but not limited to: the volatility of oil, natural gas and NGL prices; regional supply and demand factors, any delays, curtailment delays or interruptions of production, and any governmental order, rule or regulation that may impose production limits; cost and availability of gathering, pipeline, refining, transportation and other midstream and downstream activities; severe weather and other risks that lead to a lack of any available markets; our ability to successfully complete mergers, acquisitions and divestitures; the inability or failure of the Company to successfully integrate the acquired assets into its operations and development activities; the potential delays in the development, construction or start-up of planned projects; the risk that the Company's EOR project may not perform as expected or produce the anticipated benefits; risks relating to our operations, including development drilling and testing results and performance of acquired properties and newly drilled wells; any reduction in our borrowing base on our revolving credit facility from time to time and our ability to repay any excess borrowings as a result of such reduction; the impact of our derivative strategy and the results of future settlement; our ability to comply with the financial covenants contained in our credit agreement; conditions in the capital, financial and credit markets and our ability to obtain capital needed for development and exploration operations on favorable terms or at all; the loss of certain tax deductions; risks associated with executing our business strategy, including any changes in our strategy; inability to prove up undeveloped acreage and maintain production on leases; risks associated with concentration of operations in one major geographic area; legislative or regulatory changes, including initiatives related to hydraulic fracturing, emissions, and disposal of produced water, which may be negatively impacted by regulation or legislation; the ability to receive drilling and other permits or approvals and rights-of-way in a timely manner (or at all), which may be restricted by governmental regulation and legislation; restrictions on the use of water, including limits on the use of produced water and a moratorium on new produced water well permits recently imposed by the RRC in an effort to control induced seismicity in the Permian Basin; changes in government environmental policies and other environmental risks; the availability of drilling equipment and the timing of production; tax consequences of business transactions; public health crisis, such as pandemics and epidemics, and any related government policies and actions and the effects of such public health crises on the oil and natural gas industry, pricing and demand for oil and natural gas and supply chain logistics; general domestic and international economic, market and political conditions, including the military conflict between Russia and Ukraine and the global response to such conflict; risks related to litigation; and cybersecurity threats, technology system failures and data security issues. Additional factors that could cause results to differ materially from those described above can be found in Riley Permian’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC and available from the Company’s website at www.rileypermian.com under the “Investor” tab, and in other documents the Company files with the SEC.

The forward-looking statements in this press release are made as of the date hereof and are based on information available at that time. The Company does not undertake, and expressly disclaims, any duty to update or revise our forward-looking statements based on new information, future events or otherwise.

Cautionary Statement Regarding Guidance

The estimates and guidance presented in this release are based on assumptions of current and future capital expenditure levels, prices for oil, natural gas and NGLs, available liquidity, indications of supply and demand for oil, well results, and operating costs. The guidance provided in this release does not constitute any form of guarantee or assurance that the matters indicated will be achieved. While we believe these estimates and the assumptions on which they are based are reasonable as of the date on which they are made, they are inherently uncertain and are subject to, among other things, significant business, economic, operational, and regulatory risks, and uncertainties, some of which are not known as of the date of the statement. Guidance and estimates, and the assumptions on which they are based, are subject to material revision. Actual results may differ materially from estimates and guidance. Please read the "Cautionary Statement Regarding Forward Looking Information" section above, as well as "Risk Factors" in our annual report on Form 10-K and our quarterly reports on Form 10-Q, which are incorporated herein.

Source: Riley Exploration Permian, Inc.

| | | | | | | | | | | | | | | | |

| RILEY EXPLORATION PERMIAN, INC. | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | | |

| | (Unaudited) | | | | |

| | June 30, 2023 | | December 31, 2022 | | |

| | (In thousands, except share amounts) | | |

| Assets | | | | | | |

| Current Assets: | | | | | | |

| Cash and cash equivalents | | $ | 6,741 | | | $ | 13,301 | | | |

| Accounts receivable | | 32,584 | | | 25,551 | | | |

| | | | | | |

| Prepaid expenses and other current assets | | 2,254 | | | 3,236 | | | |

| Inventory | | 9,630 | | | 8,886 | | | |

| Current derivative assets | | 3,924 | | | 20 | | | |

| Total current assets | | 55,133 | | | 50,994 | | | |

| Oil and natural gas properties, net (successful efforts) | | 841,891 | | | 440,102 | | | |

| Other property and equipment, net | | 20,058 | | | 20,023 | | | |

| Non-current derivative assets | | 3,799 | | | — | | | |

| | | | | | |

| | | | | | |

| Other non-current assets, net | | 11,042 | | | 4,175 | | | |

| Total Assets | | $ | 931,923 | | | $ | 515,294 | | | |

| Liabilities and Shareholders' Equity | | | | | | |

| Current Liabilities: | | | | | | |

| Accounts payable | | $ | 5,404 | | | $ | 3,939 | | | |

| | | | | | |

| | | | | | |

| Accrued liabilities | | 28,880 | | | 35,582 | | | |

| Revenue payable | | 25,234 | | | 17,750 | | | |

| Current derivative liabilities | | 2,117 | | | 16,472 | | | |

| Current portion of long-term debt | | 20,000 | | | — | | | |

| Other current liabilities | | 7,216 | | | 2,562 | | | |

| Total Current Liabilities | | 88,851 | | | 76,305 | | | |

| Non-current derivative liabilities | | 260 | | | 12 | | | |

| Asset retirement obligations | | 21,005 | | | 2,724 | | | |

| Long-term debt | | 374,256 | | | 56,000 | | | |

| Deferred tax liabilities | | 59,493 | | | 45,756 | | | |

| Other non-current liabilities | | 1,205 | | | 1,051 | | | |

| Total Liabilities | | 545,070 | | | 181,848 | | | |

| Commitments and Contingencies | | | | | | |

| | | | | | |

| | | | | | |

| Shareholders' Equity: | | | | | | |

| Preferred stock, $0.0001 par value, 25,000,000 shares authorized; 0 shares issued and outstanding | | — | | | — | | | |

| Common stock, $0.001 par value, 240,000,000 shares authorized; 20,181,704 and 20,160,980 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | | 20 | | | 20 | | | |

| Additional paid-in capital | | 276,828 | | | 274,643 | | | |

| Retained earnings | | 110,005 | | | 58,783 | | | |

| Total Shareholders' Equity | | 386,853 | | | 333,446 | | | |

| Total Liabilities and Shareholders' Equity | | $ | 931,923 | | | $ | 515,294 | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RILEY EXPLORATION PERMIAN, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | | | |

| | (In thousands) |

| Revenues: | | | | | | | | | | | | | | |

| Oil and natural gas sales, net | | $ | 99,312 | | | $ | 87,781 | | | $ | 165,724 | | | $ | 154,426 | | | | | | | |

| Contract services - related parties | | 600 | | | 600 | | | 1,200 | | | 1,200 | | | | | | | |

| Total Revenues | | 99,912 | | | 88,381 | | | 166,924 | | | 155,626 | | | | | | | |

| Costs and Expenses: | | | | | | | | | | | | | | |

| Lease operating expenses | | 17,514 | | | 8,062 | | | 26,389 | | | 14,892 | | | | | | | |

| Production and ad valorem taxes | | 7,221 | | | 5,526 | | | 11,331 | | | 9,028 | | | | | | | |

| Exploration costs | | 80 | | | 22 | | | 412 | | | 1,520 | | | | | | | |

| Depletion, depreciation, amortization and accretion | | 18,601 | | | 7,188 | | | 27,684 | | | 13,821 | | | | | | | |

| | | | | | | | | | | | | | |

| General and administrative: | | | | | | | | | | | | | | |

| Administrative costs | | 6,500 | | | 4,399 | | | 11,967 | | | 8,413 | | | | | | | |

| | | | | | | | | | | | | | |

| Share-based compensation expense | | 1,225 | | | 553 | | | 2,339 | | | 1,570 | | | | | | | |

| Cost of contract services - related parties | | 109 | | | 89 | | | 219 | | | 174 | | | | | | | |

| Transaction costs | | 3,652 | | | — | | | 5,539 | | | 2,638 | | | | | | | |

| Total Costs and Expenses | | 54,902 | | | 25,839 | | | 85,880 | | | 52,056 | | | | | | | |

| Income From Operations | | 45,010 | | | 62,542 | | | 81,044 | | | 103,570 | | | | | | | |

| Other Income (Expense): | | | | | | | | | | | | | | |

| Interest expense, net | | (10,161) | | | (697) | | | (11,177) | | | (1,375) | | | | | | | |

| Gain (loss) on derivatives | | 8,665 | | | (12,363) | | | 14,420 | | | (61,995) | | | | | | | |

| Loss from equity method investment | | (4) | | | — | | | (236) | | | — | | | | | | | |

| Total Other Income (Expense) | | (1,500) | | | (13,060) | | | 3,007 | | | (63,370) | | | | | | | |

| Net Income From Operations Before Income Taxes | | 43,510 | | | 49,482 | | | 84,051 | | | 40,200 | | | | | | | |

| Income tax expense | | (10,442) | | | (10,927) | | | (19,132) | | | (8,813) | | | | | | | |

| | | | | | | | | | | | | | |

| | |

|

| | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Income | | $ | 33,068 | | | $ | 38,555 | | | $ | 64,919 | | | $ | 31,387 | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Income per Share: | | | | | | | | | | | | | | |

| Basic | | $ | 1.68 | | | $ | 1.97 | | | $ | 3.30 | | | $ | 1.61 | | | | | | | |

| Diluted | | $ | 1.65 | | | $ | 1.96 | | | $ | 3.25 | | | $ | 1.60 | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | | | | | | | |

| Basic | | 19,671 | | | 19,542 | | | 19,660 | | | 19,521 | | | | | | | |

| Diluted | | 19,985 | | | 19,660 | | | 19,951 | | | 19,646 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RILEY EXPLORATION PERMIAN, INC. | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| (Unaudited) | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | | | | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | |

| | (In thousands) | |

| Cash Flows from Operating Activities: | | | | | | | | | | | | | | | | | |

| Net income | | $ | 33,068 | | | $ | 38,555 | | | $ | 64,919 | | | $ | 31,387 | | | | | | | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Oil and natural gas lease expirations | | 56 | | | — | | | 388 | | | 1,464 | | | | | | | | | | |

| Depletion, depreciation, amortization and accretion | | 18,601 | | | 7,188 | | | 27,684 | | | 13,821 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (Gain) loss on derivatives | | (8,665) | | | 12,363 | | | (14,420) | | | 61,995 | | | | | | | | | | |

| Settlements on derivative contracts | | (2,303) | | | (25,783) | | | (7,391) | | | (44,158) | | | | | | | | | | |

| Amortization of deferred financing costs and discount | | 1,088 | | | 182 | | | 1,281 | | | 373 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Share-based compensation expense | | 1,225 | | | 828 | | | 2,485 | | | 1,889 | | | | | | | | | | |

| Deferred income tax expense | | 8,454 | | | 10,212 | | | 13,737 | | | 7,319 | | | | | | | | | | |

| Other | | 4 | | | — | | | 236 | | | — | | | | | | | | | | |

| Changes in operating assets and liabilities | | 4,387 | | | 614 | | | (199) | | | 1,410 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Cash Provided by Operating Activities | | 55,915 | | | 44,159 | | | 88,720 | | | 75,500 | | | | | | | | | | |

| Cash Flows from Investing Activities: | | | | | | | | | | | | | | | | | |

| Additions to oil and natural gas properties | | (48,090) | | | (36,876) | | | (83,023) | | | (47,042) | | | | | | | | | | |

| Net assets acquired in business combination | | (292,094) | | | — | | | (325,094) | | | — | | | | | | | | | | |

| Acquisitions of oil and natural gas properties | | (5,443) | | | — | | | (5,443) | | | — | | | | | | | | | | |

| Contributions to equity method investment | | (1,726) | | | — | | | (3,566) | | | — | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Additions to other property and equipment | | (168) | | | (92) | | | (277) | | | (1,470) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Cash Used in Investing Activities | (347,521) | | | (36,968) | | | (417,403) | | | (48,512) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| |

| |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | |

| Cash Flows from Financing Activities: | | | | | | | | | | | | | | | | | |

| Deferred financing costs | | (6,165) | | | (1,690) | | | (6,214) | | | (1,716) | | | | | | | | | | |

| Proceeds from revolving credit facility | | 145,000 | | | 1,000 | | | 178,000 | | | 4,000 | | | | | | | | | | |

| Repayments under revolving credit facility | | (19,000) | | | (3,000) | | | (19,000) | | | (8,000) | | | | | | | | | | |

| Proceeds from senior notes | | 188,000 | | | — | | | 188,000 | | | — | | | | | | | | | | |

| Repayments of senior notes | | (5,000) | | | — | | | (5,000) | | | — | | | | | | | | | | |

| Payment of common share dividends | | (6,695) | | | (6,058) | | | (13,363) | | | (12,198) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Common stock repurchased for tax withholding | | (68) | | | (252) | | | (300) | | | (591) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Cash Provided by (Used in) Financing Activities | | 296,072 | | | (10,000) | | | 322,123 | | | (18,505) | | | | | | | | | | |

| Net Increase (Decrease) in Cash and Cash Equivalents | | 4,466 | | | (2,809) | | | (6,560) | | | 8,483 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Cash and Cash Equivalents Cash, Beginning of Period | | 2,275 | | | 19,609 | | | 13,301 | | | 8,317 | | | | | | | | | | |

| Cash and Cash Equivalents Cash, End of Period | | $ | 6,741 | | | $ | 16,800 | | | $ | 6,741 | | | $ | 16,800 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

OIL, NATURAL GAS AND NGL RESERVES

The Company prepared estimates of reserves using an average price equal to the unweighted arithmetic average of the first day of each month within the 12-month period ended June 30, 2023 of $83.23 per Bbl for oil and $4.76 per Mcf for gas in accordance with SEC guidelines. The Company also prepared estimates of proved reserves as of June 30, 2023 using NYMEX pricing. Netherland, Sewell & Associates, Inc. (“NSAI”) is the Company’s third-party reservoir engineer, which prepares estimates of the Company's proved reserves annually as of its year-end, in accordance with the rules and regulations of the SEC. NSAI has not reviewed our proved reserves at June 30, 2023 using SEC or NYMEX pricing. A summary of these internal estimates as of June 30, 2023 is presented below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | SEC Pricing | | NYMEX Pricing(1) | | | |

Reserves as of June 30, 2023 | | Proved Developed Reserves | | Total Proved Reserves | | Proved Developed Reserves | | Total Proved Reserves | | | |

| Oil (MBbls) | | 39,040 | | | 63,028 | | 37,854 | | | 61,240 | | | |

| Natural gas (MMcf) | | 72,746 | | | 109,100 | | 70,466 | | | 105,837 | | | |

| Natural gas liquids (MBbls) | | 11,995 | | | 18,613 | | 11,621 | | | 18,066 | | | |

| Total (MBoe) | | 63,159 | | | 99,824 | | 61,219 | | | 96,945 | | | |

PV-10(2) (in thousands) | | $ | 1,184,354 | | | $ | 1,621,310 | | | $ | 806,537 | | | $ | 1,012,955 | | | | |

___________________

(1)See table below for the NYMEX pricing used to prepare internal reserve estimates.

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Oil | | Natural Gas | | | |

| ($ per Bbl) | | ($ per Mcf) | | | |

| July-December 2023 | $ | 70.52 | | | $ | 3.01 | | | | |

| Calendar year 2024 | $ | 68.50 | | | $ | 3.52 | | | | |

| Calendar year 2025 | $ | 65.54 | | | $ | 3.94 | | | | |

| Calendar year 2026 | $ | 63.04 | | | $ | 3.91 | | | | |

| Calendar year 2027 | $ | 60.83 | | | $ | 3.78 | | | | |

| After 2027 | $ | 59.90 | | | $ | 4.20 | | | | |

| | | | | | |

(2)A non-GAAP financial measure as defined and reconciled in the supplemental financial tables available on the Company’s website at www.rileypermian.com.

OIL, NATURAL GAS AND NGL RESERVES, Continued

NSAI prepared the estimates of the Company's proved reserves as of December 31, 2022, in accordance with the rules and regulations of the SEC using an average price equal to the unweighted arithmetic average of the first day of each month within the 12-month period ended December 31, 2022 of $94.14 per Bbl for oil and $6.36 per Mcf for natural gas. The Company prepared estimates of proved reserves as of December 31, 2022 using NYMEX pricing, which were not reviewed by NSAI. The table below presents a summary of our proved reserves as of December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | SEC Pricing | | NYMEX Pricing(1) | | | | | | | | |

| Reserves as of December 31, 2022 | | Proved Developed Reserves | | Total Proved Reserves | | Proved Developed Reserves | | Total Proved Reserves | | | | | | | | |

| Oil (MBbls) | | 29,632 | | | 48,882 | | | 28,270 | | | 45,151 | | | | | | | | | |

| Natural gas (MMcf) | | 59,314 | | | 86,018 | | | 56,492 | | | 79,762 | | | | | | | | | |

| Natural gas liquids (MBbls) | | 9,604 | | | 14,454 | | 9,170 | | 13,393 | | | | | | | | |

| Total (MBoe) | | 49,122 | | | 77,673 | | | 46,855 | | | 71,838 | | | | | | | | | |

PV-10(2) (in thousands) | | $ | 1,010,251 | | | $ | 1,401,148 | | | $ | 652,817 | | | $ | 802,174 | | | | | | | | | |

___________________

(1)See table below for the NYMEX pricing used to prepare internal reserve estimates.

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Oil | | Natural Gas | | | |

| ($ per Bbl) | | ($ per Mcf) | | | |

| | | | | | |

| Calendar year 2023 | $ | 79.07 | | | $ | 4.24 | | | | |

| Calendar year 2024 | $ | 73.89 | | | $ | 4.27 | | | | |

| Calendar year 2025 | $ | 69.77 | | | $ | 4.39 | | | | |

| Calendar year 2026 | $ | 66.55 | | | $ | 4.46 | | | | |

| Calendar year 2027 | $ | 63.87 | | | $ | 4.50 | | | | |

| After 2027 | $ | 63.87 | | | $ | 4.50 | | | | |

(2)A non-GAAP financial measure as defined and reconciled in the supplemental financial tables available on the Company’s website at www.rileypermian.com.

Reserve estimates above do not include any value for probable or possible reserves that may exist, nor do they include any value for undeveloped acreage. The reserve estimates represent our net revenue interest in our properties, all of which are located within the continental United States. NYMEX pricing does not comport with the reporting requirements of the SEC and should not be used as a substitute for or compared with estimates of proved reserves using SEC pricing.

DERIVATIVE CONTRACTS

The following table summarizes the open financial derivatives as of August 4, 2023, related to oil and natural gas production.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Weighted Average Price |

Period (1) | | Notional Volume | | Fixed | | Put | | Call |

| | | | ($ per unit) |

| Oil Swaps (Bbl) | | | | | | | | |

| Q3 2023 | | 437,000 | | | $ | 68.18 | | | $ | — | | | $ | — | |

| Q4 2023 | | 392,000 | | | $ | 68.06 | | | $ | — | | | $ | — | |

| 2024 | | 690,000 | | | $ | 70.54 | | | $ | — | | | $ | — | |

| 2025 | | 135,000 | | | $ | 69.19 | | | $ | — | | | $ | — | |

| | | | | | | | |

| | | | | | | | |

| Oil Collars (Bbl) | | | | | | | | |

| Q3 2023 | | 330,000 | | | $ | — | | | $ | 68.64 | | | $ | 88.85 | |

| Q4 2023 | | 330,000 | | | $ | — | | | $ | 68.64 | | | $ | 88.85 | |

| 2024 | | 1,621,000 | | | $ | — | | | $ | 61.12 | | | $ | 84.39 | |

| 2025 | | 423,000 | | | $ | — | | | $ | 60.00 | | | $ | 77.23 | |

| | | | | | | | |

| Natural Gas Swaps (MMBtu) | | | | | | | | |

| Q3 2023 | | 470,000 | | | $ | 2.61 | | | $ | — | | | $ | — | |

| Q4 2023 | | 670,000 | | | $ | 3.26 | | | $ | — | | | $ | — | |

| 2024 | | 2,400,000 | | | $ | 3.38 | | | $ | — | | | $ | — | |

| 2025 | | 525,000 | | | $ | 3.90 | | | $ | — | | | $ | — | |

| | | | | | | | |

| Natural Gas Collars (MMBtu) | | | | | | | | |

| Q3 2023 | | 300,000 | | | $ | — | | | $ | 2.55 | | | $ | 3.20 | |

| Q4 2023 | | 300,000 | | | $ | — | | | $ | 3.12 | | | $ | 4.07 | |

| 2024 | | 1,065,000 | | | $ | — | | | $ | 3.19 | | | $ | 4.14 | |

| 2025 | | 555,000 | | | $ | — | | | $ | 3.30 | | | $ | 4.49 | |

| | | | | | | | |

| Oil Basis (Bbl) | | | | | | | | |

| Q3 2023 | | 420,000 | | | $ | 1.28 | | | $ | — | | | $ | — | |

| Q4 2023 | | 450,000 | | | $ | 1.28 | | | $ | — | | | $ | — | |

| 2024 | | 1,320,000 | | | $ | 0.97 | | | $ | — | | | $ | — | |

__________________

(1)Q3 2023 derivative positions shown include July and August 2023 contracts, some of which have settled as of August 4, 2023.

In April 2023, the Company entered into interest rate swaps for $80 million notional at an average fixed rate on the adjusted term secured overnight financing rate of 3.09% for the period April 2024 through April 2026.

v3.23.2

Cover

|

Aug. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity Registrant Name |

Riley Exploration Permian, Inc.

|

| Entity Incorporation, Date of Incorporation |

DE

|

| Entity File Number |

1-15555

|

| Entity Tax Identification Number |

87-0267438

|

| Entity Address, Address Line One |

29 E. Reno Avenue

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Oklahoma City

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

73104

|

| City Area Code |

405

|

| Local Phone Number |

415-8699

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

REPX

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001001614

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

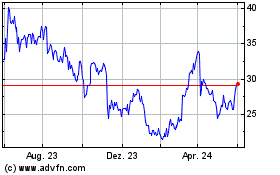

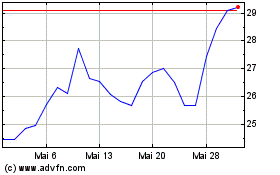

Riley Exploration Permian (AMEX:REPX)

Historical Stock Chart

Von Mai 2024 bis Mai 2024

Riley Exploration Permian (AMEX:REPX)

Historical Stock Chart

Von Mai 2023 bis Mai 2024