Loop Media, Inc. ("Loop Media" or "our" or the "Company") (NYSE

American: LPTV), a leading multichannel streaming CTV platform that

provides curated music videos, sports, news, premium entertainment

channels and digital signage for businesses, reports financial and

operating results for its 2024 fiscal third quarter ended June 30,

2024.

2024 Fiscal Third Quarter (June 30, 2024) Financial

Results

Summary Fiscal Q3 2024 vs. Fiscal Q3 2023

- Revenue in Q3 was $4.4 million, compared to $5.7 million.

- Net loss was $(5.5) million or $(0.07) per share, compared to a

loss of $(7.9) million or $(0.14).

- Adjusted EBITDA (a non-GAAP financial measure defined below)

was $(2.2) million, compared to $(3.7) million.

- Gross profit was $0.9 million, compared to $1.8 million.

- Gross margin was 20.9%, compared to 31.8%.

- As of June 30, 2024, the Company had 30,486 quarterly active

units ("QAUs") operating on its Owned and Operated ("O&O")

Platform, compared to 34,898 QAUs as of June 30, 2023.

- As of June 30, 2024, the Company had approximately 51,000

screens across its Partner Platforms, compared to approximately

37,000 as of June 30, 2023.

In the 2024 fiscal third quarter, revenue decreased

approximately 23% to $4.4 million compared to $5.7 million for the

same period in fiscal 2023. This decrease was primarily driven by a

challenging ad market environment in the second quarter of fiscal

year 2024 due to one of the largest ad demand participants changing

their terms of business with ad publishers, including us, which

resulted in a material negative impact on the Company’s ad demand

partner revenue.

Gross profit in the 2024 fiscal third quarter was $0.9 million

compared to $1.8 million for the same period in fiscal 2023. Gross

margin was 20.9% in the 2024 fiscal third quarter compared to 31.8%

for the same period in fiscal 2023. The decrease in margin rate was

primarily driven by decreased revenue.

Total sales, general, and administrative ("SG&A") expenses

(excluding stock-based compensation, depreciation and amortization,

impairment of goodwill and intangible assets, and restructuring

costs) in the 2024 fiscal third quarter were $4.1 million, a

decrease of $2.2 million, or 35%, from $6.3 million for the same

period in fiscal 2023. This decrease in SG&A expenses was

primarily due to reductions in headcount, marketing costs, and

professional and administration fees. As a result of the

cost-cutting measures that the Company has undertaken in fiscal

year 2024, the Company has realized a quarter-on-quarter reduction

in SG&A expenses of $1.6 million, or 28%, from $5.7 million in

the second quarter ended March 31, 2024, to $4.1 million in the

third quarter ended June 30, 2024.

Net loss in the third quarter of fiscal 2024 was $(5.5) million

or $(0.07) per share, compared to a net loss of $(7.9) million or

$(0.14) per share for the same period in fiscal 2023.

Adjusted EBITDA in the third quarter of fiscal 2024 was $(2.2)

million compared to $(3.7) million for the same period in fiscal

2023.

On June 30, 2024, cash and cash equivalents were $1.5 million

compared to $2.2 million on March 31, 2024. The decrease was

primarily driven by use of cash from operations. As of June 30,

2024, the Company had total net debt of $6.2 million compared to

$6.0 million as of March 31, 2024, a 3% increase.

For the third quarter of fiscal 2024, the Company had

approximately 81,000 active Loop Players and Partner Screens across

the Loop Platform, which included 30,486 QAUs across the Company’s

O&O Platform, a decrease of 13% (or 4,412 QAUs) over the 34,898

QAUs for the third quarter of fiscal 2023, and a decrease of 7% (or

2,172 QAUs) over the 32,658 QAUs for the second quarter of fiscal

2024, and approximately 51,000 Partner Screens across the Company’s

Partner Platforms at the end of the third quarter of fiscal 2024,

an increase of 38% (or approximately 14,000 Partner Screens) over

approximately 37,000 Partner Screens at the end of the third

quarter of fiscal 2023, and an increase of approximately 2% (or

approximately 1,000 Partner Screens) over approximately 50,000

Partner Screens at the end of the second quarter of fiscal

2024.

Continued Cost-Cutting Initiatives

During the third quarter of fiscal year 2024, the Company

continued the cost-cutting review it began earlier in fiscal year

2024, which it believed would provide the framework for making it

more competitive in the CTV for business/DOOH industry and would

accelerate its potential path to break even and achieve operating

profitability. These measures have included: (1) discussions with

certain third-party content providers and other licensors with a

view to (i) restructuring existing or new license agreements and

(ii) eliminating certain fixed fee content licenses, in each case

to more closely align payments to content licensors with revenue

associated with such content; (2) the development and promotion of

lower cost channels to reduce or eliminate third-party content

license fees, where possible; and (3) a continued review of

existing third-party vendor products and services with a view to

eliminating approximately $750,000 in ongoing yearly costs and

expenses beginning in the first quarter of fiscal year 2025.

These efforts are ongoing and as these initiatives and changes

continue to take effect, the Company believes it will see improved

margins for the business. There can be no assurances, however, that

the Company will be able to effect all changes that it has

identified or that any such changes will achieve the desired

results.

Justis Kao, CEO, stated, "Since my recent appointment as CEO, I

have focused my attention on those areas of the business where we

can look to increase revenues, leverage the Company’s fixed and

variable expenses and improve profitability. As we have already

undertaken significant cost-cutting measures, we will continue to

streamline our operations and create further cost efficiencies for

the remainder of this fiscal year and into the next. We are also

continuing to work toward the expansion of our subscription

offerings to our out-of-home business clients, including the

introduction of a two-tier music video service offering, which will

include a “primary tier” consisting of fewer than ten music video

channels provided under a free ad-based service, and a “premium

tier” of Loop’s full library of curated music video channels

provided under a subscription service. We have also recently

announced a non-music subscription offering that includes a number

of live channels ranging from live sports events (including The NFL

Redzone and The NFL Network) to news and lifestyle offerings which

we believe will continue to support the growth opportunities of our

business while further enhancing the customer experience for our

business venue partners.”

Conference Call

The Company will conduct a conference call today, August 7,

2024, at 5:00 p.m. Eastern Daylight Time to discuss its financial

and operating results for its 2024 fiscal third quarter ended June

30, 2024.

Loop Media's management will host the conference call.

Date: August 7, 2024 Time: 5:00 p.m. Eastern Time Participant

registration link: Q3 Link

Below are the details for those participants who would like to

dial in.

Conference ID: 1588215 Participant Toll-Free Dial-In

Number: 1(800) 715-9871 Participant International Dial-In

Number: 1(646) 307-1963

The conference call will also be available for replay on the

investor relations section of the Company's website at

https://ir.loop.tv/

About Loop Media, Inc.

Loop Media, Inc. ("Loop®") (NYSE American: LPTV) is a leading

connected television (CTV) / streaming / digital out-of-home TV and

digital signage platform optimized for businesses, providing music

videos, news, sports, and entertainment channels through its Loop®

TV service. Loop Media is the leading company in the U.S. licensed

to stream music videos to businesses through its proprietary Loop®

Player.

Loop® TV’s digital video content is streamed to millions of

viewers in CTV / streaming / digital out of home locations

including bars/restaurants, office buildings, retail businesses,

college campuses, airports, among many other venues in the United

States, Canada, Australia and New Zealand.

Loop® TV is fueled by one of the largest and most important

premium short-form entertainment libraries that includes music

videos, movie trailers, branded content, and live performances.

Loop Media’s non-music channels cover a wide variety of genres and

moods and include movie trailers, sports highlights, lifestyle and

travel videos, viral videos, and more. Loop Media’s streaming

services generate revenue from programmatic and direct advertising,

and subscriptions.

To learn more about Loop Media products and applications, please

visit us online at Loop.tv

Follow us on social:

Instagram: @loopforbusiness

X (Twitter): @loopforbusiness

LinkedIn: https://www.linkedin.com/company/loopforbusiness/

Safe Harbor Statement and Disclaimer

This news release includes "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, including, but not limited to, Loop Media's expected

performance, ability to compete in the highly competitive markets

in which it operates, statements regarding Loop Media's ability to

develop talent and attract future talent, the success of strategic

actions Loop Media is taking, and the impact of strategic

transactions. Forward-looking statements give Loop Media’s current

expectations, opinion, belief or forecasts of future events and

performance. A statement identified by the use of forward-looking

words including "will," "may," "expects," "projects,"

"anticipates," "plans," "believes," "estimate," "should," and

certain of the other foregoing statements may be deemed

forward-looking statements. Although Loop Media believes that the

expectations reflected in such forward-looking statements are

reasonable, these statements involve risks and uncertainties that

may cause actual future activities and results to be materially

different from those suggested or described in this news release.

Investors are cautioned that any forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected. The forward-looking

statements in this press release are made as of the date hereof.

Loop Media takes no obligation to update or correct its own

forward-looking statements, except as required by law, or those

prepared by third parties that are not paid for by Loop Media. Loop

Media's Securities and Exchange Commission filings are available at

www.sec.gov.

Non-GAAP Measures

Loop Media uses non-GAAP financial measures, including Adjusted

EBITDA and quarterly active units or QAUs, as supplemental measures

of the performance of the Company's business. Use of these

financial measures has limitations, and you should not consider

them in isolation or use them as substitutes for analysis of Loop

Media’s financial results under generally accepted accounting

principles in the United States of America (“U.S. GAAP”).

We believe that the presentation of Adjusted EBITDA, provides

investors with additional information about our financial results.

Adjusted EBITDA is an important supplemental measure used by our

board of directors and management to evaluate our operating

performance from period-to-period on a consistent basis and as a

measure for planning and forecasting overall expectations and for

evaluating actual results against such expectations.

Adjusted EBITDA is not measured in accordance with, or an

alternative to, measures prepared in accordance with U.S. GAAP. In

addition, this non-GAAP financial measure is not based on any

comprehensive set of accounting rules or principles. As a non-GAAP

financial measure, Adjusted EBITDA has limitations in that it does

not reflect all of the amounts associated with our results of

operations as determined in accordance with U.S. GAAP. In

particular:

●

Adjusted EBITDA does not reflect the

amounts we paid in interest expense on our outstanding debt;

●

Adjusted EBITDA does not reflect the

amounts we paid in taxes or other components of our tax

provision;

●

Adjusted EBITDA does not include

depreciation expense from fixed assets;

●

Adjusted EBITDA does not include

amortization expense;

●

Adjusted EBITDA does not include the

impact of stock-based compensation;

●

Adjusted EBITDA does not include the

impact of non-recurring expense;

●

Adjusted EBITDA does not include the

impact of restructuring costs;

●

Adjusted EBITDA does not include the

impact of the loss on the extinguishment of debt;

●

Adjusted EBITDA does not include the

impact of employee retention credits; and

●

Adjusted EBITDA does not include the

impact of other income including foreign currency translation

adjustments, realized foreign currency gains/losses and unrealized

gains/losses.

Because of these limitations, you should consider Adjusted

EBITDA alongside other financial performance measures including net

income (loss) and our financial results presented in accordance

with U.S. GAAP. The financial tables below provide a reconciliation

of Adjusted EBITDA to the most nearly comparable measure under U.S.

GAAP.

The Company defines an “active unit” as (i) an ad-supported Loop

Player (or DOOH location using Loop Media’s ad-supported service

through its “Loop for Business” application or using a DOOH

venue-owned computer screening the Company’s content) that is

online, playing content, and has checked into the Loop analytics

system at least once in the 90-day period or (ii) a DOOH location

customer using the Company’s paid subscription service at any time

during the 90-day period. The Company uses quarterly active units,

or “QAUs,” to refer to the number of such active units during such

period.

LOOP MEDIA, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS June 30, 2024 September 30,

2023 ASSETS

(UNAUDITED) Current assets Cash $

1,546,088

$

3,068,696

Accounts receivable, net

3,541,592

6,211,815

Prepaid expenses and other current assets

443,045

987,605

Content assets - current

997,508

2,218,894

Total current assets

6,528,233

12,487,010

Non-current assets Deposits

9,954

12,054

Content assets - non current

211,661

448,726

Deferred costs - non current

503,123

744,408

Property and equipment, net

2,507,776

2,711,558

Operating lease right-of-use assets

189,650

—

Intangible assets, net

393,556

477,889

Total non-current assets

3,815,720

4,394,635

Total assets $

10,343,953

$

16,881,645

LIABILITIES AND STOCKHOLDERS’

EQUITY Current liabilities Accounts payable $

5,501,995

$

4,978,920

Accrued liabilities

1,866,161

3,546,338

Accrued royalties and revenue share

7,829,892

4,930,329

License content liabilities - current

708,567

489,157

Equipment financing liability, current

131,348

—

Deferred Income

26,278

—

Lease liability, current

67,689

—

Revolving line of credit - current

2,175,456

2,985,298

Non-revolving line of credit, current

1,000,000

Non-revolving line of credit - related party, current

1,329,750

2,124,720

Total current liabilities

20,637,136

19,054,762

Non-current liabilities License content liabilities - non

current

129,000

208,000

Equipment financing liability, non-current

229,846

—

Lease liability, non-current

121,961

—

Revolving line of credit - related party, non-current

1,679,226

—

Non-revolving line of credit, non-current

—

475,523

Non-revolving line of credit - related party, non-current

—

1,959,693

Total non-current liabilities

2,160,033

2,643,216

Total liabilities

22,797,169

21,697,978

Commitments and contingencies

—

—

Stockholders’ equity Common Stock, $0.0001 par value,

150,000,000 shares authorized, 71,173,736 and 65,620,151 shares

issued and outstanding as of March 31, 2024 and September 30, 2023,

respectively

7,904

6,562

Additional paid in capital

134,132,075

123,462,648

Accumulated deficit

(146,593,195

)

(128,285,543

)

Total stockholders' equity

(12,453,216

)

(4,816,333

)

Total liabilities and stockholders' equity $

10,343,953

$

16,881,645

LOOP MEDIA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three months ended June

30,

Nine months ended June

30,

2024

2023

2024

2023

Revenue $

4,350,570

$

5,734,976

$

18,524,289

$

25,954,038

Cost of revenue Cost of revenue - Advertising and Legacy and

other revenue

2,641,779

3,132,568

11,214,512

14,767,807

Cost of revenue - depreciation and amortization

798,434

779,165

2,356,717

2,091,876

Total cost of revenue

3,440,213

3,911,733

13,571,229

16,859,683

Gross profit

910,357

1,823,243

4,953,060

9,094,355

Operating expenses Sales, general and administrative

4,116,186

6,284,514

16,022,857

22,011,961

Stock-based compensation

931,571

2,592,369

3,371,933

6,858,983

Depreciation and amortization

422,882

295,008

1,217,955

717,733

Restructuring costs

220,053

146,672

220,053

146,672

Total operating expenses

5,690,692

9,318,563

20,832,798

29,735,349

Loss from operations

(4,780,335

)

(7,495,320

)

(15,879,738

)

(20,640,994

)

Other income (expense) Interest expense

(670,981

)

(962,718

)

(2,402,444

)

(2,889,745

)

Employee retention credits

—

648,543

648,543

Loss on extinguishment of debt

(25,424

)

—

Other expense

34

(65,643

)

289

(68,267

)

Total other income (expense)

(670,947

)

(379,818

)

(2,427,579

)

(2,309,469

)

Loss before income taxes

(5,451,282

)

(7,875,138

)

(18,307,317

)

(22,950,463

)

Income tax (expense)/benefit

(335

)

(394

)

(335

)

(1,624

)

Net loss $

(5,451,617

)

$

(7,875,532

)

$

(18,307,652

)

$

(22,952,087

)

Basic and diluted net loss per common share $

(0.07

)

$

(0.14

)

$

(0.26

)

$

(0.41

)

Weighted average number of basic and diluted common

shares outstanding

75,146,980

56,604,812

70,966,475

56,455,743

LOOP MEDIA, INC.

ADJUSTED EBITDA

RECONCILIATION

Three months ended June

30,

Nine months ended June

30,

2024

2023

2024

2023

GAAP net loss $

(5,451,617

)

$

(7,875,532

)

$

(18,307,652

)

$

(22,952,087

)

Adjustments to reconcile to Adjusted EBITDA: Interest expense

670,981

962,718

2,402,444

2,889,745

Depreciation and amortization expense*

1,221,316

1,074,173

3,574,672

2,809,609

Income tax expense (benefit)

335

394

335

1,624

Stock-based compensation**

931,571

2,592,369

3,371,933

6,858,983

Non-recurring expense

159,425

62,615

437,838

62,615

Restructuring costs

220,053

146,672

220,053

146,672

Loss on extinguishment of debt

25,424

Employee retention credits

(648,543

)

(648,543

)

Other expense

(34

)

3,028

(289

)

5,652

Adjusted EBITDA $

(2,247,970

)

$

(3,682,106

)

$

(8,275,242

)

$

(10,825,730

)

* Includes amortization of content assets and for cost of revenue

and operating expenses and ATM facility. ** Includes options,

Restricted Stock Units ("RSUs") and warrants.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807898882/en/

Loop Media Investor Contact ir@loop.tv

Loop Media Press Contact Grant Genske grant@loop.tv

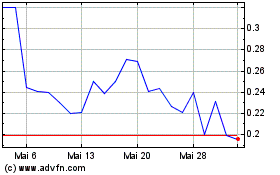

Loop Media (AMEX:LPTV)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Loop Media (AMEX:LPTV)

Historical Stock Chart

Von Jan 2024 bis Jan 2025