Current Report Filing (8-k)

22 Dezember 2020 - 10:51PM

Edgar (US Regulatory)

0001374310

false

0001374310

2020-12-17

2020-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 17, 2020

Cboe Global Markets, Inc.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

|

001-34774

|

|

20-5446972

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

400 South LaSalle Street

Chicago, Illinois 60605

(Address and Zip Code of Principal Executive

Offices)

Registrant's telephone number,

including area code: (312) 786-5600

Not applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common

Stock, par value of $0.01 per share

|

|

CBOE

|

|

CboeBZX

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 1.01. ENTRY INTO

A MATERIAL DEFINITIVE AGREEMENT.

Amended and Restated Credit Agreement

On

December 21, 2020, Cboe Global Markets, Inc. (the “Company”), as borrower, entered into an Amended and

Restated Credit Agreement (the “Revolving Credit Agreement”), which amended and restated the Credit Agreement,

dated as of December 15, 2016 (as amended on May 29, 2020), with Bank of America, N.A., as administrative agent and

as swing line lender, certain lenders named therein (the “Revolving Lenders”), BOFA Securities, Inc., as

sole lead arranger and sole bookrunner and certain syndication agents named therein ("Syndication Agents").

The Revolving Credit

Agreement provides for a senior unsecured $250 million three-year revolving credit facility (the “Revolving Credit Facility”)

that includes a $25 million swing line sub-facility. The Company may also, subject to the agreement of the applicable lenders,

increase the commitments under the Revolving Credit Facility by up to $100 million, for a total of $350 million. Subject to specified

conditions, the Company may designate one or more of its subsidiaries as additional borrowers under the Revolving Credit Agreement

provided that the Company guarantees all borrowings and other obligations of any such subsidiaries under the Revolving Credit Agreement.

Loans under the

Revolving Credit Agreement will bear interest, at the Company’s option, at either (i) LIBOR plus a margin (based on

the Company’s public debt ratings) ranging from .875 percent per annum to 1.50 percent per annum or (ii) a daily floating

rate based on the Agent’s prime rate (subject to certain minimums based upon the federal funds effective rate or LIBOR) plus

a margin (based on the Company’s public debt ratings) ranging from zero percent per annum to 0.50 percent per annum. The

Revolving Credit Agreement includes a mechanism to replace LIBOR with an alternate benchmark rate that includes the forward-looking

term rate for any interest period that is based on the secured overnight financing rate published by the Federal Reserve Bank of

New York, as may be adjusted pursuant to the terms of the Revolving Credit Agreement.

Subject to certain

conditions stated in the Revolving Credit Agreement, the Company and any subsidiaries designated as additional borrowers may borrow,

prepay and reborrow amounts under the Revolving Credit Facility at any time during the term of the Revolving Credit Agreement.

The Revolving Credit Agreement will terminate and all amounts owing thereunder will be due and payable on December 21, 2023,

unless the commitments are terminated earlier, either at the request of the Company or, if an event of default occurs, by the Revolving

Lenders (or automatically in the case of certain bankruptcy-related events). The Revolving Credit Agreement contains customary

representations, warranties and affirmative and negative covenants for facilities of its type, including financial covenants, events

of default and indemnification provisions in favor of the Revolving Lenders. The negative covenants include restrictions regarding

the incurrence of liens, the incurrence of indebtedness by the Company’s subsidiaries and fundamental changes, subject to

certain exceptions in each case. The financial covenants require the Company to meet a quarterly financial test with respect to

a minimum consolidated interest coverage ratio of not less than 4.00 to 1.00 and a maximum consolidated leverage ratio of not greater

than 3.50 to 1.00; provided that the consolidated leverage ratio may, subject to certain triggering events set forth in the Revolving

Credit Agreement, be increased to 4.00 to 1.00 for four consecutive fiscal quarters.

The foregoing description

does not purport to be complete and is qualified in its entirety by reference to the Revolving Credit Agreement, which is attached

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Other Information

Bank of America,

N.A., certain Revolving Lenders, certain Syndication Agents or certain of their respective affiliates are

trading permit holders or members (collectively “Participants”) and engage in trading activities on Company exchanges.

In addition, certain of the Participants are clearing members of the Options Clearing Corporation, and, as such, these Participants

clear the market-maker sides of transactions at Company exchanges.

ITEM 2.03. CREATION OF A DIRECT

FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

The information

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS’ APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS

OF CERTAIN OFFICERS.

Election of Directors

On December 17, 2020, the Board of

Directors (the “Board”) of the Company elected Ivan K. Fong and Alexander J. Matturri, effective immediately, to fill

an existing vacancy on the Board and increased the Board size to 15 directors. Messrs. Fong and Matturri will receive

compensation for their service on the Board as non-employee members of the Board in the same manner as other non-employee members

of the Board. For a description of the Company’s director compensation programs, see “Director Compensation”

in the definitive proxy statement filed by the Company on April 2, 2020 in connection with its 2020 Annual Meeting of Stockholders;

provided, however, that following such annual meeting, the value of the annual stock retainer for the Company’s directors

increased from $130,000 to $145,000.

A copy of the press release regarding the

election of these directors is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Ivan K. Fong

Mr. Fong, 59, is currently Senior Vice

President, General Counsel and Secretary of 3M Company, a position he has held from June 2019. Prior to this position, he

served as Senior Vice President, Legal Affairs and General Counsel of 3M Company from 2012 to 2019. Prior to joining 3M Company,

Mr. Fong was General Counsel of the United States Department of Homeland Security from 2009 to 2012 and the Chief Legal Officer

and Secretary of Cardinal Health, Inc. from 2005 to 2009. Mr. Fong holds an S.B. degree in Chemical Engineering and an

S.M. degree in Chemical Engineering Practice from Massachusetts Institute of Technology, a J.D. degree from Stanford University,

and a Bachelor of Civil Law from Oxford University.

Mr. Fong has been appointed to the

Risk Committee of the Board, effective upon his election to the Board.

There is no arrangement or understanding

between Mr. Fong and any other persons pursuant to which Mr. Fong was elected to serve on the Board.

Mr. Fong does not have any direct or

indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation

S-K or Item 5.02(d) of Form 8-K.

Alexander J. Matturri

Mr. Matturri, 62, is the retired Chief

Executive Officer of S&P Dow Jones Indices LLC (“S&P”), a position he held from July 2012 to June 2020.

Prior to this position, he served as Executive Managing Director and Head of S&P Indices from 2007 to 2012. Prior to joining

S&P, Mr. Matturri served as Senior Vice President and Director of Global Equity Index Management at Northern Trust Global

Investments from 2003 to 2007. From 2000 to 2003 he was Director and Senior Index Investment Strategist at Deutsche Asset Management.

Mr. Matturri holds a B.S. degree in Finance from Lehigh University and a J.D. degree from Syracuse University. Mr. Matturri

holds the Chartered Financial Analyst designation.

Mr. Matturri has been appointed to

the Audit Committee of the Board, effective upon his election to the Board.

There is no arrangement

or understanding between Mr. Matturri and any other persons pursuant to which Mr. Matturri was elected to serve on the

Board.

Mr. Matturri does not have any direct

or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation

S-K or Item 5.02(d) of Form 8-K. As disclosed in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2019, the Company is party to a license with S&P pursuant to which the Company has the exclusive right to

offer exchange-listed options contracts in the United States on the S&P 500 Index, the S&P 100 Index and the S&P

Select Sector Indices through December 31, 2033, with an exclusive license to trade options on the S&P 500 Index through

December 31, 2032.

ITEM 9.01. FINANCIAL

STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

10.1

|

|

Amended and Restated

Credit Agreement, dated as of December 21, 2020, by and among Cboe Global Markets, Inc., with Bank of America, N.A., as

administrative agent and as swing line lender, certain lenders named therein, BOFA Securities, Inc., as sole lead

arranger and sole bookrunner and certain syndication agents named

therein

|

|

|

|

|

|

99.1

|

|

Press Release, dated December 17, 2020

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document)

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

CBOE GLOBAL MARKETS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Brian N. Schell

|

|

|

Name:

|

Brian N. Schell

|

|

|

Title:

|

Executive Vice President, Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

|

Dated: December 22, 2020

|

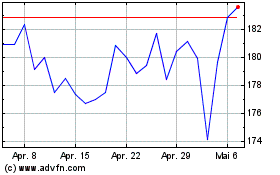

Cboe Global Markets (AMEX:CBOE)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

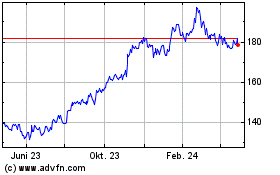

Cboe Global Markets (AMEX:CBOE)

Historical Stock Chart

Von Jul 2023 bis Jul 2024