Limited Brands, Inc. Bath & Body Works Installs Energy Focus, Inc. Lighting Systems and Energy Focus, Inc. Announces $10 Million

14 März 2008 - 2:27PM

PR Newswire (US)

SOLON, Ohio, March 14 /PRNewswire-FirstCall/ -- Energy Focus, Inc.

(NASDAQ:EFOI), the global leader in energy-efficient lighting

technologies, announced today that Bath & Body Works, a

subsidiary of Limited Brands, Inc., has installed Energy Focus,

Inc.'s EFO(R)-LED Light Bar systems in a number of locations. The

system has been approved for retrofits for stores using fluorescent

shelf-lighting. With more than 1,600 stores nationwide, Bath &

Body Works describes itself as a "21st-century apothecary" and is

one of the nation's leading bath product chains. "The EFO-LED Light

Bar system offers bright light while emitting no heat or UV, making

it the perfect solution for highlighting Bath & Body Work's

soaps, cremes, and other personal care products," said John

Davenport, president and CEO of Energy Focus, Inc. "With our

EFO-LED Light Bars, Bath & Body Works can attractively display

their products while saving energy over conventional fluorescent

systems." The Energy Focus EFO(R)-LED Light Bar system is designed

specifically for the needs of retail display cases. The system

offers customers bright, pure light without concern for heat, UV

fading, or electrical hazard while saving energy over traditional

lighting systems. EFO(R) systems are currently used by jewelry

stores, department stores, and other retailers. Energy Focus, Inc.

today also announced that it has received a commitment for $10

million of new investment in the Company. The capital will be used

to fund ongoing operations, including working capital for its

EFO(R) systems and future R&D. The transaction is expected to

close on March 14, 2008. The investment was made by several current

Energy Focus investors, with the largest share being made by The

Quercus Trust, Costa Mesa, California. The investors agreed to an

at-market purchase of approximately 3.1 million units for $3.205

per unit, based on the closing bid price of Energy Focus common

shares on March 13, 2008 of $3.08. Each unit comprises one share of

the Company's common stock, par value $0.0001 per share, and one

warrant to purchase one share of the Company's common stock at an

exercise price of $3.08 per share. The warrants are immediately

separable from the units and immediately exercisable, and will

expire five years after the date of their issuance. Merriman Curhan

Ford & Co. acted as sole placement agent in this transaction.

About Energy Focus Energy Focus designs, develops, manufactures and

markets fiber optic lighting systems for wide-ranging uses in both

the general commercial and the pool and spa lighting markets.

Energy Focus's EFO(R) system, introduced in 2004, offers energy

savings, heat dissipation and maintenance cost benefits over

conventional lighting for multiple applications. The Company's

headquarters are located at 32000 Aurora Road, Solon, Ohio. The

Company has additional offices in California, England and Germany.

Telephone: 440-715-1300. Web site: http://www.energyfocusinc.com/.

Safe Harbor Statements under the Private Securities Litigation

Reform Act of 1995: Material contained in this press release may

include statements that are not historical facts and are considered

"forward-looking" within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

reflect Energy Focus's current views about future events and

financial performances. These forward-looking statements are

identified by the use of terms and phrases such as "believe,"

"expect," "plan," "anticipate," and similar expressions identifying

forward-looking statements. Investors should not rely on

forward-looking statements because they are subject to a variety of

risks, uncertainties, and other factors that could cause actual

results to differ materially from the Company's expectation. These

factors include: a history of losses and anticipated continued

losses from operations; a possible need to raise additional capital

or other financing; any weakness in general economic conditions or

conditions in target markets; intense competition from companies

with greater financial resources; reliance on a small number of

third-party suppliers; reliance on limited production facilities;

reliance on a small number of third-party operators;

creditworthiness of customers; possible loss of government funding

for research; reliance on overseas manufacturers and assemblers,

subject to various political and social conditions, and the

financial strength of the companies where the Company does business

overseas; any failure to protect intellectual property; retaining

key executives and employees and the possible need in the future to

hire and retain key executives and employees; and the historical

volatility of the Company's stock price. These factors are

elaborated upon and other factors may be disclosed from time to

time in Energy Focus's filings with the Securities and Exchange

Commission. Energy Focus, Inc. expressly does not undertake any

duty to update forward-looking statements. Additional Note This

press release does not and shall not constitute an offer to sell or

the solicitation of an offer to buy any of the securities.

DATASOURCE: Energy Focus, Inc. CONTACT: Public Relations Office of

Energy Focus, Inc., +1-440-715-1295, Web site:

http://www.energyfocusinc.com/

Copyright

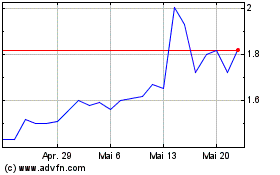

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

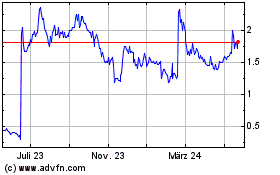

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024