UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ]

Preliminary Proxy Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X]

Definitive Proxy Statement

[ ]

Definitive Additional Materials

[ ]

Soliciting Material Pursuant to Section 240.14a-12

CINCINNATI FINANCIAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (check the appropriate box):

[X]

No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:....................................................................................

2) Aggregate number of securities to which transaction applies: ...................................................................................

3) Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ......................................................

4) Proposed maximum aggregate value of transaction:...................................................................................................

5) Total fee paid:..............................................................................................................................................................

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid: ............................................................................................................................................

2) Form, Schedule or Registration Statement No.:...........................................................................................................

3) Filing Party: .................................................................................................................................................................

4) Date Filed:....................................................................................................................................................................

March 22, 2017

To the Shareholders of Cincinnati Financial Corporation:

You are cordially invited to attend the Annual Meeting of Shareholders of Cincinnati Financial Corporation, which will take place at 9:30 a.m. on Saturday, May 6, 2017, at the Cincinnati Art Museum, located in Eden Park, Cincinnati, Ohio. The business to be conducted at the meeting includes:

|

|

|

|

1.

|

Electing 14 directors for one-year terms;

|

|

|

|

|

2.

|

Ratifying the selection of Deloitte & Touche LLP as the company’s independent registered public accounting firm for 2017;

|

|

|

|

|

3.

|

Voting on a nonbinding proposal to approve compensation for the company’s named executive officers;

|

|

|

|

|

4.

|

Voting on a nonbinding proposal to establish the frequency of future nonbinding votes on executive compensation; and

|

|

|

|

|

5.

|

Transacting such other business as may properly come before the meeting.

|

Shareholders of record at the close of business on March 7, 2017, are entitled to vote at the meeting.

Whether or not you plan to attend the meeting, please cast your vote as promptly as possible. We encourage convenient online voting, which saves your company significant postage and processing costs. If you prefer, you may submit your vote by telephone or by mail. Detailed voting instructions can be found in the Frequently Asked Questions section on Page 9 of this proxy statement.

Thank you for your interest and participation in the affairs of the company.

/S/ Lisa A. Love

Lisa A. Love, Esq.

Senior Vice President, General Counsel and Corporate Secretary

This proxy statement, the Annual Report on Form 10-K, the Letter From the Chairman and the Chief Executive Officer and voting instructions were first made available to Cincinnati Financial Corporation shareholders on March 22, 2017.

Table of Contents

|

|

|

|

|

|

|

Proxy Summary

|

|

|

|

2017 Annual Meeting of Shareholders

|

|

|

|

Voting Matters and Board Recommendations

|

|

|

|

2016 Governance Highlights

|

|

|

|

Director Nominees

|

|

|

|

2016 Business Highlights

|

|

|

|

2016 Executive Compensation Highlights

|

|

|

|

Important Dates for the 2018 Annual Meeting of Shareholders

|

|

|

|

Frequently Asked Questions

|

|

|

|

Security Ownership of Principal Shareholders and Management

|

|

|

|

Section 16(A) Beneficial Ownership Reporting Compliance

|

|

|

|

Information About the Board of Directors

|

|

|

|

Proposal 1 - Election of Directors

|

|

|

|

Directors of Your Company

|

|

|

|

Governance of Your Company

|

|

|

|

2016 Governance Highlights

|

|

|

|

Governance Policies and Practices

|

|

|

|

Certain Relationships and Transactions

|

|

|

|

Audit-Related Matters

|

|

|

|

Proposal 2 - Ratifying the Selection of the Independent Registered Public Accounting Firm

|

|

|

|

Report of the Audit Committee

|

|

|

|

Fees Billed by the Independent Registered Public Accounting Firm

|

|

|

|

Services Provided by the Independent Registered Public Accounting Firm

|

|

|

|

Compensation of Named Executive Officers and Directors

|

|

|

|

Proposal 3 - Say-on-Pay: Advisory vote on Compensation of Named Executive Officers

|

|

|

|

Proposal 4 - Advisory Vote on Frequency of Future Advisory Votes on Compensation of Our Named Executive Officers

|

|

|

|

Report of the Compensation Committee

|

|

|

|

Compensation Committee Interlocks and Insider Participation

|

|

|

|

Compensation Discussion and Analysis

|

|

|

|

Conclusion

|

|

|

|

Shareholder Proposals for Next Year

|

|

|

|

Cost of Solicitation

|

|

|

|

Other Business

|

|

|

|

Appendix A

|

|

|

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information that you should consider before voting. Please read the entire proxy statement, and for more complete information about the company’s 2016 performance, please review the company’s 2016 Annual Report on Form 10-K.

2017 Annual Meeting of Shareholders

Date and Time: May 6, 2017, 9:30 a.m. ET

Place: Cincinnati Art Museum, 953 Eden Park Drive, Cincinnati, Ohio 45202

Record Date: March 7, 2017

Meeting Webcast:

cinfin.com/investors

Voting Matters and Board Recommendations

|

|

|

|

|

|

|

Our Board’s Recommendation

|

Election of Directors (Page

16

)

|

FOR Each Director Nominee

|

Ratification of Auditors (Page

34

)

|

FOR

|

Advisory Vote to Approve Executive Compensation (Page

37

)

|

FOR

|

Establish Frequency of Future Advisory Votes to Approve Executive Compensation (Page

38

)

|

1 YEAR

|

2016 Governance Highlights

In 2016, the company continued to follow its strong governance policies and practices to benefit shareholders. Highlights included:

|

|

|

|

•

|

Majority Voting - Shareholders voted in line with the board's recommendation to amend the company's Articles of Incorporation to provide for a majority voting standard in uncontested director elections. The board believes that implementation of this voting standard gives shareholders a more meaningful voice in electing our directors and reinforces our commitment to accountability and strong corporate governance practices. Majority voting will apply to the uncontested election of directors at the 2017 Annual Meeting of Shareholders.

|

|

|

|

|

•

|

Cybersecurity - Cybersecurity is a growing threat for all companies. For the second year in a row, the audit committee increased its understanding of the company’s cybersecurity risk by engaging third-party experts to test and audit the company’s cybersecurity program structure and capabilities and hosted a cybersecurity tabletop exercise in which all directors participated.

|

|

|

|

|

•

|

Board Refreshment and Composition - Informed by feedback from its annual board self-evaluation, engagement with investors each year and our Corporate Governance Guidelines, the board continuously assesses the composition of the board of directors. Its goal is to balance independence, board size, tenure, and

diversity of experience, skills, competencies and other qualities of current directors and future director candidates

to best structure and govern itself in the short- and long-term for the benefit of shareholders.

Occasionally the size of the board is increased, as it was in 2013, to add a new independent director with a particular subject matter expertise. Occasionally the size of the board is decreased. In 2016, current director John J. Schiff, Jr. attained the maximum age specified in the Corporate Governance Guidelines and therefore is not a candidate for re-election to the board at the 2017 Annual Meeting of Shareholders. At its meeting immediately following the shareholder vote, the board intends to reduce the size of the board to 14 members.

|

|

|

|

|

•

|

Succession Planning - Succession planning at all levels is important to the long-term success of the company. In 2016, the board continued its practice of attending meetings of the subsidiary boards during which more than a dozen executives provide reports. These meetings provide the directors with opportunities to become familiar with this level of management, assess their development over time and gain in-depth knowledge about the company’s operating businesses. In 2016, the board also discussed potential management succession candidates with the chief executive officer at one of its regular meetings.

|

Director Nominees

The following table provides summary information about each director nominee. Complete information about each director’s background and experience begins on Page 16. Each director stands for election annually.

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Primary Occupation

|

Independent

|

Committee Memberships

|

Other Public Company Boards

|

|

William F. Bahl*

|

65

|

Chairman, Bahl & Gaynor Investment Counsel Inc.

|

ü

|

A, C, E, I, N (Chair)

|

0

|

|

Gregory T. Bier

|

70

|

Managing Partner (Retired), Deloitte LLP

|

ü

|

A, C, I

|

0

|

|

Linda W. Clement-Holmes

|

54

|

Chief Information Officer, The Procter & Gamble Company

|

ü

|

A, N

|

0

|

|

Dirk J. Debbink

|

61

|

Chairman and Chief Executive Officer, MSI General Corporation

|

ü

|

A, C

|

0

|

|

Steven J. Johnston

|

57

|

President and Chief Executive Officer, Cincinnati Financial Corporation

|

|

E (Chair), I

|

0

|

|

Kenneth C. Lichtendahl

|

68

|

Director of Development and Sales, Heliosphere Designs LLC

|

ü

|

A, N

|

0

|

|

W. Rodney McMullen

|

56

|

Chairman and Chief Executive Officer, The Kroger Co.

|

ü

|

C (Chair), E, I

|

2

|

|

David P. Osborn

|

56

|

President, Osborn Williams & Donohoe LLC

|

ü

|

A, I

|

0

|

|

Gretchen W. Price

|

62

|

Executive Vice President, Chief Financial and Administrative Officer, Arbonne International LLC

|

ü

|

A (Chair), C, N

|

0

|

|

Thomas R. Schiff

|

69

|

Chairman and Chief Executive Officer, John J. & Thomas R. Schiff & Co. Inc.

|

|

I

|

0

|

|

Douglas S. Skidmore

|

54

|

Chief Executive Officer, Skidmore Sales & Distributing Company Inc.

|

ü

|

A, N

|

0

|

|

Kenneth W. Stecher

|

70

|

Chairman of the Board, Cincinnati Financial Corporation

|

|

E, I (Chair)

|

0

|

|

John F. Steele, Jr.

|

63

|

Chairman and Chief Executive Officer, Hilltop Basic Resources Inc.

|

ü

|

A, E

|

0

|

|

Larry R. Webb

|

61

|

President, Webb Insurance Agency Inc.

|

|

E, I

|

0

|

*Lead Independent Director

A Audit Committee

C Compensation Committee

E Executive Committee

I Investment Committee

N Nominating Committee

2016 Business Highlights

In 2016, the company delivered strong operating results

1

and financial performance that benefited shareholders with one-year and three-year total shareholder return (TSR) of 31.5 percent and 60.6 percent respectively; a 10 percent increase in book value; and a 4.3 percent increase in regular cash dividends, excluding the special cash dividend declared in the fourth quarter of 2015. This strong performance generated payouts of annual incentive compensation at the maximum level and payouts of performance restricted stock units at target levels for our named executive officers. Highlights of our company's strong year included:

|

|

|

|

•

|

Our fifth consecutive year of underwriting profit with a combined ratio of 94.8 percent. In 2016, our efforts to further segment our renewal and new business opportunities with better pricing precision and risk-selection decisions continued to benefit underwriting performance, but were offset by less favorable reserve development on prior accident years and higher losses from natural catastrophes when compared with prior year results.

|

|

|

|

|

•

|

An all-time record level of consolidated property casualty new business written premiums at $551 million, up 4 percent, driven by new agency appointment contributions.

|

|

|

|

|

•

|

A 5 percent increase in consolidated property casualty net written premiums. The increase in premiums reflects our growth initiatives, modest average price increases and a higher level of insured exposures.

|

|

|

|

|

•

|

A 17 percent increase in full-year 2016 life insurance subsidiary net income, primarily due to more favorable mortality experience and an increase in realized investment gains

|

|

|

|

|

•

|

$16.277 billion in consolidated cash and invested assets, up 9 percent over the prior year.

|

|

|

|

|

•

|

A 4 percent increase in pretax investment income, net of expenses, reflecting a 7 percent increase in equity portfolio dividends and a 3 percent growth in interest income.

|

|

|

|

|

•

|

A value creation ratio (VCR) of 14.5 percent, above our announced goal of producing an annual average VCR of 10 percent to 13 percent for the five-year period from 2013 to 2017. Our VCR exceeded the VCR of eight of the nine companies in our peer group.

|

Additionally, our results allowed our board to continue to reward shareholders with an increase of our regular annual cash dividend for the 56

th

consecutive year. Through the cash dividends paid and share repurchases made during the year, we returned $345 million to shareholders in 2016, and $1.063 billion during the three years ended December 31, 2016.

1

In our disclosure about compensation paid to our named executive officers we refer to several Non-GAAP measures, including “operating income,” “net written premiums,” “value creation ratio” and "life insurance subsidiary results." The Definitions of Non-GAAP Information and Reconciliation to Comparable GAAP Measures are attached to this proxy statement in Appendix A.

2016 Executive Compensation Highlights

As discussed in Compensation Discussion and Analysis beginning on Page 40, we seek to align the interests of our named executive officers with the interests of our shareholders. The compensation committee endeavors to ensure that overall compensation paid to our executive officers is appropriate and in line with our overall compensation objective to attract, motivate, reward, develop and retain the executive talent required to achieve the company’s business objectives, with the ultimate goal of increasing shareholder value.

Set forth below is the 2016 compensation for each named executive officer as determined under Securities and Exchange Commission (SEC) rules. See the notes accompanying the Summary Compensation Table (SCT) on Page 60 for more information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

Salary

($)

|

Bonus

($)

|

Stock Awards

($)

|

Option Awards

($)

|

Non-

equity Incentive Plan Compensa-

tion

($)

|

Change in Pension Value and Non-

qualified Deferred Compensa-

tion Earnings

($)

|

All Other Compensa-

tion

($)

|

Total Compensa-

tion

($)

|

|

Steven J. Johnston

|

960,814

|

|

—

|

917,696

|

|

155,459

|

|

2,121,792

|

|

—

|

94,142

|

|

4,249,903

|

|

|

Chief Executive Officer

& President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jacob F. Scherer, Jr.

|

887,747

|

|

—

|

581,968

|

|

93,542

|

|

1,160,572

|

|

575,137

|

|

19,200

|

|

3,318,166

|

|

|

Chief Insurance Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael J. Sewell

|

784,665

|

|

—

|

513,159

|

|

82,525

|

|

1,023,925

|

|

—

|

71,520

|

|

2,475,794

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin F. Hollenbeck

|

646,808

|

|

—

|

423,473

|

|

68,033

|

|

844,032

|

|

—

|

59,884

|

|

2,042,230

|

|

|

Chief Investment Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles P. Stoneburner II

|

657,090

|

|

—

|

431,722

|

|

69,367

|

|

860,582

|

|

444,699

|

|

13,533

|

|

2,476,993

|

|

|

Senior Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

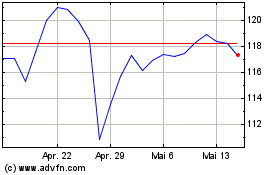

Generally, the Committee expects that when the company’s performance adds or preserves more value for shareholders than its peers, compensation of the named executive officers, including the chief executive officer, will be higher than when the company’s performance lags its peers. The following graph illustrates the directional relationships between company performance, based on the two performance metrics used in our performance-based awards, and the compensation of our chief executive officer for the three calendar years ending December 31, 2016.

CEO Pay for Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEO Pay for Performance

|

2014

|

|

2015

|

|

2016

|

|

SCT Total Compensation

|

$

|

2,623,807

|

|

|

$

|

2,163,984

|

|

|

$

|

4,249,903

|

|

|

Realized Total Compensation

(1)

|

$

|

2,434,715

|

|

|

$

|

1,936,016

|

|

|

$

|

3,711,998

|

|

|

1-Year VCR

|

12.6

|

%

|

|

3.4

|

%

|

|

14.5

|

%

|

|

3-Year TSR

(2)

|

90.6

|

%

|

|

69.1

|

%

|

|

60.6

|

%

|

|

|

|

|

(1)

|

Realized compensation is the sum of salary and annual incentive cash compensation reported in the SCT for the year plus the value realized from the exercise of stock options and vesting of time-vesting or performance-based restricted stock units, if any, reported in the Option Exercises and Stock Vested table for the year.

|

|

|

|

|

(2)

|

3-Year TSR is total shareholder return for the 3-year performance period ending December 31 of a given year, as calculated by and displayed on Bloomberg LP.

|

Important Dates for the 2018 Annual Meeting of Shareholders

|

|

|

|

•

|

Shareholder proposals submitted for inclusion in our 2018 proxy statement pursuant to SEC Rule 14a-8 must be received by us by November 16, 2017.

|

|

|

|

|

•

|

Notice of shareholder proposals to be raised from the floor of the 2018 Annual Meeting of Shareholders outside of SEC Rule 14a-8 must be received by us between January 26, 2018, and March 7, 2018.

|

More information about submitting shareholder proposals for the 2018 Annual Meeting of Shareholders begins on Page 75.

Frequently Asked Questions

Why are these materials important?

The board of directors of Cincinnati Financial Corporation is soliciting your vote for the 2017 Annual Meeting of Shareholders. Shareholders of record at the close of business on March 7, 2017, may vote. You have one vote for each share of common stock you owned on that date. There were 164,815,425 shares of common stock outstanding as of the close of business on March 7, 2017. A majority of the outstanding shares, or 82,407,714 shares, must be represented to hold the meeting. This constitutes a quorum.

How do I vote?

You may vote by proxy, whether or not you attend the meeting. Even if you plan to attend the annual meeting, we ask that you vote your shares in one of the ways listed below. Attending the meeting does not constitute a revocation of a previously submitted vote.

A Notice Regarding the Availability of Proxy Materials will be provided to you by mail in late March or early April, unless you previously requested for these materials to be delivered to you in paper or by email. The Notice includes instructions for viewing our year-end 2016 financial materials and proxy statement online and for voting via the internet, by telephone or by mail, along with the required Control Number (the Control Number is unique to each account). The Notice also includes instructions on how to request paper materials.

Shareholders who previously requested paper or email delivery of all materials will receive the 2016 Annual Report on Form 10-K, the Annual Letter From the Chairman and the Chief Executive Officer and the 2017 Shareholder Meeting Notice and Proxy Statement in late March or early April.

If you are a Shareholder of Record who owns shares directly in your name, you may vote your shares in one of the following ways:

|

|

|

|

|

|

|

|

|

By telephone. You may vote your shares by calling 1-866-804-9616.

|

|

|

|

Over the internet. Go to

www.AALvote.com/cinf

. You will need to have your Control Number available when you access the website. Your Control Number is on the Notice or proxy card that you received in the mail.

|

|

|

|

By scanning the QR code on your proxy card or Notice with your mobile device. The QR code on your proxy card or Notice is a unique identifier so you will not need to enter a Control Number. If you scan the QR code with your mobile device, you will access our proxy materials along with a voting screen.

|

|

|

|

By mail. If you received printed proxy materials, you may submit your vote by completing, signing and dating each proxy card received and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Be sure to return your proxy card in time to be received and counted before the Annual Meeting.

|

|

|

|

In person at the Annual Meeting. You may vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you also submit your proxy card or voting instructions, vote by telephone or via the internet by the applicable deadline so that your vote will be counted if you later decide not to attend the meeting.

|

If you vote by telephone or via the internet at

www.AALvote.com/cinf

or by scanning the QR code with your mobile device, you must vote no later than 11:59 p.m. ET on May 5, 2017. You do not need to return a proxy card by mail. Voting electronically or by telephone is convenient, reduces the use of natural resources and saves significant postage and processing costs. Your vote is also recorded immediately and there is no risk that postal delays could cause your vote to arrive late and therefore not be counted.

If you are a Beneficial Shareholder who owns shares indirectly through a bank, broker or other nominee, you should follow the instructions in the Notice or voting instructions that you receive from the broker or other nominee holding your shares. Beneficial Shareholders include current and former company associates who hold shares in the Cincinnati Financial Corporation Savings Plan. The availability of telephone and internet voting will depend on the voting process of your broker or nominee. Shares held beneficially may be voted in person at the Annual Meeting only if you obtain a legal proxy from your broker or nominee giving you the right to vote the shares.

How do I locate my Control Number?

If you receive our information in the mail, the Control Number is on the Notice or proxy card that also indicates your name and the number of shares you own. If you receive our information electronically, the Control Number is in the text of the email. If you are a Shareholder of Record, you may also obtain your Control Number by calling 1-877-777-2857. If you are a Beneficial Shareholder, your bank, broker or other nominee can provide your Control Number.

Can I obtain another proxy card so I can vote by mail?

If you are a Shareholder of Record, you may obtain another proxy card by calling 1-877-777-2857. If you are a Beneficial Shareholder, your bank, broker or other nominee can supply another voting instruction form.

Can my shares be voted if I don’t return my proxy or voting instructions and don’t attend the annual meeting?

If you are a Shareholder of Record, the answer is no. If you are a Beneficial Shareholder and you do not direct your nominee as to how to vote your shares, applicable rules provide that the nominee generally may vote your shares on any of the routine matters scheduled to come before the meeting. The proposal to ratify the selection of the independent registered public accounting firm is believed to be the only routine matter scheduled to come before this year’s annual meeting. If your nominee indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, these shares (called broker nonvotes) are counted as present in determining whether we have a quorum but have no effect on the votes required to elect directors, to approve compensation for our named executive officers, or on the proposal to establish the frequency of future nonbinding votes on executive compensation.

Can I change my vote or revoke my proxy?

Yes. Simply cast a new vote by internet or telephone or send in a new signed proxy card with a later date. If you are a Shareholder of Record, you may send a written notice of revocation to the corporate secretary of the company. If you hold shares directly in your name and attend the annual meeting, you also may choose to vote in person. At the meeting, you can request a ballot and direct that your previously submitted proxy not be used.

How are the votes counted?

Votes cast by proxy are tabulated prior to the meeting by the holders of the proxies. Inspectors of election appointed at the meeting count the votes and announce the preliminary results at the meeting. The proxy agent reserves the right not to vote any proxies that are altered in a manner not intended by the instructions contained in the proxy. The company publicly discloses the final voting results in a Form 8-K filing after the vote count is certified, usually within a week of the meeting.

Could other matters be decided at the meeting?

We do not know of any matters to be considered at the annual meeting other than the election of directors and the proposals described in this proxy statement. For any other matters that do properly come before the meeting, your shares will be voted at the discretion of the proxy holder.

Can I listen to the meeting if I cannot attend in person?

The meeting is open to all interested parties. You can also listen to a live webcast of the meeting if you are unable to attend. Instructions are available at

cinfin.com/investors

approximately two weeks before the meeting. An audio replay is available on the website within two hours after the close of the meeting.

How can I obtain a 2016 Annual Report?

You can obtain our 2016 Annual Report on Form 10-K as filed with the SEC at no cost in several ways. You may view, search or print the document online from

cinfin.com/investors

or

viewproxy.com/cinfin/2017

. You may ask that a copy be mailed to you by contacting the corporate secretary of Cincinnati Financial Corporation. Or, you may request it directly from Shareholder Services. Please see the Investor Contacts page of

cinfin.com/investors

for details. These contacts are also listed at the end of this proxy statement.

Security Ownership of Principal Shareholders and Management

Under Section 13(d) of the Securities Exchange Act of 1934 (Exchange Act), a beneficial owner of a security is any person who directly or indirectly has or shares voting power or investment authority over such security. A beneficial owner under this definition need not enjoy the economic benefit of such securities. The following are the only shareholders known to the company who are deemed to be beneficial owners of at least 5 percent of our common stock as of March 7, 2017.

|

|

|

|

|

|

|

|

|

|

|

Title

of Class

|

Name and Address of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Footnote Reference

|

Percent of Class

|

|

Common Stock

|

The Vanguard Group Inc.

|

15,805,265

|

|

(1)

|

9.59

|

|

|

|

100 Vanguard Blvd.

|

|

|

|

|

|

Malvern, PA 19355

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

BlackRock Inc.

|

12,888,090

|

|

(2)

|

7.82

|

|

|

|

40 East 52nd Street

|

|

|

|

|

|

New York, NY 10022

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

John J. Schiff, Jr., CPCU*

|

11,419,620

|

|

(3)(4)(5)(6)(7)

|

6.93

|

|

|

|

Cincinnati Financial Corporation

|

|

|

|

|

|

6200 South Gilmore Road

|

|

|

|

|

|

Fairfield, Ohio 45014

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

State Street Corporation

|

9,739,956

|

|

(8)

|

5.91

|

|

|

|

State Street Financial Center

|

|

|

|

|

|

One Lincoln Street

|

|

|

|

|

|

Boston, MA 02111

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

Thomas R. Schiff*

|

9,422,576

|

|

(3)(4)(7)(9)

|

5.72

|

|

|

|

Cincinnati Financial Corporation

|

|

|

|

|

|

6200 South Gilmore Road

|

|

|

|

|

|

Fairfield, Ohio 45014

|

|

|

|

|

|

|

|

|

|

*John J. Schiff, Jr. and Thomas R. Schiff are brothers.

The outstanding common shares beneficially owned by each other director and our named executive officers and total outstanding shares for all directors and executive officers as a group as of March 7, 2017, are shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Footnote

Reference

|

Percent

of Class

|

|

|

|

|

|

|

|

|

|

|

Other Directors and

Named Executive Officers

|

|

|

|

|

|

|

|

William F. Bahl, CFA, CIC

|

229,122

|

|

|

(10)

|

0.14

|

|

|

|

|

Gregory T. Bier, CPA (ret.)

|

24,722

|

|

|

|

0.01

|

|

|

|

|

Linda W. Clement-Holmes

|

9,307

|

|

|

|

0.01

|

|

|

|

|

Dirk J. Debbink

|

25,801

|

|

|

|

0.02

|

|

|

|

|

Martin F. Hollenbeck,

CFA, CPCU

|

76,915

|

|

|

(5)(6)(7)

|

0.05

|

|

|

|

|

Steven J. Johnston,

FCAS, MAAA, CFA, CERA

|

239,071

|

|

|

(5)(6)

|

0.15

|

|

|

|

|

Kenneth C. Lichtendahl

|

35,181

|

|

|

|

0.02

|

|

|

|

|

W. Rodney McMullen

|

50,057

|

|

|

|

0.03

|

|

|

|

|

David P. Osborn, CFA

|

33,512

|

|

|

|

0.02

|

|

|

|

|

Gretchen W. Price

|

26,241

|

|

|

|

0.02

|

|

|

|

|

Jacob F. Scherer, Jr.

|

184,722

|

|

|

(5)(7)

|

0.11

|

|

|

|

|

Michael J. Sewell, CPA

|

92,510

|

|

|

(5)(6)

|

0.06

|

|

|

|

|

Douglas S. Skidmore

|

35,623

|

|

|

(11)

|

0.02

|

|

|

|

|

Kenneth W. Stecher

|

191,550

|

|

|

(5)(7)

|

0.12

|

|

|

|

|

John F. Steele, Jr.

|

23,161

|

|

|

|

0.01

|

|

|

|

|

Charles P. Stoneburner II,

CPCU, AIM**

|

89,446

|

|

|

(5)(7)

|

0.05

|

|

|

|

|

Larry R. Webb, CPCU

|

499,237

|

|

|

(12)

|

0.30

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and nondirector executive officers as a group

(28 individuals)

|

15,248,811

|

|

|

(3)(4)(5)(6)(7)

(9)(10)(11)(12)

|

9.25

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Mr. Stoneburner retired from the company on January 6, 2017.

Except as otherwise indicated in the notes below, each person has sole voting and investment power with respect to the common shares noted.

|

|

|

|

(1)

|

Reflects ownership as of December 31, 2016, according to Form 13G/A filed by The Vanguard Group Inc. on February 9, 2017.

|

|

|

|

|

(2)

|

Reflects ownership as of December 31, 2016, according to Form 13G/A filed by BlackRock Inc. on January 19, 2017.

|

|

|

|

|

(3)

|

Includes 6,735,249 shares owned of record by the Mary R. Schiff and John J. Schiff Foundation and 563,269 shares owned of record by the John J. Schiff Charitable Lead Trust. The trustees of both are Messrs. J. Schiff, Jr., T. Schiff and Ms. S. Reid, who share voting and investment power equally.

|

|

|

|

|

(4)

|

Includes 107,186 shares owned of record by the John J. & Thomas R. Schiff & Co. Inc. pension plan, the trustees of which are Messrs. J. Schiff, Jr. and T. Schiff, who share voting and investment power; and 124,249 shares owned by John J. & Thomas R. Schiff & Co. Inc. for which Messrs. J. Schiff, Jr. and T. Schiff share voting and investment power.

|

|

|

|

|

(5)

|

Includes shares available within 60 days from exercise of stock options in the amount of 62,785 shares for Mr. Johnston; 45,453 for Mr. Scherer; 71,502 shares for Mr. J. Schiff, Jr.; 25,253 shares for Mr. Sewell; 27,188 shares for Mr. Hollenbeck; 45,304 shares for Mr. Stecher; 35,637 for Mr. Stoneburner; and 100,304 shares for the nondirector executive officers as a group.

|

|

|

|

|

(6)

|

Includes shares held in the company’s nonqualified savings plan for highly compensated associates in the amounts of 92,212 shares for Mr. Johnston; 4,719 shares for Mr. Hollenbeck; 11,366 shares for Mr. Sewell; 18,084 shares for Mr. J. Schiff, Jr.; and 18,793 shares for the nondirector executive officers as a group. Individuals participating in this plan do not have the right to vote these shares.

|

|

|

|

|

(7)

|

Includes shares pledged as collateral as of December 31, 2016, in the amounts of 18,218 for Mr. Hollenbeck; 126,683 for Mr. Scherer; 1,363,512 for Mr. J. Schiff, Jr.; 753,233 for Mr. T. Schiff; 51,556 for Mr. Stecher; 15,291 for Mr. Stoneburner and 245,830 for the nondirector executive officers as a group.

|

|

|

|

|

(8)

|

Reflects ownership as of December 31, 2016, according to Form 13G filed by State Street Corporation on February 6, 2017.

|

|

|

|

|

(9)

|

Includes 111,468 shares held in Thomas R. Schiff Foundation and 236,540 shares held in TRS Investments LLC., of which Mr. T. Schiff has voting and investment power.

|

|

|

|

|

(10)

|

Includes 8,821 shares held in the Bahl Family Foundation, of which Mr. Bahl is president.

|

|

|

|

|

(11)

|

Includes 7,035 shares owned of record by Skidmore Sales Profit Sharing Plan, of which Mr. Skidmore is an administrator and shares investment authority.

|

|

|

|

|

(12)

|

Includes 186,257 shares owned of record by a limited partnership of which Mr. Webb is a general partner and 43,478 shares owned of record by a marital trust for the benefit of his wife and children.

|

Section 16(A) Beneficial Ownership Reporting Compliance

Directors, executive officers and 10 percent shareholders are required to report their beneficial ownership of our stock according to Section 16 of the Exchange Act. Those individuals are required by SEC regulations to furnish the company with copies of all Section 16(a) forms they file.

SEC regulations require us to identify in this proxy statement anyone who filed a required report late during the most recent calendar year. Based on our review of forms we received or written representations from reporting persons stating that they were not required to file these forms, we believe that all Section 16(a) filing requirements were satisfied on a timely basis during calendar year 2016.

Information About the Board of Directors

The mission of the board is to encourage, facilitate and foster the long-term success of Cincinnati Financial Corporation. The board oversees management in the performance of the company’s obligations to our independent agents, policyholders, associates, communities and suppliers in a manner consistent with the company’s mission and with the board’s responsibility to shareholders to achieve the highest sustainable shareholder value over the long term.

Proposal 1 - Election of Directors

Directors are elected annually. The board of directors currently consists of 15 directors, 10 of whom are independent. On November 18, 2016, the board, upon the recommendation of its nominating committee, unanimously nominated the 14 directors listed below for re-election to the board at the 2017 Annual Meeting of Shareholders. Mr. John J. Schiff, Jr. is not standing for re-election, having attained the age limitation established in the company's Corporate Governance Guidelines. The board intends to reduce the size of the board to 14 directors at its regularly scheduled meeting that immediately follows the 2017 Annual Meeting of Shareholders.

The directors elected at the Annual Meeting will hold office until the 2018 Annual Meeting and until their successors are duly elected and qualified. Unless otherwise instructed, the persons named in the proxy card (the proxy holders) attached to this proxy statement, as filed with the SEC, intend to vote the proxies held by them for the election of the 14 nominees named below. The board of directors knows of no reason why these nominees should be unable or unwilling to serve, but if that should be the case, proxies received will be voted for the election of such other persons, if any, as the board of directors may designate.

Vote Required

Director nominees receiving more votes cast for their election than against will be elected directors of the company. Abstentions and broker nonvotes have no effect on the voting for this proposal.

The board of directors recommends a vote FOR William F. Bahl, Gregory T. Bier, Linda W. Clement-Holmes, Dirk J. Debbink, Steven J. Johnston, Kenneth C. Lichtendahl, W. Rodney McMullen, David P. Osborn, Gretchen W. Price, Thomas R. Schiff, Douglas S. Skidmore, Kenneth W. Stecher, John F. Steele, Jr. and Larry R. Webb as directors to hold office until the 2018 Annual Meeting of Shareholders and until their successors are elected and seated.

Directors of Your Company

Each of our directors brings to our board extensive management and leadership experience gained through their service as executives and, in several cases, chief executive officers of diverse businesses. In these executive roles, they have taken hands-on, day-to-day responsibility for strategy and operations, including management of capital, risk and business cycles. In addition, most current directors bring public company board experience – either significant experience on other boards or long service on our board – that broadens their knowledge of board policies and processes, rules and regulations, issues and solutions. Further, each director has civic and community involvement that mirrors our company’s values emphasizing personal service, relationships and local decision making. The nominating committee’s process to recommend qualified director candidates is described on Page 30 under Director Nomination Considerations and Process.

Below are the names of our current directors along with their ages, the year first elected as a director, their present positions, principal occupations and public company directorships held in the past five or more years. For each director, we also describe specific individual qualifications and skills that contribute to the overall effectiveness of our board and its committees.

Biographical Information About Our Directors

(Data as of March 7, 2017)

|

|

|

|

|

|

|

William F. Bahl, CFA, CIC

, age 65, has been a director of the company since 1995 and currently is our independent lead director and chairman of the nominating committee. He is a member of the audit, compensation, executive and investment committees and a director on our insurance subsidiary boards.

Mr. Bahl co-founded an independent registered investment advisory firm that performs financial analysis of publicly held securities, advising and managing portfolios for high net worth individuals and institutional clients. His expertise helps support the board’s oversight of our investment operations, which continue to be our

|

|

main source of profits. His familiarity with public company governance structures and policies beyond our own contributes to full discussion and evaluation of our options.

Mr. Bahl is chairman of the board of Cincinnati-based Bahl & Gaynor Investment Counsel Inc. Prior to co-founding Bahl & Gaynor in 1990, he was senior vice president and chief investment officer at Northern Trust Company in Chicago, having previously worked for Fifth Third Bank and Mellon Bank. From 2005 to 2014, Mr. Bahl was a director of publicly traded LCA-Vision Inc., serving as chair of the compensation committee and a member of the audit and nominating committees. He was a trustee of The Preferred Group of Funds until 2006 and a board member from 2000 to 2006 of The Hennegan Company, a privately owned, Cincinnati-based printing company. Mr. Bahl earned a Master of Business Administration from the University of Michigan after graduating from the University of Florida. He has qualified for the Chartered Financial Analyst designation since 1979 and the Chartered Investment Counselor designation since 1991. His activities have included leadership and service on nonprofit community boards and foundations benefiting parks, schools, a hospital association and youth organizations.

|

|

|

Gregory T. Bier, CPA (Ret.)

, age 70, has been a director of the company since 2006. He is a member of the audit, compensation and investment committees and a director on our insurance subsidiary boards.

As a former lead partner for a respected independent registered public accounting firm, Mr. Bier brings to our board relevant experience with accounting and financial reporting, SEC filings, complex corporate transactions and mergers and acquisitions for public companies, including Fifth Third Bancorp, The Procter & Gamble Company, The Midland Company, Cincinnati Financial Corporation and The E.W.

|

|

Scripps Company.

Mr. Bier was the managing partner of the Cincinnati office of Deloitte LLP, an independent registered public accounting firm, from 1998 to 2002. He retired in 2002 after 23 years as a partner of the firm and 35 years of service, beginning in 1967 when he joined Haskins & Sells, which later became part of Deloitte. From 2008 to 2016, he was a director of publicly held LifePoint Health Inc., a leading provider of healthcare services in nonurban communities in 21 states, where he chaired the audit and compliance committees and served on the compensation, corporate governance and nominating, and quality committees. From 2002 to 2007, Mr. Bier was an audit committee member for Catholic Healthcare Partners (now Mercy Health), one of the largest not-for-profit health systems in the United States. A graduate of Xavier University, he became a CPA in 1970 and is a member with retired status of the American Institute of Certified Public Accountants and the Ohio Society of Certified Public Accountants. His activities have included leadership and service on nonprofit community boards and foundations benefiting several high schools, colleges, social services and civic organizations.

|

|

|

|

|

|

|

|

Linda W. Clement-Holmes

, age 54, has been a director of the company since 2010 and is a member of our audit and nominating committees.

Ms. Clement-Holmes ensures full leverage of emerging business technologies to support and speed The Procter & Gamble Company’s innovation and product-supply efforts. Her aptitude and accomplishments in these areas help our board to effectively evaluate our business processes and technology initiatives, supporting alignment of those initiatives with our strategic goals.

|

|

Ms. Clement-Holmes is chief information officer of publicly traded The Procter & Gamble Company. From 2010 to 2014, she was senior vice president of Global Business Services and also served as chief diversity officer from 2010 to 2012. She was vice president of Global Business Services from 2007 to 2010, with responsibility from 2007 to 2009 for Central and Eastern Europe, Middle East and Africa and, in 2009, for External Strategic Alliances, Flow-to-the-Work Resources & Employee Solutions. From 2006 to 2007, she was manager, Global Business Services, Central and Eastern Europe, Middle East and Africa; and in 2005, manager of Information & Decision Solutions, Infrastructure Services & Governance. Other management positions since 1983 have included service in various business areas: IT Outsourcing Initiative, Global Engineering & Development and Communications, Knowledge & Innovation Center of Expertise, New Initiatives and E-commerce, Sales Management Systems, and Management Systems Operations and Development. Ms. Clement-Holmes holds a Bachelor of Science in industrial management and computer science from Purdue University. Her activities have included leadership and service with academic councils and nonprofit community boards supporting women, families and child care, educational and civic organizations, and professional organizations.

|

|

|

Dirk J. Debbink

, age 61, returned as a director of the company in 2012 after a four‑year recall to active duty with the U.S. Navy in Washington, D.C. He previously served as a director from 2004 to 2008. He is a member of the audit and compensation committees.

Mr. Debbink has served as a leader, chief executive officer and board member of private companies, nonprofit entities and government organizations ranging from small firms typical of the company’s commercial policyholders to extremely large organizations, including Reserve Deputy Commander of U.S. Pacific Fleet (170,000

|

|

sailors) and Commander, Navy Reserve Force (64,000 sailors). While on active duty with the U.S. Navy, he served as a senior member of the staff of the Chief of Naval Operations in the Pentagon. He has extensive experience in strategic planning and execution, sales, marketing, information technology for a worldwide dispersed workforce, human resources, including pension and profit-sharing plans, and government relationships at the federal level. A founder of both private and public nonoperating foundations, he understands the benefits of a long-term perspective toward serving others.

Mr. Debbink is chairman since 2007 and chief executive officer since 2012 of MSI General Corporation, a privately owned design/build construction firm. He joined MSI General in 1983, holding various positions of increasing leadership responsibility and serving as the company’s president from 1991 to 2007. From 2008 to 2012, he served in active military duty as Vice Admiral, Chief of Navy Reserve and Commander, Navy Reserve Force. Mr. Debbink joined the board of the United States Naval Institute in 2012 and chairs its finance committee. He is a board member of Fisher House Wisconsin and serves on the fund development and strategic planning committees. In 2014, he became a director of Froedtert Health System and serves on its finance committee. Mr. Debbink earned a Bachelor of Science in systems engineering from the U.S. Naval Academy and a Master of Business Administration from the University of Chicago. He holds professional engineer and real estate broker licenses in the state of Wisconsin and has served the Oconomowoc, Wisconsin area as a member of various community bank, hospital and other nonprofit boards.

|

|

|

|

|

|

|

|

Steven J. Johnston, FCAS, MAAA, CFA, CERA

, age 57, has been a director of the company since 2011. He is chairman of the executive committee, a member of the investment committee and a director on all subsidiary boards.

As chief executive officer of Cincinnati Financial Corporation, Mr. Johnston provides the board with information gained from hands-on management of our operations, identifying our near‑term and long-term challenges, opportunities and strategies. His management and actuarial expertise and his experience driving technology and efficiency improvements combine with his strong communication skills to aid in his

|

|

role as liaison between the board and the company management team.

Mr. Johnston has been chief executive officer of the company and all subsidiaries, and president of the company and its lead subsidiary, The Cincinnati Insurance Company, since 2011. From 2008 to 2011, he was chief financial officer, senior vice president and secretary for both the company and The Cincinnati Insurance Company, and treasurer of the company. Prior to joining Cincinnati Financial Corporation, Mr. Johnston was chief financial officer of State Auto Insurance Company. He came to the company with more than 25 years of property casualty insurance experience, including a broad background in accounting, finance, actuarial, reinsurance, technology, investments and management of investor and ratings agency relationships. He also served as a director and chairman of the investment committee for State Automobile Mutual Insurance Company. A graduate of Otterbein University, he is a Fellow of the Casualty Actuarial Society, where he served as a member of the audit committee and chairman of the investment and enterprise risk committees. He is a member of the American Academy of Actuaries, a Chartered Financial Analyst and a Chartered Enterprise Risk Analyst.

|

|

|

Kenneth C. Lichtendahl

, age 68, has been a director of the company since 1988 and is a member of our audit and nominating committees.

Mr. Lichtendahl’s years of service on our board and audit committee supports institutional continuity with company and industry knowledge accumulated through all phases of industry and economic cycles and through our expansion over that period. He brings valuable insights gained in developing customer relationships, ethical practices, high-quality staff and product differentiation that helped turn his company, Hudepohl-Schoenling Brewing Co., into the 10th largest brewer in the

|

|

United States before its sale in 1996.

Mr. Lichtendahl is the director of development and sales for Heliosphere Designs LLC, a private company marketing solar timepieces. From 2011 to 2012, he served as a senior adviser for Nestle Waters of North America, following Nestle’s acquisition of Sweet Leaf Tea, which had acquired Tradewinds Beverage Company in 2010. From 1996 to 2010, Mr. Lichtendahl was president and a director of Tradewinds, a privately owned, Cincinnati-based company formed following the sale of Hudepohl-Schoenling. He served as president of Hudepohl-Schoenling from 1978 to 1996 and previously held various management positions. He was a director for 12 years of Centennial Savings Bank in Cincinnati, which had grown to 11 offices and $700 million of deposits before its sale to National City Bank in 2000. A graduate of the University of Cincinnati with a Bachelor of Science in industrial management, Mr. Lichtendahl has contributed his leadership and service on nonprofit community boards supporting youth, civic and conservation organizations.

|

|

|

|

|

|

|

|

W. Rodney McMullen

, age 56, has been a director of the company since 2001. He is chairman of the compensation committee, a member of the executive and investment committees and a director on our insurance subsidiary boards.

Mr. McMullen has worked with The Kroger Co.’s board on business strategy initiatives and transactions, including business model transformation, mergers and acquisitions, divestitures and management transitions. His daily experience leading a large public company equips him to understand and guide management decisions and actions related to planning, risk management, investor relations, marketing and

|

|

capital management.

Mr. McMullen has been chairman of the board of Kroger since January 2015 and chief executive officer since 2014. Kroger is a publicly traded Cincinnati-based company and the world’s third-largest retailer. He served as Kroger’s president and chief operating officer from 2009 through 2013. Mr. McMullen has been a director of Kroger since 2003, when he was promoted to vice chairman of the board. From 2000 to 2003, he was executive vice president of strategy, planning and finance. He joined Kroger as a part-time store clerk in 1978 and advanced to hold key financial positions, including corporate controller and chief financial officer. In 2016, Mr. McMullen was elected to the board of VF Corporation where he serves on the audit and nominating and governance committees. He is a board member of the Cincinnati Business Committee and Cincinnati Center City Development Corporation (3CDC). From 2007 to 2014, he served on the board of Global Standards 1, a privately owned company that owns UPC and RFID codes, and from 2010 to 2014, he was chairman of GS1 US, a not-for-profit organization that develops supply-chain standards, solution and services for 25 industries. He also was chairman from 2012 to 2014 of 1WorldSync, a nonprofit organization supporting retailers and consumer product manufacturers across the world. Mr. McMullen holds a Master of Science in accounting from the University of Kentucky, where he also completed his Bachelor of Science in accounting and Bachelor of Business Administration in finance. Other activities have included leadership and service on nonprofit community boards and committees that support a private university and independent living for the disabled and disadvantaged.

|

|

|

David P. Osborn, CFA

, age 56, has been a director since 2013. He is a member of our audit and investment committees and a director on our insurance subsidiary boards.

Mr. Osborn draws on more than 30 years of experience as an investment professional to lead his independent investment advisory firm’s dividend growth strategy team. This dividend growth strategy mirrors our own investment strategy, supporting investment committee decisions. His experiences building relationships and setting long-term, strategic business plans enhance board discussions of our

|

|

company's long-term outlook and strategic planning activities.

Since 2012, Mr. Osborn has been president of Cincinnati-based Osborn Williams & Donohoe LLC. He joined its predecessor firm in 1993, becoming a partner in 2010. Mr. Osborn previously held positions at PNC Bank from 1987 to 1993 and at Thomson McKinnon Inc. from 1983 to 1987, prior to its acquisition by Prudential Securities. He earned his Bachelor of Science in business administration from Miami University in Oxford, Ohio. Mr. Osborn has qualified for the Chartered Financial Analyst designation since 1991 and is a former president of the CFA Society of Cincinnati. His activities also include leadership and service on the board of a children’s hospital, as well as nonprofit organizations supporting the arts, education, youth services and the care of adults with neurological disorders.

|

|

|

|

|

|

|

|

Gretchen W. Price

, age 62, has been a director of the company since 2002. She chairs our audit committee and is a member of our compensation and nominating committees.

Ms. Price’s current and past executive positions have developed her expertise in areas of focus for our board, including accounting, auditing and financial reporting, investor relations, capital management, human resources, information technology, strategic planning and business planning. Board discussions and decisions benefit from her knowledge of customer relationship management and distribution chains.

|

|

Ms. Price is executive vice president, chief financial and administrative officer since 2011 of Arbonne International LLC, a beauty and nutritional product company headquartered in Irvine, California. She leads the firm’s financial, accounting, strategy and business planning, operations, information technology, human resources and international functions. She was executive vice president and chief financial officer from 2008 to 2011 of Philosophy Inc., an international, prestige beauty brand based in Phoenix, Arizona. Prior to 2008, she held positions with increasing responsibility during her 31-year tenure at publicly traded The Procter & Gamble Company, including vice president and general manager from 2006 to 2007 with responsibility for the go-to-market reinvention strategy for Global Operations and the integration of the Gillette acquisition; vice president of finance and accounting for Global Operations from 2001 to 2005, responsible for worldwide financial leadership; vice president and treasurer from 1998 to 2001, responsible for Global Treasury, investor relations and mergers and acquisitions; and vice president of Global Internal Audit from 1996 to 1998. Ms. Price served on the board of Beam Inc., a publicly traded, leading global premium spirits company from 2012 to 2015, where she chaired the audit committee and was a member of the compensation committee until it was acquired by Suntory Holdings Ltd. A graduate of the University of Kentucky, she earned the Certified Internal Auditor designation in 1996 and has been a member of the Financial Executives Institute and the Board of Governors of the Institute of Internal Auditors. Her activities have included leadership and service on nonprofit community boards and committees that provide funding for fine arts and music, human service programs and student scholarships.

|

|

|

|

|

|

|

|

John J. Schiff, Jr., CPCU

, age 73, has been a director of the company since 1968. He is a member of the investment committee. Mr. Schiff is not a nominee for re-election at the 2017 Annual Meeting of Shareholders.

Mr. Schiff’s long service in our executive and board leadership strongly links us to the mission and values established by our founding agents in 1950. As our former chairman of the board, chief executive officer and a licensed insurance agent, he brings a blended perspective, assuring leadership and cultural continuity through agent-centered decisions that differentiate us from competitors. His insights gained

|

|

from years of service on multiple public company boards help preserve our business model's long-term approach to creating shareholder value. He also brings the perspective of a large shareholder to our board discussions and decisions.

From 1986 to 2011, Mr. Schiff was chairman of the company’s board of directors and, except from 2006 to 2008, chairman of its lead subsidiary, The Cincinnati Insurance Company. He also was president and chief executive officer of the company and of its lead subsidiary from 1999 to 2006. He retained only the company-level chairman and chief executive officer roles from 2006 to 2008 when he resumed the subsidiary chairman title. From 1983 to 1996, Mr. Schiff was chairman, chief executive officer and an agent with John J. & Thomas R. Schiff & Co. Inc., a privately owned, Cincinnati-based independent insurance agency. Prior to 1983, he was an agent, vice president and secretary of John J. Schiff & Company Inc., which he joined in 1965 after earning a Bachelor of Science in risk and insurance management from The Ohio State University. He earned the Chartered Property Casualty Underwriter designation in 1972 and is a member of The American Institute for Chartered Property Casualty Underwriters, serving as a trustee from 1992 to 2004 and as an executive committee member.

Mr. Schiff also has experience as a director of publicly traded Cincinnati-based companies: The Standard Register Company, a document management services company, from 1982 to 2015, with service on its audit and pension advisory committees; Fifth Third Bancorp and The Fifth Third Bank, from 1983 to 2014, with periods of service on the compensation, executive and trust committees; Cinergy Corporation, from 1994 to 2005 when it was acquired by Duke Energy Corporation; and Cinergy’s predecessor, Cincinnati Gas & Electric Company, from 1986 to 1995. He served at various times on Cinergy’s audit and compensation committees. Mr. Schiff also is a director of two privately owned companies, the Cincinnati Bengals Inc. and the independent insurance agency named above. His activities have included leadership and service to nonprofit community boards and foundations that support arts education, high school and university education, a hospital and general philanthropy.

|

|

|

|

|

|

|

|

Thomas R. Schiff

, age 69, has been a director of the company since 1975 and is a member of our investment committee. He is a director on our insurance subsidiary boards.

Mr. Schiff’s experience on our board helps provide ongoing insight into how we are serving our primary customer, the independent insurance agent. He contributes to board assessments of the impacts of our decisions on agency operations, including sales, claims, professional advising and financial management. Additionally, he brings the perspective of a large shareholder to our board

|

|

discussions and decisions.

Mr. Schiff has been chairman and chief executive officer since 1996 and a director and an

agent with John J. & Thomas R. Schiff & Co. Inc., a privately owned, Cincinnati-based independent insurance agency. He was the agency’s president from 1983 to 1996 and sales manager from 1970 to 1983. He also is chief executive officer and chairman of Lightborne Properties and Lightborne Communications, privately owned media companies based in the Cincinnati area. Mr. Schiff earned a Bachelor of Business Administration from Ohio University. His activities have included leadership and service to nonprofit community boards and foundations that support fine and performing arts, arts education, a hospital, children’s dental services and general philanthropy.

|

|

|

Douglas S. Skidmore

, age 54, has been a company director since 2004 and is a member of our audit and nominating committees.

Mr. Skidmore has been responsible in his executive roles for strategic direction, marketing, human resources and overall growth and performance of his second-generation family business, which shares many characteristics with our typical commercial policyholders. In addition to providing a policyholder view of our products and services, he has management experience that equips him to contribute to the board’s oversight of business processes and technology initiatives.

|

|

Mr. Skidmore has been chief executive officer since 2003 and director since 1994 of Skidmore Sales & Distributing Company Inc., a privately owned, Cincinnati-based, full-service independent distributor and broker of quality industrial food ingredients. He was president from 1994 to 2013 and marketing manager from 1990 to 1994. Mr. Skidmore was an account marketing representative for IBM Corporation from 1987 to 1990, with early experiences at Intellitech Corporation and at The Procter & Gamble Company’s Food Process and Product Development Lab. He earned a Master of Business Administration in management and operations from the J.L. Kellogg School of Management at Northwestern University after graduating from Purdue University. Mr. Skidmore is a past president of the Food Ingredient Distributors Association and a trustee of the organization since 2005. He is also a member of the Institute of Food Technologists since 1990, with experience on its information systems committee. He currently serves on the national board of Athletes in Action, a global nonprofit organization.

|

|

|

|

|

|

|

|

Kenneth W. Stecher

, age 70, has been a company director since 2008 and chairman of the board since 2011. He is chairman of the investment committee and a member of the executive committee. He also is the chairman of all subsidiary boards.

Mr. Stecher facilitates and guides the business of the board, supporting its effectiveness with his deep knowledge of the company as well as industry challenges and opportunities. Over his long tenure in management, he was our president and chief executive officer responsible for operations, our chief financial

|

|

officer responsible for capital management, our face to the analyst and investor communities and our corporate secretary conversant in governance issues and trends.

From 2008 to 2011, Mr. Stecher was president and chief executive officer of the company and its lead subsidiary, The Cincinnati Insurance Company. For both companies, he was chief financial officer from 2001 to 2008 and executive vice president from 2006 to 2008. He also was chairman of the lead subsidiary from 2006 to 2008. He served as senior vice president for both companies until 2006, beginning in 1999 for the company and in 1997 for its lead subsidiary. He was secretary of both companies from 1999 to 2008, and treasurer of the company from 1999 to 2008. Mr. Stecher advanced through the ranks of the company’s life insurance subsidiaries from 1967 to 1982, when his responsibilities within the accounting area broadened to include property casualty insurance accounting. He is a trustee since 2009 of the American Institute for Chartered Property Casualty Underwriters, and past president of the Insurance Accounting & Systems Association, Southwestern Ohio Chapter. He earned a Master of Business Administration in finance from Xavier University after graduating from the University of Cincinnati with a Bachelor of Science in accounting. His activities have included service and leadership on nonprofit community boards that support high school and college institutions and the United Way of Greater Cincinnati.

|

|

|

|

|

|

|

|

John F. Steele, Jr.

, age 63, has been a company director since 2005 and is a member of our audit and executive committees. He is a director on our property casualty insurance subsidiary boards.

Mr. Steele has provided his firm with corporate oversight and strategic direction of all aspects of business ownership, operations and customer relationships. He brings to our board a policyholder perspective, including intimate knowledge of family-run corporations and the construction industry, which is the source of 40 percent of our commercial general liability insurance premiums.

|

|

Mr. Steele is chairman since 2004, chief executive officer since 1994 and a director since 1985 of Hilltop Basic Resources Inc., a privately owned, Cincinnati-based aggregates and ready mixed concrete supplier to the construction industry. He started his career at Hilltop in 1978 in sales and assumed responsibility for operations over time, becoming president in 1991 and holding that title until 2004. Prior to joining Hilltop, he was a sales executive for William Powell Company, a privately owned, industrial valve manufacturer for which he has been a director since 2004. He is a member of the board of advisers of Lykins Companies Inc., a privately owned full-service oil company, since 2012. From 2015 to 2016, Mr. Steele served on the board of advisers of Down-Lite International, a privately held manufacturer of down and feather bedding. He was a director for privately owned Smook Bros. Inc., a Canadian construction company from 2006 to 2010. He has served on professional boards including the National Stone, Sand & Gravel Association, the Ohio Aggregates Association and the Ohio Ready Mixed Concrete Association. Mr. Steele has a Master of Business Administration from Xavier University and a Bachelor of Arts from Rollins College. His activities have included leadership and service on nonprofit boards for a youth mentoring organization, a university center for the study of family businesses and a community college.

|

|

|

Larry R. Webb, CPCU

, age 61, has been a director of the company since 1979 and is a member of our executive and investment committees. He is a director on our property casualty insurance subsidiary boards.

Mr. Webb brings to our board his insights as a principal owner of an independent insurance agency, with duties in financial management and accounting oversight, information technology, human resources, sales and marketing, risk management and relationship development with insurance companies and clients. His long tenure on our board and as a large shareholder, as well as his agency’s representation of

|

|

our products and services since 1951, brings the board deep institutional knowledge, promoting continuity of the agent-centered mission and values essential to our business model. His agency does not advise the company on our insurance needs or sell insurance products or services to the company.