Yen Falls As Risk Aversion Wanes

27 September 2016 - 5:41AM

RTTF2

The Japanese yen drifted lower against its major counterparts in

pre-European deals on Tuesday, as risk sentiment improved after

strong performance by Hillary Clinton in the first U.S.

Presidential debate between Donald Trump before the November 8

election.

According to a CNN/ORC poll of debate watchers, Hillary has won

the debate held at the Hofstra University, New York.

The next debate is on October 4 and will feature the vice

presidential candidates, Republican Mike Pence and Democrat Tim

Kaine, at Longwood University in Farmville, Va.

Trump and Clinton will square off again on October 9 at

Washington University in St. Louis, and one final time on October

19 at the University of Nevada-Las Vegas.

In economic front, minutes from the Bank of Japan's July 28-29

meeting showed that the members of the board judged that the

county's economic recovery is on track, with the inflation outlook

remaining slightly negative due to soft energy prices.

At the meeting, board decided to hold its target of raising the

monetary base at an annual pace of about JPY 80 trillion. Also, the

board voted to maintain a negative interest rate of -0.1

percent.

The yen was higher on Monday, after the Bank of Japan Governor

Haruhiko Kuroda said that the central bank is expected to continue

the pace of increase in its government bond purchases more or less

at at the current pace. The yen dropped to 100.99 against the

greenback, 104.14 against the Swiss franc and 131.22 against the

pound, off its early near 5-week high of 100.09, 5-day high of

103.19 and a 6-week high of 129.63, respectively. The next possible

support for the yen may be found around 102.00 against the

greenback, 105.00 against the franc and 133.00 against the

pound.

The yen fell to a 5-day low of 73.79 against the kiwi, 4-day low

of 113.57 against the euro and a 6-day low of 77.50 against the

aussie, from its early high of 72.70, 5-day high of 112.48 and a

6-day high of 76.19, respectively. The yen is seen finding support

around 75.00 against the kiwi, 115.00 against the euro and 79.00

against the aussie.

The yen slid to 76.69 against the loonie, reversing from its

early more than 4-year high of 75.41. Continuation of the yen's

downtrend may see it finding support around the 78.00 mark.

Looking ahead, Eurozone M3 money supply for August is due

shortly.

In the New York session, U.S. S&P/Case-Shiller home price

index for July, consumer confidence, Markit's preliminary services

PMI and Richmond Fed manufacturing index for September are set for

release.

At 11:15 am ET, Federal Reserve Governor Stanley Fischer will

deliver a speech titled "Why Study Economics?" at the Howard

University Economic Convocation in Washington DC.

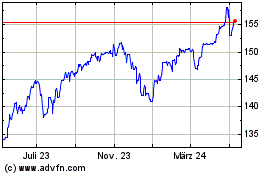

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

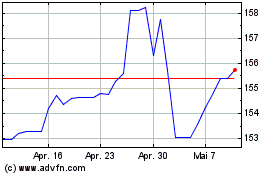

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024