Swedish Krona Falls Sharply Vs Dollar, Euro After Riksbank's QE Expansion

28 Oktober 2015 - 6:12AM

RTTF2

The Swedish Krona declined sharply against the U.S. dollar and

the euro in European morning deals on Wednesday, after Sweden's

central bank kept its key rate unchanged, while extending its

quantitative easing program due to considerable uncertainty in

global economic outlook.

The bank retained its repo rate at -0.35, as widely expected by

economists. The rates will be effective from November 4.

The Executive Board has decided to extend the government bond

purchasing programme by an additional SEK 65 billion, taking the

total purchases to SEK 200 billion by the end of June 2016.

"There is still considerable uncertainty regarding the strength

of the global economy and central banks abroad are expected to

pursue an expansionary monetary policy for a longer time," the bank

said.

The Riksbank also indicated willingness to intervene on the

foreign exchange market if the upturn in inflation should be

threatened as the result of a problematic market development.

The Krona depreciated to a 6-day low of 9.4321 against the euro,

reversing from a 2-day high of 9.3609 hit immediately after the

decision. The Krona is seen finding support around the 9.42

region.

At the same time, the Krona fell to more than a 2-month low of

8.5444 against the greenback, down from its early 5-day high of

8.4651. The Krona is likely to challenge support around the 8.6

mark.

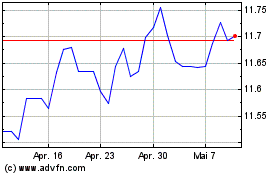

Euro vs SEK (FX:EURSEK)

Forex Chart

Von Mär 2024 bis Apr 2024

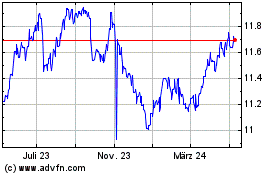

Euro vs SEK (FX:EURSEK)

Forex Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Euro vs Swedish Krona (Forex): 0 Nachrichtenartikel

Weitere Euro (B) VS Swedish Krona Spot (Eur/Sek) News-Artikel