Swiss Franc Falls Amid Risk Appetite

02 Oktober 2015 - 7:52AM

RTTF2

The Swiss franc weakened against the other major currencies in

the European session on Friday amid risk appetite, as investors

await the U.S. employment data due later in the day to get more

clues about the possible timing of the first Fed rate hike.

The U.K.'s FTSE 100 index is currently up 1.31 percent or 79.52

points at 6,151., France's CAC 40 index is up 1.55 percent or 68.63

points at 4,495 and Germany's DAX is up 1.21 percent or 112.79

points at 9,623.

The report is expected to show an increase of about 203,000 jobs

in September following the addition of 173,000 jobs in August. The

jobs data could have a significant impact on expectations regarding

whether the Federal Reserve will raise interest rates later this

month.

In the Asian session today, the Swiss franc held steady against

its major rivals.

In the early European trading, the Swiss franc fell to 4-day

lows of 1.4840 against the pound and 0.9789 against the U.S.

dollar, from early highs of 1.4776 and 0.9762, respectively. If the

Swiss franc extends its downtrend, it is likely to find support

around 1.50 against the pound and 0.99 against the greenback.

Against the euro and the yen, the franc dropped to 1.0909 and

122.93 from early highs of 1.0909 and 122.93, respectively. On the

downside, 1.10 against the euro and 121.00 against the yen are seen

as the next support levels for the franc.

Looking ahead, U.S. jobs data for September and factory orders

for August are slated for release in the New York session.

At 8:45 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is scheduled to give opening remarks before the "New

Perspectives on Consumer Behavior in Credit and Payments Markets"

conference hosted by the Federal Reserve Bank of Philadelphia.

Half-an-hour later, Federal Reserve Bank of St. Louis President

James Bullard is expected to speak on the economy and monetary

policy before a Shadow Open Market Committee meeting hosted by the

Manhattan Institute for Policy Research, in New York.

At 1:30 pm ET, Federal Reserve Bank of Boston President Eric

Rosengren will give welcome and opening remarks before the "Macro

Prudential Monetary Policy" conference hosted by the Federal

Reserve Bank of Boston. Additionally, Federal Reserve Governor

Stanley Fischer is expected to speak at the conference.

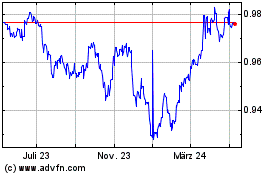

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Apr 2024 bis Mai 2024

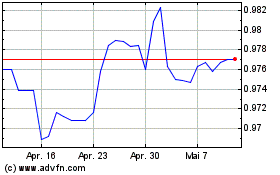

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Mai 2023 bis Mai 2024