Yen Falls Amid Risk Appetite

02 Juli 2015 - 7:12AM

RTTF2

The Japanese yen fell against the other major currencies in the

Asian session on Thursday as positive reaction to the latest news

about Greece as well as some upbeat U.S. economic data generated

risk appetite.

While Greece failed to make a 1.6 billion euro payment to the

International Monetary Fund, Greek Prime Minister Alexis Tsipras

sent a letter indicating he will accept most of the demands made by

the country's creditors.

However, investors are treading cautiously ahead of the release

of the U.S. Labor Department's monthly jobs report later in the

day, which is being released a day earlier than usual due to the

July 3rd holiday in observance of the Independence Day.

A report released by payroll processor ADP on Wednesday showed

that U.S. private sector employment jumped by 237,000 jobs in June

following an upwardly revised increase of 203,000 jobs in May.

Economists had expected an increase of about 220,000 jobs compared

to the addition of 201,000 jobs originally reported for the

previous month.

Also, the Institute for Supply Management's manufacturing index

rose by slightly more than expected in June. The ISM said its

purchasing managers index rose to 53.5 in June from 52.8 in May,

with a reading above 50 indicating an increase in manufacturing

activity. Economists had expected the index to edge up to 53.2.

A separate report showed that construction spending climbed 0.8

percent to an annual rate of $1.036 trillion in May after jumping

2.1 percent to a revised $1.027 trillion in April. Economists had

expected construction spending to rise by 0.5 percent.

In other economic news, the Bank of Japan said that the monetary

base in Japan surged 34.2 percent on year in June, coming in at

325.047 trillion yen. That follows the 35.6 percent spike in

May.

Wednesday, the yen showed mixed trading against its major

rivals. While the yen fell against the U.S. dollar, it rose against

the Swiss franc. Meanwhile, the yen held steady against the euro

and the pound.

In the Asian trading today, the yen fell to a 6-day low of

123.45 against the U.S. dollar, from yesterday's closing value of

123.16. On the downside, 126.00 is seen as the next support level

for the yen.

Against the euro, the pound, the Swiss franc and the Canadian

dollar, the yen edged down to 136.44, 192.62, 130.24 and 98.06 from

yesterday's closing quotes of 98.06, 192.29, 129.81 and 97.81,

respectively. If the yen extends its downtrend, it is likely to

find support around 140.00 against the euro, 196.00 against the

pound, 134.50 against the franc and 99.90 against the loonie.

Looking ahead, U.K. Nationwide house price index for June is due

to be release at 2:00 am ET. Additionally, U.K. CIPS/Markit

construction PMI for June and Eurozone PPI for May are slated for

release.

In the New York session, U.S. weekly jobless claim for the week

ended June 27, U.S. jobs data and factory orders, both for June,

are set to be announced.

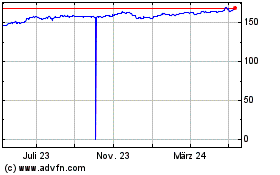

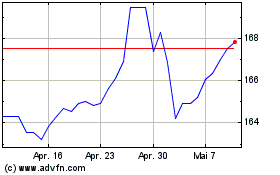

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024