Euro Down As German Bond Yields Fall

26 Februar 2015 - 12:55PM

RTTF2

The euro traded in lower ranges against its most major rivals on

Thursday's European deals, as yields on Germany's 7-year bonds fell

below zero ahead of the commencement of European Central Bank's

quantitative easing program in March.

Yields on German seven-year notes declined two basis points, or

0.02 percentage, to minus 0.009 percent on Thursday. Similarly,

German ten-year bond yields fell 3 basis points to 0.292 percent,

and twenty-year yields were down by 0.75 percent.

Demand for German debt has grown, as the European Central Bank

is starting QE program in March. Yields move inverse to bond

prices.

Although upbeat Eurozone economic confidence in February

provided some support to the euro, it eased back in a short

while.

Survey data from European Commission showed that Eurozone

economic confidence index rose to a 7-month high of 102.1 in

February from 101.4 in the prior month. It was expected to improve

to 102.

The increase in the headline indicator resulted from improved

confidence among consumers and in retail trade, while industry,

services and construction confidence remained broadly stable.

The euro eased from an early high of 1.1379 against the

greenback with pair trading at 1.1352. The next possible support

for the euro-greenback pair is seen around the 1.12 zone.

The euro was trading lower at 134.96 against the Japanese yen,

coming off from early 2-day high of 135.36. The pair finished

Wednesday's trading at 134.99. The euro is likely to find support

around the 130.00 region.

The euro slipped to a 2-day low of 1.0731 against the franc,

after having advanced to 1.0794 at 9:55 pm ET. At yesterday's

close, the pair was valued at 1.0773. If the euro continues slide,

it may find support near the 1.05 area.

The 19-nation currency declined to more than 7-year low of

0.7304 against the pound at 3:00 am ET, before showing modest

recovery in subsequent deals. The euro-pound pair closed deals at

0.7314 on Wednesday.

The U.K. economy expanded as estimated in the fourth quarter,

according to the second estimate published by the Office for

National Statistics.

Gross domestic product grew 0.5 percent sequentially in the

fourth quarter, in line with the estimate released on January 27.

The rate of growth eased from 0.7 percent in the third quarter.

Looking ahead, Canada and U.S. CPI for January, U.S. house price

index for December, durable goods orders for January and U.S.

weekly jobless claims for the week ended February 21 are slated for

release in the New York session.

At 12:30 am ET, Bank of England Deputy Governor Nemat Shafik

will deliver a speech at the University of Warwick, in

Coventry.

After half-an-hour, U.S. Federal Reserve Bank of Atlanta

President Dennis Lockhart is expected to speak about economic

outlook and monetary policy at the Federal Reserve's 2015 Banking

Outlook Conference, in Atlanta.

Subsequently, U.S. Federal Reserve Bank of Dallas President

Richard Fisher will give a lecture on "Reflections on 10 Years at

the Fed: Through the Financial Crisis" at event hosted by the

Imperial College of London Brevan Howard Centre for Financial

Analysis & the Centre for Economic Policy Research in London,

England at 1:15 pm ET.

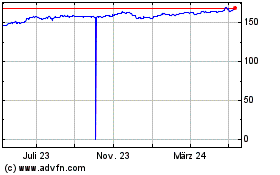

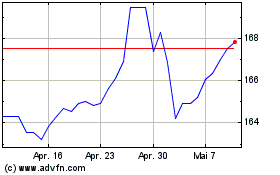

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024