BRASKEM - In 2020, the Recurring Operating Result was US$2,082 million, 38% higher than 2019

11 März 2021 - 5:15AM

PR Newswire (US)

SÃO PAULO, March 10, 2021

/PRNewswire/ -- BRASKEM S.A. (B3: BRKM3, BRKM5 and

BRKM6; NYSE: BAK; LATIBEX: XBRK) announces today its results for

4Q20 and 2020.

4Q20 HIGHLIGHTS:

Braskem - Consolidated:

- The Company's recurring Operating Result was US$833 million, 22% higher than in 3Q20,

explained mainly by better spreads for resins and main chemicals in

Brazil, for PP in the United States and for PE in Mexico. Compared to 4Q19, recurring Operating

Result in U.S. dollar was 246% higher, due to: (i) the better

spreads for resins and main chemicals in Brazil, for PP in the United States and Europe and for PE in Mexico; and (ii) the higher sales volume of

resins and main chemicals in Brazil. In Brazilian real, the recurring

Operational Result was R$4,522

million, 23% and 355% higher than in 3Q20 and 4Q19,

respectively, due to the depreciation in the Brazilian real against

the U.S. dollar.

- In 2020, the Company recorded a net loss1 of

R$6,692 million, explained mainly by

the provisions related to the geological event in Alagoas in the

amount of R$6,902 million and by the

impact of the exchange variation on the financial result given the

Brazilian real depreciation against the U.S. dollar on net exposure

of US$3,400 million.

- In the year, the Company registered positive net cash

generation of R$1,276 million, mainly

due to: (i) strong operating result; (ii) the monetization of

PIS/COFINS credits of R$1,786

million; and (iii) the reduction of the Company's projected

investments by 23%. These impacts were partially offset by the

impact from working capital on cash flow in the first half of the

year, given the cash consumption caused by the change in the

feedstock profile, with lower volumes of imported naphtha.

- Supported by the Company's cash generation and continued

commitment to its financial health, corporate leverage measured by

the ratio of Net Debt to recurring Operating Result2 in

U.S. dollar was 2.94x.

- In the year, the overall accident frequency rate with and

without lost time (CAF + SAF) was 0.95 event per million hours

worked, 71% below the industry average3. The rate is the

lowest rate of the last three years and was achieved with the

efforts and training under the Company's Human Reliability Program.

Also, the Company achieved the best historical results in process

safety with a Tier 1 accident frequency rate of 0.07 Tier 1/million

hours.

- In December 2020, the Company

concluded an important advance relating to the geological event in

Alagoas and its potential impacts by entering into agreements for

Compensation of Residents and for Socio-Environmental Reparations

(jointly referred to as "Agreements"). After approval of the

Agreements by the competent authorities, the Public-Interest Civil

Actions filed against Braskem relating to the compensation of

residents and social and environmental reparations arising from the

geological event in Alagoas were dismissed.

- In December 2020, Braskem

concluded the renewal of its feedstock supply agreements for its

petrochemical plants with Petrobras by executing contracts for the

supply of petrochemical naphtha to its industrial unit in São Paulo

and for ethane and propane to its industrial unit in Rio de Janeiro. The purpose of the contracts,

with duration of around 5 years after the end of the current

contracts in December 2020, is to

supply annual volumes of up to 2 million tons of petrochemical

naphtha to São Paulo and of up to 580,000 tons of ethylene

equivalent (ethylene volume for each ton of ethane and propane) to

Rio de Janeiro, with prices based

on international references.

- In February 2021, the Company

announced the resumption of chlor-alkali production and

dichloroethane in its unit located in the Pontal da Barra district

of Maceió, Alagoas, which had been shut down since May 2019. To restart the Chlor-Alkali Plant,

Braskem concluded the project to produce brine as feedstock made

from imported salt, which allowed it to resume production of PVC

and caustic soda with an integrated model.

- In the quarter, recycled products sales reached 5.7 kton, up

310% from 3Q20, reflecting the stronger demand in Mexico and the start of recycled resins

commercialization in Europe.

- In the year, the utilization rate of green ethylene was 87%, an

increase of 9 p.p. in relation to 2019, and Green PE sales achieved

170 kton, higher 5% in relation to the previous year, being both

amounts historical records since the beginning of Company's

biopolymers operations in 2010.

Brazil:

- The recurring Operating Result in Brazil was US$680

million (R$3,684 million), 29%

higher than 3Q20, mainly due to the higher spreads in the

international market for PE, PP, PVC and main chemicals, accounting

for 79% of the Company's consolidated recurring Operating

Result.

- In 4Q20, in line with its strategy of prioritizing serving the

Brazilian market, the Company registered resin sales volume in the

domestic market of over 1,0 million tons, which is approximately

17% higher than its historical average4.

United States and

Europe:

- The recurring Operating Result in the

United States and Europe

was US$117 million (R$626 million), 12% lower than in 3Q20, mainly

due to the lower products supply in both regions, and accounting

for 13% of the Company's consolidated recurring Operating Result.

In relation to 4Q19, the 87% increase is basically explained by

better PP spreads in the United

States and Europe.

- In the quarter, the ramp-up process of the new PP plant in

the United States (Delta) improved

significantly in terms of both production volume and quality of the

material produced. The new plant's production was 101 ktons,

representing approximately 90% of utilization rate, considering the

quarterly production capacity of around 113 ktons.

Mexico:

- The recurring Operating Result in Mexico was US$63

million (R$350 million), 20%

lower than 3Q20 and 18% lower than 4Q19. Mexico's recurring Operating Result accounted

for 8% of consolidated the Company's consolidated recurring

Operating Result.

- In the quarter, Braskem Idesa imported approximately 35,000

tons (average of 7,000 barrels per day) of ethane from the United States to complement the ethane

supplied by Pemex, which represented 9% of the PE utilization rate

of the Petrochemical Complex in Mexico, whose utilization rate stood at 48% in

the quarter. In December 2020,

Braskem Idesa completed an expansion of the Fast Track operation,

which currently has an expected capacity of 20 thousand barrels per

day of ethane, or about 30% of the total ethane requirement of the

petrochemical complex.

- In December 2020, the subsidiary

Braskem Idesa was notified by the Centro Nacional de Control del

Gas Natural ("Cenagas"), the Mexican government agency responsible

for the natural gas pipeline and transportation system in the

region, regarding the unilateral suspension of natural gas

transportation, an energy input essential for the production of

polyethylene at the Petrochemical Complex in Mexico. As a result, and respecting the safety

protocols, Braskem Idesa immediately suspended its operations.

- On January 7, 2021, the Company

announced the partial resumption of polyethylene production by

Braskem Idesa based on an experimental business model that follows

all safety protocols and reduces the impacts on serving the demand

from Mexico's plastics

industry.

- According to Notice to the Market of March 1, 2021, Braskem Idesa signed with PEMEX

and Cenagas the following documents to enable BI continued

operation:

-

-

- i. a memorandum of understanding ("MoU") with

PEMEX setting out respective understandings for the discussion of

potential amendments to the Ethane Supply Contract and for the

development of an ethane import terminal, subject to negotiation,

entering into definitive documentation, approvals of BI's

shareholders and creditors and with reservations of rights;

and

- ii. an agreement for natural gas transport service

with CENAGAS, with a term of 15 years, such term conditioned upon

the execution of the definitive documentation referenced in item

(i) above.

- With the execution of these documents by BI, BI commenced to

receive the service of natural gas transportation, which had been

unilaterally terminated in December

2020, allowing the Company to use natural gas in its

production process and electricity generation. Additionally, the

existing Ethane Supply Contact between BI and PEMEX has not been

modified. At the time, BI cannot predict the outcome of such

discussions with PEMEX, its shareholders and creditors.

The full earnings release is available on the Company's IR

website: www.braskem-ri.com.br/home-en

Braskem will host conference calls to discuss its Results

THURSDAY, March 11 at 09:00 a.m. US ET.

Additional information may be obtained from the Investor

Relations Department at +55 11 3576-9531 or

braskem-ri@braskem.com.br.

1Based on net loss attributable to the Company's

shareholders.

2Excludes the Project Finance in Mexico and based on recurring EBITDA.

3 The industry average is 3.25 per million hours

worked according to the American Chemistry Council. The most

recent data refers to 2018.

4Considering the historical average since 1Q10.

View original

content:http://www.prnewswire.com/news-releases/braskem---in-2020--the-recurring-operating-result-was-us2-082-million-38-higher-than-2019--301245186.html

View original

content:http://www.prnewswire.com/news-releases/braskem---in-2020--the-recurring-operating-result-was-us2-082-million-38-higher-than-2019--301245186.html

SOURCE Braskem S.A.

Copyright 2021 PR Newswire

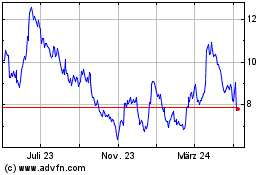

Braskem (NYSE:BAK)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

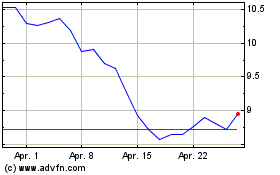

Braskem (NYSE:BAK)

Historical Stock Chart

Von Jan 2024 bis Jan 2025