SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

BRASKEM S.A.

National Register of Legal Entities (CNPJ)

No. 42.150.391/0001-70

State Registration (NIRE) 29300006939

A Publicly Held Company

MANAGEMENT PROPOSAL

FOR THE EXTRAORDINARY GENERAL MEETING OF BRASKEM

S.A.

TO BE HELD ON FEBRUARY 3, 2025

Dear Shareholders,

The Management of Braskem S.A. (“Company”

or “Braskem’”) hereby submits a proposal (“Proposal”) in relation to the matters contained

in the agenda of Braskem’s Extraordinary General Meeting, to be held on February 3, 2025, at 11 a.m., in an exclusively digital

manner, pursuant to article 5, paragraph 2, item I, and article 28, paragraphs 1, 2 and 3 of Brazilian Securities Commission (“CVM”)

Ruling No. 81, of March 29, 2022 (“CVM Ruling 81”), through digital platform Webex (“Digital Platform”

and “Meeting”, respectively).

1.

Replacement of one (1) effective member of the Company’s Board

of Directors appointed by shareholder Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) to conclude the remaining

terms of office, until the Annual General Ordinary Meeting that will resolve on the Company’s financial statements for the fiscal

year to end on December 31, 2025.

In view of the correspondence sent by shareholder

Petrobras exercising the right provided for in Item 3.2.2 (a) of Braskem’s Shareholders Agreement, entered into by Novonor S.A.

– Em Recuperação Judicial, NSP Investimentos S.A. – Em recuperação Judicial and Petrobras on February

8, 2010, as amended (“Shareholders Agreement”), the Management of the Company proposes that the Shareholders resolve

on the election of Mr. Luiz Eduardo Valente Moreira, appointed by shareholder Petrobras, to hold the position of effective member

of the Board of Directors, in replacement of Mr. Danilo Ferreira da Silva, also appointed by Petrobras, both to conclude the remaining

terms of office, until the Annual General Ordinary Meeting that will resolve on the Company's financial statements for the fiscal year

to end on December 31, 2025 (“AGO 2026”).

The Board of Directors (“BOD”),

after analyzing the classification of the candidate to the independence criteria established in Exhibit K to CVM Ruling No. 80, of March

29, 2022 (“CVM Ruling 80”) and in the Global Policy of the Company's Compliance System, attested that Mr. Luiz Eduardo

Valente Moreira do not meet the aforementioned criteria, based on the self-declarations presented by said candidate

and on the opinion of the Company's Statutory Compliance and Audit Committee, which also evaluated the matter.

Exhibit I of this Proposal provides information

of the candidate appointed by shareholder Petrobras, as well as his professional experiences, as per items 7.3 to 7.6 of the Reference

Form, pursuant to article 11, item I, of CVM Ruling 81.

Impossibility of Separate Election or Multiple

Vote

In accordance with the CVM Board of Commissioners

understanding, given that the Extraordinary General Meeting hereby called refers only to the replacement of one (1) effective member of

the Company's Board of Directors, elected in a majority vote, there shall be no possibility to adopt the separate election, as provided

for in paragraphs 4 and 5 of article 141 of Law No. 6,404 of December 15, 1976 (“Brazilian Corporate Law”), nor does

the possibility of adopting multiple vote apply.

2.

Resolve on the substitution of the Chairman of the Company’s Board

of Directors appointed by shareholders Novonor S.A. – Em Recuperação Judicial (“Novonor”) and NSP Investimentos

S.A. – Em Recuperação Judicial (“NSP”).

The Management submits to the Shareholders,

in accordance with article 19 of its Bylaws and with the item 3.2.5 of its Shareholders Agreement, the election of Mr. Héctor

Nuñez, currently serving as an effective member of the Board of Directors, to hold the position of President of the Company's

Board of Directors, in replacement of Mr. José Mauro Mettrau Carneiro da Cunha, that will remain as effective member

of the Board of Directors, both to conclude the remaining terms of office, until the AGO 2026.

Considering the above, the Board of Directors

will have the following composition:

| EFFECTIVE MEMBERS |

ALTERNATES |

|

HECTOR NUÑEZ

(Chairman) |

- |

|

OLAVO BENTES DAVID

(Vice Chairman) |

MARCOS ANTONIO ZACARIAS |

| PAULO ROBERTO BRITTO GUIMARÃES |

RODRIGO TIRADENTES MONTECHIARI |

|

GESNER JOSÉ DE OLIVEIRA FILHO

(Membro Independente) |

- |

| JOÃO PINHEIRO NOGUEIRA BATISTA |

- |

| MAURICIO DANTAS BEZERRA |

- |

| JULIANA SÁ VIEIRA BAIARDI |

- |

| JOSÉ MAURO METTRAU CARNEIRO DA CUNHA |

GUILHERME SIMÕES DE ABREU |

|

ROBERTO FALDINI

(Independent Member) |

- |

|

CARLOS PLACHTA

(Independent Member) |

DANIEL PEREIRA DE ALBUQUERQUE ENNES |

| LUIZ EDUARDO VALENTE MOREIRA |

LINEU FACHIN LEONARDO |

| I. | Shareholders’ Participation: |

The Meeting will be held exclusively digitally,

for which reason the Shareholder's participation can only be:

(a) via remote voting ballot, with detailed

instructions regarding the documentation required for remote voting provided in the Ballot and in the Manual for Shareholder’s Participation,

which can be accessed on the Company website (www.braskem-ri.com.br), CVM website (www.cvm.gov.br) and B3 website (www.b3.com.br); and

via Digital Platform, in person or through

an attorney-in-fact duly appointed pursuant to article 28, paragraphs 2 and 3 of CVM Ruling 81, in which case the Shareholders may: (i)

simply take part in the Meeting, whether or not they have sent the Ballot; or (ii) participate and vote at the Meeting, noting that, for

the Shareholders who have already sent the Ballot and wish to vote at the Meeting, all voting instructions received by Ballot will be

disregarded.

The Braskem’s Extraordinary General Meeting

will be held exclusively in a digital format, considering that, in the judgment of the Management, this format reduces Shareholder participation

costs, facilitates and contributes to greater attendance from the Company's shareholder base at the Meeting, thus increasing the representativeness

of the resolutions to be taken.

Documents necessary to access the Digital

Platform:

The Shareholders that wish to take part in the

Meeting must send to e-mail address braskem-ri@braskem.com, with a request for receipt confirmation, at least two (2) days in advance

of the date scheduled for the Meeting, that is, by February 1st, 2025, the following documents:

| (i) | evidence issued by the financial

institution depositary of the book-entry shares held thereby, proving ownership of the shares at least eight (8) days prior to the Meeting; |

| (ii) | if the Shareholder is (a) an

individual, the Shareholder’s identity document; or (b) legal entity, instrument of incorporation, bylaws or articles of incorporation,

minutes of election of the Board of Directors (if any) and minutes of election of the Executive Office that prove the powers of representation; |

| (iii) | if the Shareholder is an investment

fund, the fund rules with the information referred to above, pertaining to its administrator or manager, according to the representation

rules foreseen in the fund’s regulation; |

| (iv) | additionally, in case the Shareholder

(individual, legal entity or investment fund) is represented by an attorney-in-fact, (i) the respective power of attorney, granted in

compliance with article 126, paragraph 1, of the Brazilian Corporations Law; and (b) identity document of the attorney-in-fact; and |

| (v) | with respect to Shareholders

participating in the fungible custody of registered shares, a statement with the respective equity interest, issued by the entity with

authority. |

Pursuant to article 6, paragraph 3, of CVM Ruling

81, access to the Digital Platform shall be forbidden to Shareholders that do not submit the necessary participation documents within

the deadline set forth herein.

The Company explains that it shall waive the

sending of the physical counterparts of the Shareholders’ representation documents to the Company’s offices, as well as the

authenticity certification of the grantor’s signature on the power of attorney for representation of the Shareholder, the notarization,

the consularization, the annotation and the sworn translation of all of the Shareholder’s representation documents, sufficing to

send a simple copy of the original counterparts of said documents to the Company’s e-mail stated above.

The Company does not accept powers of attorney

granted by Shareholders through electronic means (i.e., digitally signed powers of attorney without any digital certification).

Below we describe detailed information about

the deadlines and procedures for participating in the Meeting:

(a) via remote voting ballot: the Company will

adopt the remote voting in accordance with CVM Ruling 81, allowing its Shareholders to submit their votes up to 4 (four) days before

the designated date of the Meeting: (i) through their respective custodians; (ii) through the Company's share registrar (Itaú Corretora

de Valores S.A.), located at Avenida Brigadeiro Faria Lima, No. 3,500, 3rd floor, São Paulo, CEP 04538-132, shareholder service

via telephone 3003-9285 (capitals and metropolitan regions); or 0800 7209285 (other locations through the website https://assembleiadigital.certificadodigital.com/itausecuritiesservices/artigo/atendimento/perguntas-frequentes

or email PreAtendimentoEscritural@itau-unibanco.com.br); or (iii) directly to the Company: (iii.1) by physical delivery, by sending to

the office located at Rua Lemos Monteiro, No. 120, 24th floor, City of São Paulo, State of São Paulo, CEP 05501-050; or

(iii.2) by electronic means, to the email braskem-ri@braskem.com, with a receipt confirmation request, as per the instructions contained

in the Ballot itself.

(b) via Digital Platform: the Shareholders

that wish to take part in the Meeting must send the request to the Company through e-mail braskem-ri@braskem.com, with a request for

receipt confirmation, at least two (2) days in advance of the date set for the Meeting to be held, that is, by February 1ts, 2025,

which must also be properly accompanied by all of the Shareholder’s documents for participation in the Meeting (as detailed above,

in the Call Notice and in the Manual to Participate in the Meeting), noting that access to the Digital Platform shall be forbidden

for shareholders that do not submit the necessary participation documents within the deadline set herein, pursuant to article 6, paragraph

3, of CVM Ruling 81.

The Company shall send the individual invitations

to access the Digital Platform and the respective instructions to access the Digital Platform to the Shareholders that have submitted

their requests within the deadline and under the conditions above, as already stated in the Manual to Participate in the Meeting.

The Shareholder that participates through the

Digital Platform shall be deemed present at the Meeting and may exercise its voting rights and sign the respective Meeting Minutes, pursuant

to article 47, paragraph 1, of CVM Ruling 81.

If the Shareholder that has properly requested

to participate does not receive from the Company the e-mail with the instructions for access and participation in the Meeting at least

24 hours in advance of its holding (that is, by 11 a.m. of February 2, 2025), it shall get in touch with the Company through phone

numbers +55 (11) 3576-9531 – in any event, before 9 a.m. of February 3, 2025, so that its respective access instructions

are resent (or provided over the phone).

The Company shall provide technical support

in case the Shareholders have any problems participating in the Meeting. However, the Company takes no responsibility for any operational

or connection issues the Shareholder may face, nor for any other possible matters not related to the Company, which may hinder or prevent

the Shareholder from participating in and voting at the Meeting.

The Company also recommends that the Shareholders

become familiar with the use thereof beforehand, as well as that they ensure the compatibility of their electronic devices with the use

of the platform (by video and audio).

Additionally, the Company asks the Shareholders

to, on the day of the Meeting, access the Digital Platform at least fifteen (15) minutes before the time scheduled for the Meeting to

start, to enable access validation and participation of all Shareholders using it.

Finally, all the exhibits are detailed in this

Proposal in accordance with the laws and regulations.

The Management

* * *

| EXHIBIT |

PAGE |

| EXHIBIT I – Information of candidates appointed by shareholder Petrobras to hold the positions of Effective Members of the Board of Directors of the Company, pursuant to article 11, item I, of CVM Ruling 81. |

7 |

BRASKEM S.A.

National Register of Legal Entities (CNPJ)

No. 42.150.391/0001-70

State Registration (NIRE) 29300006939

A Publicly Held Company

MANAGEMENT PROPOSAL

FOR THE EXTRAORDINARY GENERAL MEETING OF BRASKEM

S.A.

TO BE HELD ON FEBRUARY 3, 2025

EXHIBIT I

Information of the candidates appointed by shareholders

Novonor and NSP and by shareholder Petrobras to hold the positions of Effective Members of the Board of Directors of the Company, pursuant

to article 11, item 1 of CVM Resolution 81.

7.3. In relation to each of the managers and members of

the issuer's fiscal council, indicate[1]:

| Name |

Management Body |

Elective office held |

Date of Election |

Date of Investiture |

| Luiz Eduardo Valente Moreira |

Board of Directors |

Board Member

(Effective) |

02/03/2025 |

02/03/2025 |

| Nationality |

Individual Taxpayer Registry (Cadastro de Pessoas Físicas – CPF) |

Term of Office |

Start of

1st Term |

Elected by the controlling shareholder? |

No. of Passport |

|

| Brazilian |

929.338.668-20 |

Until AGO 2026 |

02/03/2025 |

Yes |

N/A |

|

| Date of Birth |

Profession |

Is part of a Committee? |

Name of the Committee |

Position on the Committee |

Date of election on the Committee |

Date of Investiture on the Committee |

Time Period of the Committee's Term |

Date of 1st Term (Committee) |

| |

|

|

|

|

|

|

|

|

[1] Mr. Luiz Eduardo Valente

Moreira does not hold positions on Committees, reason why item 7.4. is not being presented.

| 02/19/1957 |

Chemical Engenieer |

No |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

| Professional Experience: |

| Mr. Luiz Eduardo Valente Moreira is a candidate for the Company's Board of Directors, appointed by the shareholder Petrobras. Mr. Luiz Eduardo Valente Moreira holds a degree in Chemical Engineering from the Federal University of Rio de Janeiro (UFRJ) and began his career at Petrobras in the same year of his graduation, in 1980. He has a postgraduate degree in Petroleum Processing Engineering from the Federal University of Rio de Janeiro (UFRJ) and an Executive MBA from COPPEAD (UFRJ). He has been working for 44 (forty-four) years in the Petrobras system, where he has held various managerial positions, including the following: (i) Superintendent of the Presidente Getúlio Vargas Refinery (REPAR) from 09/01/1999 to 07/31/2000; (ii) General Manager of Refining Technology in Supply (AB-RE/TR) from 12/19/2001 to 04/30/2005; (iii) General Manager of the Henrique Lage Refinery (REVAP) from 05/01/2005 to 09/14/2008; (iv) General Manager of the Fábrica de Fertilizantes Nitrogenados da Bahia (FAFEN-BA) from 09/15/2008 to 09/21/2009; (v) Executive Manager of Gas and Energy - Gas-Chemical and Liquefaction (GE-GQL) from 09/22/2009 to 08/31/2013; (vi) Director of the "Comperj Petrochemical" project at Braskem from 09/01/2013 to 05/31/2015; (vii) Executive Manager of Safety, Environment, and Health (SMS) from 06/01/2015 to 03/31/2018; (viii) Executive Manager of Industrial (Refining) from 04/01/2018 to 04/08/2019; (ix) Vice President of Projects and Digital Technologies at BRASKEM S.A. from 04/08/2019 to 06/30/2020; (x) Director of Services at PETROBRAS TRANSPORTE S.A - TRANSPETRO from 07/01/2020 to 09/24/2021; (xi) President of Petrobras Transporte S.A - Transpetro from 09/25/2021 to 04/30/2023; and (xii) Managing Director of Fábrica Carioca de Catalisadores S.A., a position he has held since 05/01/2023. |

| Convictions: |

| The Candidate hereby declares that he does not have: (a) any criminal conviction; (b) any conviction in an administrative proceeding of CVM, the Brazilian Central Bank or the Superintendence of Private Insurance; or (c) a final and unappealable conviction, legal or administrative, that suspended or disqualified him for the practice of any professional or business activity. |

7.5. Existence of Marital Relationship, Civil

Partnership or Family Partnership up to the 2nd Degree between a. Issuer’s Managers; b. (i) Issuer’s Managers and

(ii) Managers of direct or indirect subsidiaries of the issuer; c. (i) Managers of the issuer or its direct or indirect subsidiaries (ii)

direct or indirect controllers of the issuer; d. (i) Managers of the issuer; and (ii) Managers of the issuer's direct and indirect controlling

companies

Not applicable, as there are no marital relationship,

civil partnership or family partnership up to the 2nd Degree between the candidates and the people indicated in items ‘a’,

‘b’, ‘c’ and ‘d’ above.

7.6. State subordination, service, or control

relationships in the last three fiscal years between the managers of the issuer and: a. a company directly or indirectly controlled by

the issuer, except those in which the issuer directly or indirectly holds equity interest that is equal to or greater than ninety-nine

percent (99%) of the capital stock; b. direct or indirect controlling shareholder of the issuer; and c. any relevant supplier, customer,

debtor, or creditor of the issuer, its controlled company or controlling shareholders, or controlled company of any of them.

2024:

| Manager’s Name |

|

Type of Person |

|

Manager’s CPF |

|

Nationality |

|

No. of Passport |

| Luiz Eduardo Valente Moreira |

|

Brazilian |

|

929.338.668-20 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Company |

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Member of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Person |

|

Type of Person |

|

CPF/CNPJ of the Related Person |

|

Nationality |

|

No. of Passport |

| FÁBRICA CARIOCA DE CATALISADORES S.A.[2] |

|

Legal Entity |

|

28.944.734/0001-48 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Related Person |

|

Type of Relationship with the Related Person |

|

Type of related person |

|

|

|

|

|

|

| Managing Director |

|

Subordination |

|

Supplier |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[2]

Fábrica Carioca de Catalisadores S.A. is a company controlled by Petrobras, which, in turn, is a significant supplier to the Company.

2023:

| Manager’s Name |

|

Type of Person |

|

Manager’s CPF |

|

Nationality |

|

No. of Passport |

| Luiz Eduardo Valente Moreira |

|

Brazilian |

|

929.338.668-20 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Company |

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Member of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Person |

|

Type of Person |

|

CPF/CNPJ of the Related Person |

|

Nationality |

|

No. of Passport |

| FÁBRICA CARIOCA DE CATALISADORES S.A.[3] |

|

Legal Entity |

|

28.944.734/0001-48 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Related Person |

|

Type of Relationship with the Related Person |

|

Type of related person |

|

|

|

|

|

|

| Managing Director |

|

Subordination |

|

Supplier |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Manager’s Name |

|

Type of Person |

|

Manager’s CPF |

|

Nationality |

|

No. of Passport |

| Luiz Eduardo Valente Moreira |

|

Brazilian |

|

929.338.668-20 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Company |

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Member of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[3]

Fábrica Carioca de Catalisadores S.A. is a company controlled by Petrobras, which, in turn, is a significant supplier to the Company.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Person |

|

Type of Person |

|

CPF/CNPJ of the Related Person |

|

Nationality |

|

No. of Passport |

| PETROBRAS TRANSPORTE S.A - TRANSPETRO[4] |

|

Legal Entity |

|

02.709.449/0001-59 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Related Person |

|

Type of Relationship with the Related Person |

|

Type of related person |

|

|

|

|

|

|

| Chairman |

|

Subordination |

|

Supplier |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[4]

Petrobras Transportes S.A. – Traspetro is a company controlled by Petrobras, which, in turn, is a significant supplier to the Company.

2022:

| Manager’s Name |

|

Type of Person |

|

Manager’s CPF |

|

Nationality |

|

No. of Passport |

| Luiz Eduardo Valente Moreira |

|

Brazilian |

|

929.338.668-20 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Company |

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Member of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Person |

|

Type of Person |

|

CPF/CNPJ of the Related Person |

|

Nationality |

|

No. of Passport |

| PETROBRAS TRANSPORTE S.A - TRANSPETRO[5] |

|

Legal Entity |

|

02.709.449/0001-59 |

|

Brazil |

|

N/A |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Position in the Related Person |

|

Type of Relationship with the Related Person |

|

Type of related person |

|

|

|

|

|

|

| Chairman |

|

Subordination |

|

Supplier |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[5]

Petrobras Transportes S.A. – Traspetro is a company controlled by Petrobras, which, in turn, is a significant supplier to the Company.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: January 12, 2025

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Felipe Montoro Jens |

| |

|

|

| |

|

Name: |

Felipe Montoro Jens |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates

of future economic and other circumstances, industry conditions, company performance and financial results, including any potential

or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial

condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and

financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our

financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the

current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control.

There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions

and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such

assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the

unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders,

could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the

year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each

of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact

any forward-looking statements in this presentation.

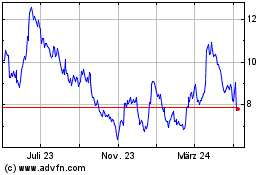

Braskem (NYSE:BAK)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

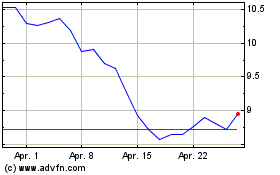

Braskem (NYSE:BAK)

Historical Stock Chart

Von Jan 2024 bis Jan 2025