Triton Distribution Systems, Inc. Management Preparing the Company for Major Financial Growth

13 Januar 2011 - 2:00PM

Marketwired

Triton's (PINKSHEETS: TTDZ) management, in anticipation of the

closing of the acquisition of AGT on January 15, 2011 and the

greatly welcomed pending private placement, is pleased to announce

today that based upon shareholders and board of directors approval

of the various note transactions, warrant conversions and debt

exchange agreements, Triton is in a position to have up to

approximately $4.2 million in debt and $4.1 million in other

liabilities eliminated. As a result, management anticipates an

increase of approximately $8.3 million in total shareholder's

equity.

Immediately after the closing of the acquisition and preceding

the acceptance of the private placement investment, the company

will post publicly the new modified financial reports that will

clearly position it in a very appropriate place to accept

comfortably the new investors and adjust to the rapid financial

growth.

Additionally management is planning in the very near future to

upgrade the company to a higher exchange suited to trade Triton's

stock.

FORWARD-LOOKING STATEMENTS This news

release includes forward-looking statements. While these statements

are made to convey to the public the company's progress, business

opportunities and growth prospects, readers are cautioned that such

forward-looking statements represent management's opinion. The

company's operations and business prospects are always subject to

risk and uncertainties.

Contact: Triton Distribution Systems, Inc. Gregory

Lykiardopoulos CEO 415-381-4806

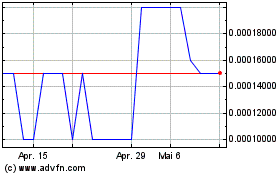

Green Cures and Botanica... (PK) (USOTC:GRCU)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

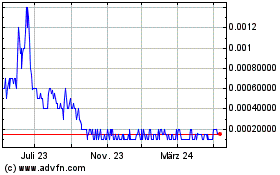

Green Cures and Botanica... (PK) (USOTC:GRCU)

Historical Stock Chart

Von Mai 2023 bis Mai 2024

Echtzeit-Nachrichten über Green Cures and Botanical Distribution Inc (PK) (OTCMarkets): 0 Nachrichtenartikel

Weitere Triton Distribution Systems, Inc. News-Artikel