TIDMCHAR

RNS Number : 3839Z

Chariot Oil & Gas Ld

12 January 2011

Immediate Release 13 January 2011

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Resource Update

Increase of 3.1 billion barrels to a new total of 13.2 billion

barrels of Gross Unrisked Mean Prospective Resources

Mega Structure Identified

Chariot Oil & Gas Limited (AIM: CHAR), the Africa focused

oil and gas exploration company, is pleased to announce an increase

of a further 3.1 billion barrels in its estimate of gross unrisked

mean prospective resources in its Southern licence 2714A offshore

Namibia. Further technical work undertaken on the 3D seismic data

acquired across this block, in which Chariot has a 50% interest,

has identified additional resources within a single

'mega-structure' and significantly increased the estimated chance

of success on this primary prospect to from 16% to 20%. Chariot's

gross mean unrisked prospective resource volume now totals 13.2

billion bbls (9.7 billion bbls net to Chariot).

This technical work, which included remapping and seismic

attribute analysis, was undertaken subsequent to the updated

resource statement released on the 6 September 2010 which announced

an increase in gross mean unrisked prospective resources to 10.1

billion barrels and a prospect and lead inventory of 11 prospects

and 6 leads. These figures were verified by the independent

assessment of Netherland Sewell & Associates Inc. in its

Competent Persons Report, announced on 28 October 2010.

The further increase in prospective resource volume has been

identified in a single very large structural prospectin the

Southern acreage. This 'mega-structure', some 500 km2 in area, lies

wholly within the 3D seismic area and displays seismic attributes,

including Amplitude Versus Offset ("AVO") anomalies, that are

indicative of a hydrocarbon charge in what is believed to be a

Lower Cretaceous deltaic sandstone reservoir. The robust geological

interpretation (sealed reservoir within a large structural closure

surrounded by a mapped potential charge kitchen) suggests the AVO

anomaly is valid and has justified an increase in the estimated

chance of success to 20% for this 'mega-structure'. Chariot

continues to evaluate other plays in the block, particularly deeper

Barremian targets, equivalent to the reservoir level of the Kudu

field, where additional AVO anomalies are indicated. Additionally,

further evaluation is ongoing in Chariot's Northern acreage with a

technical update on these areas to be included in future

announcements.

Paul Welch, CEO of Chariot commented, "Our portfolio continues

to develop in an extremely positive way, with our technical work

providing further insight and understanding of the prospectivity of

our licence areas. We are very pleased with this further increase

in resource volumes, the identification of a mega structure and the

resultant de-risking. These findings continue to underscore the

world-class potential we believe is held within our licence

areas."

Gross attributable Net attributable

to Licence in MMboe to Group MMboe

========= ========== =============== ---------------------------------------- --------------------------------------- ---------- --------- ---------

Probabilistic

Volume Method Low Best High Low Best High Working

========= ========== =============== ========= ========= ========= ======= ========= ========= ========= ====== ========== ========= =========

(Monte Carlo

Region Status Simulation) Estimate Estimate Estimate Estimate Estimate Estimate Risk Interest Operator

========= ========== =============== ========= ========= ========= ======= ========= ========= ========= ====== ========== ========= =========

Factor***

P90 P50 P10 Mean P90 P50 P10 Mean (%) (%)

========= ========== =============== ========= ========= ========= ======= ========= ========= ========= ====== ---------- --------- ---------

North Prospect Tapir N 166 278 451 294 166 278 451 294 14% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

North Prospect Tapir 89 139 211 146 89 139 211 146 14% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

North Prospect Tapir S 122 190 277 196 122 190 277 196 14% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

North Lead Tapir NE 180 296 449 306 180 296 449 306 12% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

North Prospect Tapir S Fan 83 175 319 190 83 175 319 190 12% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

North Prospect Zamba N 53 91 141 95 53 91 141 95 12% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

North Lead Zamba 350 667 1,145 713 350 667 1,145 713 15% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Total Northern

Block Oil* 1,043 1,836 2,993 1,940 1,043 1,836 2,993 1,940 100% Enigma

------------------------------------ --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

South Prospect A Structural 126 215 339 225 63 108 170 113 16% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

South Prospect B Structural 197 301 448 313 99 151 224 157 16% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

South Prospect C Structural 149 326 620 361 75 163 310 181 16% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

C

South Lead Stratigraphic 321 942 2,153 1,118 161 471 1,077 559 12% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Nimrod Albian

Structural

South Prospect Oil 2,299 3,629 5,321 3,736 1,150 1,815 2,661 1,868 20% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

G Barremian

South Prospect Structural 95 172 289 184 48 86 144 92 16% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

H Barremian

South Prospect Structural 273 450 714 475 137 225 357 238 16% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

South Prospect K Structural 248 518 979 571 124 259 490 286 16% 50% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Total Southern

Block Oil* 3,708 6,553 10,863 6,983 1,854 3,277 5,431 3,491 50% Enigma

------------------------------------ --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Central Lead Klipspringer 587 1,772 3,916 2,055 587 1,772 3,916 2,055 7% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Central Lead Hartebeest 502 1,489 3,287 1,720 502 1,489 3,287 1,720 7% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Central Lead Oryx 157 467 1,025 543 157 467 1,025 543 6% 100% Enigma

--------- ---------- --------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Total Central

Block Oil* 1,246 3,728 8,228 4,318 1,246 3,728 8,228 4,318 100% Enigma

------------------------------------ --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

Total

Northern,

Central and

Namibia Southern** 5,997 12,117 22,084 13,241 4,143 8,841 16,652 9,749 Enigma

--------------------- -------------- --------- --------- --------- ------- --------- --------- --------- ------ ---------- --------- ---------

This table of unrisked prospective resources is as determined by

Netherland,

Sewell & Associates, Inc. dated 28 October 2010 together with updated

volumes and risk factors for the Nimrod Albian Structural prospect

based on DHIs as determined by Chariot. The G and H Barremian prospects

which underly the Albian Nimrod prospect are unchanged (NSAI figures).

* Total resource numbers are arithmetically summed in accordance with

SPE 2007 PRMS guidelines; therefore, these totals do not include the

portfolio effect that might result from statistical aggregation.

** Many of the prospects and leads in the Northern and Southern blocks

have multiple horizons with independent chances of success. The stated

risk factors; however, are consistent with the given volumes.

QUALIFIED PERSON

Martin Richards, Chariot's Chief Reservoir Engineer, is the qualified

person for the purpose of this release. Martin has worked in the oil

and gas industry for over 30 years and has an in-depth experience

of all aspects of subsurface management, reservoir engineering and

petroleum economics. He has an MA in Physics from Oxford University,

an MSc in Geophysics and Planetary Physics from Newcastle University

and an MEng in Petroleum Engineering from Heriot-Watt University.

He has read and approved the technical disclosures in this announcement.

For further information please contact:

Chariot Oil & Gas Limited +44 (0)20 7318 0450

Paul Welch, CEO

Ambrian Partners Limited

(Joint Broker and NOMAD)

Richard Swindells +44 (0)20 7634 4856

RBC Capital Markets

(Joint Broker) Josh

Critchley, Martin Eales +44 (0)20 7653 4000

Buchanan Communications

Bobby Morse, Ben Romney,

Chris McMahon +44 (0)20 7466 5000

NOTES TO EDITORS

About Chariot

Chariot Oil & Gas Limited is an independent oil and gas

exploration group. The Group currently holds licences covering

eight blocks in Namibia, through its wholly owned subsidiary Enigma

Oil & Gas (Pty) Limited, all of which are offshore. All of

these blocks are currently in the exploration phase.

Shares in Chariot Oil & Gas limited are admitted to trading

on the AIM Market of the London Stock Exchange under the symbol

'CHAR'.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBLLLFFFFLBBV

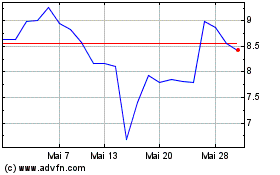

Chariot (LSE:CHAR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Chariot (LSE:CHAR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024