|

NOTICE OF EXEMPT SOLICITATION: (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: Exxon Mobil Corporation

NAME OF PERSON RELYING ON EXEMPTION: Majority Action

ADDRESS OF PERSON RELYING ON EXEMPTION: PO Box 4831, Silver Spring, MD 20914 |

|

|

|

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily.

|

|

Vote Recommendation:

We urge shareholders to vote AGAINST the election of Executive Chair and

CEO Darren W. Woods (Item 1.12) and Lead Independent Director and Nominating and Governance Chair Joseph L. Hooley (Item 1.06) for permitting

the company to attack its own shareholders and lack of oversight with respect to climate strategy and climate risk management. Votes AGAINST

all other director nominees facing election are also warranted (Items 1.01–1.05 and 1.07–1.11) for poor oversight of climate

governance.

Summary:

ExxonMobil has launched an unprecedented attack on its own shareholders

that appears to be aimed at stifling investor concerns related to the company’s management of climate-related financial risk. This

failure of corporate governance is in the service of a risky and flawed climate strategy. While ExxonMobil has attempted to cast climate-related

concerns as not material to shareholder value, the company’s climate strategy—which seeks to increase oil and gas production,

sets production and greenhouse gas reduction targets that are misaligned with the objectives of the Paris Agreement, and overrelies on

untested carbon capture technologies to cut emissions—poses significant company-specific and portfolio-wide risks to diversified

investors seeking long-term returns. ExxonMobil’s attacks on climate-concerned investors seem to be the latest chapter in its time-tested

playbook of deflecting corporate responsibility for climate change. ExxonMobil’s related failures of corporate governance and climate

strategy reflect a profound failure of board oversight, and thus warrant director accountability.

ExxonMobil’s unprecedented attacks on shareholders

On January 21, 2024, ExxonMobil sued investors

Arjuna Capital and Follow This, seeking a ruling that the company could exclude a shareholder resolution requesting that it

accelerate the pace of medium-term greenhouse gas (GHG) emissions reductions.1ExxonMobil decided to continue pursuing the lawsuit even after the proponents withdrew the proposal and pledged not to resubmit

it in the future. In filing suit, ExxonMobil bypassed the Securities and Exchange Commission’s (SEC’s) cost-effective and

efficient “no action” process, which is used by almost all publicly traded companies to determine whether a shareholder proposal

may be excluded from its proxy. The judicial relief ExxonMobil is seeking is unusual and extraordinary: ExxonMobil has asked the court

to allow it to exclude any “future similar proposals” by the proponents, even though existing SEC rules articulate standards

for the resubmission and excludability of shareholder resolutions.2ExxonMobil has also asked the court to prohibit the proponents from collaborating or communicating with shareholders about

future similar proposals.3

1

Complaint, Exxon Mobil Corporation v. Arjuna Capital, LLC and Follow This, No. 4:24-cv-00069 (N.D. Texas).

2

Memorandum of Law In Opposition To Defendants’ Motions to Dismiss, Exxon Mobil Corporation v. Arjuna Capital and Follow This,

No. 4:24-cv-00069 (N.D. Texas), p. 17.

3

Ibid.

ExxonMobil went one step further in its

2024 proxy statement, where it singles out by name, criticizes, and makes disparaging statements about its own investors. ExxonMobil

discriminates between two classes of owners—“our investors” and “other shareholders” [emphasis

added]4—the latter an apparent euphemism

for investors concerned about the company’s management of environmental, social, and governance risks. ExxonMobil attempts to delegitimize

these investors by claiming they do not care about long-term economic value and should not be permitted to submit shareholder resolutions—a

critical tool of shareholder democracy.5

These attacks parallel ExxonMobil’s characterization of Arjuna Capital and Follow This, who Chairman and CEO Darren Woods has referred

to as “not legitimate investors.”6

ExxonMobil’s lawsuit has drawn criticism

from prominent members of the investor community. Representatives of large institutional investors including Norges Bank and

CalPERS have characterized the lawsuit as “unprecedented,” “worrisome,” “aggressive,” and an attempt

to “silence shareholders.”7

In response to the lawsuit, the Council of Institutional Investors issued a press release defending the SEC as a “fair arbiter of

shareholder proposals” and stating that the “no-action process generally is superior to litigating.”8

4

ExxonMobil, DEF14A, filed April 11, 2024, https://investor.exxonmobil.com/sec-filings/all-sec-filings/content/0001193125-24-092545/0001193125-24-092545.pdf,

p. 79(“We have observed a distinction in approach between our investors, who are looking to ensure long-term economic value,

and other shareholders…” [emphasis added]).

5

Ibid; ExxonMobil, “Shareholder Proposal Lawsuit – Our responsibility to fight back,” February 29, 2024, https://corporate.exxonmobil.com/news/corporate-news/shareholder-proposal

(“We believe activists with minimal or even no shares should not be permitted to re-submit proposals...”).

6

Isla Binne, “CalPERS says Exxon should drop lawsuit against climate-conscious investors,” Reuters, March 21, 2024,

https://www.reuters.com/legal/calpers-says-exxon-should-drop-lawsuit-against-climate-conscious-investors-2024-03-21/.

7

Michael Frerichs, “Exxon shouldn’t be able to silence its shareholders,” Houston Chronicle, April 8, 2024, https://www.houstonchronicle.com/opinion/outlook/article/exxon-shareholder-lawsuit-respite-19388256.php;

Mona Dohle, “‘CalPERS will not be silenced’ pension fund CEO warns ExxonMobil,” Net Zero Investor, April

19, 2024, https://www.netzeroinvestor.net/news-and-views/calpers-will-not-be-silenced-pension-fund-ceo-warns-exxon-mobil; Richard Milne

and Myles McCormick, “Norway oil fund boss criticises ExxonMobil’s ‘aggressive’ climate lawsuit,” Financial

Times, February 7, 2024, https://www.ft.com/content/58952fc6-9b52-4e22-8fd5-8c24ddd9f7b2.

Investors Wespath Benefits and Investments and Mercy Investment Services

have also co-filed an exempt solicitation at ExxonMobil calling on shareholders to vote against Darren Woods and Joseph Hooley for the

company’s conduct towards investors.

8

Council of Institutional Investors, “Leading Investor Group Defends SEC as Fair Arbiter of Shareholder Proposals as ExxonMobil Goes

to Court,” February 8, 2024, https://www.cii.org/feb82024-press-release-exxon.

ExxonMobil’s lawsuit could undermine shareholder rights by trying

to intimidate shareholders concerned about climate-related financial risk

ExxonMobil states in its proxy statement, “We respect that our investors

may have viewpoints and perspectives that differ from those of our management and Board.”9

Yet its recent actions express a growing hostility towards investors concerned about its management of

climate-related financial risk.

In its court submissions and proxy materials,

ExxonMobil attempts to isolate and discredit climate-concerned shareholders by claiming they are not “legitimate investors”

and do not care about long-term value creation. Contrary to ExxonMobil’s insinuation that climate change is a fringe

issue for investors,10 the importance of

decarbonization to mitigating climate risk exposure and securing long-term returns is acknowledged by much of the mainstream investor

community.11 Indeed, recent voting outcomes

demonstrate that climate change is far from marginal to the concerns of ExxonMobil’s own investor base: Since 2021, eight shareholder

proposals filed at ExxonMobil related to climate lobbying, scenario analysis, emissions disclosures, and environmental impact received

over 25 percent support, and three received more than majority support.12

We believe ExxonMobil is using the threat

of protracted, expensive litigation to intimidate investors and deter them from filing climate-related shareholder resolutions. Shareholder

resolutions are a critical tool of corporate governance that enable investors to alert company leadership to their concerns and request

timely action on potential, emerging, or neglected risks that could become financial liabilities.13

Over the years, shareholder resolutions have spurred companies, including ExxonMobil, to disclose important information about their exposure

to and management of climate risks.14 In

our view, that the current lawsuit constitutes an implicit threat to shareholders who are contemplating filing proposals on climate risk

mitigation. By erecting burdensome legal and financial barriers to the shareholder resolution process, ExxonMobil appears to be trying

to silence investors concerned about climate-related financial risk, potentially depriving them of a critical tool of shareholder democracy

and corporate governance.

ExxonMobil’s actions could undermine

the rights of not just its own shareholders, but the rights of all shareholders. ExxonMobil’s lawsuit sets a potentially

dangerous precedent for other climate-recalcitrant companies, who may similarly sidestep the SEC and litigate against proponents. The

National Association of Manufacturers, a trade group representing fossil fuel interests, has admitted that corporations are watching the

ExxonMobil case for precisely this reason.15

9

ExxonMobil, DEF14A, p. 79.

10

Complaint, Exxon Mobil Corporation v. Arjuna Capital, LLC and Follow This, p. 13 (“Defendants submit these shareholder proposals

to…promote their own interests over those of ExxonMobil’s shareholders….Defendants’ objectives and tactics run

counter to the interests of ExxonMobil and its shareholders.”)

11

Climate Action 100+, https://www.climateaction100.org/approach/business-case/.

12

Majority Action analysis of data from Diligent Market Intelligence.

13

Ceres, US SIF, and the Interfaith Center on Corporate Responsibility, The Business Case for the Current SEC Shareholder Proposal Process

April 2017, https://www.ussif.org/files/Public_Policy/Comment_Letters/Business%20Case%20for%2014a-8.pdf.

14

Caroline Flammer et al, “Shareholder activism and firms' voluntary disclosure of climate change risks,” Strategic Management

Journal, vol. 42 (2021): 1850-1879, https://onlinelibrary.wiley.com/doi/abs/10.1002/smj.3313.

15

Michael Coplay, “ExxonMobil is suing investors who want faster climate action,” NPR, February 29, 2024, https://www.npr.org/2024/02/29/1234358133/exxon-climate-change-oil-fossil-fuels-shareholders-investors-lawsuit.

Exxon’s attacks on shareholders are an escalation of its longstanding

strategy of climate denial, disinformation, and delay

For decades, ExxonMobil’s approach to the escalating climate crisis

has been to proceed with business-as-usual while denying and delaying action on climate change. Troves of company documents have revealed

that ExxonMobil spent decades delegitimizing climate science and stymieing climate policy despite knowing about the dangers of burning

fossil fuels.16 These revelations have led

dozens of states, municipalities, and tribal nations to take legal action against ExxonMobil, exposing the company to considerable legal,

political, and reputational risk. While ExxonMobil now acknowledges that anthropogenic climate change is real and driven by fossil fuel

use, CEO Darren Woods continues to deflect responsibility by writing off the objectives of the Paris Agreement, accusing society of “waiting

too long” to reduce emissions, and blaming consumers for not bearing the costs of the energy transition.17

ExxonMobil’s efforts to frustrate shareholder action on climate change appears to be the latest

chapter in this time-tested playbook of climate denial and delay.

Exxon’s attack on shareholder rights is in the service of a flawed

climate strategy that poses company-specific and portfolio-wide risks to investors

By aggressively targeting investors concerned about

climate-related financial risk, ExxonMobil is potentially foreclosing on an urgent and necessary discussion of its climate strategy, which

is gravely misaligned with the objectives of the Paris Agreement:

| · | Demand projections: According to the International Energy Agency’s 2023 World Energy Outlook, global demand for

all fossil fuels will peak before 2030, and the outlook for oil and gas demand out to 2050 is lower than in previous projections.18

This is the case even under the IEA’s slowest transition scenario, the 2.4°C Stated Policies Scenario (STEPS), which reflects

current policy settings and accounts for significantly more long-term fossil fuel demand than the IEA’s 1.7°C Announced Pledges

(APS) or 1.5°C Net Zero Emissions by 2050 (NZE) scenarios.19

Yet ExxonMobil’s long-term demand projections for oil and gas consumption exceed even those modeled

by the 2.4°C STEPS.20 |

16

G. Supran et al, "Assessing ExxonMobil's global warming projections," Science, vol. 379, no. 6628 (2023): https://www.science.org/doi/10.1126/science.abk0063;

Alex Thomson, “Revealed: ExxonMobil’s lobbying war on climate change legislation,” Channel 4 News, June 30, 2021,

https://www.channel4.com/news/revealed-exxonmobils-lobbying-war-on-climate-change-legislation; Christopher Mathews and Collin Eaton, “Inside

Exxon’s Strategy to Downplay Climate Change,” The Wall Street Journal, September 14, 2023, https://www.wsj.com/business/energy-oil/exxon-climate-change-documents-e2e9e6af.

17

Jane Thier, “Exxon Mobil CEO on the ‘dirty secret’ of Net Zero: ‘People who are generating the emissions need

to be aware … and pay the price,’” Fortune, February 27, 2024, https://fortune.com/2024/02/27/exxon-ceo-darren-woods-interview-pay-the-price-for-net-zero/.

18

International Energy Agency, World Energy Outlook 2023, https://iea.blob.core.windows.net/assets/86ede39e-4436-42d7-ba2a-edf61467e070/WorldEnergyOutlook2023.pdf.

19

Ibid.

20

Carbon Tracker, Oil and Gas Company Profile: ExxonMobil, February 2024, https://carbontracker.org/wp-content/uploads/2024/03/CompanyProfile_ExxonMobil_2024-02-27.pdf;

ExxonMobil, ExxonMobil Global Outlook:

Our view to 2050, 2023, https://corporate.exxonmobil.com/what-we-do/energy-supply/global-outlook#Keyinsights.

| · | Target setting: ExxonMobil’s emissions reduction targets do not capture full life-cycle emissions (scope 1, 2, and 3)

and are not set on an absolute basis,21

and thus do not meet the prerequisites to be considered Paris-aligned.22 |

| - | Unlike its peers BP, Shell, and TotalEnergies,23

ExxonMobil refuses to set scope 3 targets over any time frame.24

Scope 3 emissions comprise eighty percent of oil and gas sector emissions.25

According to the Energy Transition Commission’s recent report on the fossil fuel sector, “no serious response to climate

change can focus solely on scope 1 and 2 emissions.”26 |

| - | A Transition Pathway Initiative assessment of ExxonMobil’s medium and long-term targets finds that its company-wide emissions

intensity significantly exceeds the upper boundary of the 2.4°C STEPS scenario through 2050 and beyond.27 |

| · | Production plans: Leading climate experts agree on the need for limited new development of proven reserves to meet constrained

demand scenarios.28 Yet ExxonMobil plans

to increase oil and gas production 13.5 percent from 2022 levels to 4.2 million barrels of oil equivalent per day by 2027.29

To achieve Paris alignment, ExxonMobil would have to reduce its oil and gas output by forty

percent into the 2030s compared with 2022 levels.30 |

21

ExxonMobil, 2024 Advancing Climate Solutions, January 8, 2024, https://corporate.exxonmobil.com/sustainability-and-reports/advancing-climate-solutions/emission-reduction-plans-and-progress.

22

Carbon Tracker, Absolute Impact 2022: Why Oil and Gas Companies Need Credible Plans to Meet Climate Targets, May 2022, https://carbontracker.org/reports/absolute-impact-2022/.

23

Climate Action 100+, Net Zero Company Benchmark, October 2023, https://www.climateaction100.org/wp-content/uploads/2024/01/NZB-Downloadable-Excel-6.xlsx.

24

ExxonMobil, Metrics and data, April 26, 2024, https://corporate.exxonmobil.com/sustainability-and-reports/metrics-and-data#Scope3emissions.

25

CDP, CDP Technical Note: Relevance of Scope 3 Categories by Sector, https://cdn.cdp.net/cdp-production/cms/guidance_docs/pdfs/000/003/504/original/CDP-technical-note-scope-3-relevance-by-sector.pdf.

26

Energy Transition Commission, Fossil Fuels in Transition: Committing to the phase-down of all fossil fuels, November 2023, https://www.energy-transitions.org/wp-content/uploads/2023/11/ETC-Fossil-Fuels-MainReport.pdf.

27

Transition Pathway Initiative, Exxon Mobil, https://www.transitionpathwayinitiative.org/companies/exxon-mobil#management-quality.

28

IEA, World Energy Outlook 2023.

29

This does not include the additional output gained from the acquisition of Pioneer Natural Resources, which will increase production to

5 mmboe/d by 2027. Carbon Tracker, Oil and Gas Company Profile: ExxonMobil; ExxonMobil, Form 10-K, filed February 28, 2024, https://investor.exxonmobil.com/sec-filings/annual-reports/content/0000034088-24-000018/0000034088-24-000018.pdf,

p. 12; ExxonMobil, Corporate Plan Update, December 6, 2023, https://d1io3yog0oux5.cloudfront.net/_2f5d9b33003bc2c09deb06159a006145/exxonmobil/db/2260/22168/presentation/Corporate+Plan+Update+slides_12.06.23.pdf.

30

Carbon Tracker, Oil and Gas Company Profile: ExxonMobil, pp. 7-8. This calculation assumes individual company market shares remain

equal.

| · | Capital expenditures: ExxonMobil plans ~$97.5 billion in total capex between 2024 and 2027 and only $3.3 billion in “Low

Carbon Solutions” capex between 2022 and 2027, suggesting that oil and gas will comprise the vast majority of its medium-term capex.31

If ExxonMobil continues to invest in new projects in line with its bullish outlook on hydrocarbon demand, over fifty percent of its potential

upstream investments may fail to clear expected hurdle rates under the IEA’s moderate 1.7°C APS scenario.32

The recently acquisition of Pioneer Natural Resources is projected to further increase the proportion of potentially uneconomic projects

in ExxonMobil’s portfolio.33 |

| · | Carbon capture: ExxonMobil’s emissions reduction plan overrelies on carbon capture, utilization, and storage (CCUS),

an unproven and uneconomical technology that in the absence of production declines cannot achieve the emissions cuts necessary to limit

warming to 1.5°C.34 |

| · | Executive renumeration: Nearly one-third of its target variable executive pay comprises direct growth metrics such as oil and

gas production, refining throughput, and blue hydrogen output and indirect growth metrics such as profits or cash flows—all of which

increase emissions.35 |

ExxonMobil’s climate strategy poses company-specific

and portfolio-wide risks to investor returns:

| · | Should the energy transition unfold faster than ExxonMobil expects, the company is exposing itself

and its investors to significant transition risk. In the coming decades, the availability of renewable energy sources, reduced

demand for fossil fuels, and increased pressure from civil society, policymakers, and investors to reduce GHG emissions could make new

and existing oil and gas projects vulnerable to oversupply, volatile commodity prices, and lower returns.36

ExxonMobil would face high stranded asset risk as its upstream assets become financially unviable

under a moderate or rapid transition scenario.37 |

31

Ibid.

32

Ibid.

33

Ibid.

34

ExxonMobil has committed only $3.3 billion between 2022 and 2027 to its Low Carbon Solutions segment, which includes CCUS. In contrast,

the IEA finds that $3.7 trillion of annual average investment in CCUS and DAC through to 2050 is needed in order to achieve net zero emissions

by 2050 and limit temperature rise to 1.5C under the STEPS scenario. International Energy Agency, The Oil and Gas Industry in Net Zero

Transitions, November 2023, https://iea.blob.core.windows.net/assets/f065ae5e-94ed-4fcb-8f17-8ceffde8bdd2/TheOilandGasIndustryinNetZeroTransitions.pdf.

35

Carbon Tracker, Crude Intentions II: How oil and gas execs are still incentivized to grow production despite peaking demand, February

2024, https://carbontracker.org/reports/crude-intentions-ii-how-oil-and-gas-execs-are-still-incentivised-to-grow-production-despite-peaking-demand/.

36

Carbon Tracker, Navigating Peak Demand: Strategies for oil and gas companies to respond to the substitution challenge of the energy

transition, November 2023, https://carbontracker.org/reports/navigating-peak-demand/.

37

Carbon Tracker, Oil and Gas Company Profile: ExxonMobil; Gregor Semieniuk et al, “Stranded fossil-fuel assets translate to

major losses for investors in advanced economies,” Nature, vol. 12 (2022): 532-538, https://www.nature.com/articles/s41558-022-01356-y.

| · | Simultaneously, ExxonMobil’s growth-focused upstream strategy contributes to systemic climate

risk, which threatens portfolio-wide returns for long-term diversified investors. The climate crisis poses systemic, unhedgeable,

portfolio-wide risks to long-term and institutional investors with broad market exposure.38

Independent of future emissions, climate change is predicted to inflict $38 trillion in annual macroeconomic damages by 2049.39

Economic impairments at this scale will impact all economies, asset classes, and industries, resulting in lower returns across portfolios

for diversified investors.40 Since the Paris

Agreement, ExxonMobil has been the largest GHG emitter among investor-owned oil and gas firms, and it produces the most oil and gas of

any investor-owned company by a 24 percent margin.41

Its plan to increase oil and gas production while gambling on untested CCUS technology portends a “hot-house” scenario42

that will escalate climate risks, compound macroeconomic losses, and further depress portfolio returns for long-term investors.

|

Exxon’s governance and climate failures warrant votes AGAINST

all director nominees, especially Joseph L. Hooley and Darren W. Woods

ExxonMobil’s poor climate strategy and attempts to undermine shareholder

rights reflect a fundamental failure of board oversight. In particular, ExxonMobil’s lawsuit against

its own shareholders constitutes an “extraordinary circumstance” of governance failure that according to the Institutional

Shareholder Services (ISS) Benchmark Policy would trigger votes against directors.43

These failures warrant votes against the entire

board, but especially against directors Joseph L. Hooley and Darren W. Woods.

| · | The entire ExxonMobil board should be held accountable for poor climate governance. According

to ExxonMobil’s proxy statement, the board as a whole is responsible for reviewing litigation, global energy projections, climate

change mitigation plans, developments in climate science and policy, and long-term strategic plans.44

The IEA has deemed the period between now and 2030 “crucial”

to keeping the 1.5°C goal within reach.45

ExxonMobil’s board has endorsed management’s plan of increased production through 2027, increasing the likelihood the world

transgresses the 1.5°C tipping point and compounding ExxonMobil’s transition risk exposure should the energy transition occur

faster than it expects.46 |

38

University of Cambridge Institute for Sustainability Leadership, Unhedgeable risk: How climate change sentiment impacts investment,

2015. https://www.cisl.cam.ac.uk/system/files/documents/unhedgeable-risk.pdf/

39

Maximilian Kotz et al, “The economic commitment of climate change,” Nature,

vol. 628 (2024), 551–557: https://doi.org/10.1038/s41586-024-07219-0.

40

University of Cambridge Institute for Sustainability Leadership, Unhedgeable risk.

41

Carbon Majors, The Carbon Majors Database Launch Report, April 2024, https://carbonmajors.org/site//data/000/027/Carbon_Majors_Launch_Report.pdf.

42

Network for Greening the Financial System, Scenarios Portal, https://www.ngfs.net/ngfs-scenarios-portal/.

43

Institutional Shareholder Services, United States Proxy Voting Guidelines Benchmark Policy Recommendations, January 2024, https://www.issgovernance.com/file/policy/active/americas/US-Voting-Guidelines.pdf?v=1.

(“Governance Failures: Under extraordinary circumstances, vote against or withhold from directors individually, committee members,

or the entire board, due to: Material failures of governance, stewardship, risk oversight, fiduciary responsibilities at the company.”)

44

ExxonMobil, DEF14A, p. 22.

45

International Energy Agency, Net Zero Roadmap: A Global Pathway to Keep the 1.5C Goal in Reach: 2023 Update, https://iea.blob.core.windows.net/assets/9a698da4-4002-4e53-8ef3-631d8971bf84/NetZeroRoadmap_AGlobalPathwaytoKeepthe1.5CGoalinReach-2023Update.pdf.

46

ExxonMobil, DEF14A, p. 1.

| · | Lead Independent Director and Nominating and Governance Committee Chair Joseph L. Hooley should be

held accountable for ExxonMobil’s undermining of shareholder rights. In allowing ExxonMobil to target and malign its

own investors, Joseph L. Hooley is failing in his role as Lead Independent Director, where one of his duties includes engaging with shareholders.47

ExxonMobil’s Corporate Governance Guidelines explicitly state that director candidates “should be committed to representing

the interests of all shareholders and not just any particular constituency [emphasis added].”48

Yet as Lead Director, Hooley has permitted Exxon to attack shareholders whose perspectives on climate risk management and long-term value

creation differ from those of management and the board. Hooley’s poor oversight of shareholder engagement is particularly glaring

given his prior tenure as Chair and CEO of State Street Corporation, where he oversaw the stewardship of over $4 trillion in capital.49

Indeed, Hooley’s conduct belies the particular expertise he is supposed to bring to the board: According to ExxonMobil, Hooley’s

asset management background is intended to help the board “better understand investors’ perspectives on risk” and ensure

that these perspectives “are incorporated into Board discussions with management on important strategic decisions.”50 |

| · | Chairman and CEO Darren Woods should be held accountable for ExxonMobil’s business strategy,

mismanagement of long-term climate risk, and hostile treatment of shareholders seeking an orderly transition towards a net zero economy.

As CEO, Darren Woods is primarily responsible for executing ExxonMobil’s long-term strategic objectives related to the

energy transition and enterprise-wide initiatives such as risk management.51

As Chairman, Woods provides broad leadership for the board in its consideration of strategy and exercise of fiduciary responsibilities

to shareholders, including the management to strategy and risks.52

In cases where the Chairman and CEO toles are combined, the board chair shares responsibility with the lead independent director for failures

in board oversight. |

47

ExxonMobil, Corporate Governance Guidelines, amended February 22, 2023, https://corporate.exxonmobil.com/corporate-governance/corporate-governance-guidelines-and-additional-policies#CorporateGovernanceGuidelines.

48

ExxonMobil, Corporate Governance Guidelines.

49

ExxonMobil, DEF14A, p. 15.

50

Ibid.

51

Ibid, pp. 52-53.

52

Ibid, p. 23.

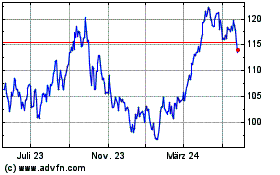

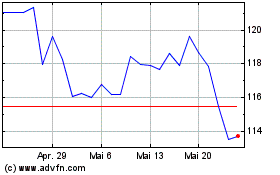

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

Von Mai 2023 bis Mai 2024