A High Honor for Global Trade: Regions Bank Receives 2024 Presidential Award for Excellence in Supporting Exports

15 Mai 2024 - 3:00PM

Business Wire

Regions is one of 10 U.S. entities recognized with the nation’s

highest export service honor.

Regions Bank on Wednesday announced it has received the 2024

President’s “E” Award for Export Service in recognition of the

bank’s work to provide financing solutions for Corporate Banking

clients that collectively increase the nation’s exports.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240515672944/en/

Carson Strickland and Thomas Matthias

with Regions' Global Trade Finance team accepted the 2024

President's "E" Award for Export Service. The award is the nation's

highest honor for export service. (Photo: Business Wire)

Regions received the award at a ceremony Tuesday afternoon at

the U.S. Department of Commerce in Washington, D.C.

“Our focus at Regions Bank is helping business clients maximize

opportunities for growth, and our work with exporters helps

American businesses expand their global reach while building on

their success,” said Ronnie Smith, head of Corporate Banking for

Regions. “Exports strengthen our local economies, create jobs and

keep our communities moving forward. Regions’ Global Trade Finance

team is an important resource for clients to expand their market

reach. The President’s ‘E’ Award is a testament to our

relationship-based approach toward delivering customized insights

from specialized bankers who are committed to client success.”

The “E” Award was created in 1961 by Executive Order and serves

as the highest recognition a person or U.S. entity can receive for

making a significant contribution to the expansion of American

exports. This year, Regions is one of only 10 entities receiving

the “E” Award for Export Service; the “Service” category honors

organizations like Regions who support exporters as they distribute

their products or services to the global marketplace. Also at this

week’s ceremony were 30 individual exporters who were recognized

for their success in global trade.

“Regions Bank has demonstrated a sustained commitment to export

expansion,” said Secretary of Commerce Gina Raimondo in her

congratulatory letter to the bank. “The ‘E’ Awards Committee

recognizes Regions Bank’s near doubling of export financing

provided over the past four years. Regions Bank’s achievements have

undoubtedly contributed to national export expansion efforts that

support the U.S. economy and create American jobs.”

The 2024 award reaffirms Regions’ longtime commitment to serving

clients in the export space. The bank’s first such recognition came

in 1968 when the Merchants National Bank of Mobile, a predecessor

bank to Regions, received the President’s “E” Award for Export

Service.

Regions provides a diverse suite of modern global trade finance

options for clients. Resources include:

- Treasury Management Solutions: These services are

designed to help improve cash flow, strategically manage liquidity,

streamline payables and mitigate unnecessary risk exposure. At the

same time, clients are given a more real-time, cash-centric view of

their balance sheets. In addition, through payment-risk mitigation

solutions, payments can be streamlined for overseas transactions by

using Regions’ connections with banks around the world to collect

and process payments from foreign financial institutions.

- Performance Solutions: These options are designed to

help develop and expand a company’s global customer base and

negotiate international contracts while minimizing financial risks.

Through various standby Letter of Credit services, business owners

can support regular supply contracts with foreign buyers and be

covered for those goods in the event the buyer defaults on

payment.

- Working Capital Solutions: This supports the growth of

international sales by financing the exporting of products while

maintaining working capital availability. Through the Export-Import

Bank (Ex-Im Bank), the official export credit agency of the United

States, the U.S. Small Business Administration’s export financing,

or Trade Credit Insurance, businesses owners have additional

options to access working capital needed to provide their goods

around the world.

- Foreign Business Solutions: These help international

companies receive goods and services from U.S.-based companies by

providing financing for purchases. Through the use of Bankers

Acceptance, foreign companies receive a letter of credit for a

specified time period. Additionally, Ex-Im Bank Guarantee

Medium-Term Financing helps creditworthy international buyers and

facilitates payments to U.S. companies.

“Regions Bank has a strong legacy of supporting vibrant trade,”

said Carson Strickland, head of Regions’ Global Trade Finance

Relationship team. “Over the past 100 years, Regions Bank and its

predecessor banks have continued to build upon the capabilities and

services business clients need to grow their international

presence. Our growth reflects the global demand for U.S. products

and services. As we look to the future, we will continue to provide

the same personalized attention our clients have come to know, and

we look forward to welcoming new clients to Regions’ approach to

international trade.”

Regions has been recognized by other government agencies for its

work to support exports. The U.S. Small Business Administration

recognized Regions in 2019 and 2023 as its Export Lender of the

Year. Additionally, the Ex-Im Bank of the United States named

Regions Bank Lender of the Year in 2020 and honored the company

with the Deal of the Year recognition in 2022.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $155 billion in

assets, is a member of the S&P 500 Index and is one of the

nation’s largest full-service providers of consumer and commercial

banking, wealth management, and mortgage products and services.

Regions serves customers across the South, Midwest and Texas, and

through its subsidiary, Regions Bank, operates approximately 1,250

banking offices and more than 2,000 ATMs. Regions Bank is an Equal

Housing Lender and Member FDIC. Additional information about

Regions and its full line of products and services can be found at

www.regions.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515672944/en/

Jennifer Elmore Regions Bank Regions News Online:

regions.doingmoretoday.com Regions Media Line: (205) 264-4551

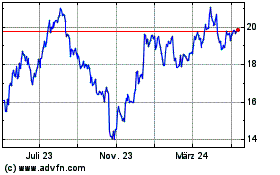

Regions Financial (NYSE:RF)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

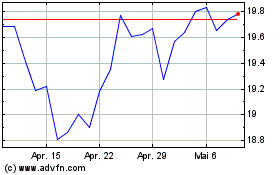

Regions Financial (NYSE:RF)

Historical Stock Chart

Von Nov 2023 bis Nov 2024