Form 8-K - Current report

03 Juni 2024 - 10:59PM

Edgar (US Regulatory)

00014825120001496264falsefalse0001482512hpp:HudsonPacificPropertiesLPMember2024-06-032024-06-0300014825122024-06-032024-06-030001482512us-gaap:CommonStockMember2024-06-032024-06-030001482512us-gaap:CumulativePreferredStockMember2024-06-032024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 3, 2024

_________________________________

Hudson Pacific Properties, Inc.

Hudson Pacific Properties, L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Hudson Pacific Properties, Inc. | | Maryland | | 001-34789 | | 27-1430478 |

| Hudson Pacific Properties, L.P. | | Maryland | | 333-202799-01 | | 80-0579682 |

| | (State or other jurisdiction | | (Commission | | (IRS Employer |

| | of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 11601 Wilshire Blvd., Ninth Floor | | |

| Los Angeles, | California | 90025 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (310) 445-5700

Not Applicable

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Registrant | | Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Hudson Pacific Properties, Inc. | | Common Stock, $0.01 par value | | HPP | | New York Stock Exchange |

| Hudson Pacific Properties, Inc. | | 4.750% Series C Cumulative Redeemable Preferred Stock | | HPP Pr C | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Hudson Pacific Properties, Inc ☐

Hudson Pacific Properties, L.P. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Hudson Pacific Properties, Inc. ☐

Hudson Pacific Properties, L.P. ☐

Item 7.01. Regulation FD Disclosure.

On June 3, 2024, Hudson Pacific Properties, Inc. (the “Company”) published a presentation on its Investor Relations page of its website in connection with NAREIT’s REITweek Conference held June 3-6, 2024. A copy of this presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information being furnished pursuant to Item 7.01 shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| | |

Exhibit No. | | Description |

99.1** | | |

| 104 | | |

_____________

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: June 3, 2024 | | | | |

| | | | |

| | HUDSON PACIFIC PROPERTIES, INC. |

| | |

| | By: | | /s/ Mark Lammas |

| | | | Mark Lammas |

| | | | President |

| | HUDSON PACIFIC PROPERTIES, L.P. |

| | By: | | Hudson Pacific Properties, Inc., Its General Partner |

| | | | |

| | By: | | /s/ Mark Lammas |

| | | | Mark Lammas |

| | | | President |

Investor Update | Nareit REITWeek June 2024

Multiple positive occupier trends pointing to the potential for improved office leasing demand and more limited supply of high-quality product extending to HPP markets Positive U.S. Office Sector Trends Continue 2Note: JLL, 1Q24. Tenant Requirements Increasing +28% (1Q24 v. 1Q23) Gross Leasing Activity Accelerating +14% (1Q24 v. 1Q23) Gross Sublease Additions Slowing -67% (Mar 2024 v. Dec 2022 Peak) Development Pipeline Shrinking -62% (2023 v. 2019) 64% of CEOs Believe Hybrid Schedules Return to Pre-Pandemic Attendance Frequency by 2026 Remote Share of LinkedIn Job Postings Declining -12%pts (Feb 2022 v. Dec 2023) Space Per Employee Reached All-Time Lows -19% (Dec 2023 v. Dec 2010) Placer.ai Data Points to Higher In-Office Attendance than Kastle +10% (As of 1Q24) Above Metrics Trending in Right Direction and/or Poised for Improvement

HPP’s markets are showing signs of stabilizing, such as increased or consistent tenant demand, declining or stable sublease vacancy, and diminishing new supply pipelines Office Leasing Green Shoots in HPP Markets 3 W. Los Angeles San Francisco San Francisco Peninsula Silicon Valley Seattle Vancouver Tenant Demand 3.2M Sq Ft Increased 6.4M Sq Ft Increased to highest level since 1Q20 2.3M Sq Ft Stable 5.6M Sq Ft Increased 30% 1.8M Sq Ft Stable 450K Sq Ft Stable Sublease Availability 2.9M Sq Ft Decreased for 3rd consecutive quarter 8.9M Sq Ft Decreased by 400K sq ft 3.0M Sq Ft Stable 5.6M Sq Ft Decreased by 500K sq ft 3.9M Sq Ft Stable 670K Sq Ft Decreased by 75K sq ft Under Construction as % of Inventory 2.0% Decreased ~130 bps YOY 0% Decreased – no new supply 2.5% Stable 1.0% Decreased ~290 bps YOY 1.7% Decreased ~370 bps YOY 3.7% Decreased ~260 bps YOY Note: CBRE, 1Q24. Positive Market Trends – 1Q24 v. 4Q23 (Unless Otherwise Indicated)

Mayor Breed’s Roadmap to San Francisco’s Future is yielding positive results, with the City showing progress and resiliency contrary to negative headlines San Francisco’s Revitalization Effort Underway 4Note: Sf.gov/roadmap. HPP Ferry Building Highlights +14% Sales Increasing (2023 v. 2022) +1.2M # Visitors Increasing (2023 v. 2022) Public Safety Efforts Delivering New Businesses Launching Tourism Rebounding Shifting Political Landscape Crime reached lowest level in 10 years (excl. 2020 shutdown), including 41% drop in property crime, 23% drop in violent crime (as of Feb 2024) Nearly 700 new businesses registered per month in San Francisco during 4Q23 – 200+ businesses started in downtown last year SFO domestic travel at 97% pre-pandemic levels and hotel occupancy at 80% pre-pandemic levels Board of Supervisors projected to shift to more moderate majority in 2025 elections (expected to focus on funding police, tax / business incentives)

YTD AI companies leased 228K sq ft with another 825K sq ft of requirements currently in the market with Bay Area targeted AI VC funding continuing to fuel growth San Francisco AI Leasing on Pace for Another Strong Year 5Note: CBRE, May 2024. 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 (YTD) Record 1.7M Sq Ft of San Francisco AI Leasing Activity in 2023 Bay Area Received 78% of ~$10B US AI VC Funding in 1Q24 Largest AI VC Funding Rounds 1Q24 – All Bay Area Located Anthropic $350B San Francisco Figure $675M Sunnyvale Lambda $320M San Jose Freenome $254M S. San Francisco Applied Intuition $250M Mountain View Glean $200M Palo Alto Celestial AI $175M Santa Clara BioAge Labs $150M Richmond Sq Ft $0 $5 $10 $15 $20 $25 1H19 2H19 1H20 2H20 1H21 2H21 1H22 2H22 1H23 2H23 1Q24 Bay Area AI Funding US AI Funding San Francisco AI Leasing Activity 54% 59% 66% 50% 61% 53% 57% 39% 50% 30% 78% $ in Billions US v. Bay Area AI VC Funding

0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 Tour Sq Ft Pipeline Sq Ft 1.8M Sq Ft 1.4M Sq Ft HPP is on track for another solid leasing quarter based on signed leases, as well as deals in- leases or LOI, with new deals now comprising the majority of activity HPP 2Q Leasing Activity Remains Strong 6 Note: There can be no assurance that deals will be consummated at expected terms or at all. Square footage represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area and may change over time due to re-measurement or re-leasing. (1) HPP’s pipeline comprised of deals in leases, LOIs or proposals. (2) HPP activity comprised of deals in leases, LOI, proposals and discussions. . 1Q24 Executed Leases Apr-May Executed Leases Deals In-Leases or LOI Total Leases Sq Ft 509K 305K 414K % New Leases 58% 83% 65% Activity on 45% of 1.2M Sq Ft of HPP’s 2024 Expirations2 Lowest Level of Expirations in 3 Years – In Line with Historical Average Only 1 Expiration >100K Sq Ft + 814K sq ft of new / renewal leases signed year-to- date—already ahead of 1H23 total activity + New deals as percent of year-to-date total activity trending well above avg. 41% signed last 8 quarters Even After Apr-May Leasing Current Pipeline Increased 10% to 2.0M Sq Ft v. 1Q241 Sq Ft QTD Leasing Activity Status 1.5M Sq Ft 5-Yr Avg. Pipeline 750K Sq Ft 5-Yr Avg. Tours

57.0% 58.8% 67.8% 75.4% 78.1% 79.2% 81.2% 93.3% 0 10,000 20,000 30,000 40,000 50,000 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Renewal Leases New Leases % Leased At 411 First in Pioneer Square, HPP leveraged spec suites to capture a disproportionate share of leasing from small, high-quality tenants—an ongoing strategy for other assets / markets HPP’s Success in Capturing Small Tenant Demand 7 HPP Signed 91K Sq Ft of Leases Over 8 Quarters Taking 411 First from 57% to 93% Leased % Leased Sq Ft HPP’s Portfolio Comprises 19% of Pioneer Square Market Yet HPP Signed 40% of Leases in that Market Since 2021 +3,630 BPS + 11 new leases with high-quality / credit national tenants (avg. ~6K sq ft, 65% spec suites) + ~12K sq ft of new street-level restaurants / retail at 411 First and adjacent HPP assets 411 First Lease Up 2Q22-1Q24 Note: Percent leased calculated as square footage under commenced and uncommenced leases as of 3/31/24 divided by total square feet. Square footage represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area and may change over time due to re-measurement or re-leasing.

80% Class A as Determined by CBRE 77% Built or Substantially Renovated 2010 or Thereafter 95% Feature Functional Outdoor Space 89% Feature End-of- Trip Facilities with Bike Storage, Showers, Lockers 67% Feature Conference Centers (Multi-Tenant Only) 73% Feature Fitness Centers (Multi-Tenant Only) 95% Feature EV Charging Stations 92% LEED Certified HPP has already invested capital to appropriately reposition most assets with the modern features and amenities essential to accelerate leasing in the current market climate HPP Portfolio Aligns with Tenant Preferences 8 Notes: (1) JLL, March 2024. (2) Data as of 3/31/24 and reflects percentage of in-service office portfolio square footage (owned office properties, excluding repositioning, under construction, future development and held for sale assets) and 100% ownership of consolidated and unconsolidated joint ventures. Square footage represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area and may change over time due to re-measurement or re-leasing. Building age reflects management’s assessment of (re)development or renovation completion for in-service office portfolio. 0.1% 0.5% 0.5% 0.6% 1.4% 1.4% 1.6% 2.2% 2.8% 2.9% 3.5% 3.9% 5.2% -1% 0% 1% 2% 3% 4% 5% 6% Banking or Convenience Store Food Service or Restaurant Fittness Center Conferencing Facility Day Care Food Court or Hall Dry Cleaners Atrium w/ Reception Car Charging Station LEED Certified Fittness Center w/ Shower Facilities Courtyard w/ Outdoor Seating Natural Light Roof Terrace or Sky Terrace Office Rent Premium Associated with Different Amenities1 -0.1% (Based on Class A in Same Submarket) HPP Portfolio Attributes & Amenities2

HPP engaged JLL to leverage its national tiering framework and create custom local-market tiering forecasts for each of HPP’s assets and markets JLL Analysis Underscores HPP’s High-Quality Portfolio 9 Note: JLL analysis reflects HPP in service, repositioning and under construction office portfolio (excludes only future development) and 100% ownership of consolidated and unconsolidated joint ventures as of 3/31/24. Square footage represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area and may change over time due to re-measurement or re-leasing. Better Asset Quality Be tte r L oc at io n Tier 3-4 + Higher Quality Location Total: 17% or 2.5M Sq Ft (75% Tier 3) Tier 1-2 + Higher Quality Location Total: 64% 9.3M Sq Ft (20% Tier 1) Tier 3-4 + Low Quality Location Total: 17% or 2.4M Sq Ft (93% Tier 3) Tier 1-2 + Low Quality Location Total: 3% or 418K Sq Ft (100% Tier 2) 84% of HPP assets are top tier and / or in high-quality locations with potential upside as west coast office market fundamentals recover (See Appendix for further details on JLL framework)

10 Studio-Related Union Negotiations Progressing Productive negotiations continue with AMPTP regarding EO July contract expirations and IATSE/Teamsters have underscored their desire to not extend negotiations past that deadline Membership Contract Expiration Date Negotiations Status2 13 Hollywood locals represent ~50K members and 23 locals outside Los Angeles represent ~20K members—all behind the scenes workers in the entertainment industry July 31, 2024 + Craft-specific agreements reached (Hollywood locals) + Area Standards Agreement (locals outside Los Angeles) negotiations on pause until “later in June” + Basic Agreement (Hollywood locals) negotiations restarted and scheduled to go through June 5 Represents ~6.4K members in motion picture industry in California and New Mexico (e.g. animal handlers, casting, couriers, drivers, mechanics, warehousemen) July 31, 2024 + Teamsters set to begin negotiations on June 10 On June 1, IATSE international president said in a statement, “I’m hopeful that we will soon reach a tentative agreement that members will want to ratify.” Note: Variety, 6/1/24 and IATSE, 6/124. IATSE Teamsters Local 399

8% 9% 9% 10% 11% 14% 19% 22% 25% 29% $1.1 $1.5 $1.9 $1.8 $1.4 $1.9 $2.4 $2.8 $2.8 $3.5 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 0% 5% 10% 15% 20% 25% 30% 35% Utilization Revenue HPP leased or has activity on ~80% of stage square footage, inclusive of recently delivered Sunset Glenoaks, while transportation utilization and revenue continue to improve Studio Business Continuing to Ramp Up 11Note: Data as of May 2024. Square footage represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area and may change over time due to re-measurement or re-leasing. Film & TV Stages Leasing Activity Snapshot Total Leased Coverage* Holds** # Stages Sq Ft # Stages % of Total Sq Ft Wtd. Avg. Term Remaining # Stages % of Total Sq Ft # Stages % of Total Sq Ft 59 908K 34 61% 28 Mos 5 10% 6 9% *Coverage = Uncommenced leases and contracts in negotiation **Holds = Expression of interest / right of first refusal with no contractual obligation Transportation Utilization & Revenue Trends % Utilization Revenue ($ in Millions)+151% (Nov 2023 – Apr 2024) +1,830 BPS (Nov 2023 – Apr 2024) Includes first 2 stages leased at Sunset Glenoaks

Appendix 12

JLL Asset & Location Tiering Framework 13 JLL National Asset Tiering Framework JLL’s original study applied to 2.5B sq ft across top 20 MSAs, A and B Assets, 100K+ sq ft buildings Tier Criteria % of Sq Ft Tier 1 – Lifestyle, Experiential 2015+ Vintage 10% Tier 2 – Highly Competitive 2000-2014 build Pre-2000 Renovated in 2010+ Renovation significantly reimagined asset appropriate for submarket / location 35% Tier 3 – Positionable / Market Appropriate 1990-1999 assets Pre-1990, renovated*1990-2009 Includes positionable assets with ability to move to Tier 2, as well as those already repositioned appropriate for submarket where further investment does not make financial sense 34% Tier 4 – Functionally Challenged Pre-1990 build, not substantially renovated since 21% JLL Custom HPP Location Tiering Framework JLL also worked with HPP to evaluate and tier each of its assets’ locations / submarkets + High Quality / Top Tier Location – Resilient, Strong Recovery Anticipated + High Quality / Recoverable Location – Likely Mid- to Long-Term Recovery + Low Quality / Challenged Location – Meaningful Long-Term Recovery Unclear 45% of JLL’s 2.5B Sq Ft Data Set Qualify as Tier 1-2 Assets (v. 67% for HPP’s Portfolio)

14 Disclaimer Hudson Pacific Properties, Inc. is referred to herein as the “Company,” “Hudson Pacific,” “HPP,” “we,” “us,” or “our.” This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. You should not rely on forward-looking statements as predictions of future events. Forward-looking statements involve numerous risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statement made by us. These risks and uncertainties include, but are not limited to: adverse economic and real estate developments in California, the Pacific Northwest, New York, Western Canada, Greater London or other markets where we invest; general economic conditions; decreased rental rates or increased vacancy rates; defaults on, early terminations of, or non-renewal of leases by tenants; increased interest rates and operating costs; failure to obtain necessary outside financing, including as a result of further downgrades in the credit ratings of our unsecured indebtedness; failure to generate sufficient cash flows to service our outstanding indebtedness and maintain dividend payments; difficulties in identifying properties to acquire and completing acquisitions; risks related to acquisitions generally, including the diversion of management’s attention from ongoing business operations and the impact on customers, tenants, lenders, operating results and business; inability to successfully integrate pending and recent acquisitions, realize the anticipated benefits of acquisitions or capitalize on value creation opportunities; failure to successfully operate acquired properties and operations; failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended; the loss of key personnel; possible adverse changes in laws and regulations; environmental uncertainties; risks related to joint venture investments, including as a result of our lack of control of such investments; the expected operating performance of certain properties and descriptions relating to these expectations, including without limitation, the estimated stabilized NOI and estimated stabilized yields; the ability to successfully complete development and redevelopment projects on schedule and within budgeted amounts; delays or refusals in obtaining all necessary zoning, land use and other required entitlements, governmental permits and authorizations for our development and redevelopment properties; risks related to adverse weather conditions and natural disasters; lack or insufficient amount of insurance; inability to successfully expand into new markets or submarkets; risks associated with property development; changes in the tax laws and uncertainty as to how those changes may be applied; changes in real estate and zoning laws and increases in real property tax rates; an epidemic or pandemic, and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities may implement to address it, which may precipitate or exacerbate one or more of the above-mentioned factors and/or other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period; and other factors affecting the real estate industry generally. These factors are not exhaustive. For a discussion of important risks related to HPP’s business and an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information, see the discussion under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K as well as other risks described in documents we file with the Securities and Exchange Commission, or SEC. You are cautioned that the information contained herein speaks only as of the date hereof and HPP assumes no obligation to update any forward-looking information, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures This document also includes non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with GAAP. In addition, quantitative reconciliations of the differences between the most directly comparable GAAP and non-GAAP financial measures shown are also provided within this presentation (other than forward looking information). Definitions of these non-GAAP financial measures, along with that of HPP’s Share of certain of these measures, can be found in the definitions section of this document. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

HudsonPacificProperties.com

v3.24.1.1.u2

Cover

|

Jun. 03, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 03, 2024

|

| Entity Registrant Name |

Hudson Pacific Properties, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34789

|

| Entity Tax Identification Number |

27-1430478

|

| Entity Address, Address Line One |

11601 Wilshire Blvd., Ninth Floor

|

| Entity Address, City or Town |

Los Angeles,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90025

|

| City Area Code |

310

|

| Local Phone Number |

445-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001482512

|

| Amendment Flag |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of each class |

Common Stock, $0.01 par value

|

| Trading Symbol |

HPP

|

| Security Exchange Name |

NYSE

|

| Cumulative Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of each class |

4.750% Series C Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

HPP Pr C

|

| Security Exchange Name |

NYSE

|

| Hudson Pacific Partners L.P. |

|

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 03, 2024

|

| Entity Registrant Name |

Hudson Pacific Properties, L.P.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

333-202799-01

|

| Entity Tax Identification Number |

80-0579682

|

| Entity Address, Address Line One |

11601 Wilshire Blvd., Ninth Floor

|

| Entity Address, City or Town |

Los Angeles,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90025

|

| City Area Code |

310

|

| Local Phone Number |

445-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001496264

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CumulativePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=hpp_HudsonPacificPropertiesLPMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

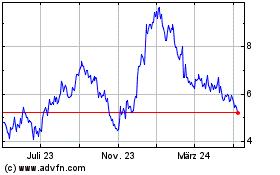

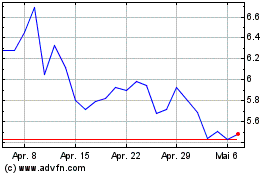

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

Von Jun 2023 bis Jun 2024