SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

NOTICE TO THE MARKET

São Paulo, December

4, 2023 – Braskem S.A. ("Braskem" or "Company") (Ticker B3: BRKM3, BRKM5 and BRKM6; NYSE: BAK; LATIBEX:

XBRK), in relation to the geological event in Alagoas and the information recently released in the media, it is hereby informing its shareholders

and the market what follows.

Braskem's rock salt extraction

activities in Alagoas were terminated in May 2019, as previously disclosed to the market, and the Company, since then, has been adopting

measures to definitively close the salt wells (“Cavities”), according to the plan and timeline presented to the authorities,

and approved by the National Mining Agency (“Definitive Closure Plan”).

The actions of the Definitive

Closure Plan for the 35 Cavities have already reached 70% progress, and completion is scheduled for mid-2025, as detailed below:

(i) 9 Cavities

were recommended to be filled with sand. Of these, 5 have already been filled, 3 have filling work in progress, and 1 is already pressurized,

indicating that filling is no longer necessary;

(ii) 5 Cavities

had their self-filling status confirmed; and

(iii) 21 Cavities

are being plugged and/or monitored, and in 7 of them, the work has already been completed.

Additionally, in the context

of preventive soil monitoring that has been carried out since 2019, microseisms and atypical soil movements were recently recorded concentrated

at the Cavity 18 location, with Braskem preventively halting its well filling activities in the area, as well as its activities preparatory

to the beginning of filling Cavity 18.

It is worth noting that

the process of preventive eviction of the area began in December 2019 and that the risk area on the map defined by the Civil Defense of

Maceió is completely unoccupied. The protection area in the Mutange neighborhood, where Cavity 18 is located, was already unoccupied,

with no person residing in that area, since April 2020.

Current monitoring data

demonstrates that the soil movement condition continues to be concentrated in the Cavity 18 area. All data is being shared in real-time

with the authorities, with whom the Company has been working in collaboration, providing all information.

The Company remains mobilized

and continuously monitors the situation with the competent authorities and will keep the market informed of any relevant developments

on the matter.

For more information,

contact Braskem’s Investor Relations Department by calling +55 (11) 3576-9531 or emailing braskem-ri@braskem.com.br.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: December 4, 2023

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

Notice to the Market may contain forward-looking statements. These statements are not historical facts, but rather are based on the current

view and estimates of the Company's management regarding future economic and other circumstances, industry conditions, financial performance

and results, including any potential or projected impact regarding the geological event in Alagoas and related legal procedures on the

Company's business, financial condition and operating results. The words “project,” “believe,” “estimate,”

“expect,” “plan”, “objective” and other similar expressions, when referring to the Company, are used

to identify forward-looking statements. Statements related to the possible outcome of legal and administrative proceedings, implementation

of operational and financing strategies and investment plans, guidance on future operations, the objective of expanding its efforts to

achieve the sustainable macro objectives disclosed by the Company, as well as factors or trends that affect the financial condition, liquidity

or operating results of the Company are examples of forward-looking statements. Such statements reflect the current views of the Company's

management and are subject to various risks and uncertainties, many of which are beyond the Company’s control. There is no

guarantee that the events, trends or expected results will actually occur. The statements are based on various assumptions and factors,

including, but not limited to, general economic and market conditions, industry conditions and operating factors, availability, development

and financial access to new technologies. Any change in these assumptions or factors, including the projected impact from the joint venture

and its development of technologies, from the geological event in Alagoas and related legal procedures and the unprecedented impact

on businesses, employees, service providers, shareholders, investors and other stakeholders of the Company could cause effective results

to differ significantly from current expectations. For a comprehensive description of the risks and other factors that could impact any

forward-looking statements in this document, especially the factors discussed in the sections, see the reports filed with the Brazilian

Securities and Exchange Commission (CVM). This Notice to the Market does not constitute any offer of securities for sale in Brazil. No

securities may be offered or sold in Brazil without being registered or exempted from registration, and any public offer of securities

carried out in Brazil must be made through a prospectus, which would be made available by Braskem and contain detailed information on

Braskem and its management, as well as its financial statements.

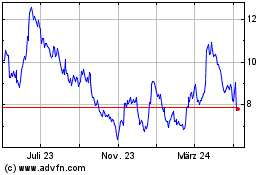

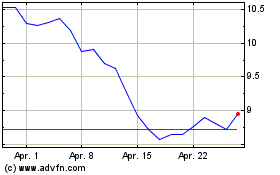

Braskem (NYSE:BAK)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Braskem (NYSE:BAK)

Historical Stock Chart

Von Mai 2023 bis Mai 2024