Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 November 2023 - 11:00PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2023

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

NOTICE ON RELATED-PARTY TRANSACTIONS

São Paulo, November 29, 2023

- Braskem S.A. (“Braskem”), in compliance with article 33, XXXII of CVM Resolution 80/2022, hereby informs its shareholders

and the market in general of the following transaction between related parties:

| Parties |

Braskem, Atvos Participações S/A (“Atvos”) and Usina Conquista do Pontal S.A. (“UCP”) |

| Relationship with the issuer |

Related to Braskem, on the date of approval of the contract. |

| Purpose |

Contract for the purchase of ethanol by Braskem, for the Q2-RS unit, from the Conquista do Pontal-SP plant. |

| Key terms and conditions |

Purchase of 4,000 m³/month of hydrated

ethanol with flexibility of 10% of the monthly volume for the period of 7 months, from November 23 to May 24 (inclusive), totaling a volume

of 28,000 m³ and the total estimated value of the agreement of up to R$110,000,000.00. There is flexibility of ±10% in the

monthly volume, according to Braskem's request. The price will be calculated monthly based on the ESALQ-SP index for Hydrated Ethanol/Fuel.

The payment will be made up to 90 days from the date of invoicing.

The agreement may be terminated in the event

of (a) bankruptcy, (b) a change in Braskem's shareholders, or a corporate operation that affects Braskem's corporate composition and the

execution of the Agreement without the prior express consent of the other party, (c) if any partner or administrator of either party is

convicted of a felony or misdemeanor, or if a party is involved in conduct that may compromise the reputation of the other Party, (d)

suspension, cancellation or revocation of any license necessary for the execution of the agreement by UCP, (e) failure to comply with

any obligations that are not remedied within 15 (fifteen) days from receipt of written notice by the offending party, (f) finding of untrue

statements; and/or (g) without just cause upon 60 (sixty) days' prior notice and payment of a compensatory penalty. |

| Date of signing of the Amendment |

November 21, 2023 |

1

| Any participation by the counterparty, its partners, or managers in the issuer’s decision-making process or in the negotiation of the transaction as representatives of the issuer |

The counterparty and its partners and managers have not participated in Braskem’s decision process or in the negotiations of the mentioned agreements. |

| Detailed justification of the reasons why the management of the issuer believes the transaction was carried out on an arm’s length basis or involves adequate compensatory payment |

The issuer requested proposals from Braskem's current suppliers and from other suppliers, and Atvos submitted the most competitive proposal, with the most competitive additional volume price and, in some cases, a price lower than that provided for in some current agreements. In addition, in the comparison with new suppliers, the proposal was more competitive not only because of the logistical and financial aspects, but also because it was more in line with Braskem's required compliance and sustainability standards. |

2

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: November 29, 2023

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates

of future economic and other circumstances, industry conditions, company performance and financial results, including any potential

or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial

condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and

financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our

financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the

current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control.

There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions

and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such

assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the

unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders,

could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the

year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each

of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact

any forward-looking statements in this presentation.

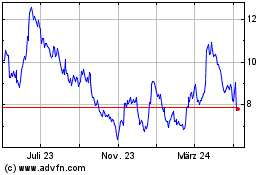

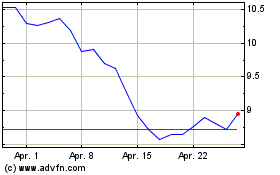

Braskem (NYSE:BAK)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Braskem (NYSE:BAK)

Historical Stock Chart

Von Mai 2023 bis Mai 2024