Valley National Bancorp

(

NASDAQ:VLY), the holding company for Valley

National Bank, today reported net income for the fourth quarter

2023 of $71.6 million, or $0.13 per diluted common share, as

compared to the fourth quarter 2022 net income of $177.6 million,

or $0.34 per diluted common share, and net income of $141.3

million, or $0.27 per diluted common share, for the third quarter

2023. Excluding all non-core items, our adjusted net income (a

non-GAAP measure) was $116.3 million, or $0.22 per diluted common

share, for the fourth quarter 2023, $182.9 million, or $0.35 per

diluted common share, for the fourth quarter 2022, and $136.4

million, or $0.26 per diluted common share, for the third quarter

2023. See further details below, including a reconciliation of our

adjusted net income in the "Consolidated Financial Highlights"

tables.

Key Financial Highlights for the Fourth

Quarter 2023:

- Loan

Portfolio: Loan growth in most categories remained at

modest levels during the fourth quarter 2023 due to the ongoing

impact of elevated market interest rates and other factors. Total

loans increased $112.8 million, or 1.0 percent on an annualized

basis, to $50.2 billion at December 31, 2023 from

September 30, 2023, mainly as a result of well-controlled

organic loan growth in the commercial real estate and consumer

loan categories. Annualized loan growth totaled 7.0 percent for the

year ended December 31, 2023. See the "Loans" section below

for more details.

-

Allowance and Provision for Credit Losses for

Loans: The allowance for credit losses for loans totaled

$465.6 million and $462.3 million at December 31, 2023 and

September 30, 2023, respectively, representing 0.93 percent

and 0.92 percent of total loans at each respective date. During the

fourth quarter 2023, the provision for credit losses for loans was

$20.7 million as compared to $9.1 million and $7.3 million for the

third quarter 2023 and fourth quarter 2022, respectively. See the

"Credit Quality" section below for more details.

- Credit

Quality: Net loan charge-offs totaled $17.5 million for

the fourth quarter 2023 as compared to $5.5 million and $22.4

million for the third quarter 2023 and fourth quarter 2022,

respectively. The loan charge-offs in the fourth quarter 2023 were

primarily due to partial charge-offs of certain non-performing loan

relationships in the commercial loan categories. Total accruing

past due loans increased $12.1 million to $91.6 million, or 0.18

percent of total loans, at December 31, 2023 as compared to

$79.5 million, or 0.16 percent of total loans, at

September 30, 2023. Non-accrual loans represented 0.58 percent

and 0.52 percent of total loans at December 31, 2023 and

September 30, 2023, respectively. See the "Credit Quality"

section below for more details.

-

Deposits: Total deposits

decreased $642.5 million to $49.2 billion at December 31, 2023

as compared to $49.9 billion at September 30, 2023. During the

fourth quarter 2023, a $2.4 billion reduction in indirect customer

time deposits was partially offset by $1.7 billion of direct

customer deposit inflows across the franchise. See the "Deposits"

section below for more details.

- Net

Interest Income and Margin: Net interest income on a tax

equivalent basis of $398.6 million for the fourth quarter 2023

decreased $15.1 million and $68.7 million as compared to the third

quarter 2023 and fourth quarter 2022, respectively. Our net

interest margin on a tax equivalent basis decreased by 9 basis

points to 2.82 percent in the fourth quarter 2023 as compared to

2.91 percent for the third quarter 2023. The decline in both net

interest income and margin as compared to the linked third quarter

reflects the ongoing repricing of our interest bearing deposits,

net of a 7 basis point increase in the yield of average interest

earnings assets for the fourth quarter 2023. See the "Net Interest

Income and Margin" section below for more details.

-

Non-Interest Income: Non-interest income decreased

$6.0 million to $52.7 million for the fourth quarter 2023 as

compared to the third quarter 2023 mainly due to a $6.8 million

decrease in net gains on sales of assets (primarily caused by the

net gain on sale of non-branch offices during the third quarter

2023).

-

Non-Interest Expense: Non-interest expense

increased $73.3 million to $340.4 million for the fourth quarter

2023 as compared to the third quarter 2023 largely due to non-core

charges of $50.3 million and $10.0 million related to the FDIC

special assessment and the termination of certain technology

contracts, respectively, during the fourth quarter 2023.

Professional and legal fees increased $8.1 million as compared to

the third quarter 2023 due, in part, to elevated consulting

expenses related to our new core banking system implemented in

early October 2023, as well as additional non-core legal reserves

and settlement charges totaling a combined $3.5 million during the

fourth quarter 2023.

- Income

Tax Expense: Our effective tax rate was 19.6 percent for

the fourth quarter 2023 as compared to 27.5 percent for the third

quarter 2023. The decrease was mostly due to an increase in tax

credits caused by additional tax credit investments during the

fourth quarter 2023.

-

Efficiency Ratio: Our efficiency ratio was 60.70

percent for the fourth quarter 2023 as compared to 56.72 percent

and 49.30 percent for the third quarter 2023 and fourth quarter

2022, respectively. See the "Consolidated Financial Highlights"

tables below for additional information regarding our non-GAAP

measures.

-

Performance Ratios: Annualized return on average

assets (ROA), shareholders’ equity (ROE), and tangible ROE were

0.47 percent, 4.31 percent, and 6.21 percent for the fourth quarter

2023, respectively. Annualized ROA, ROE, and tangible ROE, adjusted

for non-core items, were 0.76 percent, 7.01 percent, and 10.10

percent for the fourth quarter 2023, respectively. See the

"Consolidated Financial Highlights" tables below for additional

information regarding our non-GAAP measures.

In January 2024, we entered an agreement to sell

our commercial premium finance lending business and a significant

portion of its outstanding loan portfolio. This line of business

represented $274.7 million, or 0.55 percent of our total loans

outstanding at December 31, 2023. Actual loans to be sold as part

of this transaction will be identified shortly before the close

date. Loans retained from this line of business are expected to

mostly run-off at their normal maturity dates over the next 12

months. The pending transaction is expected to close during the

first quarter 2024 and is not anticipated to be material to our

operations or financial statements.

Ira Robbins, CEO, commented, "The year of 2023

presented significant challenges for most of the banking industry

and Valley. That said, I am pleased with our ability to respond to

the challenges early in the year, and find opportunities to enhance

our funding and capital position as the year progressed. This,

along with our asset quality, is a testament to our dedicated

associates and diversified business model."

Mr. Robbins continued, "As we look forward to

2024, we will continue our efforts to build the value of our

franchise with a focus on our key strategic priorities, including

further diversifying our loan portfolio, enhancing our core funding

base, and lastly improving our non-interest income sources. We

believe that these initiatives, and a continued emphasis on

providing premier relationship banking services, will further

differentiate Valley as a leading regional bank."

Net Interest Income and Margin

Net interest income on a tax equivalent basis

totaling $398.6 million for the fourth quarter 2023 decreased $15.1

million and $68.7 million as compared to the third quarter 2023 and

fourth quarter 2022, respectively. The decrease as compared to the

third quarter 2023 was mainly due to increased interest rates on

most interest bearing deposit products, partially offset by higher

loan yields and a decline in average time deposit balances. As a

result of the higher cost of deposits, total interest expense

increased $20.3 million to $420.9 million for the fourth quarter

2023 as compared to the third quarter 2023. Interest income on a

tax equivalent basis increased $5.2 million to $819.5 million for

the fourth quarter 2023 as compared to the third quarter 2023. The

increase in the fourth quarter 2023 was mostly due to higher yields

on both new originations and adjustable rate loans in our

portfolio, as well as higher yields on investments, partially

offset by a decline in average interest bearing deposits with banks

as overnight excess cash liquidity was reduced as compared to the

third quarter 2023.

Net interest margin on a tax equivalent basis of

2.82 percent for the fourth quarter 2023 decreased 9 basis points

and 75 basis points from 2.91 percent and 3.57 percent,

respectively, for the third quarter 2023 and fourth quarter 2022.

The decrease as compared to the third quarter 2023 was largely

driven by higher interest rates on interest bearing deposits,

partially offset by an increase in the yield on average interest

earning assets. Our cost of total average deposits was 3.13 percent

for the fourth quarter 2023 as compared to 2.94 percent for the

third quarter 2023. The overall cost of average interest-bearing

liabilities increased by 21 basis points to 4.13 percent for the

fourth quarter 2023 as compared to the linked third quarter 2023

primarily driven by the continued rise in market interest rates on

deposits. The yield on average interest earning assets increased by

7 basis points to 5.80 basis points on a linked quarter basis

largely due to the increased yield of the loan portfolio. The yield

on average loans increased to 6.10 percent for the fourth quarter

2023 from 6.03 percent for the third quarter 2023 mostly due to the

higher level of market interest rates on new originations and

adjustable rate loans.

Loans, Deposits and Other Borrowings

Loans. Total loans modestly

increased to approximately $112.8 million to $50.2 billion at

December 31, 2023 from September 30, 2023 mainly due to

well-controlled organic loan growth in the commercial real estate

and consumer loan categories. Total commercial real estate

(including construction) loans increased $95.7 million or 1.2

percent on an annualized basis during the fourth quarter 2023.

Automobile loans increased by $34.4 million, or 8.7 percent on an

annualized basis during the fourth quarter 2023 partly due to an

uptick in demand for commercial vehicle financing. At

December 31, 2023, the residential mortgage loan portfolio

totaled $5.6 billion and remained relatively unchanged as compared

to September 30, 2023. During the fourth quarter 2023, we sold

$49.9 million of residential mortgage loans originated for sale as

compared to $80.8 million in the third quarter 2023.

Deposits. Total deposits

decreased $642.5 million to approximately $49.2 billion at

December 31, 2023 from September 30, 2023 mainly due to a

decline of $1.9 billion in time deposits, partially offset by a

$1.4 billion increase in savings, NOW and money market deposits.

The decrease in time deposits was largely due to maturities of

indirect customer time deposits, which were partially offset by the

origination of new direct time deposits. The increase in savings,

NOW and money market deposits was mostly broad-based, reflecting

strong customer inflows from both our physical branch and online

delivery channels, as well as our niche deposit businesses.

Non-interest bearing balances remained relatively stable as

compared to September 30, 2023, as outflows slowed

significantly during the fourth quarter 2023. Non-interest bearing

deposits; savings, NOW, and money market deposits; and time

deposits represented approximately 23 percent, 50 percent and 27

percent of total deposits as of December 31, 2023,

respectively, as compared to 24 percent, 46 percent and 30 percent

of total deposits as of September 30, 2023, respectively.

Other Borrowings. Short-term

borrowings increased $828.0 million to approximately $917.8 million

at December 31, 2023 as compared to September 30, 2023

mainly due to greater utilization of FHLB advances as part of our

liquidity management strategies as of December 31, 2023 and a

corresponding decline in indirect customer time deposits (see the

"Deposits" section above). Long-term borrowings totaled $2.3

billion at December 31, 2023 and remained relatively unchanged

as compared to September 30, 2023.

Credit Quality

Non-Performing Assets (NPAs).

Total NPAs, consisting of non-accrual loans, other real estate

owned (OREO) and other repossessed assets increased $33.1 million

to $293.4 million at December 31, 2023 compared to $260.3

million at September 30, 2023 largely due to higher

non-accrual loan balances within commercial loans categories.

Non-accrual commercial real estate and commercial and industrial

loans increased $16.4 million and $12.3 million, respectively, as

compared to September 30, 2023. These increases were mostly

driven by a few new non-performing loan relationships, partially

offset by full repayments of two non-accrual commercial real estate

loans totaling $12.7 million during the fourth quarter 2023.

Non-accrual loans represented 0.58 percent of total loans at

December 31, 2023 as compared to 0.52 percent of total loans

at September 30, 2023. Within non-accrual commercial real

estate loans at December 31, 2023, one loan totaling $9.1

million, net of partial charge-offs of $1.5 million during the

fourth quarter 2023, was paid off in early January 2024.

Accruing Past Due Loans. Total

accruing past due loans (i.e., loans past due 30 days or more and

still accruing interest) increased $12.1 million to $91.6 million,

or 0.18 percent of total loans, at December 31, 2023 as

compared to $79.5 million, or 0.16 percent of total loans, at

September 30, 2023. Loans 30 to 59 days past due increased

$11.8 million to $59.2 million at December 31, 2023 as

compared to September 30, 2023 largely due to higher

residential mortgage delinquencies, partially offset by declines in

commercial real estate and commercial and industrial loans within

this early stage delinquency category. Loans 90 days or more past

due totaled $13.1 million at December 31, 2023 as compared to

$12.4 million at September 30, 2023. All loans 90 days or more

past due and still accruing interest are well-secured and in the

process of collection.

Allowance for Credit Losses for Loans

and Unfunded Commitments. The following table summarizes

the allocation of the allowance for credit losses to loan

categories and the allocation as a percentage of each loan category

at December 31, 2023, September 30, 2023, and

December 31, 2022:

| |

|

December 31, 2023 |

|

September 30, 2023 |

|

December 31, 2022 |

| |

|

|

|

Allocation |

|

|

|

Allocation |

|

|

|

Allocation |

| |

|

|

|

as a % of |

|

|

|

as a % of |

|

|

|

as a % of |

| |

|

Allowance |

|

Loan |

|

Allowance |

|

Loan |

|

Allowance |

|

Loan |

| |

|

Allocation |

|

Category |

|

Allocation |

|

Category |

|

Allocation |

|

Category |

| |

|

($ in thousands) |

| Loan

Category: |

|

|

|

|

|

|

|

|

|

|

|

| Commercial and

industrial loans |

$ |

133,359 |

|

1.44 |

% |

|

$ |

133,988 |

|

1.44 |

% |

|

$ |

139,941 |

|

1.59 |

% |

| Commercial real

estate loans: |

|

|

|

|

|

|

|

|

|

|

|

| |

Commercial real estate |

|

194,820 |

|

0.69 |

|

|

|

191,562 |

|

0.68 |

|

|

|

200,421 |

|

0.78 |

|

| |

Construction |

|

54,778 |

|

1.47 |

|

|

|

53,485 |

|

1.40 |

|

|

|

58,987 |

|

1.59 |

|

| Total commercial

real estate loans |

|

249,598 |

|

0.78 |

|

|

|

245,047 |

|

0.77 |

|

|

|

259,408 |

|

0.88 |

|

| Residential

mortgage loans |

|

42,957 |

|

0.77 |

|

|

|

44,621 |

|

0.80 |

|

|

|

39,020 |

|

0.73 |

|

| Consumer

loans: |

|

|

|

|

|

|

|

|

|

|

|

| |

Home equity |

|

3,429 |

|

0.61 |

|

|

|

3,689 |

|

0.67 |

|

|

|

4,333 |

|

0.86 |

|

| |

Auto and other consumer |

|

16,737 |

|

0.58 |

|

|

|

14,830 |

|

0.52 |

|

|

|

15,953 |

|

0.57 |

|

| Total consumer

loans |

|

20,166 |

|

0.59 |

|

|

|

18,519 |

|

0.55 |

|

|

|

20,286 |

|

0.61 |

|

| Allowance for loan

losses |

|

446,080 |

|

0.89 |

|

|

|

442,175 |

|

0.88 |

|

|

|

458,655 |

|

0.98 |

|

| Allowance for

unfunded credit commitments |

|

19,470 |

|

|

|

|

20,170 |

|

|

|

|

24,600 |

|

|

| Total allowance

for credit losses for loans |

$ |

465,550 |

|

|

|

$ |

462,345 |

|

|

|

$ |

483,255 |

|

|

| Allowance for

credit losses for |

|

|

|

|

|

|

|

|

|

|

|

|

loans as a % loans |

|

|

0.93 |

% |

|

|

|

0.92 |

% |

|

|

|

1.03 |

% |

Our loan portfolio, totaling $50.2 billion at

December 31, 2023, had net loan charge-offs totaling $17.5

million for the fourth quarter 2023 as compared to $5.5 million and

$22.4 million for the third quarter 2023 and the fourth quarter

2022, respectively. Gross charge-offs totaled $22.6 million for the

fourth quarter 2023 and largely consisted of partial loan

charge-offs in the commercial loan categories, including

approximately $4.7 million of gross loan charge-offs related to our

premium finance lending business expected to be sold during the

first quarter 2024.

The allowance for credit losses for loans,

comprised of our allowance for loan losses and unfunded credit

commitments, as a percentage of total loans was 0.93 percent at

December 31, 2023, 0.92 percent at September 30, 2023 and

1.03 percent at December 31, 2022. During the fourth quarter

2023, the provision for credit losses for loans totaled $20.7

million as compared to $9.1 million for the third quarter 2023 and

$7.3 million for the fourth quarter 2022. The provision for credit

losses for the fourth quarter 2023 reflects, among other factors,

an increase in quantitative reserves largely related to classified

loans within the commercial portfolios and higher specific reserves

associated with collateral dependent loans, partially offset by

lower qualitative and economic forecast reserves at

December 31, 2023.

Capital Adequacy

Valley's regulatory capital ratios continue to

reflect its well-capitalized position. Valley's total risk-based

capital, Tier 1 capital, common equity Tier 1 capital, and Tier 1

leverage capital ratios were 11.76 percent, 9.72 percent, 9.29

percent, and 8.16 percent, respectively, at December 31,

2023.

Investor Conference Call

Valley will host a conference call with

investors and the financial community at 11:00 A.M. Eastern

Standard Time, today to discuss the fourth quarter 2023 earnings

and related matters. Interested parties should pre-register using

this link: https://register.vevent.com/register to receive the

dial-in number and a personal PIN, which are required to access the

conference call. The teleconference will also be webcast live:

https://edge.media-server.com/ and archived on Valley’s website

through February 29, 2024.

About Valley

As the principal subsidiary of Valley National

Bancorp, Valley National Bank is a regional bank with approximately

$61 billion in assets. Valley is committed to giving people and

businesses the power to succeed. Valley operates many convenient

branch locations and commercial banking offices across New Jersey,

New York, Florida, Alabama, California, and Illinois, and is

committed to providing the most convenient service, the latest

innovations and an experienced and knowledgeable team dedicated to

meeting customer needs. Helping communities grow and prosper is the

heart of Valley’s corporate citizenship philosophy. To learn more

about Valley, go to www.valley.com or call our Customer Care Center

at 800-522-4100.

Forward Looking Statements

The foregoing contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are not historical facts and

include expressions about management’s confidence and strategies

and management’s expectations about our business, new and existing

programs and products, acquisitions, relationships, opportunities,

taxation, technology, market conditions and economic expectations.

These statements may be identified by such forward-looking

terminology as “intend,” “should,” “expect,” “believe,” “view,”

“opportunity,” “allow,” “continues,” “reflects,” “typically,”

“usually,” “anticipate,” “may,” “estimate,” “outlook,” “project” or

similar statements or variations of such terms. Such

forward-looking statements involve certain risks and uncertainties.

Actual results may differ materially from such forward-looking

statements. Factors that may cause actual results to differ

materially from those contemplated by such forward-looking

statements include, but are not limited to:

- the impact of

monetary and fiscal policies of the federal government and its

agencies, including in response to higher inflation, which could

have a material adverse effect on our clients, as well as our

business, our employees, and our ability to provide services to our

customers;

- the impact of a

potential U.S. Government shutdown, default by the U.S. government

on its debt obligations, or related credit-rating downgrades, on

economic activity in the markets in which we operate and, in

general, on levels of end market demand in the economy;

- the impact of

unfavorable macroeconomic conditions or downturns, instability or

volatility in financial markets, unanticipated loan delinquencies,

loss of collateral, decreased service revenues, increased business

disruptions or failures, reductions in employment, and other

potential negative effects on our business, employees or clients

caused by factors outside of our control, such as geopolitical

instabilities or events (including the Israel-Hamas war); natural

and other disasters (including severe weather events); health

emergencies; acts of terrorism or other external events;

- risks associated

with our acquisition of Bank Leumi Le-Israel Corporation (Bank

Leumi USA), including (i) the inability to realize expected cost

savings and synergies from the acquisition in the amounts or

timeframe anticipated and (ii) greater than expected costs or

difficulties relating to integration as part of Valley's new core

banking system implemented in the fourth quarter 2023;

- the impact of

potential instability within the U.S. financial sector in the

aftermath of the banking failures in 2023, including the

possibility of a run on deposits by a coordinated deposit base, and

the impact of the actual or perceived soundness, or concerns about

the creditworthiness of other financial institutions, including any

resulting disruption within the financial markets, increased

expenses, including FDIC insurance premiums, or adverse impact on

our stock price, deposits or our ability to borrow or raise

capital;

- the impact of

negative public opinion regarding Valley or banks in general that

damages our reputation and adversely impacts business and

revenues;

- the loss of or

decrease in lower-cost funding sources within our deposit

base;

- damage verdicts

or settlements or restrictions related to existing or potential

class action litigation or individual litigation arising from

claims of violations of laws or regulations, contractual claims,

breach of fiduciary responsibility, negligence, fraud,

environmental laws, patent, trademark or other intellectual

property infringement, misappropriation or other violation,

employment related claims, and other matters;

- a prolonged

downturn in the economy, as well as an unexpected decline in

commercial real estate values collateralizing a significant portion

of our loan portfolio;

- higher or lower

than expected income tax expense or tax rates, including increases

or decreases resulting from changes in uncertain tax position

liabilities, tax laws, regulations and case law;

- the inability to

grow customer deposits to keep pace with loan growth;

- a material

change in our allowance for credit losses under CECL due to

forecasted economic conditions and/or unexpected credit

deterioration in our loan and investment portfolios;

- the need to

supplement debt or equity capital to maintain or exceed internal

capital thresholds;

- greater than

expected technology related costs due to, among other factors,

prolonged or failed implementations, additional project staffing

and obsolescence caused by continuous and rapid market

innovations;

- cyberattacks,

ransomware attacks, computer viruses, malware or other

cybersecurity incidents that may breach the security of our

websites or other systems or networks to obtain unauthorized access

to personal, confidential, proprietary or sensitive information,

destroy data, disable or degrade service, or sabotage our systems

or networks;

- results of

examinations by the Office of the Comptroller of the Currency

(OCC), the Federal Reserve Bank, the Consumer Financial Protection

Bureau (CFPB) and other regulatory authorities, including the

possibility that any such regulatory authority may, among other

things, require us to increase our allowance for credit losses,

write-down assets, reimburse customers, change the way we do

business, or limit or eliminate certain other banking

activities;

- our inability or

determination not to pay dividends at current levels, or at all,

because of inadequate earnings, regulatory restrictions or

limitations, changes in our capital requirements or a decision to

increase capital by retaining more earnings;

- unanticipated

loan delinquencies, loss of collateral, decreased service revenues,

and other potential negative effects on our business caused by

severe weather, pandemics or other public health crises, acts of

terrorism or other external events; and

- unexpected

significant declines in the loan portfolio due to the lack of

economic expansion, increased competition, large prepayments,

changes in regulatory lending guidance or other factors.

A detailed discussion of factors that could

affect our results is included in our SEC filings, including the

“Risk Factors” section of our Annual Report on Form 10-K for the

year ended December 31, 2022 and in Item 1A of our Quarterly Report

on Form 10-Q for the quarter ended September 30, 2023.

The financial results and disclosures reported

in this release are preliminary. Final 2023 financial results and

other disclosures will be reported in our Annual Report on Form

10-K for the year ended December 31, 2023, and may differ

materially from the results and disclosures in this document due

to, among other things, the completion of final review procedures,

the occurrence of subsequent events, or the discovery of additional

information.

We undertake no duty to update any

forward-looking statement to conform the statement to actual

results or changes in our expectations, except as required by law.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or

achievements.

-Tables to Follow-

SELECTED FINANCIAL DATA

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Years Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

| ($ in thousands, except for

share data) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| FINANCIAL

DATA: |

|

|

|

|

|

|

|

|

|

| Net interest income - FTE

(1) |

$ |

398,581 |

|

|

$ |

413,657 |

|

|

$ |

467,233 |

|

|

$ |

1,670,973 |

|

|

$ |

1,660,468 |

|

| Net interest income |

|

397,275 |

|

|

|

412,418 |

|

|

|

465,819 |

|

|

|

1,665,478 |

|

|

|

1,655,640 |

|

| Non-interest income |

|

52,691 |

|

|

|

58,664 |

|

|

|

52,796 |

|

|

|

225,729 |

|

|

|

206,793 |

|

| Total revenue |

|

449,966 |

|

|

|

471,082 |

|

|

|

518,615 |

|

|

|

1,891,207 |

|

|

|

1,862,433 |

|

| Non-interest expense |

|

340,421 |

|

|

|

267,133 |

|

|

|

266,240 |

|

|

|

1,162,691 |

|

|

|

1,024,949 |

|

| Pre-provision net revenue |

|

109,545 |

|

|

|

203,949 |

|

|

|

252,375 |

|

|

|

728,516 |

|

|

|

837,484 |

|

| Provision for credit

losses |

|

20,580 |

|

|

|

9,117 |

|

|

|

7,239 |

|

|

|

50,184 |

|

|

|

56,817 |

|

| Income tax expense |

|

17,411 |

|

|

|

53,486 |

|

|

|

67,545 |

|

|

|

179,821 |

|

|

|

211,816 |

|

| Net income |

|

71,554 |

|

|

|

141,346 |

|

|

|

177,591 |

|

|

|

498,511 |

|

|

|

568,851 |

|

| Dividends on preferred

stock |

|

4,104 |

|

|

|

4,127 |

|

|

|

3,630 |

|

|

|

16,135 |

|

|

|

13,146 |

|

| Net income available to common

stockholders |

$ |

67,450 |

|

|

$ |

137,219 |

|

|

$ |

173,961 |

|

|

$ |

482,376 |

|

|

$ |

555,705 |

|

| Weighted average

number of common shares outstanding: |

|

Basic |

|

507,683,229 |

|

|

|

507,650,668 |

|

|

|

506,359,704 |

|

|

|

507,532,365 |

|

|

|

485,434,918 |

|

|

Diluted |

|

509,714,526 |

|

|

|

509,256,599 |

|

|

|

509,301,813 |

|

|

|

509,245,768 |

|

|

|

487,817,710 |

|

| Per common share data: |

|

|

|

|

|

|

|

|

|

|

Basic earnings |

$ |

0.13 |

|

|

$ |

0.27 |

|

|

$ |

0.34 |

|

|

$ |

0.95 |

|

|

$ |

1.14 |

|

|

Diluted earnings |

|

0.13 |

|

|

|

0.27 |

|

|

|

0.34 |

|

|

|

0.95 |

|

|

|

1.14 |

|

| Cash dividends declared |

|

0.11 |

|

|

|

0.11 |

|

|

|

0.11 |

|

|

|

0.44 |

|

|

|

0.44 |

|

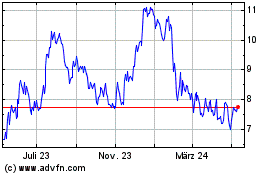

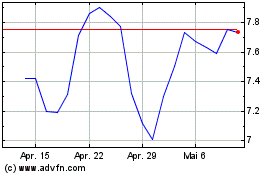

| Closing stock price -

high |

|

11.10 |

|

|

|

10.30 |

|

|

|

12.92 |

|

|

|

12.59 |

|

|

|

15.02 |

|

| Closing stock price - low |

|

7.71 |

|

|

|

7.63 |

|

|

|

10.96 |

|

|

|

6.59 |

|

|

|

10.14 |

|

| FINANCIAL

RATIOS: |

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

2.81 |

% |

|

|

2.90 |

% |

|

|

3.56 |

% |

|

|

2.95 |

% |

|

|

3.44 |

% |

| Net interest margin - FTE

(1) |

|

2.82 |

|

|

|

2.91 |

|

|

|

3.57 |

|

|

|

2.96 |

|

|

|

3.45 |

|

| Annualized return on average

assets |

|

0.47 |

|

|

|

0.92 |

|

|

|

1.25 |

|

|

|

0.82 |

|

|

|

1.09 |

|

| Annualized return on avg.

shareholders' equity |

|

4.31 |

|

|

|

8.56 |

|

|

|

11.23 |

|

|

|

7.60 |

|

|

|

9.50 |

|

| NON-GAAP

FINANCIAL DATA AND RATIOS: (3) |

| Basic earnings per share, as

adjusted |

$ |

0.22 |

|

|

$ |

0.26 |

|

|

$ |

0.35 |

|

|

$ |

1.06 |

|

|

$ |

1.31 |

|

| Diluted earnings per share, as

adjusted |

|

0.22 |

|

|

|

0.26 |

|

|

|

0.35 |

|

|

|

1.06 |

|

|

|

1.31 |

|

| Annualized return on average

assets, as adjusted |

|

0.76 |

% |

|

|

0.89 |

% |

|

|

1.29 |

% |

|

|

0.91 |

% |

|

|

1.25 |

% |

| Annualized return on average

shareholders' equity, as adjusted |

|

7.01 |

|

|

|

8.26 |

|

|

|

11.56 |

|

|

|

8.45 |

|

|

|

10.87 |

|

| Annualized return on avg.

tangible shareholders' equity |

|

6.21 |

% |

|

|

12.39 |

% |

|

|

16.70 |

% |

|

|

11.05 |

% |

|

|

14.08 |

% |

| Annualized return on average

tangible shareholders' equity, as adjusted |

|

10.10 |

|

|

|

11.95 |

|

|

|

17.20 |

|

|

|

12.29 |

|

|

|

16.10 |

|

| Efficiency ratio |

|

60.70 |

|

|

|

56.72 |

|

|

|

49.30 |

|

|

|

56.62 |

|

|

|

50.55 |

|

| |

|

|

|

|

|

|

|

|

|

| AVERAGE BALANCE SHEET

ITEMS: |

|

|

|

|

|

|

|

|

|

| Assets |

$ |

61,113,553 |

|

|

$ |

61,391,688 |

|

|

$ |

56,913,215 |

|

|

$ |

61,065,897 |

|

|

$ |

52,182,310 |

|

| Interest earning assets |

|

56,469,468 |

|

|

|

56,802,565 |

|

|

|

52,405,601 |

|

|

|

56,500,528 |

|

|

|

48,067,381 |

|

| Loans |

|

50,039,429 |

|

|

|

50,019,414 |

|

|

|

46,086,363 |

|

|

|

49,351,861 |

|

|

|

41,930,353 |

|

| Interest bearing

liabilities |

|

40,753,313 |

|

|

|

40,829,078 |

|

|

|

33,596,874 |

|

|

|

40,042,506 |

|

|

|

30,190,267 |

|

| Deposits |

|

49,460,571 |

|

|

|

49,848,446 |

|

|

|

46,234,857 |

|

|

|

48,491,669 |

|

|

|

42,451,465 |

|

| Shareholders' equity |

|

6,639,906 |

|

|

|

6,605,786 |

|

|

|

6,327,970 |

|

|

|

6,558,768 |

|

|

|

5,985,236 |

|

| |

|

|

|

|

|

|

|

|

|

| |

As of |

| BALANCE SHEET

ITEMS: |

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

| (In thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Assets |

$ |

60,934,974 |

|

|

$ |

61,183,352 |

|

|

$ |

61,703,693 |

|

|

$ |

64,309,573 |

|

|

$ |

57,462,749 |

|

| Total loans |

|

50,210,295 |

|

|

|

50,097,519 |

|

|

|

49,877,248 |

|

|

|

48,659,966 |

|

|

|

46,917,200 |

|

| Deposits |

|

49,242,829 |

|

|

|

49,885,314 |

|

|

|

49,619,815 |

|

|

|

47,590,916 |

|

|

|

47,636,914 |

|

| Shareholders' equity |

|

6,701,391 |

|

|

|

6,627,299 |

|

|

|

6,575,184 |

|

|

|

6,511,581 |

|

|

|

6,400,802 |

|

| |

|

|

|

|

|

|

|

|

|

| LOANS: |

|

|

|

|

|

|

|

|

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

| Commercial and industrial |

$ |

9,230,543 |

|

|

$ |

9,274,630 |

|

|

$ |

9,287,309 |

|

|

$ |

9,043,946 |

|

|

$ |

8,804,830 |

|

| Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

28,243,239 |

|

|

|

28,041,050 |

|

|

|

27,793,072 |

|

|

|

27,051,111 |

|

|

|

25,732,033 |

|

|

Construction |

|

3,726,808 |

|

|

|

3,833,269 |

|

|

|

3,815,761 |

|

|

|

3,725,967 |

|

|

|

3,700,835 |

|

|

Total commercial real estate |

|

31,970,047 |

|

|

|

31,874,319 |

|

|

|

31,608,833 |

|

|

|

30,777,078 |

|

|

|

29,432,868 |

|

| Residential mortgage |

|

5,569,010 |

|

|

|

5,562,665 |

|

|

|

5,560,356 |

|

|

|

5,486,280 |

|

|

|

5,364,550 |

|

| Consumer: |

|

|

|

|

|

|

|

|

|

|

Home equity |

|

559,152 |

|

|

|

548,918 |

|

|

|

535,493 |

|

|

|

516,592 |

|

|

|

503,884 |

|

|

Automobile |

|

1,620,389 |

|

|

|

1,585,987 |

|

|

|

1,632,875 |

|

|

|

1,717,141 |

|

|

|

1,746,225 |

|

|

Other consumer |

|

1,261,154 |

|

|

|

1,251,000 |

|

|

|

1,252,382 |

|

|

|

1,118,929 |

|

|

|

1,064,843 |

|

|

Total consumer loans |

|

3,440,695 |

|

|

|

3,385,905 |

|

|

|

3,420,750 |

|

|

|

3,352,662 |

|

|

|

3,314,952 |

|

| Total loans |

$ |

50,210,295 |

|

|

$ |

50,097,519 |

|

|

$ |

49,877,248 |

|

|

$ |

48,659,966 |

|

|

$ |

46,917,200 |

|

| |

|

|

|

|

|

|

|

|

|

| CAPITAL

RATIOS: |

|

|

|

|

|

|

|

|

|

| Book value per common

share |

$ |

12.79 |

|

|

$ |

12.64 |

|

|

$ |

12.54 |

|

|

$ |

12.41 |

|

|

$ |

12.23 |

|

| Tangible book value per common

share (3) |

|

8.79 |

|

|

|

8.63 |

|

|

|

8.51 |

|

|

|

8.36 |

|

|

|

8.15 |

|

| Tangible common equity to

tangible assets (3) |

|

7.58 |

% |

|

|

7.40 |

% |

|

|

7.24 |

% |

|

|

6.82 |

% |

|

|

7.45 |

% |

| Tier 1 leverage capital |

|

8.16 |

|

|

|

8.08 |

|

|

|

7.86 |

|

|

|

7.96 |

|

|

|

8.23 |

|

| Common equity tier 1

capital |

|

9.29 |

|

|

|

9.21 |

|

|

|

9.03 |

|

|

|

9.02 |

|

|

|

9.01 |

|

| Tier 1 risk-based capital |

|

9.72 |

|

|

|

9.64 |

|

|

|

9.47 |

|

|

|

9.46 |

|

|

|

9.46 |

|

| Total risk-based capital |

|

11.76 |

|

|

|

11.68 |

|

|

|

11.52 |

|

|

|

11.58 |

|

|

|

11.63 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Years Ended |

| ALLOWANCE FOR CREDIT

LOSSES: |

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

| ($ in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Allowance for credit

losses for loans |

|

|

|

|

|

|

|

|

|

| Beginning balance |

$ |

462,345 |

|

|

$ |

458,676 |

|

|

$ |

498,408 |

|

|

$ |

483,255 |

|

|

$ |

375,702 |

|

|

Impact of the adoption of ASU No. 2022-02 |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,368 |

) |

|

|

— |

|

|

Allowance for purchased credit deteriorated (PCD) loans, net

(2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

70,319 |

|

| Beginning balance,

adjusted |

|

462,345 |

|

|

|

458,676 |

|

|

|

498,408 |

|

|

|

481,887 |

|

|

|

446,021 |

|

| Loans charged-off: |

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

(10,616 |

) |

|

|

(7,487 |

) |

|

|

(22,106 |

) |

|

|

(48,015 |

) |

|

|

(33,250 |

) |

|

Commercial real estate |

|

(8,814 |

) |

|

|

(255 |

) |

|

|

(388 |

) |

|

|

(11,134 |

) |

|

|

(4,561 |

) |

|

Construction |

|

(1,906 |

) |

|

|

— |

|

|

|

— |

|

|

|

(11,812 |

) |

|

|

— |

|

|

Residential mortgage |

|

(25 |

) |

|

|

(20 |

) |

|

|

(1 |

) |

|

|

(194 |

) |

|

|

(28 |

) |

|

Total consumer |

|

(1,274 |

) |

|

|

(1,156 |

) |

|

|

(1,544 |

) |

|

|

(4,298 |

) |

|

|

(4,057 |

) |

| Total loans charged-off |

|

(22,635 |

) |

|

|

(8,918 |

) |

|

|

(24,039 |

) |

|

|

(75,453 |

) |

|

|

(41,896 |

) |

| Charged-off loans

recovered: |

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

4,655 |

|

|

|

3,043 |

|

|

|

1,069 |

|

|

|

11,270 |

|

|

|

17,081 |

|

|

Commercial real estate |

|

1 |

|

|

|

5 |

|

|

|

13 |

|

|

|

34 |

|

|

|

2,073 |

|

|

Residential mortgage |

|

15 |

|

|

|

30 |

|

|

|

17 |

|

|

|

201 |

|

|

|

711 |

|

|

Total consumer |

|

473 |

|

|

|

362 |

|

|

|

498 |

|

|

|

1,986 |

|

|

|

2,929 |

|

| Total loans recovered |

|

5,144 |

|

|

|

3,440 |

|

|

|

1,597 |

|

|

|

13,491 |

|

|

|

22,794 |

|

| Total net charge-offs |

|

(17,491 |

) |

|

|

(5,478 |

) |

|

|

(22,442 |

) |

|

|

(61,962 |

) |

|

|

(19,102 |

) |

| Provision for credit losses

for loans |

|

20,696 |

|

|

|

9,147 |

|

|

|

7,289 |

|

|

|

45,625 |

|

|

|

56,336 |

|

| Ending balance |

$ |

465,550 |

|

|

$ |

462,345 |

|

|

$ |

483,255 |

|

|

$ |

465,550 |

|

|

$ |

483,255 |

|

|

Components of allowance for credit losses for

loans: |

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

$ |

446,080 |

|

|

$ |

442,175 |

|

|

$ |

458,655 |

|

|

$ |

446,080 |

|

|

$ |

458,655 |

|

|

Allowance for unfunded credit commitments |

|

19,470 |

|

|

|

20,170 |

|

|

|

24,600 |

|

|

|

19,470 |

|

|

|

24,600 |

|

| Allowance for credit losses

for loans |

$ |

465,550 |

|

|

$ |

462,345 |

|

|

$ |

483,255 |

|

|

$ |

465,550 |

|

|

$ |

483,255 |

|

|

Components of provision for credit losses for

loans: |

|

|

|

|

|

|

|

|

|

|

Provision for credit losses for loans |

$ |

21,396 |

|

|

$ |

11,221 |

|

|

$ |

5,353 |

|

|

$ |

50,755 |

|

|

$ |

48,236 |

|

|

(Credit) provision for unfunded credit commitments |

|

(700 |

) |

|

|

(2,074 |

) |

|

|

1,936 |

|

|

|

(5,130 |

) |

|

|

8,100 |

|

| Total provision for credit

losses for loans |

$ |

20,696 |

|

|

$ |

9,147 |

|

|

$ |

7,289 |

|

|

$ |

45,625 |

|

|

$ |

56,336 |

|

| |

|

|

|

|

|

|

|

|

|

| Annualized ratio of total net

charge-offs to average loans |

|

0.14 |

% |

|

|

0.04 |

% |

|

|

0.19 |

% |

|

|

0.13 |

% |

|

|

0.05 |

% |

| Allowance for credit losses as

a % of total loans |

|

0.93 |

% |

|

|

0.92 |

% |

|

|

1.03 |

% |

|

|

0.93 |

% |

|

|

1.03 |

% |

| |

As of |

| ASSET

QUALITY: |

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

|

($ in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Accruing past due loans: |

|

|

|

|

|

|

|

|

|

| 30 to 59 days past due: |

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

$ |

9,307 |

|

|

$ |

10,687 |

|

|

$ |

6,229 |

|

|

$ |

20,716 |

|

|

$ |

11,664 |

|

|

Commercial real estate |

|

3,008 |

|

|

|

8,053 |

|

|

|

3,612 |

|

|

|

13,580 |

|

|

|

6,638 |

|

|

Residential mortgage |

|

26,345 |

|

|

|

13,159 |

|

|

|

15,565 |

|

|

|

12,599 |

|

|

|

16,146 |

|

|

Total consumer |

|

20,554 |

|

|

|

15,509 |

|

|

|

8,431 |

|

|

|

7,845 |

|

|

|

9,087 |

|

| Total 30 to 59 days past

due |

|

59,214 |

|

|

|

47,408 |

|

|

|

33,837 |

|

|

|

54,740 |

|

|

|

43,535 |

|

| 60 to 89 days past due: |

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

5,095 |

|

|

|

5,720 |

|

|

|

7,468 |

|

|

|

24,118 |

|

|

|

12,705 |

|

|

Commercial real estate |

|

1,257 |

|

|

|

2,620 |

|

|

|

— |

|

|

|

— |

|

|

|

3,167 |

|

|

Residential mortgage |

|

8,200 |

|

|

|

9,710 |

|

|

|

1,348 |

|

|

|

2,133 |

|

|

|

3,315 |

|

|

Total consumer |

|

4,715 |

|

|

|

1,720 |

|

|

|

4,126 |

|

|

|

1,519 |

|

|

|

1,579 |

|

| Total 60 to 89 days past

due |

|

19,267 |

|

|

|

19,770 |

|

|

|

12,942 |

|

|

|

27,770 |

|

|

|

20,766 |

|

| 90 or more days past due: |

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

5,579 |

|

|

|

6,629 |

|

|

|

6,599 |

|

|

|

8,927 |

|

|

|

18,392 |

|

|

Commercial real estate |

|

— |

|

|

|

— |

|

|

|

2,242 |

|

|

|

— |

|

|

|

2,292 |

|

|

Construction |

|

3,990 |

|

|

|

3,990 |

|

|

|

3,990 |

|

|

|

6,450 |

|

|

|

3,990 |

|

|

Residential mortgage |

|

2,488 |

|

|

|

1,348 |

|

|

|

1,165 |

|

|

|

1,668 |

|

|

|

1,866 |

|

|

Total consumer |

|

1,088 |

|

|

|

391 |

|

|

|

1,006 |

|

|

|

747 |

|

|

|

47 |

|

| Total 90 or more days past

due |

|

13,145 |

|

|

|

12,358 |

|

|

|

15,002 |

|

|

|

17,792 |

|

|

|

26,587 |

|

| Total accruing past due

loans |

$ |

91,626 |

|

|

$ |

79,536 |

|

|

$ |

61,781 |

|

|

$ |

100,302 |

|

|

$ |

90,888 |

|

| Non-accrual loans: |

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

$ |

99,912 |

|

|

$ |

87,655 |

|

|

$ |

84,449 |

|

|

$ |

78,606 |

|

|

$ |

98,881 |

|

|

Commercial real estate |

|

99,739 |

|

|

|

83,338 |

|

|

|

82,712 |

|

|

|

67,938 |

|

|

|

68,316 |

|

|

Construction |

|

60,851 |

|

|

|

62,788 |

|

|

|

63,043 |

|

|

|

68,649 |

|

|

|

74,230 |

|

|

Residential mortgage |

|

26,986 |

|

|

|

21,614 |

|

|

|

20,819 |

|

|

|

23,483 |

|

|

|

25,160 |

|

|

Total consumer |

|

4,383 |

|

|

|

3,545 |

|

|

|

3,068 |

|

|

|

3,318 |

|

|

|

3,174 |

|

| Total non-accrual loans |

|

291,871 |

|

|

|

258,940 |

|

|

|

254,091 |

|

|

|

241,994 |

|

|

|

269,761 |

|

| Other real estate owned

(OREO) |

|

71 |

|

|

|

71 |

|

|

|

824 |

|

|

|

1,189 |

|

|

|

286 |

|

| Other repossessed assets |

|

1,444 |

|

|

|

1,314 |

|

|

|

1,230 |

|

|

|

1,752 |

|

|

|

1,937 |

|

| Total non-performing

assets |

$ |

293,386 |

|

|

$ |

260,325 |

|

|

$ |

256,145 |

|

|

$ |

244,935 |

|

|

$ |

271,984 |

|

| Total non-accrual loans as a %

of loans |

|

0.58 |

% |

|

|

0.52 |

% |

|

|

0.51 |

% |

|

|

0.50 |

% |

|

|

0.57 |

% |

|

Total accruing past due and non-accrual loans as a % of loans |

|

0.76 |

% |

|

|

0.68 |

% |

|

|

0.63 |

% |

|

|

0.70 |

% |

|

|

0.77 |

% |

|

Allowance for losses on loans as a % of non-accrual loans |

|

152.83 |

% |

|

|

170.76 |

% |

|

|

171.76 |

% |

|

|

180.54 |

% |

|

|

170.02 |

% |

NOTES TO SELECTED FINANCIAL

DATA

| |

|

|

(1 |

) |

Net interest income and net interest margin are presented on a tax

equivalent basis using a 21 percent federal tax rate. Valley

believes that this presentation provides comparability of net

interest income and net interest margin arising from both taxable

and tax-exempt sources and is consistent with industry practice and

SEC rules. |

|

(2 |

) |

Represents the allowance for acquired PCD loans, net of PCD loan

charge-offs totaling $62.4 million in the second quarter 2022. |

|

(3 |

) |

Non-GAAP Reconciliations. This press release

contains certain supplemental financial information, described in

the Notes below, which has been determined by methods other than

U.S. Generally Accepted Accounting Principles ("GAAP") that

management uses in its analysis of Valley's performance. The

Company believes that the non-GAAP financial measures provide

useful supplemental information to both management and investors in

understanding Valley’s underlying operational performance, business

and performance trends, and may facilitate comparisons of our

current and prior performance with the performance of others in the

financial services industry. Management utilizes these measures for

internal planning, forecasting and analysis purposes. Management

believes that Valley’s presentation and discussion of this

supplemental information, together with the accompanying

reconciliations to the GAAP financial measures, also allows

investors to view performance in a manner similar to management.

These non-GAAP financial measures should not be considered in

isolation or as a substitute for or superior to financial measures

calculated in accordance with U.S. GAAP. These non-GAAP financial

measures may also be calculated differently from similar measures

disclosed by other companies. |

Non-GAAP Reconciliations to GAAP

Financial Measures

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Years Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

| ($ in thousands, except for

share data) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Adjusted net income

available to common shareholders (non-GAAP): |

|

|

|

|

|

|

|

|

|

| Net income, as reported

(GAAP) |

$ |

71,554 |

|

|

$ |

141,346 |

|

|

$ |

177,591 |

|

|

$ |

498,511 |

|

|

$ |

568,851 |

|

|

Add: FDIC Special assessment (net of tax)(a) |

|

36,053 |

|

|

|

— |

|

|

|

— |

|

|

|

36,053 |

|

|

|

— |

|

|

Less: Net (gains) losses on available for sale and held to maturity

securities transactions (net of tax)(b) |

|

(629 |

) |

|

|

318 |

|

|

|

5 |

|

|

|

(288 |

) |

|

|

(69 |

) |

|

Add: Restructuring charge (net of tax)(c) |

|

(386 |

) |

|

|

(484 |

) |

|

|

— |

|

|

|

7,145 |

|

|

|

— |

|

|

Add: Provision for credit losses for available for sale securities

(d) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

|

Add: Non-PCD provision for credit losses (net of tax)(e) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

29,282 |

|

|

Add: Merger related expenses (net of tax)(f) |

|

7,168 |

|

|

|

— |

|

|

|

5,285 |

|

|

|

10,130 |

|

|

|

52,388 |

|

|

Less: Net gains on sales of office buildings (net of tax)(g) |

|

— |

|

|

|

(4,817 |

) |

|

|

— |

|

|

|

(4,817 |

) |

|

|

— |

|

|

Add: Litigation reserve (net of tax)(h) |

|

2,537 |

|

|

|

— |

|

|

|

— |

|

|

|

2,537 |

|

|

|

— |

|

| Net income, as adjusted

(non-GAAP) |

$ |

116,297 |

|

|

$ |

136,363 |

|

|

$ |

182,881 |

|

|

$ |

554,271 |

|

|

$ |

650,452 |

|

| Dividends on preferred

stock |

|

4,104 |

|

|

|

4,127 |

|

|

|

3,630 |

|

|

|

16,135 |

|

|

|

13,146 |

|

| Net income available to common

shareholders, as adjusted (non-GAAP) |

$ |

112,193 |

|

|

$ |

132,236 |

|

|

$ |

179,251 |

|

|

$ |

538,136 |

|

|

$ |

637,306 |

|

| _____________ |

|

|

|

|

|

|

|

|

|

|

(a) Included in FDIC insurance assessment. |

|

(b) Included in gains (losses) on securities transactions,

net. |

|

(c) Represents severance (credit adjustments) expense related to

workforce reductions within salary and employee benefits

expense. |

|

(d) Included in provision for credit losses for available for sale

and held to maturity securities (tax disallowed). |

|

(e) Represents provision for credit losses for non-PCD assets and

unfunded credit commitments acquired during the period. |

|

(f) Represents data processing termination costs within technology,

furniture and equipment expense and severance within salary and

employee benefits expense for the 2023 periods. The merger related

expense for the 2022 periods were mainly salary and employee

benefits expense. |

|

(g) Included in net (losses) gains on sale of assets within

non-interest income. |

|

(h) Represents legal reserves and settlement charges included in

professional and legal fees. |

| |

|

|

|

|

|

|

|

|

|

| Adjusted per common

share data (non-GAAP): |

|

|

|

|

|

|

|

|

|

| Net income available to common

shareholders, as adjusted (non-GAAP) |

$ |

112,193 |

|

|

$ |

132,236 |

|

|

$ |

179,251 |

|

|

$ |

538,136 |

|

|

$ |

637,306 |

|

| Average number of shares

outstanding |

|

507,683,229 |

|

|

|

507,650,668 |

|

|

|

506,359,704 |

|

|

|

507,532,365 |

|

|

|

485,434,918 |

|

|

Basic earnings, as adjusted (non-GAAP) |

$ |

0.22 |

|

|

$ |

0.26 |

|

|

$ |

0.35 |

|

|

$ |

1.06 |

|

|

$ |

1.31 |

|

| Average number of diluted

shares outstanding |

|

509,714,526 |

|

|

|

509,256,599 |

|

|

|

509,301,813 |

|

|

|

509,245,768 |

|

|

|

487,817,710 |

|

|

Diluted earnings, as adjusted (non-GAAP) |

$ |

0.22 |

|

|

$ |

0.26 |

|

|

$ |

0.35 |

|

|

$ |

1.06 |

|

|

$ |

1.31 |

|

| Adjusted annualized

return on average tangible shareholders' equity

(non-GAAP): |

|

|

|

|

|

|

|

|

|

| Net income, as adjusted

(non-GAAP) |

$ |

116,297 |

|

|

$ |

136,363 |

|

|

$ |

182,881 |

|

|

$ |

554,271 |

|

|

$ |

650,452 |

|

| Average shareholders'

equity |

|

6,639,906 |

|

|

|

6,605,786 |

|

|

|

6,327,970 |

|

|

|

6,558,768 |

|

|

|

5,985,236 |

|

|

Less: Average goodwill and other intangible assets |

|

2,033,656 |

|

|

|

2,042,486 |

|

|

|

2,074,367 |

|

|

|

2,047,172 |

|

|

|

1,944,503 |

|

| Average tangible shareholders'

equity |

$ |

4,606,250 |

|

|

$ |

4,563,300 |

|

|

$ |

4,253,603 |

|

|

$ |

4,511,596 |

|

|

$ |

4,040,733 |

|

| Annualized return on average

tangible shareholders' equity, as adjusted (non-GAAP) |

|

10.10 |

% |

|

|

11.95 |

% |

|

|

17.20 |

% |

|

|

12.29 |

% |

|

|

16.10 |

% |

Non-GAAP Reconciliations to GAAP

Financial Measures (Continued)

| |

Three Months Ended |

|

Years Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

| ($ in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Adjusted annualized

return on average assets (non-GAAP): |

|

|

|

|

|

|

|

|

|

| Net income, as adjusted

(non-GAAP) |

$ |

116,297 |

|

|

$ |

136,363 |

|

|

$ |

182,881 |

|

|

$ |

554,271 |

|

|

$ |

650,452 |

|

| Average assets |

|

61,113,553 |

|

|

|

61,391,688 |

|

|

|

56,913,215 |

|

|

|

61,065,897 |

|

|

|

52,182,310 |

|

|

Annualized return on average assets, as adjusted (non-GAAP) |

|

0.76 |

% |

|

|

0.89 |

% |

|

|

1.29 |

% |

|

|

0.91 |

% |

|

|

1.25 |

% |

| Adjusted annualized

return on average shareholders' equity (non-GAAP): |

|

|

|

|

|

|

|

|

|

| Net income, as adjusted

(non-GAAP) |

$ |

116,297 |

|

|

$ |

136,363 |

|

|

$ |

182,881 |

|

|

$ |

554,271 |

|

|

$ |

650,452 |

|

| Average shareholders'

equity |

|

6,639,906 |

|

|

|

6,605,786 |

|

|

|

6,327,970 |

|

|

|

6,558,768 |

|

|

|

5,985,236 |

|

| Annualized return on average

shareholders' equity, as adjusted (non-GAAP) |

|

7.01 |

% |

|

|

8.26 |

% |

|

|

11.56 |

% |

|

|

8.45 |

% |

|

|

10.87 |

% |

| Annualized return on

average tangible shareholders' equity (non-GAAP): |

|

|

|

|

|

|

|

|

|

| Net income, as reported

(GAAP) |

$ |

71,554 |

|

|

$ |

141,346 |

|

|

$ |

177,591 |

|

|

$ |

498,511 |

|

|

$ |

568,851 |

|

| Average shareholders'

equity |

|

6,639,906 |

|

|

|

6,605,786 |

|

|

|

6,327,970 |

|

|

|

6,558,768 |

|

|

|

5,985,236 |

|

|

Less: Average goodwill and other intangible assets |

|

2,033,656 |

|

|

|

2,042,486 |

|

|

|

2,074,367 |

|

|

|

2,047,172 |

|

|

|

1,944,503 |

|

| Average tangible shareholders'

equity |

$ |

4,606,250 |

|

|

$ |

4,563,300 |

|

|

$ |

4,253,603 |

|

|

$ |

4,511,596 |

|

|

$ |

4,040,733 |

|

| Annualized return on average

tangible shareholders' equity (non-GAAP) |

|

6.21 |

% |

|

|

12.39 |

% |

|

|

16.70 |

% |

|

|

11.05 |

% |

|

|

14.08 |

% |

| Efficiency ratio

(non-GAAP): |

|

|

|

|

|

|

|

|

|

| Non-interest expense, as

reported (GAAP) |

$ |

340,421 |

|

|

$ |

267,133 |

|

|

$ |

266,240 |

|

|

$ |

1,162,691 |

|

|

$ |

1,024,949 |

|

|

Less: FDIC Special assessment (pre-tax) |

|

50,297 |

|

|

|

— |

|

|

|

— |

|

|

|

50,297 |

|

|

|

— |

|

|

Less: Restructuring charge (pre-tax) |

|

(538 |

) |

|

|

(675 |

) |

|

|

— |

|

|

|

9,969 |

|

|

|

— |

|

|

Less: Merger-related expenses (pre-tax) |

|

10,000 |

|

|

|

— |

|

|

|

7,372 |

|

|

|

14,133 |

|