UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant To Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commissions Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to Section 240.14a-12 |

| P&F INDUSTRIES, INC. |

| (Name of Registrant as Specified in its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that

apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

P&F INDUSTRIES, INC.

Supplement to Proxy Statement For

The Special Meeting of Stockholders

To Be Held on Tuesday, December 19, 2023

EXPLANATORY NOTE

As previously announced, on

October 13, 2023, P&F Industries, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger

Agreement”) with Tools AcquisitionCo, LLC, a limited liability company organized under the Laws of the State of Delaware (“Parent”)

and Tools MergerSub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Acquisition Sub”),

with the Company surviving the Merger as a wholly owned subsidiary of Parent. On November 17, 2023, The Company filed with the Securities

and Exchange Commission a definitive proxy statement (the “Original Proxy Statement”), as supplemented on December

4, 2023 by a proxy supplement (the “First Proxy Supplement”, together with the Original Proxy Statement, the “Definitive

Proxy Statement”) in connection with the Company’s Special Meeting of the Stockholders to be held on Tuesday, December

19, 2023, at 10:00 a.m., Eastern Standard Time, at the Conference Center located at 445 Broadhollow Road, Melville, New York 11747 (the

“Special Meeting”). This supplement (the “Supplement”) to the Definitive Proxy Statement is being

filed to supplement the Definitive Proxy Statement as described below.

As previously disclosed in the First Proxy Supplement, two (2) lawsuits

against the Company and its board of directors (the “Board”) were filed on November 30, 2023 (the “Actions”)

and the Company has received several demand letters from counsel representing purported stockholders of the Company alleging that the

Original Proxy Statement omitted material information that rendered it incomplete and misleading (the “Demand Letters”).

The Company vigorously denies that the Original Proxy Statement or the Definitive Proxy Statement

is deficient, incomplete or misleading in any respect. The Company believes that the claims asserted in the Actions and Demand Letters

are without merit and no further disclosure is required to supplement the Definitive Proxy Statement under applicable laws. However, solely

to moot the unmeritorious disclosure claims and minimize the risk, costs, burden, nuisance and uncertainties inherent in litigation, the

Company hereby supplements the disclosures contained in the Definitive Proxy Statement (the “Supplemental Disclosures”).

Nothing in this Supplement will be deemed an admission of the legal necessity or materiality under any applicable laws for any of the

disclosures set forth herein. The Supplemental Disclosures are set forth below and should be read in conjunction with the Definitive Proxy

Statement.

SUPPLEMENTAL DISCLOSURES TO THE DEFINITIVE PROXY

STATEMENT

This Supplement should be read

in conjunction with the Definitive Proxy Statement, which you are urged to read in its entirety. Nothing in this Supplement shall be deemed

an admission of the legal necessity or materiality of the disclosures set forth herein. To the contrary, the Company specifically denies

all allegations in the Demand Letters and the complaints filed in the Actions that any additional disclosure was or is required. The information

contained in this Supplement is incorporated by reference into the Definitive Proxy Statement. To the extent that information in this

Supplement differs from or updates information contained in the Definitive Proxy Statement, the information in this Supplement shall supersede

or supplement the information in the Definitive Proxy Statement. Paragraph and page references used herein refer to the Definitive Proxy

Statement before any additions or deletions resulting from this Supplement. Capitalized terms used herein, but not otherwise defined,

shall have the meanings ascribed to such terms in the Definitive Proxy Statement. New text within the restated language from the Definitive

Proxy Statement is highlighted with bold, underlined text and removed language within restated language from

the Definitive Proxy Statement is indicated by strikethrough text. Except as specifically noted herein, the information

set forth in the Definitive Proxy Statement remains unchanged.

On page 45 of the Definitive Proxy Statement,

the fourth full paragraph on the page in the section entitled “Opinion of P&F’s Financial Advisor – Discounted Cash

Flow Analysis” is hereby amended as follows:

The discounted projected free cash flow

that East Wind utilized in the analysis, was based on projections prepared by management (the “Projections”)

which provided the basis for its Fairness Opinion, was provided by Management as set forth is presented

in the section below entitled “Projections Prepared by P&F Management” and the discounted cash flow analysis

it performed was based on those free cash flow projections (the “Projections”). Consistent with the periods included

in the Projections, East Wind used fiscal year 2027 as the final year for the analysis and utilized two methodologies for comparison purposes

to calculate a terminal value: (i) applied multiples ranging from 6.5x to 7.5x, selected by East Wind upon the application of its professional

judgment and expertise after reviewing M&A transaction multiples for comparable companies, to normalized fiscal year 2027 EBITDA in

order to derive a range of terminal values for P&F in 2027, and (ii) applied perpetual growth rates ranging from 2.5% to 3.5%, selected

by East Wind upon the application of its professional judgment and expertise, to normalized fiscal year 2027 unlevered free cash flow

in order to derive a range of terminal values for P&F in 2023. Normalized EBITDA and normalized free cash flow are derived from

the Projections but assumes (i) forecasted capital expenditures in the terminal year to be equal to the average of capital expenditures

as a percentage of revenue from 2023-2027 (2.7%) applied to the revenue in the terminal year, and (ii) depreciation and amortization in

the terminal year being equal to normalized capital expenditures. The perpetual growth rates were chosen based on historical inflation

rates, as well as being below historical GDP growth rates.

On page 45 of the Definitive Proxy Statement,

the fifth full paragraph on the page in the section entitled “Opinion of P&F’s Financial Advisor – Discounted Cash

Flow Analysis” is hereby amended as follows:

The projected unlevered free cash flows

and terminal values were discounted using rates ranging from 17.0% to 19.0%, which range was selected, upon the application of East Wind’s

professional judgment and expertise, to reflect the weighted average after-tax cost of debt and equity capital associated with executing

P&F’s business plan. This range was selected based on the beta from a simple average of 15 publicly traded companies,

certain macroeconomic conditions, as well as East Wind’s experience and judgment. The resulting range of present

enterprise values was adjusted by P&F’s net debt (the face amount of total debt and preferred stock and book value of

non-controlling interests less the amount of excess cash and cash equivalents, as reflected on P&F’s most recent projection

for the year-end balance sheet), as well as other. Excess cash is defined as cash above the average cash balance

retained in the business for operations over the latest four quarters. Average cash balance retained in the business over the last four

quarters is $573,750. The net debt of the Company, as of September 30th, 2023 is approximately $3,940 thousands. Other wind down

expenses and transaction fees associated with executing a transaction were also factored into the calculation of equity value.

This value was divided by the number of diluted shares outstanding, approximately 3,273 thousands, in order to arrive at

a range of present values per share of P&F common stock. East Wind reviewed the range of per share prices derived

in the discounted cash flow analysis and compared them to the price per share for P&F common stock implied by the Merger Consideration.

The results of the discounted cash flow analyses are summarized below:

On page 46 of the Definitive Proxy Statement,

first and second tables on the page in the section entitled “Opinion of P&F’s Financial Advisor – Discounted Cash

Flow Analysis” are hereby amended as follows:

Exit Multiple Methodology:

| | |

| | |

Exit Multiple Methodology |

| ($ in thousands) | |

| | |

Discount Rate |

| | |

| | |

16% | | |

17% | | |

18% | | |

19% | | |

20% |

| | |

| 8.0 | x | |

$ | 49,439 | | |

$ | 48,024 | | |

$ | 46,666 | | |

$ | 45,361 | | |

$ | 44,107 |

| | |

| 7.5 | x | |

$ | 47,293 | | |

$ | 45,951 | | |

$ | 44,662 | | |

$ | 43,424 | | |

$ | 42,234 |

| Exit Multiple | |

| 7.0 | x | |

$ | 45,147 | | |

$ | 43,878 | | |

$ | 42,658 | | |

$ | 41,487 | | |

$ | 40,360 |

| | |

| 6.5 | x | |

$ | 43,002 | | |

$ | 41,804 | | |

$ | 40,654 | | |

$ | 39,549 | | |

$ | 38,487 |

| | |

| 6.0 | x | |

$ | 40,856 | | |

$ | 39,731 | | |

$ | 38,650 | | |

$ | 37,612 | | |

$ | 36,613 |

Perpetual Growth Rate Methodology:

| | |

| | |

Perpetual Growth Rate Methodology |

| ($ in thousands) | |

| | |

Discount Rate |

| | |

| | |

16% | | |

17% | | |

18% | | |

19% | | |

20% |

| | |

| 4.0 | % | |

$ | 39,589 | | |

$ | 36,781 | | |

$ | 34,369 | | |

$ | 32,274 | | |

$ | 30,437 |

| | |

| 3.5 | % | |

$ | 38,610 | | |

$ | 35,969 | | |

$ | 33,688 | | |

$ | 31,696 | | |

$ | 29,943 |

| Growth Rate | |

| 3.0 | % | |

$ | 37,706 | | |

$ | 35,215 | | |

$ | 33,052 | | |

$ | 31,155 | | |

$ | 29,478 |

| | |

| 2.5 | % | |

$ | 36,869 | | |

$ | 34,513 | | |

$ | 32,457 | | |

$ | 30,646 | | |

$ | 29,039 |

| | |

| 2.0 | % | |

$ | 36,092 | | |

$ | 33,857 | | |

$ | 31,899 | | |

$ | 30,167 | | |

$ | 28,625 |

On page 46 of the Definitive Proxy Statement,

the first table on the page in the section entitled “Opinion of P&F’s Financial Advisor – Selected Publicly Trading

Companies Analysis” is hereby amended as follows:

| $ in millions |

|

|

|

|

LTM |

|

|

Enterprise Value / LTM |

|

| Company |

|

Enterprise

Value |

|

|

Revenue |

|

|

EBITDA |

|

|

EBIT |

|

|

LTM

Revenue |

|

|

LTM

EBITDA |

|

|

LTM

EBIT |

|

| The L.S. Starrett Company |

|

$ |

81.9 |

|

|

$ |

256.2 |

|

|

$ |

35.5 |

|

|

$ |

29.1 |

|

|

|

0.3 |

x |

|

|

2.3 |

x |

|

|

2.8 |

x |

| The Eastern Company |

|

$ |

169.5 |

|

|

$ |

281.5 |

|

|

$ |

18.6 |

|

|

$ |

11.4 |

|

|

|

0.6 |

x |

|

|

9.2 9.1 |

x |

|

|

14.9 |

x |

| Coventry Group Ltd |

|

$ |

128.2 |

|

|

$ |

233.1 |

|

|

$ |

9.1 |

|

|

$ |

6.9 |

|

|

|

0.5 |

x |

|

|

14.1 |

x |

|

|

18.6 |

x |

| Cominix Co.,Ltd. |

|

$ |

54.7 |

|

|

$ |

196.5 |

|

|

$ |

7.8 |

|

|

$ |

6.0 |

|

|

|

0.3 |

x |

|

|

7.0 |

x |

|

|

9.1 |

x |

| KPT Industries Limited |

|

$ |

19.2 |

|

|

$ |

18.7 |

|

|

$ |

2.4 |

|

|

$ |

2.1 |

|

|

|

1.0 |

x |

|

|

8.0 |

x |

|

|

9.1 |

x |

| Halcyon Technology |

|

$ |

18.0 |

|

|

$ |

31.0 |

|

|

$ |

5.9 |

|

|

$ |

2.3 |

|

|

|

0.6 |

x |

|

|

3.0 |

x |

|

|

7.8 |

x |

On page 47 of the Definitive Proxy Statement,

the first table on the page in the section entitled “Opinion of P&F’s Financial Advisor – Selected Transaction Analysis”

is hereby amended as follows:

| $ in millions |

|

|

|

|

|

|

|

|

|

|

Enterprise Value |

|

| Company |

|

Enterprise

Value |

|

|

LTM

Revenue |

|

|

LTM

EBITDA |

|

|

LTM

Revenue |

|

|

LTM

EBITDA |

|

| Toyo Knife Co., Ltd. |

|

$ |

18.6 |

|

|

$ |

41.5 |

|

|

$ |

3.5 |

|

|

|

0.4 |

x |

|

|

5.3 |

x |

| East Chicago Machine Tool Corporation |

|

$ |

53.7 |

|

|

|

NA |

|

|

$ |

8.0 |

|

|

|

NA |

|

|

|

6.7 |

x |

| General Tools & Instruments LLC |

|

$ |

120.4 |

|

|

|

NA |

|

|

$ |

15.2 |

|

|

|

NA |

|

|

|

7.9 |

x |

| Nubco Pty Ltd. |

|

$ |

26.3 |

|

|

$ |

27.8 |

|

|

$ |

4.2 |

|

|

|

0.9 |

x |

|

|

6.2 |

x |

| WSI Industries, Inc. |

|

$ |

22.4 |

|

|

$ |

30.6 |

|

|

$ |

2.6 |

|

|

|

0.7 |

x |

|

|

8.7 |

x |

| AWC Frac Valves, Inc. |

|

$ |

35.0 |

|

|

|

NA |

|

|

$ |

3.6 |

|

|

|

NA |

|

|

|

9.7 |

x |

| NII FPG Company |

|

$ |

173.0 |

|

|

|

NA |

|

|

$ |

21.0 |

|

|

|

NA |

|

|

|

8.2 |

x |

| Hardinge Inc. |

|

$ |

197.9 |

|

|

$ |

292.0 |

|

|

$ |

22.6 |

|

|

|

0.7 |

x |

|

|

8.7 |

x |

On page 48 of the Definitive Proxy Statement,

the first two full paragraph on the page in the section entitled “Opinion of P&F’s Financial Advisor – Premiums

Paid Analysis” is hereby amended as follows:

Premiums Paid Analysis.

East Wind analyzed the premiums paid for select acquisitions of public companies with market capitalization below $65 billion (“All

Companies”) utilizing publicly available information, industrial sector companies (“Industrial Companies”), and below

$250 million dollars (“Small Cap Companies”) that closed since January 1, 2020. To analyze historical premiums that

were paid, East Wind analyzed the average premium paid in approximately 3,000 transactions for All Companies. For Industrial Companies,

East Wind reviewed and calculated the averaged premiums paid in approximately 500 transactions. For the Small Cap Companies, East Wind

determined the average premiums paid in approximately 1,700 transactions. For the three aforementioned categories, East Wind also included

transactions that were announced in the past 12 months.

East Wind prepared a summary of the relative valuation multiples

premiums paid in these transactions, with respect to the stock price one day prior to announcement, one week prior to announcement,

and one month prior to announcement. The results for these analyses in comparison to the Merger Consideration are summarized

below:

On page 49 of the Definitive Proxy

Statement, the third full paragraph on the page in the section entitled “Opinion of P&F’s Financial Advisor – Additional

Considerations” is hereby amended as follows:

East Wind

has also provided certain financial advisory services to P&F from time to time for which it has received compensation, including

having advised the Board in 2019 with respect to the repurchase of P&F common stock from a shareholder. P&F paid East Wind

an advisory service fee of $5,000 in connection with the 2019 engagement.

On page 49 of the Definitive Proxy Statement,

the sixth full paragraph on the page in the section entitled “Projections Prepared by P&F’s Management” is hereby

amended as follows:

On

February 2, 2023 in the CIM, P&F presented to potential acquirors, including ShoreView, with historical data for the fiscal years

ending December 31, 2020, and December 31, 2021, an estimate for the fiscal year ending December 31, 2022 and a forecast for the fiscal

year ending December 31, 2023. The projections included in the CIM (the “Initial Projections”) included a financial breakdown

of each of the subsidiaries, Hy-Tech and Florida Pneumatic (the “Initial Subsidiary Projections”).

The Initial Subsidiary Projections included revenue and gross profit for HT and FP,

as well as projected revenue, gross profit margin, and EBITDA for PTG for the fiscal year ending December 31, 2022 and a

forecast for the fiscal year ending December 31, 2023. The Initial Projections also included a consolidated

pro-forma estimate for P&F for the fiscal year ending December 31, 2022 and a forecast for the fiscal year ending December 31, 2023.

On page 50 of the Definitive Proxy Statement,

the following paragraph and table are inserted immediately preceding the paragraph beginning “On April 19, 2023 and . . .”:

The

tables below summarize the Initial Subsidiary Projections that were presented to potential buyers, including ShoreView:

| $ in millions | |

Florida Pneumatic

Projections | |

| | |

Year Ending December

31, | |

| | |

2020 | | |

2021 | | |

2022 | | |

2023 | |

| Revenue | |

$ | 38.3 | | |

$ | 41.5 | | |

$ | 41.4 | | |

$ | 39.1 | |

| Gross Profit | |

$ | 14.0 | | |

$ | 15.3 | | |

$ | 16.5 | | |

$ | 17.1 | |

| Gross Margin | |

| 36.6 | % | |

| 36.8 | % | |

| 39.8 | % | |

| 43.7 | % |

| $ in millions | |

Hy-Tech

Projections | |

| | |

Year Ending December

31, | |

| | |

2020 | | |

2021 | | |

2022 | | |

2023 | |

| Revenue | |

$ | 8.6 | | |

$ | 9.3 | | |

$ | 12.0 | | |

$ | 12.3 | |

| Gross Profit | |

$ | 0.7 | | |

$ | 2.4 | | |

$ | 2.8 | | |

$ | 3.7 | |

| Gross Margin | |

| 8.6 | % | |

| 25.5 | % | |

| 23.1 | % | |

| 29.7 | % |

| $ in thousands | |

PTG

Projections | |

| | |

Year Ending December

31, | |

| | |

2020 | | |

2021 | | |

2022 | | |

2023 | |

| Revenue | |

$ | 2,326.0 | | |

$ | 2,846.0 | | |

$ | 5,616.0 | | |

$ | 6,822.0 | |

| EBITDA | |

($ | 1,160.0 | ) | |

($ | 860.0 | ) | |

($ | 1,099.0 | ) | |

$ | 393.0 | |

| Gross Margin | |

| -23.9 | % | |

| -10.2 | % | |

| -5.9 | % | |

| 13.4 | % |

Additional Information and Where to Find It

This filing may be deemed to be solicitation material

in respect of the proposed acquisition of the Company by Parent. In connection with the proposed Merger, the Company filed a definitive

proxy statement with the Securities and Exchange Commission (the “SEC”) on November 17, 2023 and mailed the definitive proxy

statement and other relevant documents to the Company’s shareholders on November 17, 2023. This filing does not constitute a solicitation

of any vote or approval. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN

ITS ENTIRETY AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE

PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors may obtain a free copy of the proxy

statement and other relevant documents filed by the Company with the SEC at the SEC’s website at www.sec.gov. In addition, investors

may obtain a free copy of the proxy statement and other relevant documents are available at www.astproxyportal.com/ast/04902 or by directing

a request to: P&F Industries, Inc., 445 Broadhollow Road, Suite 100, Melville, New York 11747 or by telephone at (631) 694-9800.

Participants in the Solicitation

The Company and its directors, executive officers

and certain other members of management and employees of the Company may be deemed to be “participants” in the solicitation

of proxies from the shareholders of the Company in connection with the proposed Merger. Information regarding the interests of the persons

who may, under the rules of the SEC, be considered participants in the solicitation of the shareholders of the Company in connection with

the proposed Merger, which may be different than those of the Company’s shareholders generally, are set forth in the proxy statement

and the other relevant documents to be filed with the SEC. Shareholders can find information about the Company and its directors and executive

officers and their ownership of the Company’s common shares in the Company’s definitive proxy statement filed on Schedule

14A, which was filed with the SEC on November 17, 2023.

Additional information regarding the interests

of such individuals in the proposed acquisition of the Company are included in the Proxy Statement. These documents may be obtained free

of charge from the SEC’s website at www.sec.gov and at www.astproxyportal.com/ast/04902.

Cautionary Statement on Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended,

including all statements other than statements of historical fact contained in this communication and includes, without limitation, statements

regarding the transaction and anticipated closing date. These statements identify prospective information and may include words such as

“expects,” “intends,” “continue,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “projects,” “potential,” “should,” “may,”

“will,” or the negative version of these words, variations of these words and comparable terminology. These forward-looking

statements are based on information available to the Company as of the date of this communication and are based on management’s

current views and assumptions. These forward-looking statements are conditioned upon and also involve a number of known and unknown risks,

uncertainties, and other factors that could cause actual results, performance or events to differ materially from those anticipated by

these forward-looking statements. Such risks, uncertainties, and other factors may be beyond the Company’s control and may pose

a risk to the Company’s operating and financial condition. Such risks and uncertainties include, but are not limited to, the following

risks: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement;

(ii) the risk that the Company’s stockholders may not approve the proposed transaction; (iii) inability to complete the proposed

transaction because, among other reasons, conditions to the closing of the proposed transaction may not be satisfied or waived; (iv)

uncertainty as to the timing of completion of the proposed transaction; (v) potential adverse effects or changes to relationships

with customers, employees, suppliers or other parties resulting from the announcement or completion of the proposed transaction;

(vi) potential litigation relating to the proposed transaction that could be instituted against the Company, Parent or their respective

directors and officers, including the effects of any outcomes related thereto; or (vii) possible disruptions from the proposed transaction

that could harm the Company’s or Parent’s business, including current plans and operations. Information concerning additional

risks, uncertainties and other factors that could cause results to differ materially from the expectations described in this communication

is contained in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”), including its annual

report on Form 10-K filed with the SEC on March 29, 2023, its quarterly reports on Form 10-Q filed with the SEC on May 12, 2023. August

11, 2023 and November 9, 2023, and other documents the Company may file with or furnish to the SEC from time to time such as annual reports

on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These forward-looking statements should not be relied upon

as representing the Company’s views as of any subsequent date and the Company undertakes no obligation to update forward-looking

statements to reflect events or circumstances after the date they were made. The information contained in, or that can be accessed through,

the Company’s website and social media channels are not part of this communication.

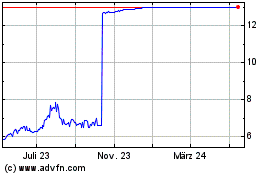

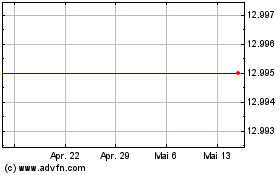

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024