UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant To Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commissions Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to Section 240.14a-12 |

| P&F INDUSTRIES, INC. |

| (Name of Registrant as Specified in its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that

apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

P&F INDUSTRIES, INC.

Supplement to Proxy Statement For

The Special Meeting of Stockholders

To Be Held on Tuesday, December 19, 2023

EXPLANATORY NOTE

As previously announced, on October 13, 2023, P&F Industries, Inc.

(the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement” ) with Tools

AcquisitionCo, LLC, a limited liability company organized under the Laws of the State of Delaware (“Parent”) and Tools

MergerSub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Acquisition Sub”), with the

Company surviving the Merger as a wholly owned subsidiary of Parent. On November 17, 2023, The Company filed with the Securities and Exchange

Commission a definitive proxy statement (the “Proxy Statement”) in connection with the Company’s Special Meeting

of the Stockholders to be held on Tuesday, December 19, 2023, at 10:00 a.m., Eastern Standard Time, at the Conference Center located at

445 Broadhollow Road, Melville, New York 11747 (the “Special Meeting”). The purpose of this supplement to the Proxy

Statement (this “Proxy Supplement”) is solely to advise stockholders of two lawsuits filed against the Company and

its directors and of demand letters received by the Company. Except as specifically amended by this Proxy Supplement, the Proxy Statement

remains unchanged, and this Proxy Supplement does not otherwise modify, amend, supplement, or affect the Proxy Statement.

SUPPLEMENTAL INFORMATION

On November 30, 2023, two lawsuits were filed alleging that the Proxy

Statement omitted material information that rendered it incomplete and misleading. The lawsuits, filed as individual actions by purported

stockholders of the Company, are captioned Mary Philips v. P&F Industries, Inc., et al., 1:23-cv-01365 (D. Del.) and James

Smith v. P&F Industries, Inc., et al., 1:23-cv-01367 (D. Del.). The alleged material omissions and misstatements relate to, among

other things, the details of the analysis conducted by the Company’s financial advisor, the Company’s projections and the

Company’s past relationship with its financial advisor, if any. As a result of the alleged omissions, the lawsuits seek to hold

the Company and its directors liable for violating Sections 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder, and additionally

seek to hold the Company’s directors liable as control persons pursuant to Section 20(a) of the Exchange Act. The lawsuits seek,

among other relief, an order enjoining consummation of the Merger, rescission of the Merger in the event it is consummated, and damages.

The Company has also received several demand letters from counsel representing purported stockholders of the Company alleging that the

Proxy Statement omitted material information that rendered it incomplete and misleading. There can be no assurance that the Company will

not receive additional demand letters and while the Company believes that the lawsuits are meritless and plans to vigorously defend itself,

there can be no assurance that it will ultimately prevail in either of the lawsuits. Additionally, similar lawsuits may be filed before

the Special Meeting.

Additional Information and Where to Find It

This filing may be deemed to be solicitation material in respect of

the proposed acquisition of the Company by Parent. In connection with the proposed Merger, the Company filed a definitive proxy statement

with the Securities and Exchange Commission (the “SEC”) on November 17, 2023 and mailed the definitive proxy statement and

other relevant documents to the Company’s shareholders on November 17, 2023. This filing does not constitute a solicitation of any

vote or approval. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY

AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors may obtain a free copy of the proxy statement and other relevant

documents filed by the Company with the SEC at the SEC’s website at www.sec.gov. In addition, investors may obtain a free copy of

the proxy statement and other relevant documents are available at www.astproxyportal.com/ast/04902 or by directing a request to: P&F

Industries, Inc., 445 Broadhollow Road, Suite 100, Melville, New York 11747 or by telephone at (631) 694-9800.

Participants in the Solicitation

The Company and its directors, executive officers and certain other

members of management and employees of the Company may be deemed to be “participants” in the solicitation of proxies from

the shareholders of the Company in connection with the proposed Merger. Information regarding the interests of the persons who may, under

the rules of the SEC, be considered participants in the solicitation of the shareholders of the Company in connection with the proposed

Merger, which may be different than those of the Company’s shareholders generally, are set forth in the proxy statement and the

other relevant documents to be filed with the SEC. Shareholders can find information about the Company and its directors and executive

officers and their ownership of the Company’s common shares in the Company’s definitive proxy statement filed on Schedule

14A, which was filed with the SEC on November 17, 2023.

Additional information regarding the interests of such individuals

in the proposed acquisition of the Company are included in the Proxy Statement. These documents may be obtained free of charge from the

SEC’s website at www.sec.gov and at www.astproxyportal.com/ast/04902.

Cautionary Statement on Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including all statements

other than statements of historical fact contained in this communication and includes, without limitation, statements regarding the transaction

and anticipated closing date. These statements identify prospective information and may include words such as “expects,” “intends,”

“continue,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “potential,” “should,” “may,” “will,” or the negative version

of these words, variations of these words and comparable terminology. These forward-looking statements are based on information available

to the Company as of the date of this communication and are based on management’s current views and assumptions. These forward-looking

statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause

actual results, performance or events to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties,

and other factors may be beyond the Company’s control and may pose a risk to the Company’s operating and financial condition.

Such risks and uncertainties include, but are not limited to, the following risks: (i) the occurrence of any event, change or other circumstances

that could give rise to the termination of the merger agreement; (ii) the risk that the Company’s stockholders may not approve

the proposed transaction; (iii) inability to complete the proposed transaction because, among other reasons, conditions to the closing

of the proposed transaction may not be satisfied or waived; (iv) uncertainty as to the timing of completion of the proposed transaction;

(v) potential adverse effects or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement

or completion of the proposed transaction; (vi) potential litigation relating to the proposed transaction that could be instituted

against the Company, Parent or their respective directors and officers, including the effects of any outcomes related thereto; or

(vii) possible disruptions from the proposed transaction that could harm the Company’s or Parent’s business, including current

plans and operations. Information concerning additional risks, uncertainties and other factors that could cause results to differ materially

from the expectations described in this communication is contained in the Company’s filings with the U.S. Securities and Exchange

Commission (“SEC”), including its annual report on Form 10-K filed with the SEC on March 29, 2023, its quarterly reports on

Form 10-Q filed with the SEC on May 12, 2023. August 11, 2023 and November 9, 2023, and other documents the Company may file with or furnish

to the SEC from time to time such as annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These

forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company

undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made. The information

contained in, or that can be accessed through, the Company’s website and social media channels are not part of this communication.

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

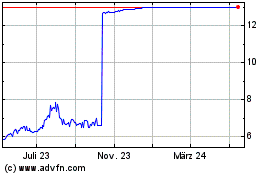

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024