UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant To Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commissions Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material Pursuant to Section 240.14a-12 |

| P&F INDUSTRIES, INC. |

| (Name of Registrant as Specified in its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that

apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Subject Line: Important Announcement from Richard Horowitz

Dear Team,

I am writing to share important news about the future of our company.

A few moments ago, we announced that P&F Industries has agreed to be acquired by ShoreView Industries, a highly regarded investment

firm with significant experience and success growing companies like ours.

Through this transaction, P&F will become a privately-held company,

which will provide added flexibility and enhanced resources to position us for an even stronger future. The leadership team and I are

excited by the opportunities ahead with a trusted partner that believes in our business, recognizes the strength of our global brands

and team and is aligned to our strategy.

Following the closing of the transaction, we expect minimal changes

to our brands and the current operating management of our subsidiaries will continue running the company. ShoreView will invest in the

businesses, grow the company and build on our many successes over the years.

In terms of next steps, we expect the transaction to close in the fourth

quarter of 2023, subject to P&F shareholder approval and certain closing conditions. As with any transaction of this nature, there

can be no assurances that all of these conditions will be satisfied. Until then, we remain an independent, publicly traded company. This

means it is business as usual, and we should all remain focused on our day-to-day responsibilities and delivering for our customers.

All subsidiary presidents will be hosting individual team town hall

meetings throughout the day where they will share more information about what this means for you and the company. You’ll be receiving

a calendar invite with details shortly. In the meantime, the attached FAQs should answer some of your immediate questions.

Last but certainly not least, I want to say thank you to all of you.

You have each played a unique role in growing our business, which has far exceeded our expectations since my family founded the company

60 years ago. It is because of you — and the dedication, passion, and innovative mindset you bring to work every day — that

we have arrived at this pivotal moment.

Sincerely,

Richard

Cautionary Statement on Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including all statements

other than statements of historical fact contained in this communication and includes, without limitation, statements regarding the transaction

and anticipated closing date. These statements identify prospective information and may include words such as “expects,” “intends,”

“continue,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “potential,” “should,” “may,” “will,” or the negative version

of these words, variations of these words and comparable terminology. These forward-looking statements are based on information available

to the Company as of the date of this communication and are based on management’s current views and assumptions. These forward-looking

statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause

actual results, performance or events to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties,

and other factors may be beyond the Company’s control and may pose a risk to the Company’s operating and financial condition.

Such risks and uncertainties include, but are not limited to, the following risks: (i) the occurrence of any event, change or other circumstances

that could give rise to the termination of the merger agreement; (ii) the risk that the Company’s stockholders may not approve

the proposed transaction; (iii) inability to complete the proposed transaction because, among other reasons, conditions to the closing

of the proposed transaction may not be satisfied or waived; (iv) uncertainty as to the timing of completion of the proposed transaction;

(v) potential adverse effects or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement

or completion of the proposed transaction; (vi) potential litigation relating to the proposed transaction that could be instituted

against the Company, ShoreView or their respective directors and officers, including the effects of any outcomes related thereto;

or (vii) possible disruptions from the proposed transaction that could harm the Company’s or ShoreView’s business, including

current plans and operations. Information concerning additional risks, uncertainties and other factors that could cause results to differ

materially from the expectations described in this communication is contained in the Company’s filings with the U.S. Securities

and Exchange Commission (“SEC”), including its annual report on Form 10-K filed with the SEC on March 29, 2023, its quarterly

reports on Form 10-Q filed with the SEC on May 12, 2023 and August 11, 2023, and other documents the Company may file with or furnish

to the SEC from time to time such as annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These

forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company

undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made. The information

contained in, or that can be accessed through, the Company’s website and social media channels are not part of this communication.

Important Additional Information and Where to Find It

In connection with the proposed transaction between the Company and

ShoreView, the Company intends to file relevant materials with the SEC, including a preliminary proxy statement on Schedule 14A. Promptly

after filing its definitive proxy statement with the SEC, the Company will mail the proxy materials to each stockholder entitled to vote

at the special meeting relating to the proposed transaction. This communication is not a substitute for the proxy statement or any other

document that the Company may file with the SEC or send to its stockholders in connection with the proposed transaction. BEFORE MAKING

ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED TRANSACTION THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE PROPOSED TRANSACTION. The definitive proxy

statement, the preliminary proxy statement and other relevant materials in connection with the proposed transaction (when they become

available), and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov)

or at the Company’s website (https://pfina.com/investor_relations) or by contacting the investor relations department of

the Company.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed

to be participants in the solicitation of proxies from the Company’s stockholders with respect to the proposed transaction. Information

about the Company’s directors and executive officers and their ownership of Company common stock is set forth in the proxy statement

on Schedule 14A filed with the SEC on April 28, 2023 (the “2023 Proxy Statement”). To the extent holdings of the Company’s

securities by such potential participants (or the identity of such participants) have changed since the information set forth in the 2023

Proxy Statement, such information has been or will be reflected on Statements of Change in Ownership on Forms 3 and 4 filed with the SEC.

Information regarding the identity of the potential participants, and their direct or indirect interests in the proposed transaction,

by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with SEC in connection with

the proposed transaction. You may obtain free copies of these documents using the sources indicated above.

| 1. | Who is ShoreView? Why is ShoreView the right partner for P&F? |

| · | ShoreView

is a private equity firm based in Minneapolis, Minnesota. The ShoreView investment team has

deep industry expertise and has actively invested in a wide range of companies, including

within the manufacturing industry, for over 20 years. We encourage you to read more about

ShoreView here. |

| · | Our Board of Directors determined that partnering with ShoreView is the best

path forward for P&F. Following close, we will have access to significant additional operational and financial resources to continue

growing our brands so we can accelerate growth and better serve our customers. |

| 2. | What are the benefits of this transaction? |

| · | In addition to providing P&F shareholders with significant value, this

transaction enables us to join forces with new partners who recognize and value the strength of our brands, team and long-term potential. |

| · | ShoreView intends to provide P&F and our brands with the support and resources we need to accelerate our strategy through product

innovation, market expansion and industry leadership, so we can deliver more value to our customers. |

| 3. | What can we expect between now and closing? |

| · | Until the transaction closes, which we expect to occur in the fourth quarter

of 2023, it is business as usual and P&F remains an independent, publicly traded company. |

| · | We should all remain focused on our day-to-day responsibilities and serving

our customers. |

| 4. | Will my pay and benefits stay the same? |

| · | Our new partners recognize that our employees are our most valuable asset,

and they share our unwavering commitment to excellence and service. |

| · | We do not anticipate that there will be any changes to employee compensation

and benefits. |

| 5. | Will there be any layoffs? |

| · | This announcement is about accelerating growth to drive greater value for

customers and employees and ShoreView recognizes the strength of our team. |

| · | By and large, we expect all P&F brands and subsidiaries will continue

to operate as they do today, including current roles and reporting structures. |

| · | However, as a privately-held company, we will no longer need certain public

company organizational functions, and as a result we will be closing our New York corporate office after completing the transaction. We

expect this will impact a handful of our leadership and support functions and will be meeting with that group separately. |

| · | The transaction announcement is only the first step in the process, and we

will keep you informed as we move forward. |

| 6. | Will the Company headquarters change? |

| · | We expect our manufacturing facilities and sales and support functions to

continue operating as usual following close. |

| · | However, as a privately held company, we will no longer need certain public

company organizational functions, and as a result we will be closing our New York corporate office after completing the transaction. We

expect this will impact a handful of our leadership and support functions and will be meeting with that group separately. |

| 7. | Will Shoreview continue manufacturing our name brand tools? What about private label products? |

| · | Shoreview recognizes the value of our brands and the quality of our private

label offering and intends to keep our product offering and brands our customers know and trust. |

| · | With respect to subsidiaries, there will be no changes to current offices,

manufacturing facilities and personnel related to the transaction. |

| 8. | Will there be management changes as a result of the transaction? |

| · | The P&F corporate executive team based in New York will depart the company

following close. |

| · | There will be no impact to subsidiary presidents, who will remain in their

roles post-close. |

| 9. | What does it mean to be a private company? |

| · | Being a private company means P&F common stock will no longer be listed

or traded on the NASDAQ stock exchange. |

| · | But until the transaction closes, P&F remains a publicly traded company

and you will remain subject to the same rules with respect to confidentiality, insider trading and public communication as outlined in

our Code of Conduct. |

| 10. | Can I buy and sell stock between now and close? |

| · | Our

stock will continue to trade on the public market until the transaction closes, and you can continue to make investment and trading decisions

within our existing policies and regulations, including our insider trading policy. |

| 11. | What will happen to my stock ownership / stock options and restricted shares at close? |

| · | Upon

closing of the transaction, each vested share and unvested, time-based restricted share you own will be exchanged for $13.00 per share

in cash. |

| 12. | What do I tell customers? How will this transaction benefit customers? |

| · | Please reiterate that it is business as usual P&F and our brands. We

remain focused on delivering the same high-quality services and tools they have come to expect from us now and in the future. |

| · | We believe this transaction is a win-win for all of our stakeholders, including

our customers. As a private company supported by ShoreView, we will have enhanced financial flexibility, which will allow us to capitalize

on significant opportunities ahead and better serve customers with more innovative, differentiated products. |

| 13. | How can I obtain more information? |

| · | We will continue to keep you posted through our regular communications channels

as we progress toward the closing. |

| · | Please feel free to reach out to your manager if you have additional questions. |

Cautionary Statement on Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including all statements

other than statements of historical fact contained in this communication and includes, without limitation, statements regarding the transaction

and anticipated closing date. These statements identify prospective information and may include words such as “expects,” “intends,”

“continue,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “potential,” “should,” “may,” “will,” or the negative version

of these words, variations of these words and comparable terminology. These forward-looking statements are based on information available

to the Company as of the date of this communication and are based on management’s current views and assumptions. These forward-looking

statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause

actual results, performance or events to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties,

and other factors may be beyond the Company’s control and may pose a risk to the Company’s operating and financial condition.

Such risks and uncertainties include, but are not limited to, the following risks: (i) the occurrence of any event, change or other circumstances

that could give rise to the termination of the merger agreement; (ii) the risk that the Company’s stockholders may not approve

the proposed transaction; (iii) inability to complete the proposed transaction because, among other reasons, conditions to the closing

of the proposed transaction may not be satisfied or waived; (iv) uncertainty as to the timing of completion of the proposed transaction;

(v) potential adverse effects or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement

or completion of the proposed transaction; (vi) potential litigation relating to the proposed transaction that could be instituted

against the Company, ShoreView or their respective directors and officers, including the effects of any outcomes related thereto;

or (vii) possible disruptions from the proposed transaction that could harm the Company’s or ShoreView’s business, including

current plans and operations. Information concerning additional risks, uncertainties and other factors that could cause results to differ

materially from the expectations described in this communication is contained in the Company’s filings with the U.S. Securities

and Exchange Commission (“SEC”), including its annual report on Form 10-K filed with the SEC on March 29, 2023, its quarterly

reports on Form 10-Q filed with the SEC on May 12, 2023 and August 11, 2023, and other documents the Company may file with or furnish

to the SEC from time to time such as annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These

forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company

undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made. The information

contained in, or that can be accessed through, the Company’s website and social media channels are not part of this communication.

Important Additional Information and Where to Find It

In connection with the proposed transaction between the Company and

ShoreView, the Company intends to file relevant materials with the SEC, including a preliminary proxy statement on Schedule 14A. Promptly

after filing its definitive proxy statement with the SEC, the Company will mail the proxy materials to each stockholder entitled to vote

at the special meeting relating to the proposed transaction. This communication is not a substitute for the proxy statement or any other

document that the Company may file with the SEC or send to its stockholders in connection with the proposed transaction. BEFORE MAKING

ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED TRANSACTION THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE PROPOSED TRANSACTION. The definitive proxy

statement, the preliminary proxy statement and other relevant materials in connection with the proposed transaction (when they become

available), and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov)

or at the Company’s website (https://pfina.com/investor_relations) or by contacting the investor relations department of

the Company.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed

to be participants in the solicitation of proxies from the Company’s stockholders with respect to the proposed transaction. Information

about the Company’s directors and executive officers and their ownership of Company common stock is set forth in the proxy statement

on Schedule 14A filed with the SEC on April 28, 2023. Information regarding the identity of the potential participants, and their direct

or indirect interests in the proposed transaction, by security holdings or otherwise, will be set forth in the proxy statement and other

materials to be filed with SEC in connection with the proposed transaction.

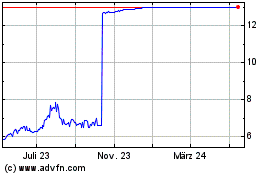

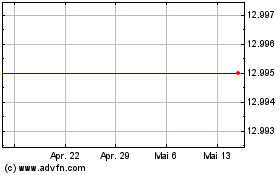

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024