UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

MASIMO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Persons who are to respond to the collection of information contained

in this form are not required to respond unless the form displays a currently valid OMB control number.

Masimo Corporation (“Masimo”) participated in the BofA

Securities Health Care Conference held in Las Vegas, Nevada on Wednesday, May 15, 2024 at 4:20 p.m. Pacific Time, which consisted of a

question and answer session with Travis Lee Steed, MD, of BofA Securities, Research Division (the “Presentation”). During

the Presentation, Joe Kiani, Masimo’s Chief Executive Officer and Chairman of the Board, made certain remarks regarding the election

of directors at Masimo’s 2024 Annual Meeting of Stockholders. Excerpts from the transcript of the Q&A Session relating to Masimo’s

2024 Annual Meeting of Stockholders can be found below:

# # #

Travis Lee Steed: There’s been a lot of back and forth

with Politan and some of the activists. I’m curious what your expectation is for kind of the annual general meeting and the shareholder

vote.

Joe Kiani: Well, I think we expect that we’ll win. The reason is that the calculus was different last time. I think ISS and

others ask, well, what’s the harm of adding 2 members or a minority out of 5 or 7? Now Politan is trying to get the control of the

company. They have 9% of our shares, and they’re trying to get 4 out of 5 Board members. So I don’t think that’s going

to play well. And on top of it, they’re trying to replace me.

I’ve been Founder, CEO and driving the innovation of Masimo since

the beginning. Any CEO, I think ISS has a high board to vote against, let alone, I think, my background. So I think we should get favorable

reports from ISS, and then hopefully, our shareholders will back us because I don’t think they want us to hand the keys over to

an activist who’s never run anything before.

Travis Lee Steed: You’ve expanded the Board to 7. You’ve announced intention to separate the consumer business, and

you’ve also expanded margins this past quarter. What else do you think that Quentin is looking for?

Joe Kiani: I don’t know. I really don’t understand what’s driving him because he’s been on our Board since

June last year, and he only made one suggestion the entire period, which is to take out the expenses for the Apple litigation out of the

non-GAAP numbers. No other recommendations, no other suggestions. And yet we’ve heard that he thinks some shareholders or he wants

us to spin the consumer health business. So now that we’re doing it, that we’ve announced it and we have really great opportunities,

either to do a straight spin or do a JV, you would think he’d be all for it. But from everything I’m seeing, he seems dead

against it. So I don’t know what he wants.

Travis Lee Steed: Any view on some of the candidates being proposed for the Board and kind of the value that they potentially bring

to the Board?

Joe Kiani: Well, first of all, historically, the people that have been on our board have been either chairmen, CEOs, senators,

very influential MDs. The candidates he usually brings are mid-level managers like Michelle. And this time, he’s got the same. One

of the candidates, it’s a biology chemistry background, CTO. So nothing to do with what we’re doing. The other one seemed

reasonable. He was an ex-CFO, and we need someone like that to chair our Audit Committee. And that’s one reason we said we will

accept him, but he rejected that.

We’re going to run, of course, not just me, but we think we have

another candidate that’s willing to take Rolf’s place. And so we’ll run another person that’s going to be really

-- I think a far better person to put on the Board. Much more strategic. And I hope our shareholders will agree with that and will vote

for us to continue what we’ve been doing. We’ve done -- just so you know, the spin/JV, I don’t think it’s the

best thing for Masimo. I really believe we can build a really much more powerful company if it’s all together. But I’ve listened

to our shareholders. Our shareholders, the majority of them actually believe this should be together. But the majority owners of Masimo,

they’d like to see it separated. So because we work for our shareholders, I agreed to do it.

Now I agreed to do it in a way that the dream stays alive for the consumer health business to help change the way patients are treated.

That’s why Sound United with the wearables, with the hearables and a team that can help make it happen. But we’re doing everything

we can to make this a company that’s run by the majority of the shares.

Travis Lee Steed: It sounds like the kind of the main reason you decided to do the separation is because it’s kind of what

you’re hearing from shareholders. Any other reasons around that separation? And then which kind of leads me to think about -- are

you kind of committed to doing that no matter what happens with the outcome of the vote?

Joe Kiani: Yes, 100% committed to doing it. We may have been able to even do a JV before the shareholder meeting because the JV

wants to get it done by June 25. But right now, the activist is pushing back, threatening litigation. So I don’t want to get into

a lawsuit. I’d rather wait until after the proxy to do it. Hopefully, they won’t go away. I always say the most important

thing to any deal is momentum. And so I hate the fact we’re going to lose momentum, and I hope they don’t go away. But I thought

the shareholders wanted that. And if they do, they should tell him to back off because he’s threatening to sue us if we try to do

the JV before the proxy, and I don’t want to do it.

# # #

Forward-Looking Statements

This communication includes forward-looking statements as defined

in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in connection

with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding

the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo Corporation (“Masimo” or the “Company”),

anticipated results of the stockholder votes at the 2024 Annual Meeting, the evaluation of Politan’s director nominees, a potential

candidate for election to Masimo’s board of directors, a potential joint venture involving Masimo, the evaluation of a potential

separation of Masimo’s Consumer Business, the expected timing for completing any joint venture or other separation of Masimo’s

Consumer Business and the potential benefits of any such separation. These forward-looking statements are based on current expectations

about future events affecting Masimo and are subject to risks and uncertainties, all of which are difficult to predict and many of which

are beyond Masimo’s control and could cause its actual results to differ materially and adversely from those expressed in its forward-looking

statements as a result of various risk factors, including, but not limited to (i) uncertainties regarding a potential separation of Masimo’s

Consumer Business, (ii) uncertainties regarding future actions that may be taken by Politan in furtherance of its nomination of director

candidates for election at the 2024 Annual Meeting, (iii) the potential cost and management distraction attendant to Politan’s

nomination of director nominees at the 2024 Annual Meeting and (iv) factors discussed in the “Risk Factors” section of Masimo’s

most recent reports filed with the Securities and Exchange Commission (“SEC”), which may be obtained for free at the SEC’s

website at www.sec.gov. Although Masimo believes that the expectations reflected in its forward-looking statements are reasonable,

the Company does not know whether its expectations will prove correct. All forward-looking statements included in this communication

are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of today’s date. Masimo does not undertake any obligation to update, amend or clarify

these statements or the “Risk Factors” contained in the Company’s most recent reports filed with the SEC, whether as

a result of new information, future events or otherwise, except as may be required under the applicable securities laws.

Additional Information Regarding the 2024 Annual Meeting of Stockholders

and Where to Find It

The Company intends to file a

proxy statement and GOLD proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation

of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT

(AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING GOLD PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as

and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors and

certain of its executive officers and employees may be deemed to be participants in connection with the solicitation of proxies from the

Company’s stockholders in connection with the matters to be considered at the 2024 Annual Meeting. Information regarding the direct

and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company is included

in Amendment No. 1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023 under the heading “Security

Ownership of Certain Beneficial Owners and Management”, filed with the SEC on April 29, 2024, which can be found through the SEC’s

website at https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000093755624000027/masi-20231230.htm. Changes to the direct or indirect

interests of Masimo’s securities by directors and executive officers are set forth in SEC filings on Statements of Change in Ownership

on Form 4 filed with the SEC on April 30, 2024 and May 3, 2024, which can be found through the SEC’s website at https://www.sec.gov/Archives/edgar/data/937556/000093755624000030/xslF345X05/wk-form4_1714522261.xml

and https://www.sec.gov/Archives/edgar/data/937556/000093755624000032/xslF345X05/wk-form4_1714772837.xml, respectively. More detailed

and updated information regarding the identity of these potential participants, and their direct or indirect interests of the Company,

by security holdings or otherwise, will be set forth in the proxy statement for the 2024 Annual Meeting and other materials to be filed

with the SEC. These documents, when filed, can be obtained free of charge from the sources indicated above.

# # #

3

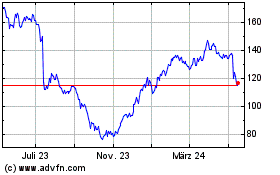

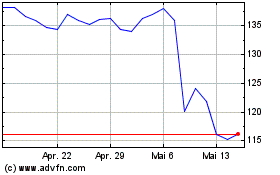

Masimo (NASDAQ:MASI)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Masimo (NASDAQ:MASI)

Historical Stock Chart

Von Jun 2023 bis Jun 2024