0001069157false00010691572023-10-192023-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 19, 2023

EAST WEST BANCORP, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

000-24939

(Commission File Number)

95-4703316

(IRS Employer Identification No.)

135 North Los Robles Ave., 7th Floor, Pasadena, California 91101

(Address of principal executive offices) (Zip code)

(626) 768-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | | EWBC | | The Nasdaq Global Select Market | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 19, 2023, East West Bancorp, Inc. (the “Company”) announced its financial results for the quarter ended September 30, 2023. A copy of the Company’s press release (the “Press Release”) is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 2.02. The Press Release is “furnished” pursuant to General Instruction B.2 of Form 8-K and the information provided in Item 2.02 of this report, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such Section. The information provided in Item 2.02 of this report, including Exhibit 99.1, shall not be deemed incorporated by reference into any filings the Company has made or may make under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as otherwise expressly stated in such filing.

Item 7.01. Regulation FD Disclosure

On October 19, 2023, the Company will hold a conference call to discuss its financial results for the quarter ended September 30, 2023 and other matters relating to the Company. The Company has also made available on its website, www.eastwestbank.com, presentation materials containing certain historical and forward-looking information relating to the Company (the “Presentation Materials”). The Presentation Materials are furnished as Exhibit 99.2 and are incorporated by reference in this Item 7.01. All information in Exhibit 99.2 is presented as of the particular date or dates referenced therein, and the Company does not undertake any obligation to, and disclaims any duty to, update any of the information provided. The information provided in Item 7.01 of this report, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such Section, nor shall such information be deemed incorporated by reference into any filings the Company has made or may make under the Securities Act or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Press Release, dated October 19, 2023. |

| Presentation Materials, dated October 19, 2023. |

| 104 | Cover Page Interactive Data (formatted in Inline XBRL). |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | EAST WEST BANCORP, INC. |

| | |

| Date: October 19, 2023 | By: | /s/ Christopher J. Del Moral-Niles | |

| | Christopher J. Del Moral-Niles | |

| | | Executive Vice President and Chief Financial Officer |

| | | | | |

| Exhibit 99.1 |

| |

| East West Bancorp, Inc. |

| 135 N. Los Robles Ave., 7th Fl. |

| Pasadena, CA 91101 |

| Tel. 626.768.6000 |

| | | | | |

| FOR INVESTOR INQUIRIES, CONTACT: |

Christopher Del Moral-Niles, CFA | Adrienne Atkinson |

Chief Financial Officer | Director of Investor Relations |

T: (626) 768-6860 | T: (626) 788-7536 |

E: chris.delmoralniles@eastwestbank.com | E: adrienne.atkinson@eastwestbank.com |

EAST WEST BANCORP REPORTS NET INCOME FOR THIRD QUARTER OF 2023

OF $288 MILLION AND DILUTED EARNINGS PER SHARE OF $2.02;

RECORD THIRD QUARTER REVENUE AND NET INTEREST INCOME

Pasadena, California – October 19, 2023 – East West Bancorp, Inc. (“East West” or the “Company”) (Nasdaq: EWBC), parent company of East West Bank, reported its financial results for the third quarter of 2023. Third quarter 2023 net income was $288 million, or $2.02 per diluted share. Total loans reached a record $50.9 billion as of September 30, 2023. Return on average assets was 1.66%, return on average common equity was 17.28%, and return on average tangible common equity1 was 18.65%.

“East West has continued to grow and support its customers. During the third quarter, we drove record quarterly revenue and net interest income, adding to record net income in the first half of this year,” said Dominic Ng, Chairman and Chief Executive Officer of East West. “We took a prudent approach to growth, adding a billion dollars in both loans and customer deposits. This growth and our industry-leading efficiency underscore the durable and diversified nature of our business model,” continued Ng.

“Our balance sheet positions us well to help our customers thrive. East West Bank is on track for another year of record earnings for 2023, and we look forward to entering 2024 with strength. Given our confidence in earnings generation, stable credit quality, and capital strength, East West’s board of directors has approved a restart of our share repurchase program in the fourth quarter,” Ng concluded.

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Quarter Ended | | Quarter Ended | | | | | | Year-over-Year Change |

| | | | | | | | | | | | | |

| ($ in millions, except per share data) | | September 30, 2023 | | September 30, 2022 | | | | | | | | | | $ | | % |

| | | | | | | | | | | | | | | | | |

| Revenue | | $648 | | $627 | | | | | | | | | | $20 | | 3% |

| Pre-tax, Pre-provision Income2 | | 446 | | 432 | | | | | | | | | | 14 | | 3 |

| Net Income | | 288 | | 295 | | | | | | | | | | (8) | | (3) |

| | | | | | | | | | | | | | | | | |

| Diluted Earnings per Share | | $2.02 | | $2.08 | | | | | | | | | | $(0.06) | | (3%) |

| | | | | | | | | | | | | | | | | |

| Return on Average Assets | | 1.66% | | 1.86% | | | | | | | | | | -20 bps | | |

| Return on Average Common Equity | | 17.28% | | 20.30% | | | | | | | | | | -302 bps | | |

| Return on Average Tangible Common Equity1 | | 18.65% | | 22.16% | | | | | | | | | | -351 bps | | |

| Total Loans | | $50,912 | | $47,457 | | | | | | | | | | $3,455 | | 7% |

| Total Deposits | | 55,087 | | 53,857 | | | | | | | | | | 1,230 | | 2 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | |

|

|

1 Tangible common equity and return on average tangible common equity are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13. |

2 Pre-tax, pre-provision income is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP financial measures in Table 12. |

BALANCE SHEET

•Total Assets – Total assets were $68.3 billion as of September 30, 2023, a decrease of $0.2 billion from $68.5 billion as of June 30, 2023, reflecting increasing balance sheet efficiency.

Third quarter 2023 average interest-earning assets of $65.1 billion were up $1.0 billion, or 2%, from $64.1 billion in the second quarter of 2023, primarily due to an increase of $1.0 billion in average loans outstanding.

•Total Loans – Total loans reached a record $50.9 billion as of September 30, 2023, an increase of $1.1 billion, or 2%, from $49.8 billion as of June 30, 2023. Year-over-year, total loans were up $3.5 billion, or 7%, from $47.5 billion as of September 30, 2022.

Third quarter 2023 average loans of $49.9 billion grew $1.0 billion, or 2%, from the second quarter of 2023. The increase was driven by growth across all our major loan portfolios.

•Total Deposits – Total deposits were $55.1 billion as of September 30, 2023, a decrease of $0.6 billion, or 1%, from $55.7 billion as of June 30, 2023, reflecting a $1.6 billion reduction in wholesale deposits, partially offset by an increase of $1 billion in customer deposits. Noninterest-bearing deposits made up 29% of our total deposits as of September 30, 2023, down from 30% as of June 30, 2023. Year-over-year, total deposits increased $1.2 billion, or 2%, from $53.9 billion as of September 30, 2022.

Third quarter 2023 average deposits of $55.2 billion increased $0.9 billion, or 2%, from the second quarter of 2023. During the third quarter, growth in average money market and time deposits was offset by declines in other deposit categories, which largely reflected our commercial and consumer customers reallocating balances to products with higher yields.

•Strong Capital Levels – As of September 30, 2023, stockholders’ equity was $6.6 billion, or $46.62 per share, both up 2% quarter-over-quarter. The stockholders’ equity to asset ratio was 9.66% as of September 30, 2023, an increase of 23 basis points quarter-over-quarter.

As of September 30, 2023, tangible book value3 per share was $43.29, up 2% quarter-over-quarter and 18% year-over-year. The tangible common equity ratio3 was 9.03%, an increase of 23 basis points quarter-over-quarter.

All of East West’s regulatory capital ratios are well in excess of regulatory requirements for well-capitalized institutions, as well as above regional and national bank averages. The common equity tier 1 (“CET1”) capital ratio increased to 13.30%, and the total risk-based capital ratio increased to 14.74%, as of September 30, 2023.

OPERATING RESULTS

Third Quarter Earnings – Third quarter 2023 net income was $288 million, and diluted earnings per share (“EPS”) were $2.02. While third quarter 2023 net income and EPS both decreased from the second quarter of 2023, revenue and pre-tax pre-provision income both improved.

Net income and diluted EPS for the nine months ended September 30, 2023 were $922 million and $6.49, which both increased 17% from the nine months ended September 30, 2022.

| | | | | | | | | | | |

| | | |

3 Tangible book value and the tangible common equity ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13. |

Third Quarter 2023 Compared to Second Quarter 2023

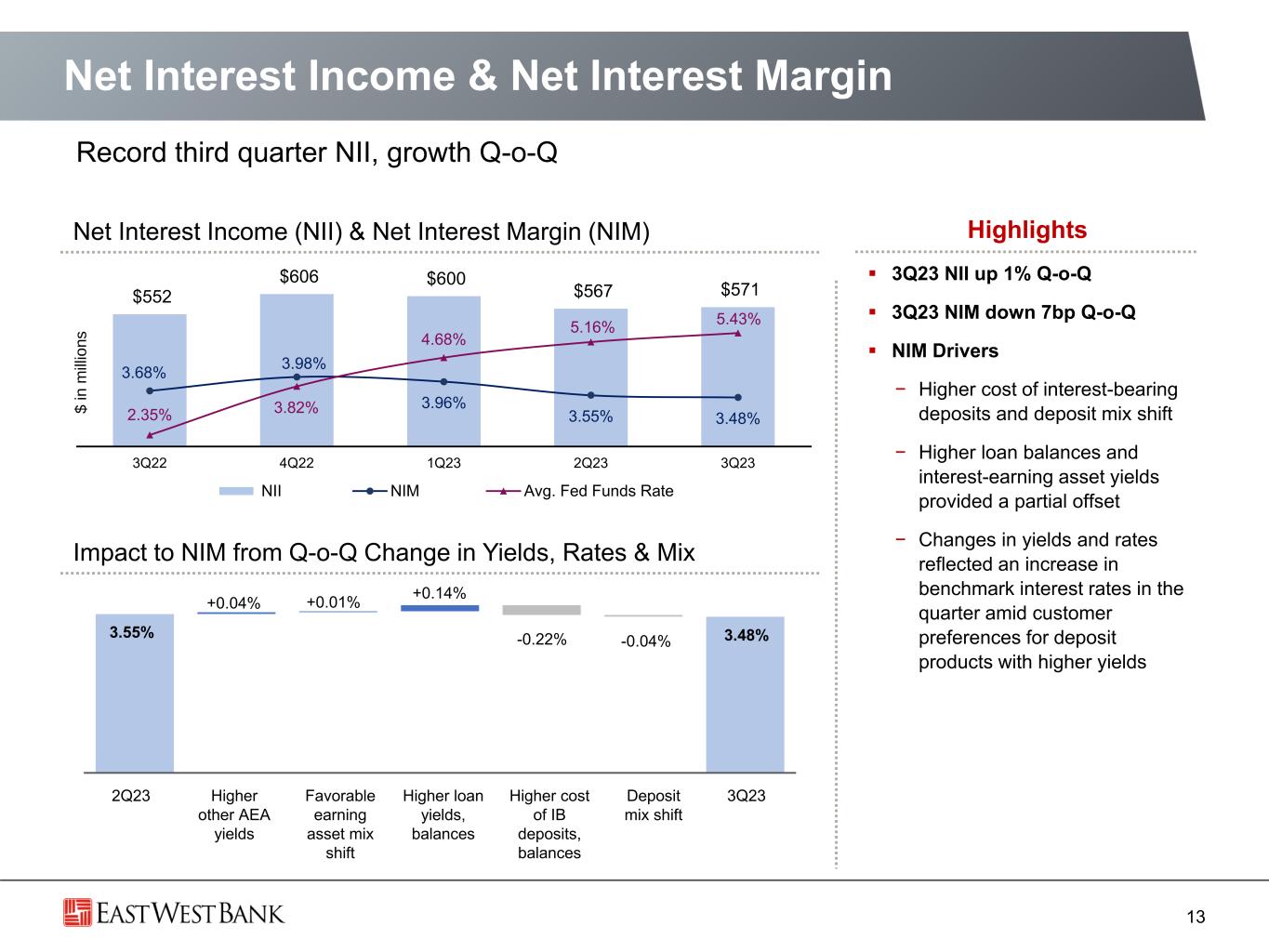

Net Interest Income and Net Interest Margin

Net interest income (“NII”) totaled $571 million in the third quarter, an increase of 1% from $567 million in the second quarter. Net interest margin (“NIM”) of 3.48% declined seven basis points from 3.55% in the second quarter.

•The change in NIM was primarily driven by a higher cost of interest-bearing deposits and changes in the deposit mix in favor of higher-cost customer deposits, partially offset by lower wholesale deposit levels and higher loan volumes and yields.

•The average loan yield was 6.51%, up 18 basis points from the second quarter. The average interest-earning asset yield was 5.87%, up 20 basis points from the second quarter.

•The average cost of funds was 2.59%, up 28 basis points from the second quarter. The average cost of deposits was 2.43%, up 31 basis points from the second quarter.

Noninterest Income

Noninterest income totaled $77 million in the third quarter, a decrease of $2 million, or 2%, from $79 million in the second quarter.

•Fee income4 of $67 million was down $2 million, or 3%, from $69 million in the second quarter.

•Interest rate contracts and other derivative income of $11 million was up from $7 million in the second quarter. The change primarily reflected a favorable change in mark-to-market adjustments.

•Other investment income of $2 million was down $2 million from $4 million in the second quarter, reflecting higher recognition of equity valuation marks for Community Reinvestment Act investments during the second quarter.

Noninterest Expense

Noninterest expense totaled $252 million in the third quarter, a decrease of 4% from $262 million in the second quarter. Third quarter noninterest expense consisted of $202 million of adjusted noninterest expense5, and $50 million in amortization expenses related to tax credit and other investments and core deposit intangibles.

•Adjusted noninterest expense of $202 million decreased over $3 million, or 2%, from $205 million in the second quarter. This was driven by decreases in consulting expense, compensation and employee benefits, loan related expenses, and occupancy expense.

•The efficiency ratio was 38.9% in the third quarter, compared with 40.6% in the second quarter and the adjusted efficiency ratio5 was 31.2% in the third quarter, compared with 31.8% in the second quarter.

TAX RELATED ITEMS

Third quarter 2023 income tax expense was $66 million, and the effective tax rate was 18.6%, compared with 12.7% for the second quarter of 2023. The lower effective tax rate in the second quarter was mainly due to a larger amount of tax credits in renewable energy investments that closed during the second quarter. The effective tax rate for the first nine months of 2023 was 18.6% compared with 22.7% for the first nine months of 2022. We currently estimate that the full year tax rate for 2023 will be between 19% - 20%.

| | | | | | | | | | | |

| | | |

4 Fee income includes lending, deposit account and wealth management fees, foreign exchange income, and interest rate contracts and other derivative income. |

5 Adjusted noninterest expense and adjusted efficiency ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 12. |

|

ASSET QUALITY

As of September 30, 2023, the credit quality of our loan portfolio remained solid.

•The nonperforming assets ratio improved to 0.15% of total assets as of September 30, 2023, down from 0.17% of total assets as of June 30, 2023. Nonperforming assets decreased $12 million, or 10%, quarter-over-quarter to $104 million as of September 30, 2023, from $116 million as of June 30, 2023.

•Third quarter 2023 net charge-offs were $18 million, or annualized 0.14% of average loans held-for-investment (“HFI”), compared with $8 million, or annualized 0.06% of average loans HFI, for the second quarter of 2023.

•The criticized loans ratio increased 38 basis points quarter-over-quarter to 2.01% of loans HFI as of September 30, 2023, compared with 1.63% as of June 30, 2023. Criticized loans increased $210 million, or 26%, quarter-over-quarter to $1.0 billion as of September 30, 2023, compared with $812 million as of June 30, 2023. The special mention loans ratio increased 29 basis points quarter-over quarter to 0.95% of loans HFI as of September 30, 2023, compared with 0.66% as of June 30, 2023, and the classified loans ratio increased nine basis points to 1.06%.

•The allowance for loan losses increased to $656 million, or 1.29% of loans HFI, as of September 30, 2023, compared with $635 million, or 1.28% of loans HFI, as of June 30, 2023.

•Third quarter 2023 provision for credit losses was $42 million, compared with $26 million in the second quarter of 2023.

CAPITAL STRENGTH

Capital levels for East West remained strong as of September 30, 2023. All capital ratios expanded quarter-over-quarter and year-over-year. The following table presents the regulatory capital metrics as of September 30, 2023, June 30, 2023 and September 30, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| EWBC Capital | | |

| ($ in millions) | | September 30, 2023 (a) | | June 30, 2023 (a) | | September 30, 2022 (a) | | | | | | |

| | | | | | | | | | | | |

Risk-Weighted Assets (“RWA”) (b) | | $52,944 | | $51,696 | | $49,266 | | | | | | |

| Risk-based capital ratios: | | | | | | | | | | | | |

| CET1 capital ratio | | 13.30% | | 13.17% | | 12.27% | | | | | | |

| Tier 1 capital ratio | | 13.30% | | 13.17% | | 12.27% | | | | | | |

| Total capital ratio | | 14.74% | | 14.60% | | 13.57% | | | | | | |

| Leverage ratio | | 10.15% | | 10.03% | | 9.55% | | | | | | |

Tangible common equity ratio (c) | | 9.03% | | 8.80% | | 8.35% | | | | | | |

|

(a)The Company has elected to use the 2020 Current Expected Credit Losses (CECL) transition provision in the calculation of its September 30, 2023, June 30, 2023 and September 30, 2022 regulatory capital ratios. The Company’s September 30, 2023 regulatory capital ratios and RWA are preliminary.

(b)Under regulatory guidelines, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories based on the nature of the obligor, or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar value in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted values from each of the risk categories are aggregated for determining total RWA.

(c)Tangible common equity ratio is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP measures in Table 13.

DIVIDEND PAYOUT AND CAPITAL ACTIONS

East West’s Board of Directors has declared fourth quarter 2023 dividends for the Company’s common stock. The common stock cash dividend of $0.48 per share is payable on November 15, 2023, to stockholders of record on November 1, 2023.

On March 3, 2020, East West’s Board of Directors authorized the repurchase of up to $500 million of East West’s common stock, of which $254 million remains available. East West did not repurchase any shares during the third quarter of 2023. The Company intends to resume share repurchases in the fourth quarter of 2023.

Conference Call

East West will host a conference call to discuss third quarter 2023 earnings with the public on Thursday, October 19, 2023, at 8:30 a.m. PT/11:30 a.m. ET. The public and investment community are invited to listen as management discusses third quarter 2023 results and operating developments.

•The following dial-in information is provided for participation in the conference call: calls within the U.S. – (877) 506-6399; calls within Canada – (855) 669-9657; international calls – (412) 902-6699.

•A presentation to accompany the earnings call will be available on the Investor Relations page of the Company’s website at www.eastwestbank.com/investors.

•A listen-only live broadcast of the call will also be available on the Investor Relations page of the Company’s website at www.eastwestbank.com/investors.

•A replay of the conference call will be available on October 19, 2023, at 11:30 a.m. PT/2:30 p.m. ET through November 19, 2023. The replay numbers are: within the U.S. – (877) 344-7529; within Canada – (855) 669-9658; international calls – (412) 317-0088; and the replay access code is: 8920769.

About East West

East West provides financial services that help customers reach further and connect to new opportunities. East West Bancorp, Inc. is a public company (Nasdaq: “EWBC”) with total assets of $68.3 billion as of September 30, 2023. The Company’s wholly-owned subsidiary, East West Bank, is the largest independent bank headquartered in Southern California, and operates over 120 locations in the United States and Asia. The Bank’s markets in the United States include California, Georgia, Illinois, Massachusetts, Nevada, New York, Texas, and Washington. For more information on East West, visit www.eastwestbank.com.

Forward-Looking Statements

Certain matters set forth herein (including any exhibits hereto) contain forward-looking statements that are intended to be covered by the safe harbor provisions for such statements provided by the Private Securities Litigation Reform Act of 1995. In addition, the Company may make forward-looking statements in other documents that it files with, or furnishes to, the U.S. Securities and Exchange Commission (“SEC”) and management may make forward-looking statements to analysts, investors, media members and others. Forward-looking statements are those that do not relate to historical facts and that are based on current assumptions, beliefs, estimates, expectations and projections, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Forward-looking statements may relate to various matters, including the Company’s financial condition, results of operations, plans, objectives, future performance, business or industry, and usually can be identified by the use of forward-looking words, such as “anticipates,” “assumes,” “believes,” “can,” “continues,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “likely,” “may,” “might,” “objective,” “plans,” “potential,” “projects,” “remains,” “should,” “target,” “trend,” “will,” “would,” or similar expressions or variations thereof, and the negative thereof, but these terms are not the exclusive means of identifying such statements. You should not place undue reliance on forward-looking statements, as they are subject to risks and uncertainties, including, but not limited to, those described below. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements the Company may make.

There are various important factors that could cause future results to differ materially from historical performance and any forward-looking statements. Factors that might cause such differences, include, but are not limited to: changes in the global economy, including an economic slowdown, capital or financial market disruption, supply chain disruption, level of inflation, interest rate environment, housing prices, employment levels, rate of growth and general business conditions, which could result in, among other things, reduced demand for loans, reduced availability of funding or increased funding costs, declines in asset values and/or recognition of allowance for credit losses; changes in local, regional and global business, economic and political conditions and geopolitical events, such as Russia’s invasion of Ukraine; the soundness of other financial institutions and the impacts related to or resulting from recent bank failures and other economic and industry volatility, including potential increased regulatory requirements, Federal Deposit Insurance Corporation (“FDIC”) insurance premiums and assessments, losses in the value of our investment portfolio, deposit withdrawals, or other adverse consequences of negative market perceptions of the banking industry or the Company; changes in laws or the regulatory environment, including regulatory reform initiatives and policies of the U.S. Department of the Treasury, the Board of Governors of the Federal Reserve System (“Federal Reserve”), the FDIC, the SEC, the Consumer Financial Protection Bureau (“CFPB”), the California Department of Financial Protection and Innovation — Division of Financial Institutions, China’s National Administration of Financial Regulation, the Hong Kong Monetary Authority, the Hong Kong Securities and Futures Commission, and the Monetary Authority of Singapore; changes and effects thereof in trade, monetary and fiscal policies and laws, including the ongoing trade, economic and political disputes between the U.S. and the People’s Republic of China and the monetary policies of the Federal Reserve; changes in the commercial and consumer real estate markets; changes in consumer or commercial spending, savings and borrowing habits, and patterns and behaviors; the impact from potential changes to income tax laws and regulations, federal spending and economic stimulus programs; the impact of any future U.S. federal government shutdown and uncertainty regarding the U.S. federal government’s debt limit and credit rating; the Company’s ability to compete effectively against financial institutions and other entities, including as a result of emerging technologies; the success and timing of the Company’s business strategies; the Company’s ability to retain key officers and employees; the impact on the Company’s funding costs, net interest income and net interest margin from changes in key variable market interest rates, competition, regulatory requirements and the Company’s product mix; changes in the Company’s costs of operation, compliance and expansion; the Company’s ability to adopt and successfully integrate new technologies into its business in a strategic manner; the impact of communications or technology disruption, failure in, or breach of, the Company’s operational or security systems or infrastructure, or those of third party vendors with which the Company does business, including as a result of cyber-attacks; and other similar matters which could result in, among other things, confidential and/or proprietary information being disclosed or misused, and materially impact the Company’s ability to provide services to its clients; the adequacy of the Company’s risk management framework, disclosure controls and procedures and internal control over financial reporting; future credit quality and performance, including the Company’s expectations regarding future credit losses and allowance levels; the impact of adverse changes to the Company’s credit ratings from major credit rating agencies; the impact of adverse judgments or settlements in litigation; the impact on the Company’s operations due to political developments, pandemics, wars, civil unrest, terrorism or other hostilities that may disrupt or increase volatility in securities or otherwise affect business and economic conditions; heightened regulatory and governmental oversight and scrutiny of the Company’s business practices, including dealings with consumers; the impact of reputational risk from negative publicity, fines, penalties and other negative consequences from regulatory violations, legal actions and the Company’s interactions with business partners, counterparties, service providers and other third parties; the impact of regulatory investigations and enforcement actions; changes in accounting standards as may be required by the Financial Accounting Standards Board (“FASB”) or other regulatory agencies and their impact on the Company’s critical accounting policies and assumptions; the Company’s capital requirements and its ability to generate capital internally or raise capital on favorable terms; the impact on the Company’s liquidity due to changes in the Company’s ability to receive dividends from its subsidiaries; any strategic acquisitions or divestitures; changes in the equity and debt securities markets; fluctuations in the Company’s stock price; fluctuations in foreign currency exchange rates; the impact of increased focus on social, environmental and sustainability matters, which may affect the Company’s operations as well as those of its customers and the economy more broadly; and the impact of climate change, natural or man-made disasters or calamities, such as wildfires, droughts, hurricanes, flooding and earthquakes or other events that may directly or indirectly result in a negative impact on the Company’s financial performance.

For a more detailed discussion of some of the factors that might cause such differences, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 under the heading Item 1A. Risk Factors and the information set forth under Item 1A. Risk Factors in the Company’s Quarterly Reports on Form 10-Q. You should treat forward-looking statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake, and specifically disclaims any obligation to update or revise any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |

| CONDENSED CONSOLIDATED BALANCE SHEET | |

| ($ and shares in thousands, except per share data) | |

| (unaudited) | |

| Table 1 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | September 30, 2023 % or Basis Point Change | |

| | | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | Qtr-o-Qtr | | Yr-o-Yr | | |

| Assets | | | | | | | | | | | | |

| | Cash and due from banks | | $ | 495,976 | | $ | 614,053 | | $ | 554,260 | | (19.2) | % | | (10.5) | % | | |

| Interest-bearing cash with banks | | 4,065,202 | | 5,763,834 | | 1,609,093 | | (29.5) | | | 152.6 | | | |

| Cash and cash equivalents | | 4,561,178 | | 6,377,887 | | 2,163,353 | | (28.5) | | | 110.8 | | | |

| | Interest-bearing deposits with banks | | 17,213 | | 17,169 | | 630,543 | | 0.3 | | | (97.3) | | | |

| | Assets purchased under resale agreements (“resale agreements”) | | 785,000 | | 635,000 | | 892,986 | | 23.6 | | | (12.1) | | | |

| | Available-for-sale (“AFS”) debt securities (amortized cost of $6,976,331, $6,820,569 and $6,771,354) | | 6,039,837 | | 5,987,258 | | 5,906,090 | | 0.9 | | | 2.3 | | | |

| Held-to-maturity (“HTM”) debt securities, at amortized cost (fair value of $2,308,048, $2,440,484 and $2,459,135) | | 2,964,235 | | 2,975,933 | | 3,012,667 | | (0.4) | | | (1.6) | | | |

| | | | | | | | | | | | | |

| | Loans held-for-sale (“HFS”) | | 4,762 | | 2,830 | | 14,500 | | 68.3 | | | (67.2) | | | |

| | Loans held-for-investment (“HFI”) (net of allowance for loan losses of $655,523, $635,400 and $582,517) | | 50,251,661 | | 49,192,964 | | 46,859,738 | | 2.2 | | | 7.2 | | | |

| | | | | | | | | | | | | |

| Investments in qualified affordable housing partnerships, tax credit and other investments, net | | 901,559 | | 815,471 | | 725,254 | | 10.6 | | | 24.3 | | | |

| | Goodwill | | 465,697 | | 465,697 | | 465,697 | | — | | | — | | | |

| Operating lease right-of-use assets | | 97,782 | | 100,500 | | 105,411 | | (2.7) | | | (7.2) | | | |

| | Other assets | | 2,200,534 | | 1,961,972 | | 1,799,822 | | 12.2 | | | 22.3 | | | |

| | Total assets | | $ | 68,289,458 | | $ | 68,532,681 | | $ | 62,576,061 | | (0.4) | % | | 9.1 | % | | |

| | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | | | | |

| | Deposits | | $ | 55,087,031 | | $ | 55,658,786 | | $ | 53,857,362 | | (1.0) | % | | 2.3 | % | | |

| | | | | | | | | | | | | |

| Short-term borrowings | | 4,500,000 | | 4,500,000 | | — | | — | | | 100.0 | | | |

| Federal funds purchased | | — | | — | | 200,000 | | — | | | (100.0) | | | |

| | FHLB advances | | — | | — | | 324,920 | | — | | | (100.0) | | | |

| | Assets sold under repurchase agreements (“repurchase agreements”) | | — | | — | | 611,785 | | — | | | (100.0) | | | |

| | Long-term debt and finance lease liabilities | | 153,087 | | 152,951 | | 152,610 | | 0.1 | | | 0.3 | | | |

| Operating lease liabilities | | 107,695 | | 110,383 | | 113,477 | | (2.4) | | | (5.1) | | | |

| | Accrued expenses and other liabilities | | 1,844,939 | | 1,648,864 | | 1,655,239 | | 11.9 | | | 11.5 | | | |

| | Total liabilities | | 61,692,752 | | 62,070,984 | | 56,915,393 | | (0.6) | | | 8.4 | | | |

| | Stockholders’ equity | | 6,596,706 | | 6,461,697 | | 5,660,668 | | 2.1 | | | 16.5 | | | |

| | Total liabilities and stockholders’ equity | | $ | 68,289,458 | | $ | 68,532,681 | | $ | 62,576,061 | | (0.4) | % | | 9.1 | % | | |

| | | | | | | | | | | | | |

| | Book value per share | | $ | 46.62 | | $ | 45.67 | | $ | 40.17 | | 2.1 | % | | 16.1 | % | | |

| | Tangible book value (1) per share | | $ | 43.29 | | $ | 42.33 | | $ | 36.80 | | 2.3 | | | 17.6 | | | |

| | Number of common shares at period-end | | 141,486 | | 141,484 | | 140,918 | | 0.0 | | | 0.4 | | | |

| Total stockholders’ equity to assets ratio | | 9.66 | % | | 9.43 | % | | 9.05 | % | | 23 | | bps | 61 | | bps | |

| Tangible common equity (“TCE”) ratio (1) | | 9.03 | % | | 8.80 | % | | 8.35 | % | | 23 | | bps | 68 | | bps | |

| | | | | | | |

(1)Tangible book value and the TCE ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| TOTAL LOANS AND DEPOSITS DETAIL |

| ($ in thousands) |

| (unaudited) |

| Table 2 |

|

| | | | | | | | | September 30, 2023 % Change |

| | | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | Qtr-o-Qtr | | Yr-o-Yr |

| Loans: | | | | | | | | | | |

Commercial: | | | | | | | | | | |

| Commercial and industrial (“C&I”) | | $ | 15,864,042 | | | $ | 15,670,084 | | | $ | 15,625,072 | | | 1.2 | % | | 1.5 | % |

| Commercial real estate (“CRE”): | | | | | | | | | | |

| CRE | | 14,667,378 | | | 14,373,385 | | | 13,573,157 | | | 2.0 | | | 8.1 | |

| Multifamily residential | | 4,900,097 | | | 4,764,180 | | | 4,559,302 | | | 2.9 | | | 7.5 | |

| Construction and land | | 798,190 | | | 781,068 | | | 556,894 | | | 2.2 | | | 43.3 | |

| Total CRE | | 20,365,665 | | | 19,918,633 | | | 18,689,353 | | | 2.2 | | | 9.0 | |

Consumer: | | | | | | | | | | |

| Residential mortgage: | | | | | | | | | | |

| Single-family residential | | 12,836,558 | | | 12,308,613 | | | 10,855,345 | | | 4.3 | | | 18.3 | |

| Home equity lines of credit (“HELOCs”) | | 1,776,665 | | | 1,862,928 | | | 2,184,924 | | | (4.6) | | | (18.7) | |

| Total residential mortgage | | 14,613,223 | | | 14,171,541 | | | 13,040,269 | | | 3.1 | | | 12.1 | |

| Other consumer | | 64,254 | | | 68,106 | | | 87,561 | | | (5.7) | | | (26.6) | |

Total loans HFI (1) | | 50,907,184 | |

| 49,828,364 | |

| 47,442,255 | | | 2.2 | | | 7.3 | |

Loans HFS | | 4,762 | | | 2,830 | | | 14,500 | | | 68.3 | | | (67.2) | |

| Total loans (1) | | 50,911,946 | | | 49,831,194 | | | 47,456,755 | | | 2.2 | | | 7.3 | |

| Allowance for loan losses | | (655,523) | | | (635,400) | | | (582,517) | | | 3.2 | | | 12.5 | |

| Net loans (1) | | $ | 50,256,423 | | | $ | 49,195,794 | | | $ | 46,874,238 | | | 2.2 | | | 7.2 | |

| | | | | | | | | | | |

Deposits: | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 16,169,072 | | | $ | 16,741,099 | | | $ | 21,645,394 | | | (3.4) | % | | (25.3) | % |

| Interest-bearing checking | | 7,689,289 | | | 8,348,587 | | | 6,822,343 | | | (7.9) | | | 12.7 | |

| Money market | | 12,613,827 | | | 11,486,473 | | | 12,113,292 | | | 9.8 | | | 4.1 | |

| Savings | | 1,963,766 | | | 2,102,850 | | | 2,917,770 | | | (6.6) | | | (32.7) | |

| | | | | | | | | | | |

| Time deposits | | 16,651,077 | | | 16,979,777 | | | 10,358,563 | | | (1.9) | | | 60.7 | |

| | | | | | | | | | |

| Total deposits | | $ | 55,087,031 | | | $ | 55,658,786 | | | $ | 53,857,362 | | | (1.0) | % | | 2.3 | % |

|

(1)Includes $(72.0) million, $(74.0) million and $(60.3) million of net deferred loan fees and net unamortized premiums as of September 30, 2023, June 30, 2023 and September 30, 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| ($ and shares in thousands, except per share data) |

| (unaudited) |

| Table 3 |

| |

| | | Three Months Ended | | September 30, 2023 % Change |

| | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | Qtr-o-Qtr | | Yr-o-Yr |

| Interest and dividend income | | $ | 961,787 | | | $ | 906,134 | | | $ | 628,236 | | | 6.1% | | 53.1% |

Interest expense | | 390,974 | | | 339,388 | | | 76,427 | | | 15.2 | | 411.6 |

| Net interest income before provision for credit losses | | 570,813 | | | 566,746 | | | 551,809 | | | 0.7 | | 3.4 |

| Provision for credit losses | | 42,000 | | | 26,000 | | | 27,000 | | | 61.5 | | 55.6 |

| Net interest income after provision for credit losses | | 528,813 | | | 540,746 | | | 524,809 | | | (2.2) | | 0.8 |

| Noninterest income | | 76,752 | | | 78,631 | | | 75,552 | |

| (2.4) | | 1.6 |

| Noninterest expense | | 252,014 | | | 261,789 | | | 215,973 | | | (3.7) | | 16.7 |

Income before income taxes | | 353,551 | | | 357,588 | | | 384,388 | | | (1.1) | | (8.0) |

Income tax expense | | 65,813 | | | 45,557 | | | 89,049 | | | 44.5 | | (26.1) |

Net income | | $ | 287,738 | | | $ | 312,031 | | | $ | 295,339 | | | (7.8)% | | (2.6)% |

Earnings per share (“EPS”) | | | | | | | | | | |

- Basic | | $ | 2.03 | | | $ | 2.21 | | | $ | 2.10 | | | (7.8)% | | (3.0)% |

- Diluted | | $ | 2.02 | | | $ | 2.20 | | | $ | 2.08 | | | (7.9) | | (2.6) |

Weighted-average number of shares outstanding | | | | | | | | | | |

- Basic | | 141,485 | | | 141,468 | | | 140,917 | | | 0.0% | | 0.4% |

- Diluted | | 142,122 | | | 141,876 | | | 142,011 | | | 0.2 | | 0.1 |

| | | | | | | | | | | |

| | | Three Months Ended | | September 30, 2023 % Change |

| | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | Qtr-o-Qtr | | Yr-o-Yr |

Noninterest income: | | | | | | | | | | |

| Lending fees | | $ | 20,312 | | | $ | 20,901 | | | $ | 20,289 | | | (2.8)% | | 0.1% |

| Deposit account fees | | 22,622 | | | 22,285 | | | 23,636 | | | 1.5 | | (4.3) |

| Interest rate contracts and other derivative income | | 11,208 | | | 7,373 | | | 8,761 | | | 52.0 | | 27.9 |

| Foreign exchange income | | 12,334 | | | 13,251 | | | 10,083 | | | (6.9) | | 22.3 |

| Wealth management fees | | 5,877 | | | 6,889 | | | 8,903 | | | (14.7) | | (34.0) |

| Net (losses) gains on sales of loans | | (12) | | | (7) | | | 2,129 | | | 71.4 | | NM |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other investment income (losses) | | 1,751 | | | 4,003 | | | (580) | | | (56.3) | | NM |

| Other income | | 2,660 | | | 3,936 | | | 2,331 | | | (32.4) | | 14.1 |

| Total noninterest income | | $ | 76,752 | | | $ | 78,631 | | | $ | 75,552 | | | (2.4)% | | 1.6% |

Noninterest expense: | | | | | | | | | | |

| Compensation and employee benefits | | $ | 123,153 | | | $ | 124,937 | | | $ | 127,580 | | | (1.4)% | | (3.5)% |

| Occupancy and equipment expense | | 15,353 | | | 16,088 | | | 15,920 | | | (4.6) | | (3.6) |

| Deposit insurance premiums and regulatory assessments | | 8,583 | | | 8,262 | | | 4,875 | | | 3.9 | | 76.1 |

| Deposit account expense | | 11,585 | | | 10,559 | | | 6,707 | | | 9.7 | | 72.7 |

| Data processing | | 3,645 | | | 3,213 | | | 3,725 | | | 13.4 | | (2.1) |

| Computer software expense | | 8,116 | | | 7,479 | | | 6,889 | | | 8.5 | | 17.8 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other operating expense | | 31,885 | | | 35,337 | | | 30,403 | | | (9.8) | | 4.9 |

| Amortization of tax credit and other investments | | 49,694 | | | 55,914 | | | 19,874 | | | (11.1) | | 150.0 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total noninterest expense | | $ | 252,014 | | | $ | 261,789 | | | $ | 215,973 | | | (3.7)% | | 16.7% |

|

NM - Not meaningful.

| | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| ($ and shares in thousands, except per share data) |

| (unaudited) |

| Table 4 |

|

| | | | Nine Months Ended | | September 30, 2023 % Change |

| | | | September 30, 2023 | | September 30, 2022 | | Yr-o-Yr |

| Interest and dividend income | | $ | 2,703,427 | | | $ | 1,560,019 | | | 73.3% |

Interest expense | | 966,007 | | | 119,645 | | | NM |

| Net interest income before provision for credit losses | | 1,737,420 | | | 1,440,374 | | | 20.6 |

| Provision for credit losses | | 88,000 | | | 48,500 | | | 81.4 |

| Net interest income after provision for credit losses | | 1,649,420 | | | 1,391,874 | | | 18.5 |

| Noninterest income | | 215,361 | | | 233,739 | | | (7.9) |

| Noninterest expense | | 732,250 | | | 602,283 | | | 21.6 |

Income before income taxes | | 1,132,531 | | | 1,023,330 | | | 10.7 |

Income tax expense | | 210,323 | | | 232,010 | | | (9.3) |

Net income | | $ | 922,208 | | | $ | 791,320 | | | 16.5% |

EPS | | | | | | |

- Basic | | $ | 6.52 | | | $ | 5.59 | | | 16.6% |

- Diluted | | $ | 6.49 | | | $ | 5.55 | | | 17.0 |

Weighted-average number of shares outstanding | | | | | | |

- Basic | | 141,356 | | | 141,453 | | | (0.1)% |

- Diluted | | 142,044 | | | 142,601 | | | (0.4) |

| | | | | | | |

| | | Nine Months Ended | | September 30, 2023

% Change |

| | | September 30, 2023 | | September 30, 2022 | | Yr-o-Yr |

Noninterest income: | | | | | | |

| Lending fees | | $ | 61,799 | | | $ | 59,869 | | | 3.2% |

| Deposit account fees | | 66,610 | | | 66,323 | | | 0.4 |

| Interest rate contracts and other derivative income | | 21,145 | | | 29,695 | | | (28.8) |

| Foreign exchange income | | 38,245 | | | 34,143 | | | 12.0 |

| Wealth management fees | | 19,070 | | | 21,494 | | | (11.3) |

| Net (losses) gains on sales of loans | | (41) | | | 5,968 | | | NM |

| Net (losses) gains on AFS debt securities | | (10,000) | | | 1,306 | | | NM |

| | | | | | | |

| | | | | | | |

| Other investment income | | 7,675 | | | 5,910 | | | 29.9 |

| Other income | | 10,858 | | | 9,031 | | | 20.2 |

| Total noninterest income | | $ | 215,361 | | | $ | 233,739 | | | (7.9)% |

Noninterest expense: | | | | | | |

| Compensation and employee benefits | | $ | 377,744 | | | $ | 357,213 | | | 5.7% |

| Occupancy and equipment expense | | 47,028 | | | 46,853 | | | 0.4 |

| Deposit insurance premiums and regulatory assessments | | 24,755 | | | 14,519 | | | 70.5 |

| Deposit account expense | | 31,753 | | | 17,071 | | | 86.0 |

| Data processing | | 10,205 | | | 10,876 | | | (6.2) |

| Computer software expense | | 22,955 | | | 20,755 | | | 10.6 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other operating expense (1) | | 102,092 | | | 86,243 | | | 18.4 |

| Amortization of tax credit and other investments | | 115,718 | | | 48,753 | | | 137.4 |

| | | | | | | |

| Total noninterest expense | | $ | 732,250 | | | $ | 602,283 | | | 21.6% |

|

NM - Not meaningful.

(1)Includes $3.9 million of repurchase agreements’ extinguishment cost for the nine months ended September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| SELECTED AVERAGE BALANCES |

| ($ in thousands) |

| (unaudited) |

| Table 5 | | | | | | |

| | | | | | |

| | Three Months Ended | | September 30, 2023 % Change | | Nine Months Ended | | September 30, 2023 % Change |

| | | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | Qtr-o-Qtr | | Yr-o-Yr | | September 30, 2023 | | September 30, 2022 | | Yr-o-Yr |

Loans: | | | | | | | | | | | | | | | | |

Commercial: | | | | | | | | | | | | | | | | |

| C&I | | $ | 15,400,172 | | | $ | 15,244,826 | | | $ | 15,282,661 | | | 1.0% | | 0.8% | | $ | 15,348,662 | | | $ | 14,850,849 | | | 3.4% |

| CRE: | | | | | | | | | | | | | | | | |

| CRE | | 14,453,014 | | | 14,130,811 | | | 13,533,482 | | | 2.3 | | 6.8 | | 14,174,100 | | | 12,958,562 | | | 9.4 |

| Multifamily residential | | 4,798,360 | | | 4,685,786 | | | 4,531,351 | | | 2.4 | | 5.9 | | 4,695,473 | | | 4,133,975 | | | 13.6 |

| Construction and land | | 807,906 | | | 782,541 | | | 532,800 | | | 3.2 | | 51.6 | | 755,651 | | | 467,731 | | | 61.6 |

| Total CRE | | 20,059,280 | | | 19,599,138 | | | 18,597,633 | | | 2.3 | | 7.9 | | 19,625,224 | | | 17,560,268 | | | 11.8 |

Consumer: | | | | | | | | | | | | | | | | |

| Residential mortgage: | | | | | | | | | | | | | | | | |

| Single-family residential | | 12,548,593 | | | 12,014,513 | | | 10,676,022 | | | 4.4 | | 17.5 | | 11,997,671 | | | 9,809,549 | | | 22.3 |

| HELOCs | | 1,816,900 | | | 1,928,208 | | | 2,216,355 | | | (5.8) | | (18.0) | | 1,931,105 | | | 2,230,060 | | | (13.4) |

| Total residential mortgage | | 14,365,493 | | | 13,942,721 | | | 12,892,377 | | | 3.0 | | 11.4 | | 13,928,776 | | | 12,039,609 | | | 15.7 |

| Other consumer | | 63,917 | | | 65,035 | | | 81,870 | | | (1.7) | | (21.9) | | 67,181 | | | 97,794 | | | (31.3) |

| Total loans (1) | | $ | 49,888,862 | | | $ | 48,851,720 | | | $ | 46,854,541 | | | 2.1% | | 6.5% | | $ | 48,969,843 | | | $ | 44,548,520 | | | 9.9% |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Interest-earning assets | | $ | 65,051,461 | | | $ | 64,061,569 | | | $ | 59,478,689 | | | 1.5% | | 9.4% | | $ | 63,545,257 | | | $ | 58,949,457 | | | 7.8% |

Total assets | | $ | 68,936,786 | | | $ | 67,497,367 | | | $ | 63,079,444 | | | 2.1% | | 9.3% | | $ | 67,196,590 | | | $ | 62,361,618 | | | 7.8% |

| | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 16,302,296 | | | $ | 16,926,937 | | | $ | 22,423,633 | | | (3.7)% | | (27.3)% | | $ | 17,633,922 | | | $ | 23,244,247 | | | (24.1)% |

| Interest-bearing checking | | 8,080,025 | | | 8,434,655 | | | 6,879,632 | | | (4.2) | | 17.4 | | 7,675,325 | | | 6,747,711 | | | 13.7 |

| Money market | | 12,180,806 | | | 10,433,839 | | | 12,351,571 | | | 16.7 | | (1.4) | | 11,295,157 | | | 12,526,222 | | | (9.8) |

| Savings | | 2,013,246 | | | 2,200,124 | | | 2,961,634 | | | (8.5) | | (32.0) | | 2,215,102 | | | 2,954,098 | | | (25.0) |

| | | | | | | | | | | | | | | | | |

| Time deposits | | 16,621,683 | | | 16,289,320 | | | 9,435,063 | | | 2.0 | | 76.2 | | 15,993,669 | | | 8,596,728 | | | 86.0 |

| Total deposits | | $ | 55,198,056 | | | $ | 54,284,875 | | | $ | 54,051,533 | | | 1.7% | | 2.1% | | $ | 54,813,175 | | | $ | 54,069,006 | | | 1.4% |

| | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities | | $ | 43,563,947 | | | $ | 42,026,844 | | | $ | 32,703,323 | | | 3.7% | | 33.2% | | $ | 40,826,548 | | | $ | 31,631,865 | | | 29.1% |

Stockholders’ equity | | $ | 6,604,798 | | | $ | 6,440,996 | | | $ | 5,772,638 | | | 2.5% | | 14.4% | | $ | 6,411,250 | | | $ | 5,765,637 | | | 11.2% |

|

(1)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| QUARTER-TO-DATE AVERAGE BALANCES, YIELDS AND RATES | | |

| ($ in thousands) | | |

| (unaudited) | | |

| Table 6 | | |

| | |

| | | Three Months Ended | | |

| | | September 30, 2023 | | June 30, 2023 | | |

| | | Average | | | | Average | | Average | | | | Average | | |

| | | Balance | | Interest | | Yield/Rate (1) | | Balance | | Interest | | Yield/Rate (1) | | |

Assets | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | |

| Interest-bearing cash and deposits with banks | | $ | 5,392,795 | | | $ | 67,751 | | | 4.98 | % | | $ | 5,247,755 | | | $ | 60,995 | | | 4.66 | % | | |

| Resale agreements | | 648,587 | | | 4,460 | | | 2.73 | % | | 641,939 | | | 3,969 | | | 2.48 | % | | |

| AFS debt securities | | 6,074,119 | | | 57,177 | | | 3.73 | % | | 6,257,397 | | | 56,292 | | | 3.61 | % | | |

| HTM debt securities | | 2,967,703 | | | 12,601 | | | 1.68 | % | | 2,983,780 | | | 12,678 | | | 1.70 | % | | |

| Loans (2) | | 49,888,862 | | | 818,719 | | | 6.51 | % | | 48,851,720 | | | 771,264 | | | 6.33 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| FHLB and FRB stock | | 79,395 | | | 1,079 | | | 5.39 | % | | 78,978 | | | 936 | | | 4.75 | % | | |

| Total interest-earning assets | | $ | 65,051,461 | | | $ | 961,787 | | | 5.87 | % | | $ | 64,061,569 | | | $ | 906,134 | | | 5.67 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | |

| Cash and due from banks | | 544,939 | | | | | | | 569,227 | | | | | | | |

| Allowance for loan losses | | (629,229) | | | | | | | (619,868) | | | | | | | |

| Other assets | | 3,969,615 | | | | | | | 3,486,439 | | | | | | | |

| Total assets | | $ | 68,936,786 | | | | | | | $ | 67,497,367 | | | | | | | |

| | | | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | |

| Checking deposits | | $ | 8,080,025 | | | $ | 54,285 | | | 2.67 | % | | $ | 8,434,655 | | | $ | 49,571 | | | 2.36 | % | | |

| Money market deposits | | 12,180,806 | | | 113,217 | | | 3.69 | % | | 10,433,839 | | | 86,419 | | | 3.32 | % | | |

| Savings deposits | | 2,013,246 | | | 4,047 | | | 0.80 | % | | 2,200,124 | | | 3,963 | | | 0.72 | % | | |

| Time deposits | | 16,621,683 | | | 166,747 | | | 3.98 | % | | 16,289,320 | | | 147,524 | | | 3.63 | % | | |

| Federal funds purchased and other short-term borrowings | | 4,501,327 | | | 49,575 | | | 4.37 | % | | 4,500,566 | | | 49,032 | | | 4.37 | % | | |

| FHLB advances | | 1 | | | — | | | — | % | | 1 | | | — | | | — | % | | |

| Repurchase agreements | | 13,897 | | | 193 | | | 5.51 | % | | 15,579 | | | 211 | | | 5.43 | % | | |

| Long-term debt and finance lease liabilities | | 152,962 | | | 2,910 | | | 7.55 | % | | 152,760 | | | 2,668 | | | 7.01 | % | | |

| Total interest-bearing liabilities | | $ | 43,563,947 | | | $ | 390,974 | | | 3.56 | % | | $ | 42,026,844 | | | $ | 339,388 | | | 3.24 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-bearing liabilities and stockholders’ equity: | | | | | | | | | | | | | | |

| Demand deposits | | 16,302,296 | | | | | | | 16,926,937 | | | | | | | |

| Accrued expenses and other liabilities | | 2,465,745 | | | | | | | 2,102,590 | | | | | | | |

| Stockholders’ equity | | 6,604,798 | | | | | | | 6,440,996 | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 68,936,786 | | | | | | | $ | 67,497,367 | | | | | | | |

| | | | | | | | | | | | | | | |

Interest rate spread | | | | | | 2.31 | % | | | | | | 2.43 | % | | |

| Net interest income and net interest margin | | | | $ | 570,813 | | | 3.48 | % | | | | $ | 566,746 | | | 3.55 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | |

(1)Annualized.

(2)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| QUARTER-TO-DATE AVERAGE BALANCES, YIELDS AND RATES | | |

| ($ in thousands) | | |

| (unaudited) | | |

| Table 7 | | |

| | |

| | | Three Months Ended | | |

| September 30, 2023 | | September 30, 2022 | | |

| Average | | | | Average | | Average | | | | Average | | |

| Balance | | Interest | | Yield/Rate (1) | | Balance | | Interest | | Yield/Rate (1) | | |

Assets | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | |

| Interest-bearing cash and deposits with banks | | $ | 5,392,795 | | | $ | 67,751 | | | 4.98 | % | | $ | 2,287,010 | | | $ | 9,080 | | | 1.58 | % | | |

| Resale agreements | | 648,587 | | | 4,460 | | | 2.73 | % | | 1,037,292 | | | 6,769 | | | 2.59 | % | | |

| AFS debt securities | | 6,074,119 | | | 57,177 | | | 3.73 | % | | 6,204,729 | | | 38,383 | | | 2.45 | % | | |

| HTM debt securities | | 2,967,703 | | | 12,601 | | | 1.68 | % | | 3,017,063 | | | 12,709 | | | 1.67 | % | | |

| Loans (2) | | 49,888,862 | | | 818,719 | | | 6.51 | % | | 46,854,541 | | | 560,452 | | | 4.75 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| FHLB and FRB stock | | 79,395 | | | 1,079 | | | 5.39 | % | | 78,054 | | | 843 | | | 4.28 | % | | |

| Total interest-earning assets | | $ | 65,051,461 | | | $ | 961,787 | | | 5.87 | % | | $ | 59,478,689 | | | $ | 628,236 | | | 4.19 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | |

| Cash and due from banks | | 544,939 | | | | | | | 615,836 | | | | | | | |

| Allowance for loan losses | | (629,229) | | | | | | | (566,369) | | | | | | | |

| Other assets | | 3,969,615 | | | | | | | 3,551,288 | | | | | | | |

| Total assets | | $ | 68,936,786 | | | | | | | $ | 63,079,444 | | | | | | | |

| | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | |

| Checking deposits | | $ | 8,080,025 | | | $ | 54,285 | | | 2.67 | % | | $ | 6,879,632 | | | $ | 8,493 | | | 0.49 | % | | |

| Money market deposits | | 12,180,806 | | | 113,217 | | | 3.69 | % | | 12,351,571 | | | 33,101 | | | 1.06 | % | | |

| Savings deposits | | 2,013,246 | | | 4,047 | | | 0.80 | % | | 2,961,634 | | | 2,268 | | | 0.30 | % | | |

| Time deposits | | 16,621,683 | | | 166,747 | | | 3.98 | % | | 9,435,063 | | | 25,032 | | | 1.05 | % | | |

| Federal funds purchased and other short-term borrowings | | 4,501,327 | | | 49,575 | | | 4.37 | % | | 211,794 | | | 1,177 | | | 2.20 | % | | |

| FHLB advances | | 1 | | | — | | | — | % | | 86,243 | | | 392 | | | 1.80 | % | | |

| Repurchase agreements | | 13,897 | | | 193 | | | 5.51 | % | | 624,821 | | | 4,421 | | | 2.81 | % | | |

| Long-term debt and finance lease liabilities | | 152,962 | | | 2,910 | | | 7.55 | % | | 152,565 | | | 1,543 | | | 4.01 | % | | |

| Total interest-bearing liabilities | | $ | 43,563,947 | | | $ | 390,974 | | | 3.56 | % | | $ | 32,703,323 | | | $ | 76,427 | | | 0.93 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-bearing liabilities and stockholders’ equity: | | | | | | | | | | | | | | |

| Demand deposits | | 16,302,296 | | | | | | | 22,423,633 | | | | | | | |

| Accrued expenses and other liabilities | | 2,465,745 | | | | | | | 2,179,850 | | | | | | | |

| Stockholders’ equity | | 6,604,798 | | | | | | | 5,772,638 | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 68,936,786 | | | | | | | $ | 63,079,444 | | | | | | | |

| | | | | | | | | | | | | | | |

Interest rate spread | | | | | | 2.31 | % | | | | | | 3.26 | % | | |

Net interest income and net interest margin | | | | $ | 570,813 | | | 3.48 | % | | | | $ | 551,809 | | | 3.68 | % | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | |

(1)Annualized.

(2)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| YEAR-TO-DATE AVERAGE BALANCES, YIELDS AND RATES |

| ($ in thousands) |

| (unaudited) |

| Table 8 | | |

| | |

| | Nine Months Ended | | |

| September 30, 2023 | | September 30, 2022 | | |

| Average | | | | Average | | Average | | | | Average | | |

| Balance | | Interest | | Yield/Rate (1) | | Balance | | Interest | | Yield/Rate (1) | | |

Assets | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | |

| Interest-bearing cash and deposits with banks | | $ | 4,703,843 | | | $ | 164,393 | | | 4.67 | % | | $ | 3,175,596 | | | $ | 17,127 | | | 0.72 | % | | |

| Resale agreements | | 659,621 | | | 12,932 | | | 2.62 | % | | 1,588,452 | | | 23,705 | | | 2.00 | % | | |

| AFS debt securities | | 6,146,653 | | | 166,666 | | | 3.63 | % | | 6,886,268 | | | 106,290 | | | 2.06 | % | | |

| HTM debt securities | | 2,982,284 | | | 38,013 | | | 1.70 | % | | 2,672,797 | | | 33,645 | | | 1.68 | % | | |

| Loans (2) | | 48,969,843 | | | 2,318,369 | | | 6.33 | % | | 44,548,520 | | | 1,376,978 | | | 4.13 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| FHLB and FRB stock | | 83,013 | | | 3,054 | | | 4.92 | % | | 77,824 | | | 2,274 | | | 3.91 | % | | |

| Total interest-earning assets | | $ | 63,545,257 | | | $ | 2,703,427 | | | 5.69 | % | | $ | 58,949,457 | | | $ | 1,560,019 | | | 3.54 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | |

| Cash and due from banks | | 578,144 | | | | | | | 656,772 | | | | | | | |

| Allowance for loan losses | | (617,381) | | | | | | | (551,818) | | | | | | | |

| Other assets | | 3,690,570 | | | | | | | 3,307,207 | | | | | | | |

| Total assets | | $ | 67,196,590 | | | | | | | $ | 62,361,618 | | | | | | | |

| | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | |

| Checking deposits | | $ | 7,675,325 | | | $ | 127,030 | | | 2.21 | % | | $ | 6,747,711 | | | $ | 13,073 | | | 0.26 | % | | |

| Money market deposits | | 11,295,157 | | | 275,738 | | | 3.26 | % | | 12,526,222 | | | 45,196 | | | 0.48 | % | | |

| Savings deposits | | 2,215,102 | | | 11,679 | | | 0.70 | % | | 2,954,098 | | | 5,836 | | | 0.26 | % | | |

| Time deposits | | 15,993,669 | | | 428,120 | | | 3.58 | % | | 8,596,728 | | | 40,266 | | | 0.63 | % | | |

| Federal funds purchased and other short-term borrowings | | 3,284,663 | | | 107,432 | | | 4.37 | % | | 93,370 | | | 1,427 | | | 2.04 | % | | |

| FHLB advances | | 164,836 | | | 6,430 | | | 5.22 | % | | 128,137 | | | 1,529 | | | 1.60 | % | | |

| Repurchase agreements | | 45,080 | | | 1,456 | | | 4.32 | % | | 433,340 | | | 8,855 | | | 2.73 | % | | |

| Long-term debt and finance lease liabilities | | 152,716 | | | 8,122 | | | 7.11 | % | | 152,259 | |

| 3,463 | | | 3.04 | % | | |

| Total interest-bearing liabilities | | $ | 40,826,548 | | | $ | 966,007 | | | 3.16 | % | | $ | 31,631,865 | | | $ | 119,645 | | | 0.51 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-bearing liabilities and stockholders’ equity: | | | | | | | | | | | | | | |

| Demand deposits | | 17,633,922 | | | | | | | 23,244,247 | | | | | | | |

| Accrued expenses and other liabilities | | 2,324,870 | | | | | | | 1,719,869 | | | | | | | |

| Stockholders’ equity | | 6,411,250 | | | | | | | 5,765,637 | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 67,196,590 | | | | | | | $ | 62,361,618 | | | | | | | |

| | | | | | | | | | | | | | | |

Interest rate spread | | | | | | 2.53 | % | | | | | | 3.03 | % | | |

Net interest income and net interest margin | | | | $ | 1,737,420 | | | 3.66 | % | | | | $ | 1,440,374 | | | 3.27 | % | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | |

(1)Annualized.

(2)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| SELECTED RATIOS |

| (unaudited) |

| Table 9 |

|

| | Three Months Ended (1) | | September 30, 2023 Basis Point Change |

| | | September 30,

2023 | | June 30,

2023 | | September 30,

2022 | | Qtr-o-Qtr | | Yr-o-Yr | |

| Return on average assets | | 1.66 | % | | 1.85 | % | | 1.86 | % | | (19) | | bps | (20) | | bps |

| Adjusted return on average assets (2) | | 1.66 | % | | 1.85 | % | | 1.86 | % | | (19) | | | (20) | | |

| Return on average common equity | | 17.28 | % | | 19.43 | % | | 20.30 | % | | (215) | | | (302) | | |

| Adjusted return on average common equity (2) | | 17.28 | % | | 19.43 | % | | 20.30 | % | | (215) | | | (302) | | |

| Return on average TCE (3) | | 18.65 | % | | 21.01 | % | | 22.16 | % | | (236) | | | (351) | | |

| Adjusted return on average TCE (3) | | 18.65 | % | | 21.01 | % | | 22.16 | % | | (236) | | | (351) | | |

| Interest rate spread | | 2.31 | % | | 2.43 | % | | 3.26 | % | | (12) | | | (95) | | |

| Net interest margin | | 3.48 | % | | 3.55 | % | | 3.68 | % | | (7) | | | (20) | | |

| | | | | | | | | | | | |

| Average loan yield | | 6.51 | % | | 6.33 | % | | 4.75 | % | | 18 | | | 176 | | |

| | | | | | | | | | | | |

| Yield on average interest-earning assets | | 5.87 | % | | 5.67 | % | | 4.19 | % | | 20 | | | 168 | | |

| Average cost of interest-bearing deposits | | 3.45 | % | | 3.09 | % | | 0.86 | % | | 36 | | | 259 | | |

| Average cost of deposits | | 2.43 | % | | 2.12 | % | | 0.51 | % | | 31 | | | 192 | | |

| Average cost of funds | | 2.59 | % | | 2.31 | % | | 0.55 | % | | 28 | | | 204 | | |

| Pre-tax, pre-provision profitability ratio (4) | | 2.56 | % | | 2.61 | % | | 2.72 | % | | (5) | | | (16) | | |

| Adjusted noninterest expense/average assets (4) | | 1.16 | % | | 1.22 | % | | 1.23 | % | | (6) | | | (7) | | |

| Efficiency ratio | | 38.92 | % | | 40.56 | % | | 34.43 | % | | (164) | | | 449 | | |

| Adjusted efficiency ratio (4) | | 31.18 | % | | 31.83 | % | | 31.18 | % | | (65) | | bps | — | | bps |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Nine Months Ended (1) | | September 30, 2023

Basis Point Change | | | | |

| | | September 30,

2023 | | September 30,

2022 | | Yr-o-Yr | | | | | |

| Return on average assets | | 1.83 | % | | 1.70 | % | | 13 | | bps | | | |

| Adjusted return on average assets (2) | | 1.85 | % | | 1.70 | % | | 15 | | | | | | |

| Return on average common equity | | 19.23 | % | | 18.35 | % | | 88 | | | | | | |

| Adjusted return on average common equity (2) | | 19.38 | % | | 18.35 | % | | 103 | | | | | | |

| Return on average TCE (3) | | 20.80 | % | | 20.04 | % | | 76 | | | | | | |

| Adjusted return on average TCE (3) | | 20.96 | % | | 20.04 | % | | 92 | | | | | | |

| Interest rate spread | | 2.53 | % | | 3.03 | % | | (50) | | | | | | |

| Net interest margin | | 3.66 | % | | 3.27 | % | | 39 | | | | | | |

| | | | | | | | | | | | |

| Average loan yield | | 6.33 | % | | 4.13 | % | | 220 | | | | | | |

| | | | | | | | | | | | |

| Yield on average interest-earning assets | | 5.69 | % | | 3.54 | % | | 215 | | | | | | |

| Average cost of interest-bearing deposits | | 3.03 | % | | 0.45 | % | | 258 | | | | | | |

| Average cost of deposits | | 2.06 | % | | 0.26 | % | | 180 | | | | | | |

| Average cost of funds | | 2.21 | % | | 0.29 | % | | 192 | | | | | | |

| Pre-tax, pre-provision profitability ratio (4) | | 2.69 | % | | 2.41 | % | | 28 | | | | | | |

| Adjusted noninterest expense/average assets (4) | | 1.22 | % | | 1.18 | % | | 4 | | | | | | |

| Efficiency ratio | | 37.50 | % | | 35.98 | % | | 152 | | | | | | |

| Adjusted efficiency ratio (4) | | 31.15 | % | | 32.98 | % | | (183) | | bps | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1)Annualized except for efficiency ratio and adjusted efficiency ratio.

(2)Adjusted return on average assets and adjusted return on average common equity are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 14.

(3)Return on average TCE and adjusted return on average TCE are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13.

(4)Pre-tax, pre-provision profitability ratio, adjusted noninterest expense/average assets and adjusted efficiency ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 12.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| ALLOWANCE FOR LOAN LOSSES & OFF-BALANCE SHEET CREDIT EXPOSURES |

| ($ in thousands) |

| (unaudited) |

| Table 10 |

|

| | | | | | | | | | | | | | | | | | | |

|

| | | Three Months Ended September 30, 2023 |

| | | Commercial | | | | | Consumer | | |

| | | | | | | | | | | | | |

| | | C&I | | | | | | | Total CRE | | | | | Total Residential Mortgage | | Other Consumer | | Total |

Allowance for loan losses, June 30, 2023 | | | $ | 375,333 | | | | | | | | $ | 202,768 | | | | | | $ | 56,039 | | | $ | 1,260 | | | $ | 635,400 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Provision for credit losses on loans | (a) | | 13,006 | | | | | | | | 22,026 | | | | | | 2,648 | | | 456 | | | 38,136 | |

| Gross charge-offs | | | (7,074) | | | | | | | | (13,879) | | | | | | (41) | | | (13) | | | (21,007) | |

| Gross recoveries | | | 2,279 | | | | | | | | 503 | | | | | | 79 | | | — | | | 2,861 | |

| Total net (charge-offs) recoveries | | | (4,795) | | | | | | | | (13,376) | | | | | | 38 | | | (13) | | | (18,146) | |

| Foreign currency translation adjustment | | | 133 | | | | | | | | — | | | | | | — | | | — | | | 133 | |

Allowance for loan losses, September 30, 2023 | | | $ | 383,677 | | | | | | | | $ | 211,418 | | | | | | $ | 58,725 | | | $ | 1,703 | | | $ | 655,523 | |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2023 | | |

| | | Commercial | | | | | Consumer | | | | | |

| | | C&I | | | | | | | Total CRE | | | | | Total Residential Mortgage | | Other Consumer | | Total | | | |

Allowance for loan losses, March 31, 2023 | | | $ | 376,325 | | | | | | | | $ | 188,915 | | | | | | $ | 52,978 | | | $ | 1,675 | | | $ | 619,893 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Provision for (reversal of) credit losses on loans | (a) | | 5,259 | | | | | | | | 16,076 | | | | | | 3,057 | | | (367) | | | 24,025 | | | | |

| Gross charge-offs | | | (7,335) | | | | | | | | (2,366) | | | | | | (6) | | | (48) | | | (9,755) | | | | |

| Gross recoveries | | | 2,065 | | | | | | | | 143 | | | | | | 10 | | | — | | | 2,218 | | | | |

| Total net (charge-offs) recoveries | | | (5,270) | | | | | | | | (2,223) | | | | | | 4 | | | (48) | | | (7,537) | | | | |

| Foreign currency translation adjustment | | | (981) | | | | | | | | — | | | | | | — | | | — | | | (981) | | | | |

Allowance for loan losses, June 30, 2023 | | | $ | 375,333 | | | | | | | | $ | 202,768 | | | | | | $ | 56,039 | | | $ | 1,260 | | | $ | 635,400 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, 2022 |

| | | Commercial | | | | | Consumer | | | |

| | | | | | | | | | | | | | |

| | | C&I | | | | | | | Total CRE | | | | | Total Residential Mortgage | | Other Consumer | | Total | |

Allowance for loan losses, June 30, 2022 | | | $ | 363,282 | | | | | | | | $ | 173,479 | | | | | | $ | 25,060 | | | $ | 1,449 | | | $ | 563,270 | | |

| Provision for credit losses on loans | (a) | | 9,575 | | | | | | | | 11,163 | | | | | | 6,281 | | | 255 | | | 27,274 | | |

| Gross charge-offs | | | (6,894) | | | | | | | | (6,226) | | | | | | (775) | | | (10) | | | (13,905) | | |

| Gross recoveries | | | 7,172 | | | | | | | | 71 | | | | | | 21 | | | — | | | 7,264 | | |

| Total net recoveries (charge-offs) | | | 278 | | | | | | | | (6,155) | | | | | | (754) | | | (10) | | | (6,641) | | |

| Foreign currency translation adjustment | | | (1,386) | | | | | | | | — | | | | | | — | | | — | | | (1,386) | | |

Allowance for loan losses, September 30, 2022 | | | $ | 371,749 | | | | | | | | $ | 178,487 | | | | | | $ | 30,587 | | | $ | 1,694 | | | $ | 582,517 | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| ALLOWANCE FOR LOAN LOSSES & OFF-BALANCE-SHEET CREDIT EXPOSURES |

| ($ in thousands) |

| (unaudited) |

| Table 10 (continued) |

|

| | | | | | | | | | | | | | | | | | | |

|

| | | Nine Months Ended September 30, 2023 |

| | | Commercial | | | | | Consumer | | |

| | | | | | | | | | | | | |

| | | C&I | | | | | | | Total CRE | | | | | Total Residential Mortgage | | Other Consumer | | Total |

Allowance for loan losses, December 31, 2022 | | | $ | 371,700 | | | | | | | | $ | 182,346 | | | | | | $ | 40,039 | | | $ | 1,560 | | | $ | 595,645 | |

| Impact of ASU 2022-02 adoption | | | 5,683 | | | | | | | | 343 | | | | | | 2 | | | — | | | 6,028 | |

| Allowance for loan losses, January 1, 2023 | | | $ | 377,383 | | | | | | | | $ | 182,689 | | | | | | $ | 40,041 | | | $ | 1,560 | | | $ | 601,673 | |

Provision for credit losses on loans | (a) | | 17,587 | | | | | | | | 44,123 | | | | | | 18,727 | | | 244 | | | 80,681 | |

| Gross charge-offs | | | (16,309) | | | | | | | | (16,251) | | | | | | (138) | | | (101) | | | (32,799) | |

| Gross recoveries | | | 5,555 | | | | | | | | 857 | | | | | | 95 | | | — | | | 6,507 | |

| Total net charge-offs | | | (10,754) | | | | | | | | (15,394) | | | | | | (43) | | | (101) | | | (26,292) | |

| Foreign currency translation adjustment | | | (539) | | | | | | | | — | | | | | | — | | | — | | | (539) | |

Allowance for loan losses, September 30, 2023 | | | $ | 383,677 | | | | | | | | $ | 211,418 | | | | | | $ | 58,725 | | | $ | 1,703 | | | $ | 655,523 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2022 | | | |

| | | Commercial | | | | | Consumer | | | | | |

| | | C&I | | | | | | | Total CRE | | | | | Total Residential Mortgage | | Other Consumer | | Total | | | |

Allowance for loan losses, December 31, 2021 | | | $ | 338,252 | | | | | | | | $ | 180,808 | | | | | | $ | 20,595 | | | $ | 1,924 | | | $ | 541,579 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Provision for (reversal of) credit losses on loans | (a) | | 37,867 | | | | | | | | 3,640 | | | | | | 10,628 | | | (140) | | | 51,995 | | | | |

| Gross charge-offs | | | (18,322) | | | | | | | | (7,304) | | | | | | (968) | | | (90) | | | (26,684) | | | | |

| Gross recoveries | | | 16,688 | | | | | | | | 1,343 | | | | | | 332 | | | — | | | 18,363 | | | | |

Total net charge-offs | | | (1,634) | | | | | | | | (5,961) | | | | | | (636) | | | (90) | | | (8,321) | | | |

| Foreign currency translation adjustment | | | (2,736) | | | | | | | | — | | | | | | — | | | — | | | (2,736) | | | |

Allowance for loan losses, September 30, 2022 | | | $ | 371,749 | | | | | | | | $ | 178,487 | | | | | | $ | 30,587 | | | $ | 1,694 | | | $ | 582,517 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | | September 30,

2023 | | June 30,

2023 | | September 30,

2022 | | September 30,

2023 | | September 30,

2022 |

| Unfunded Credit Facilities | | | | | | | | | | | |

Allowance for unfunded credit commitments, beginning of period (1) | | | $ | 29,728 | | | $ | 27,741 | | | $ | 24,304 | | | $ | 26,264 | | | $ | 27,514 | |

| | | | | | | | | | | |

| Provision for (reversal of) credit losses on unfunded credit commitments | (b) | | 3,864 | | | 1,975 | | | (274) | | | 7,319 | | | (3,495) | |

| Foreign currency translation adjustment | | | (3) | | | 12 | | | 11 | | | 6 | | | 22 | |

Allowance for unfunded credit commitments, end of period (1) | | | $ | 33,589 | | | $ | 29,728 | | | $ | 24,041 | | | $ | 33,589 | | | $ | 24,041 | |

| | | | | | | | | | | |

| Provision for credit losses | (a)+(b) | | $ | 42,000 | | | $ | 26,000 | | | $ | 27,000 | | | $ | 88,000 | | | $ | 48,500 | |

| | | | | | | | | | | |

(1)Included in Accrued expenses and other liabilities on the Condensed Consolidated Balance Sheet.

| | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |

| CRITICIZED LOANS, NONPERFORMING ASSETS AND CREDIT QUALITY RATIOS | |

| ($ in thousands) | |

| (unaudited) | |

| Table 11 | |

| |

| |

| Criticized Loans | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | |

| Special mention loans | | $ | 483,428 | | | $ | 330,741 | | | $ | 470,964 | | |

| Classified loans | | 538,258 | | | 481,051 | | | 434,242 | | |

Total criticized loans (1) | | $ | 1,021,686 | | | $ | 811,792 | | | $ | 905,206 | | |

| |

| |

| |

Nonperforming Assets | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | |

| Nonaccrual loans: | | | | | | | |

| Commercial: | | | | | | | |

| C&I | | $ | 49,147 | | | $ | 61,879 | | | $ | 47,988 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total CRE | | 16,431 | | | 20,598 | | | 11,209 | | |

| Consumer: | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total residential mortgage | | 37,986 | | | 33,032 | | | 23,309 | | |

| Other consumer | | 136 | | | 24 | | | 37 | | |

| Total nonaccrual loans | | 103,700 | | | 115,533 | | | 82,543 | | |

| | | | | | | |

| | | | | | | |

| Nonperforming loans HFS | | — | | | — | | | 14,500 | | |

| Total nonperforming assets | | $ | 103,700 | | | $ | 115,533 | | | $ | 97,043 | | |

| |

| |

| |

| Credit Quality Ratios | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | |

Annualized quarterly net charge-offs to average loans HFI | | 0.14 | % | | 0.06 | % | | 0.06 | % | |

| | | | | | | |

| Special mention loans to loans HFI | | 0.95 | % | | 0.66 | % | | 0.99 | % | |

| Classified loans to loans HFI | | 1.06 | % | | 0.97 | % | | 0.92 | % | |

| Criticized loans to loans HFI | | 2.01 | % | | 1.63 | % | | 1.91 | % | |

| Nonperforming assets to total assets | | 0.15 | % | | 0.17 | % | | 0.16 | % | |

| Nonaccrual loans to loans HFI | | 0.20 | % | | 0.23 | % | | 0.17 | % | |

| Allowance for loan losses to loans HFI | | 1.29 | % | | 1.28 | % | | 1.23 | % | |

| |

| |

| |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| |

(1)Excludes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| GAAP TO NON-GAAP RECONCILIATION |

| ($ in thousands) |

| (unaudited) |

| Table 12 |