U.S. Dollar Extends Fall Amid Rate Cut Fears

08 März 2024 - 1:58AM

RTTF2

The U.S. dollar continued its early weakness against other major

currencies in the Asian session on Friday amid rising fears among

traders that the U.S. Fed Reserve is likely to cut its interest

rates this year.

U.S. Fed Chair Jerome Powell told Congress on Thursday that rate

cuts "can and will" begin this year.

Asian stock markets traded higher amid rising optimism about

interest rate cuts by major global central banks continued to

inspire traders to get back into the markets. European Central Bank

lowered its annual inflation forecast while announcing its widely

expected decision to leave rates unchanged.

The U.S. dollar started falling against its major rivals since

1st March 2024.

In the Asian trading now, the U.S. dollar fell to nearly a

2-month low of 1.0956 against the euro and nearly a 2-1/2-month low

of 1.2820 against the pound, from yesterday's closing quotes of

1.0946 and 1.2806, respectively. If the greenback extends its

downtrend, it is likely to find support around 1.10 against the

euro and 1.29 against the pound.

Against the Swiss franc and the yen, the greenback slid to more

than a 2-week low of 0.8767 and a 5-week low of 147.52 from

Thursday's closing quotes of 0.8775 and 148.03, respectively. The

greenback may test support near 0.86 against the franc and 146.00

against the yen.

Against Australia, the New Zealand and the Canadian dollars, the

greenback dropped to nearly a 2-month low of 0.6631, nearly a

2-week low of 0.6184 and more than a 2-week low of 1.3445 from

Thursday's closing quotes of 0.6616, 0.6173 and 1.3457,

respectively. On the downside, 0.67 against the aussie, 0.63

against the kiwi and 1.33 against the loonie are seen as the next

support levels for the greenback.

Looking ahead, Germany's industrial output for January is due to

be released at 2:00 am ET in the pre-European session.

In the European session, Eurostat releases revised euro area GDP

data for the fourth quarter. The economy is forecast to remain flat

after shrinking 0.1 percent in the third quarter.

In the New York session, U.S. and Canada jobless rate for

February and U.S. Baker Hughes weekly oil rig count data are slated

for release.

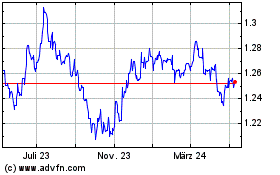

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Apr 2023 bis Apr 2024