Eurozone Lending To Households Logs Weakest Growth Since 2015

27 Februar 2024 - 7:48AM

RTTF2

Lending to the euro area households grew at the slowest pace

since 2015 and broad money supply posted a marginal growth in

January, data released by the European Central Bank showed on

Tuesday. Adjusted loans to households registered an annual increase

of 0.3 percent, which was slower than the 0.4 percent rise in

December. This was the weakest growth since early 2015.

Likewise, annual growth in loans to non-financial corporations

softened to 0.2 percent from 0.5 percent, data showed. Lending

increased for the second straight month.

Loans to the overall private sector grew 0.4 percent but it was

slightly slower than December's 0.5 percent gain.

Credit to euro area residents dropped 0.4 percent, following a

0.5 percent fall a month ago. Credit to the private sector logged a

steady growth of 0.4 percent in January.

Data showed that the monetary aggregate M3 expanded 0.1 percent

annually, weaker than the revised 0.2 percent rise in December.

The narrow measure M1, that comprises currency in circulation

and overnight deposits, declined 8.6 percent from a year ago in

January after easing 8.5 percent in December.

For the European Central Bank, today's data confirms that the

worst impact of higher rates on bank lending and money growth seems

to be over, said ING economist Bert Colijn.

This suggests that there is no immediate need to rush towards

rate cuts, the economist noted. Colijn expects the ECB to hold

rates in the coming two meetings, and sees the first cut in

June.

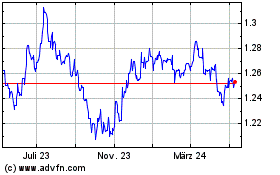

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Mär 2024 bis Apr 2024

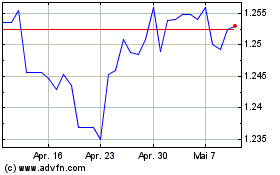

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Apr 2023 bis Apr 2024