Yen Falls Ahead Of BoJ Policy Decision

18 Dezember 2023 - 7:40AM

RTTF2

The Japanese yen weakened against other major currencies in the

European session on Monday, as traders cautiously await the Bank of

Japan's final monetary policy meeting of the year later in the

week, with the central bank expected to maintain its ultra-dovish

stance.

The Bank of Japan (BOJ) began a 2-day meeting today amid

speculation it could change its forward guidance on interest rates

or provide signals on policy change.

Most economists expect the BOJ to ditch negative interest rates

by the end of next year. Upcoming inflation data on Friday also

remained on investors' radar.

The safe-haven yen held steady against its major rivals in the

Asian session today.

In the European trading now, the yen fell to 155.64 against the

euro, 180.90 against the pound and 164.06 against the Swiss franc,

from early highs of 154.88, 180.18 and 163.24, respectively. If the

yen extends its downtrend, it is likely to find support around

163.00 against the euro, 186.00 against the pound and 170.00

against the franc.

Against the U.S. and the Australian dollars, the yen slipped to

a 4-day low of 142.55 and a 6-day low of 95.89 from early highs of

142.07 and 95.28, respectively. The yen may test support near

149.00 against the greenback and 98.00 against the aussie.

Against the New Zealand and the Canadian dollars, the yen

dropped to 5-day lows of 89.00 and 106.55 from early highs of 88.34

and 106.19, respectively. On the downside, 91.00 against the kiwi

and 109.00 against the loonie are seen as the next support levels

for the yen.

Looking ahead, Canada housing price index for November and U.S.

NAHB housing market index for December are due to be released in

the New York session.

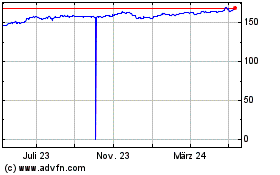

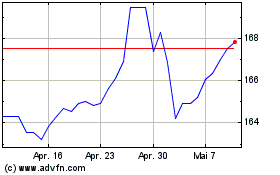

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Jun 2024 bis Jul 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Jul 2023 bis Jul 2024