Ethereum Price To Hit $10,000, ‘Just The Way The Chips Have Fallen,’ Analyst Says

19 Juni 2024 - 8:00PM

NEWSBTC

Crypto analyst and trader Tyler Durden has revealed his bullish

sentiment towards Ethereum (ETH). The analyst suggested that the

ETH rise was inevitable and that it was better for traders to go

with the tide. Ethereum Is Set To Rise To $10,000 Durden

mentioned in an X (formerly Twitter) post that Ethereum to $10,000

is the “most asymmetric bet” in crypto today. He further stated

that “as annoying as that is, [it’s] just the way the chips have

fallen,” suggesting that ETH’s rise to this price level was

inevitable. He also hinted that he would bet on ETH regardless of

how he felt about the crypto token, as he noted that traders “trade

the market” and not their emotions. Related Reading: Bitcoin

Price Drops Below Critical Support Level Following Rejection At

$70,000 The analyst suggested that the Spot Ethereum ETFs will be

key in ETH’s rise to $10,000. He claimed that Wall Street made

great efforts to ensure that the Ethereum ETFs were approved,

including changing Ethereum from a security. As such, he believes

that these institutional investors will ensure that they make as

much money as they can from these funds while pumping Ethereum’s

price. Other analysts have also shared similar sentiments to

Durden’s as they predict that the Spot Ethereum ETFs will

contribute to a massive rally for ETH. Crypto analysts Ash Crypto

and Eljaboom also recently predicted that ETH would rise to $10,000

thanks to these funds. Ash Crypto stated that it is just a “matter

of time” before Ethereum reaches this price level, with the Spot

Ethereum ETFs expected to begin trading soon enough. Crypto

analysts Altcoin Daily also previously mentioned that ETH to

$10,000 is “programmed” and mentioned the Spot Ethereum ETFs as one

of the reasons they believe that the crypto token could rise to

this price level. According to Bloomberg analyst Eric Balchunas,

these Spot Ethereum ETFs could begin trading by July 2. These

funds are expected to contribute to ETH’s parabolic rise because of

the significant inflows they could bring into the Ethereum

ecosystem. Crypto research firm K33 predicts these funds could

attract between $3.1 billion and $4.8 billion in net inflows within

the first five months of trading. Why It’s Not Worth Betting

Against ETH Durden alluded to the US Securities and Exchange

Commission’s (SEC) decision to drop its investigation against ETH

to further emphasize why betting on Ethereum was an obvious play.

Ethereum developer Consensys revealed in an X post that the

Enforcement Division of the SEC had notified them that they were

closing the investigation into whether ETH was a security.

Related Reading: XRP Enters Triangle Formation: Analyst Predicts

Rise To $200 Amid 300% Surge In Volume They added that this means

that the SEC would no longer be bringing charges alleging that the

sale of ETH is a securities transaction. The SEC’s potential

lawsuit against Ethereum was expected to be a major catalyst that

could suppress ETH’s price, just like the SEC’s lawsuit against

Ripple, which is believed to have had a negative impact on XRP’s

price. However, with the SEC opting against bringing charges

against Ethereum, ETH’s price looks all set for takeoff as this

development adds to the bullish narrative around the crypto

token. Featured image created with Dall.E, chart from

Tradingview.com

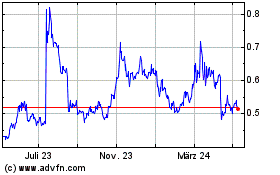

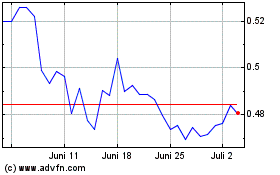

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024