PEPE Frenzy: 100% Gains In 30 Days, But Can The Memecoin Keep Its Composure?

26 Mai 2024 - 4:00PM

NEWSBTC

The cryptocurrency world is witnessing a familiar sight: a meme

coin on fire. PEPE, a token emblazoned with the internet’s favorite

frog, has skyrocketed in recent weeks, leaving investors wondering

if this is the dawn of a new era or a fleeting fad. Related

Reading: Solana to Hit $1,000? Analyst Makes Bullish Call Despite

Recent Downturn PEPE On A Tear: New Highs And Whale Activity Over

the past month, PEPE has been on a tear, exceeding expectations and

leaving a trail of green for investors. The price triumphantly

reached a new all-time high, surging over 100% in just 30 days.

This astronomical rise translated to happy hodlers, with

IntoTheBlock data revealing that a whopping 97% were sitting pretty

in profit. CoinGecko data show that Pepe has risen 56% in the

previous week and 99% in the last month, recovering its position as

the third-largest meme coin by market capitalization from Dogwifhat

(WIF). The bullish momentum hasn’t shown any signs of slowing down.

The past 24 hours saw another surge of 3.7%, further propelling

PEPE to its current peak. This impressive performance has garnered

significant attention, not just financially, but also on social

media. The coin’s social volume has spiked, indicating a surge in

interest and online chatter. Adding fuel to the fire, a whale, a

term used for large investors with significant buying power, has

been making waves. Lookonchain, a blockchain analytics platform,

recently reported a whale withdrawing a staggering 500 billion PEPE

from Binance, a major cryptocurrency exchange. This mass

accumulation suggests a whale-sized vote of confidence in PEPE’s

future. Buying Frenzy Or Overheated Engine? While the recent price

increase and social media buzz are undoubtedly positive signs, some

analysts are urging caution. A closer look at technical indicators

reveals potential signs of an overheated market. The Chaikin Money

Flow (CMF), which measures buying and selling pressure, has

registered a decline. Similarly, the Money Flow Index (MFI) and

Relative Strength Index (RSI) are both hovering in the overbought

zone, suggesting PEPE’s price might be due for a correction.

Further complicating the picture is the presence of selling

pressure. While some investors are piling in, others might be

cashing out on their profits. Santiment, a crypto analytics

platform, observed a rise in PEPE’s exchange outflow last week,

indicating buying pressure. However, they also noted an increase in

supply on exchanges, suggesting some investors might be taking

advantage of the high price to sell. Potential Price Correction

NewsBTC analyzed PEPE’s daily chart to gauge the impact of this

potential selling pressure. Their analysis suggests that the price

might first fall to $0.0000122 before potentially finding support

and initiating another bull run. However, a deeper correction could

see PEPE plummet to $0.000010 or even lower. Related Reading: Shiba

Inu On The Verge Of 600% Rally? Analyst Weighs In The Most Traded

Memecoin Meanhwhile, Pepe was still among the most traded

cryptocurrency assets over the previous day, according to data from

Binance, with only BNB Coin (BNB), Bitcoin (BTC), and Ethereum

(ETH) surpassing it. Pepe continues to be the most traded meme

coin, surpassing popular coins such as Dogecoin (DOGE), Floki

(FLOKI), and Shiba Inu (SHIB). Featured image from ART street,

chart from TradingView

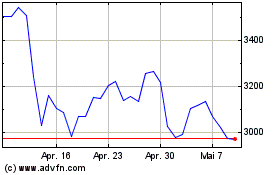

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Jun 2023 bis Jun 2024