Ethereum Bull Flag Breakout: ATH On The Horizon As Major Metrics Turn Bullish

15 Mai 2024 - 7:00PM

NEWSBTC

Crypto analyst Javon Marks has highlighted several metrics that

have turned bullish for Ethereum (ETH). The analyst noted that one

of these metrics suggests an all-time high (ATH) for the

second-largest crypto token. Bullish Metrics For Ethereum

Marks remarked in an X (formerly Twitter) post that the bull

flag-like price structure has formed on the Ethereum chart. He

added that higher lows are forming in Ethereum’s price action,

which is also a bullish signal as it suggests a strong resistance

to downward trends. Meanwhile, the analyst claims lower lows in the

Relative Strength Index (RSI) indicate a hidden bullish divergence

with Ethereum’s price. Related Reading: Brace For Impact: Mt. Gox

Set To Inject 142,000 BTC And 143,000 Bitcoin Cash Into The Market-

Here’s When Marks then raised the possibility of Ethereum hitting a

new ATH, stating that the “bull flag breakout might lead into new

all-time highs and be of major service in many Altcoin

progressions.” Before then, he claimed that Ethereum could soon

experience a larger price breakout, making the crypto token

experience a 63% upside to $4,811. Crypto analyst Michaël van de

Poppe also recently suggested that Ethereum could make a major move

soon enough and lead altcoins to make new highs. According to him,

this will be triggered by the news surrounding the Ethereum ETF, as

he expects that to be the “rotation for the Altcoins.” However,

Ethereum also risks experiencing a significant decline, considering

reports that the Securities and Exchange Commission (SEC) might

reject the Ethereum ETF applications. Crypto analyst James Van

Straten stated that a rejection of the Spot ETF “sends the ETHBTC

ratio lower 0.047 to 0.03 as a long-term projection.” This was one

of the reasons why the analyst stated that “Ethereum looks like

it’s going to the grave.” He also alluded to the fact that ETH has

become inflationary with the Decun upgrade reducing transaction

fees, which has ultimately reduced ETH’s burn rate. Things

Aren’t Looking Good For ETH Crypto analyst Derek recently mentioned

that “Ethereum dominance and recent performance are heading toward

their worst ever.” He noted that attention has turned to Bitcoin

due to the reports about a potential rejection of the Ethereum ETF

and securities status, which has put pressure on investment

sentiment. According to him, this has caused the “imbalance in

dominance” to reach its worst point. Related Reading: This

Crypto Expert Called The Bitcoin Top in 2021, Now He’s Calling The

Bottom In 2024 Derek further noted that Ethereum’s unimpressive

price action is affecting other altcoins, as their prices are

“depressed.” He also claimed that the prices of layer two coins

“continued to be under pressure.” The analyst suggested that things

could get worse, as the ETH/BTC chart shows a downward wedge

pattern in progress. He claims that altcoins can only “breathe” if

Ethereum can escape this pattern quickly. At the time of writing,

Ethereum is trading at around $2906, down in the last 24 hours

according to data from CoinMarketCap. Featured image from

Metaverse Post, chart from Tradingview.com

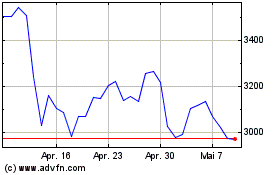

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024