|

|

|

| |

| |

BONTERRA RESOURCES

Action packed 2018 will result in

substantial resource increase

|

| |

|

|

|

|

|

| |

|

| |

|

BonTerra Resources (BTR.V) is taking advantage of the

strong capital markets and its exceptional exploration results of

the past few years, and the company has now raised enough cash to

complete a 70,000 meter drill program on its Gladiator gold project

in Québec's Urban-Barry gold camp.

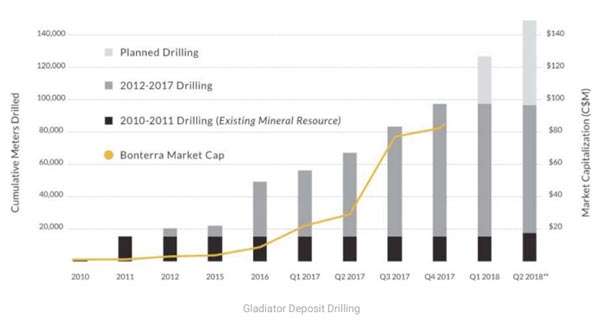

This year will be full of catalysts; the substantial drill program

will result in a continuous news flow with exploration results from

the drill program and these results will subsequently be used in a

resource update. And this will be the very first resource update

since 2012 incorporating in excess of 100,000 meters of additional

drilling...

|

| |

|

| |

|

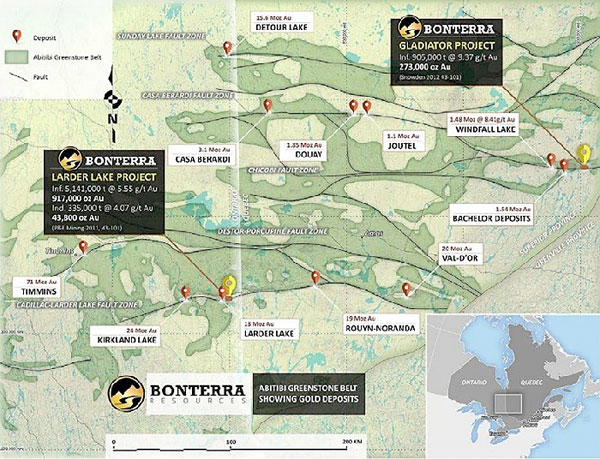

The Gladiator project (previously called

'Eastern Extension') is located in Québec's Chibougamau mining

district, and right on a southern lobe of the Abitibi greenstone

belt. This is a very prolific area and whilst the exploration

activities in the greater Abitibi region were scaled back during

the more difficult years for the mining sector, this now is one of

the most active exploration regions in the world. Osisko

Mining (OSK.TO) was the first company to announce huge

drill programs, but BonTerra immediatey followed suit with a 70,000

meter drill program for 2018.

|

| |

|

| |

|

And there's a very good reason for this

region to heat up. The existing infrastructure in this part of

Québec is pretty good, and the Gladiator property is located just

100 kilometers east of Lebel-sur-Quevillion (which has a small

airfield) and is just a 4- hour drive from Val D'Or. And whilst the

powerlines are a little bit further away, there's plenty of (cheap)

power available. Much better than the logistical nightmare other

exploration projects around the world have to deal with. Back in

2012, the company engaged Snowden to complete a maiden resource

estimate on the project. The expectations and hopes weren't very

high as BonTerra was just getting started on the property and very

little work had been completed by then. Just to give you an idea:

the first resource estimate was based on a total of 15,000 meters

of drilling on the quartz-carbonate vein system on the property.

Since the resource estimate in 2012, BonTerra has completed tens of

thousands of meters of drilling, and it would be an understatement

to say drilling was just 'successful'.

Every other few weeks or so, BonTerra announces assay results from

new drill holes, and even now, almost 6 years after that first

resource estimate, BonTerra is still figuring out where the

mineralization is actually ending as the Gladiator project is still

open in all directions and at depth.

That's why BonTerra embarked on a very aggressive drill program

this year, and the first assay results are expected any day

now!

The mineralization at Gladiator could best be described as a set of

veins, running pretty much parallel to each other. Right now, 5

veins (with a 'mineable' width) have been identified and drilled

over a total (horizontal) length of 1,200 meters. BonTerra was also

smart enough to drill a few deep holes to figure out the total

extent of the mineralization, but even at depths of in excess of

1,000 meters the mineralization seems to be continuing. That's not

a huge surprise as the gold deposits in Québec are notorious for

their depths, and in several cases in the province, gold was traced

until a depth of 1,500-2,000 meters. We're not saying the gold will

be economical at depth (it could be), but we hope it's clear the

potential at depth could be enormous. Time will tell!

|

| |

|

|

| |

|

Unfortunately the 2012 technical report

does not contain any information on the anticipated recovery rate

of the gold from the Gladiator ore. BonTerra is conducting some

metallurgical testing activities as we speak, and the company plans

to release the results of its test work sometime in the second

quarter of this year. A positive outcome would be an incredibly

important step forward for BonTerra as the viability of the project

will depend on the recovery rate of the gold as well. Fortunately

most of the other gold projects in the belt have pretty good

metallurgical recovery rates so we don't anticipate BonTerra to run

into any issues on this front. But it will be nice to have some

official numbers to rely on! The current resource estimate of less

than 300,000 ounces of gold is actually meaningless as it's based

on just 15,000 meters of drilling. This is obviously a negligible

amount of drilling for a project of this size. BonTerra hasn't

updated this resource yet, but is planning to do so by the end of

this year, and this new resource estimate will incorporate well

over 100,000 meters of 'new' drill data on the property.

|

|

|

As approximately 25% of the total amount

of new drilling will only be completed in the first semester of

this year, it's still too early to put an exploration target

together for the updated resource estimate. You should also keep in

mind the resource will be calculated based on the zones closer to

surface. As only a very few holes were drilled really deep, we

expect the updated resource estimate to show additional exploration

potential.

|

| |

|

|

| |

|

Elsewhere in Canada, BonTerra also owns

the Larder Lake gold project in Ontario, literally within a

30-minute walking distance from the border with Québec. Despite an

existing resource estimate confirming in excess of 950,000 ounces

of gold at an average grade of approximately 5.5 g/t, BonTerra was

able to purchase the property for a cash payment of C$1.15M

(completed) and issuing 10 million shares (for a total pro forma

value of C$3.8M) to Kerr Mines (KER.TO).

|

| |

|

| |

|

The Larder Lake property (which consists

of a 9-kilometer-long land package on the Cadillac Larder break)

actually contains a past producing mine and two shafts are 'silent

witnesses' of the heydays in the district. The entire

Cadillac-Larder trend produced a total of 13 million ounces of

gold, with the majority coming from the Kerr Addison mine, that

produced in excess of 10 million ounces of gold.

It's also interesting to mention that Gold Fields (GFI) worked for

three years on the property as part of a 60% earn-in deal (which

required Gold Fields to spend $40M on exploration and development

activities) but cancelled the earn-in a few years ago. Gold Fields

was quite aggressive as the company completed approximately 25,000

meters of drilling in 59 holes and all data has been handed over to

BonTerra as part of the property acquisition deal.

The Ministry of Northern Development and Mines of the province of

Ontario has actually made a historic report on the Larder Lake and

nearby Kerr Addison mines available for consultation

(find it here).

Besides completing a 3D model at Larder Lake, BonTerra hasn't done

much work on the property since it was acquired in the summer of

2016.

Whilst we obviously understand the company's main focus is the

Gladiator deposit as it's aggressively expanding the existing

resource, we do hope BonTerra will spend some money on the Larder

gold project as well.

|

| |

|

| |

|

| |

|

After raising C$21.5M by issuing 13.3

million super flow through shares at C$0.75 and 19.2 million

'normal' flow-through shares at C$0.60 per share, the current share

count has increased to approximately 226.6M shares. We expect the

share count to gradually increase as warrant holders will be

exercising their in-the-money warrants. Using the current share

price of C$0.50, this represents a total market capitalization of

C$113M resulting in an enterprise value of C$83M after deducting an

estimated C $30M in net cash. This is our own estimate based on the

cash position at the end of November (C$18.5M), the slightly higher

share count after warrant exercises, the net proceeds of the

C$21.5M financing and the expected incurred exploration

expenditures in the past four months.

Some people were surprised to see BonTerra raising more money, but

our view is pretty clear: if you're being offered money at decent

terms (in this case: a good flowthrough premium and no warrants) as

an exploration company, you should ALWAYS take it.

We would expect BonTerra's treasury to remain very healthy as a

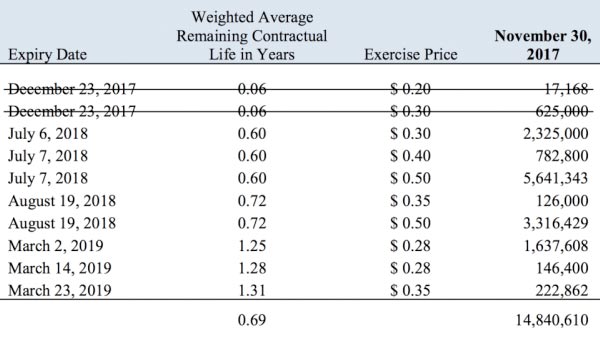

bunch of warrants will be expiring within the next 12 months. The

next table provides you with an overview of the amount of warrants

and strike prices but please note, the amount of warrants is the

situation as of November 30th, and some of those warrants have

already been exercised.

|

| |

|

| |

|

As you can see, C$0.50 is the key level.

Should the warrant holders exercise their C $0.50 warrants by July

and August, BonTerra will be able to raise an additional C $4.4M.

In case this doesn't happen, the remaining (cheaper) warrants will

allow BonTerra to add C$1.6M to the treasury by issuing 5.2 million

new shares.

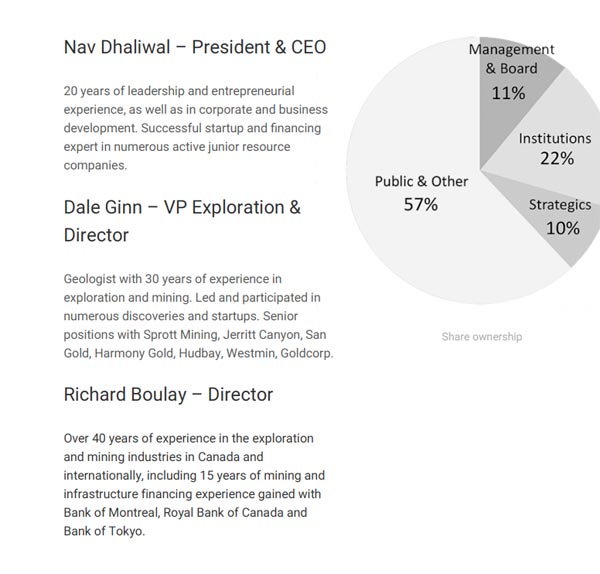

There are some big names represented in the company's share capital

as for instance ETF issuer Van Eck and Kirkland Lake Gold (KL,

KL.TO) have substantial positions in BonTerra Resources. Kirkland

Lake Gold already has a huge presence in the greater area and is

probably keeping tabs on BonTerra's exploration program.

|

| |

|

| |

|

| |

|

| |

|

BonTerra is aggressively drilling and

expanding its Gladiator deposit and we are anticipating a

substantial increase in the gold resources when the new resource

estimate will be published in the second half of this year. We

expect the total gold resource to increase to well in excess of 1

million ounces, and we will particularly focus on the grade (which

will very likely decrease compared to the previous resource

estimate) and the potential viability of the project.

Drilling is ongoing and shareholders could expect a steady news

flow throughout the next two quarters which will ultimately result

in an updated resource estimate in the second half of this

year.

For enquiries, please post a comment on the article online, contact

us at caesarsreport.com contact or

email us at info@caesarsreport.com

About Caesars Report

For enquiries, please post a comment on the article online, contact

us at caesarsreport.com/contact or email us at info@caesarsreport.com Caesars

Report is an online mining portal specialized in (junior) mining

companies. In the coming years securing resources will be

fundamental to sustaining growth so this will remain a key area of

investor interest. We provide coverage of companies that offer an

attractive risk/reward ratio. Our aim is to inform our readers and

to give them an incentive to do further research. We visit

interesting companies ourselves and report from the source. We are

also present on numerous events all over the world, ranging from

the PDAC International Convention in Toronto to smaller roadshows

all over Europe. As we are not a registered investment advisor,

please always do your own research. Visit us at www.caesarsreport.com

|

| |

|

|

|

|

|