Wealth Minerals Ltd. (the “Company” or “Wealth”) - (TSXV: WML;

OTCQX: WMLLF; SSE: WMLCL; Frankfurt: EJZN), reports that it has

negotiated an option agreement for the Goldsmith gold property

(“Goldsmith”) in south eastern British Columbia. This property

adjoins Wealth’s existing Kootenay base metal project (the

“Kootenay Project” or the “Project”; Figure 1), where the primary

target is nickel-rich volcanogenic massive sulphide (VMS)

mineralization. Goldsmith comprises 11 claims totaling 782

hectares.

Wealth’s Kootenay Project is within the

prospective Lardeau Group, which hosts numerous volcanogenic

massive sulphide deposits, including the past-producing Goldstream

mine, located 90km north of Revelstoke. Two properties, Ledgend and

Lardeau, cover some of the most prospective (95th and 99th

percentile) of the anomalous nickel-cobalt silt anomalies produced

by the historic regional stream sampling programmes of the B.C.

Ministry of Mines. Highly anomalous gold was detected in

silt samples on both properties by government sampling and was

duplicated by Wealth reconnaissance silt sampling.

Henk Van Alphen, Wealth’s CEO, states:

“Goldsmith is a welcome addition to the Kootenay Project and the

indications of high-grade gold mineralization there provide further

evidence that the particular mineralized horizons we are pursuing

in the Lardeau rocks are highly prospective for both base and

precious metals.”

Goldsmith Property: A Long History of

High-Grade Gold Discovery

The Goldsmith Property is located 65km north of

Kaslo in southeastern British Columbia. The claims lie west of the

Lardeau River, between Poplar Creek to the north and Cascade Creek

to the south. Highway 31 crosses the east edge of the claims and

access is via the Cascade Forest Service Road. The Property is

being optioned from vendors Jack and Bob Denny.

In 1890, the discovery of placer gold in the

Lardeau River below Trout Lake was closely followed by the

discovery of gold in Poplar Creek, and then the related

greenstone-hosted vein occurrences in 1898. The main rush to the

area was in June 1903, with the discovery of coarse visible gold in

quartz and sulphide veins on the Gold Park, Swede (later the

Goldsmith) and Lucky Jack claims. The initial gold rush only lasted

several months, as the high-grade surface mineralization was

quickly mined out, but significant workings remained active until

1930.

Historical workings on the property consists of

at least six adits on the Bullock and Goldsmith claims plus various

workings on the north side of Poplar Creek, most of which are a

part of the historical Gold Park group (now all part of the

Goldsmith property), all completed before 1930. Numerous veins were

exposed in open cuts and short adits in greenstone and coarsely

crystalline carbonate rock, the weathered product of which yielded

much free gold.

No further systematic exploration was recorded

until 1980-81, when Westmin conducted geological mapping, soil and

rock geochemistry, trenching and 409m of diamond drilling in six

short holes. From 2003 to 2009, Cream Minerals confirmed the

existence of the historical high grade gold mineralization by

locating and sampling many of the historical workings. They also

completed trenching, soil sampling and 200 line-kilometres of

airborne magnetics and electromagnetics. Highlights from the adit

and trench sampling included 101.78g/t over 0.2m, 63.78g/t over

0.8m, and 27.63g/t over 0.35m.

Between 2016 and 2019, Black Tusk Resources

conducted 32.5 line-kilometres of ground magnetic and VLF-EM

surveys, trenching, rock sampling, and brushing out roads, trails

and historical workings. Several northwest trending gold structures

were tested along the Bullock-Goldsmith zone, with mineralization

and geology indicating that they may be aligned along a controlling

shear. The structure contains an abundance of quartz veining as

well as sulphide minerals including arsenopyrite, pyrite, and

pyrrhotite. Large (20-90kg) trench samples were subjected to

Met-Solve Analytical bench-scale processing for gold recovery,

which indicated that most of the samples were amenable to

centrifugal gravity concentration of gold. Calculated head grades

included 14.42g/t gold from the Arsenopyrite Vein, 5.34g/t gold

from the Black Vein, and 5.26g/t gold from Hamburger Vein. This

area, about 500m in strike length, will be the initial focus of

further work.

Note that the exploration results described

above are preliminary in nature and not conclusive evidence of the

likelihood of a mineral deposit. All historic production, drill or

sample figures quoted herein are based on prior data and reports

obtained and prepared by previous operators. The Company has not

completed the work necessary to verify results and the historical

figures should not be relied upon as they have not been verified by

a Qualified Person.

Adjoining Lardeau Property

The Lardeau property, the northern claim block

of the Kootenay Project, adjoins the Goldsmith property to the

south and covers 6136 hectares of mostly low-lying forest with

sparse outcrop west of the Lardeau River. It was staked on the

basis of anomalous nickel-cobalt regional silt anomalies produced

by the regional sampling programmes of the B.C. Ministry of Mines.

Initial work by a previous operator in 2017 generated highly

anomalous Ni (>100 ppm), Co (>30 ppm) and Cu (>50 ppm)

values in three different drainages over three kilometres of their

length. Gold and base metal soil anomalies on Goldsmith trend

southeast onto the Lardeau property.

Limited reconnaissance work along the access

roads at Lardeau identified listwanite float in the northern

anomalous creeks, the same rock type associated with gold at

Goldsmith. Listwanite is a quartz-carbonate alteration product of

nickel-bearing ultramafic rocks (commonly serpentinite) and is

associated with both nickel-cobalt bearing VMS and high-grade

orogenic-style gold mineralization. Listwanite-altered ultramafic

rocks are associated with massive sulphides and orogenic gold

throughout the range of the Lardeau Group greenstone rocks, from

the Goldstream mine 90km north of Revelstoke, to the Ledgend

property 25km north of Kaslo, as well as in several other gold

belts in the Cordillera.

Wealth intends to fly a helicopter-borne VTEM™

and magnetic geophysical survey covering 2900 hectares (641

line-kilometres) over the Lardeau claim block. Base and precious

metal mineralization at Lardeau is expected to be associated with

pyrrhotite, which has a strong magnetic signature based on results

from the Ledgend property. New logging roads planned for this area

will aid in access for prospecting and geochemical sampling of

geophysical anomalies to generate drill targets. If overburden is

problematic, then ground geophysical surveys will be used to

delineate drill targets.

Exploration Potential

Wealth believes the greenstone units of the

southern Lardeau Group to have excellent potential for hosting

volcanogenic massive sulphides (VMS) and orogenic gold

mineralization. Other known VMS and gold occurrences in the Lardeau

belt were either discovered in areas of good rock exposure, at high

elevations, or by chance during construction of forestry roads. The

heavily vegetated low-elevation regions are under-explored, and few

previous local workers have recognized the potential for gold and

base metal mineralization related to widespread, narrow ultramafic

horizons altered to talc-schist and listwanite.

More details on each project are available at

www.wealthminerals.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf415b8f-ab9f-4cde-b6b5-98130ce1e20f

Details of Option Terms

The option agreement applies to the Goldsmith

Property, comprising 11 claims totaling 782 hectares. The

underlying owners are Jack and Bob Denny. Wealth has been

granted the exclusive option to acquire a 100% interest Goldsmith

by issuing 500,000 common shares and CAD$100,000 over a four-year

term, the details of which are as follows:

|

|

|

Date |

Cash (CAD) and Wealth Shares |

|

|

|

|

|

Closing |

$5,000 and 100,000 shares |

|

|

|

|

|

Year 1 Anniversary |

$15,000 and 100,000 shares |

|

|

|

|

|

Year 2 Anniversary |

$20,000 and 100,000 shares |

|

|

|

|

|

Year 3 Anniversary |

$30,000 and 100,000 shares |

|

|

|

|

|

Year 4 Anniversary |

$30,000 and 100,000 shares |

|

|

|

|

|

Total |

$100,000 and 500,000 shares |

|

|

All of the claims are subject to a 2% net

smelter return royalty. Wealth will have the right to purchase the

royalty for a payment of CAD$1,000,000 in cash at any time

following the date that Wealth exercises its right to acquire the

properties.

Qualified Person

John Drobe P.Geo., Wealth's Exploration Manager

and a qualified person as defined by National Instrument 43-101,

has reviewed the scientific information that forms the basis for

this news release, and has approved the disclosure herein.

Mr. Drobe is not independent of the Company as he is an officer, a

shareholder and holds incentive stock options.

About Wealth Minerals Ltd.

Wealth is a mineral resource company with

interests in Canada, Mexico and Chile. The Company’s main focus is

the acquisition and development of lithium projects in South

America.

The Company opportunistically advances battery

metal projects, namely copper and nickel, where it has a peer

advantage in project selection and initial evaluation.

Lithium market dynamics and a rapidly increasing

metal price are the result of profound structural issues with the

industry meeting anticipated future demand. Wealth is positioning

itself to be a major beneficiary of this future mismatch of supply

and demand. In parallel with lithium market dynamics, Wealth

believes other battery metals will benefit from similar industry

trends.

For further details on the Company readers are

referred to the Company’s website (www.wealthminerals.com) and its

Canadian regulatory filings on SEDAR at www.sedar.com.

On Behalf of the Board of Directors

ofWEALTH MINERALS LTD.

“Hendrik van Alphen”Hendrik van AlphenChief

Executive Officer

|

For further information, please contact: |

Marla Ritchie or Henk van Alphen |

|

|

|

|

|

Phone: 604-331-0096 Ext. 3886 or 604-638-3886 |

|

|

E-mail: info@wealthminerals.com |

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release, which has been prepared by

management.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian and US securities legislation. All statements, other than

statements of historical fact, included herein including, without

limitation, statements regarding the anticipated content,

commencement, timing and cost of exploration programs, anticipated

exploration program results, the discovery and delineation of

mineral deposits/resources/reserves, the Company’s expectation that

it will be able to enter into agreements to acquire interests in

additional mineral projects, and the anticipated business plans and

timing of future activities of the Company, are forward-looking

statements. Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will

prove to be correct. Forward-looking statements are typically

identified by words such as: believe, expect, anticipate, intend,

estimate, postulate and similar expressions, or are those, which,

by their nature, refer to future events. The Company cautions

investors that any forward-looking statements by the Company are

not guarantees of future results or performance, and that actual

results may differ materially from those in forward looking

statements as a result of various factors, including, but not

limited to, the state of the financial markets for the Company’s

equity securities, the state of the commodity markets generally,

variations in the nature, quality and quantity of any mineral

deposits that may be located, variations in the market price of any

mineral products the Company may produce or plan to produce, the

inability of the Company to obtain any necessary permits, consents

or authorizations required, including TSXV acceptance, for its

planned activities, the inability of the Company to produce

minerals from its properties successfully or profitably, to

continue its projected growth, to raise the necessary capital or to

be fully able to implement its business strategies, and other risks

and uncertainties disclosed in the Company’s latest interim

Management Discussion and Analysis and filed with certain

securities commissions in Canada. All of the Company’s Canadian

public disclosure filings may be accessed via www.sedar.com and

readers are urged to review these materials, including the

technical reports filed with respect to the Company’s mineral

properties.

Caution Regarding Adjacent or Similar

Mineral Properties

This news release contains information with

respect to adjacent or similar mineral properties in respect of

which the Company has no interest or rights to explore or mine.

Readers are cautioned that the Company has no interest in or right

to acquire any interest in any such properties, and that mineral

deposits, and the results of any mining thereof, on adjacent or

similar properties are not indicative of mineral deposits on the

Company’s properties or any potential exploitation thereof.

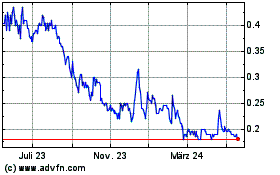

Wealth Minerals (TSXV:WML)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

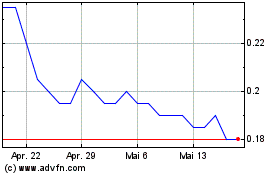

Wealth Minerals (TSXV:WML)

Historical Stock Chart

Von Dez 2023 bis Dez 2024