Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

announce that preliminary results have been received for part of

the recent ground geophysical survey, Controlled Source Audio

Magnetotellurics survey (CSAMT) covering the new Windmill target

area within its 100% owned Sandman Project

(“

Sandman” or the “

Project”)

located in Humboldt County, Nevada, USA.

HIGHLIGHTS & UPDATE:

- New high

priority drill target defined at the Windmill Prospect

- CSAMT survey

results and existing airborne magnetic and ground gravity data

define an east-west structural corridor where hydrothermally

altered and mineralized rocks have been observed in surface rock

float and outcrop on the surface

- The western end

of the interpreted structure corresponds to a mineralized dyke

which transects and extends from the Silica Ridge Mineral Resource

Estimate

- Geochemical lag

sampling within this area is underway and assays received from

reconnaissance samples define precious metal and pathfinder element

anomalies

- Drill program

planned to commence January 2022, including holes at the new

Windmill target

Gold Bull Vice President - Exploration, David Johnson

commented:

These results

appear highly encouraging given the surface mineralization and

alteration that we are seeing, which coincides with this

significant geophysical anomaly. This target will be one to watch

in our upcoming drill program that is anticipated to commence in

mid-January.

Background

Preliminary two-dimensional resistivity models

have been received from DIAS Geophysical for part of the Controlled

Source Audio Magnetotelluric (CSAMT) survey read over the Windmill

target (Figure 1) east of the Silica Ridge deposit. Further results

from surveys read in the North Hill and Abel Knoll areas, together

with models for the east-west lines at Windmill, are pending. The

CSAMT method exploits scattering of EM waves by electrical

contrasts in the Earth to image geologic structures and

mineralogical variations in rocks in the subsurface, including

those caused by hydrothermal alteration.

The Windmill target is a 2.8km east-west

trending zone on the margin of a Tertiary basin that is intruded by

mafic dykes evident in airborne magnetic data (Figure 2). One of

the east-west striking dykes within the Silica Ridge deposit at the

western end of the target zone is strongly mineralized (Figure 2).

The Windmill zone contains hydrothermally altered and mineralized

float and outcrop. A major structure is evident in the new CSAMT

models (Figure 3 and Figure 4), as a set of east-west aligned

resistive zones (interpreted hydrothermal alteration and igneous

intrusions) and disruptions to the generally shallowly dipping

Tertiary volcanic and sedimentary layers. Two drill holes have been

designed to test steeply dipping electrically resistive zones that

lie on this structure that are interpreted to be caused by adularia

alteration in breccia zones that may host gold mineralization. The

western hole, closest to the Silica Ridge deposit, is located near

a reconnaissance lag geochemical sample that returned anomalous

precious metal and pathfinder element assays. This geochemical

survey is being extended and infilled, with further results

expected in January.

Figure 1 Location of CSAMT survey lines covering the Windmill

target to the east of the Silica Ridge deposit.

-- https://www.globenewswire.com/NewsRoom/AttachmentNg/7e4a3a62-d8ec-4871-959f-2d1a4c18d9dd

Next steps

Two-dimensional resistivity models recovered

form the east-west CSAMT lines at Windmill, results from the North

Hill and Abel Knoll surveys remain pending.

The east-west CSAMT lines at Windmill traverse

several NNW striking dykes, parallel to the northerly trend of the

Silica Ridge mineralized structure, Gold Bull will be targeting

intersections of the structures intruded by these dykes with the

east-west Windmill structure. The lag geochemical sampling program

is currently being extended and infilled to support the analysis of

the geophysical data. The first batch of samples has been submitted

for assay.

The CSAMT lines at North Hill cover an area

where historic drilling and one hole (SA-0029) drilled by Gold Bull

in 2021 intersected anomalous gold in a conglomerate near the base

of the Tertiary sequence. The CSAMT survey was read to identify a

structure likely to form the conduit for hydrothermal fluids that

deposited this strata-bound mineralization.

The CSAMT lines at Abel Knoll are designed to

identify structures associated with the strata-bound mineralization

intersected by hole SA-0031, which returned 90 m (295 ft) at 0.6

g/t Au from 76.2 m (refer to press release “Gold Bull Reports

Significant New Gold Mineralization Outside of Current Resource at

Sandman Including: 90m at 0.6 g/t Au” dated July 28, 2021). This

survey will also provide useful orientation of the CSAMT method

over the mineralized diatreme breccia pipe at Abel Knoll to use for

high grade diatreme targeting.

High priority targets arising from this work

will be tested by the drilling program planned for Q1 2022. More

details of the upcoming drill program will be announced prior to

its commencement in January 2022.

Figure 2 Plan view of helicopter magnetic

reduced to pole image showing the location of the east-west mineral

bearing fault along strike of mineralised dyke at the Silica Ridge

deposit. Northwesterly striking dyke structures also highlighted

intersecting the east-west mineral bearing structure.

-- https://www.globenewswire.com/NewsRoom/AttachmentNg/0c8f75d8-8a45-4abb-b127-9f3fa4719f43

Figure 3 Oblique 3D view (looking toward SW) of

2D resistivity models recovered from the CSAMT data, with the

location of the interpreted east-west striking structure and the

Silica Ridge deposit. Initial planned drill holes designed to test

interpreted zones of alteration are shown.

-- https://www.globenewswire.com/NewsRoom/AttachmentNg/e0310d6b-74a2-4de7-97f7-bd136823da59

Figure 4 Westward view of 2D resistivity models

recovered from the CSAMT data looking along the E-W structure from

Silica Ridge deposit towards the newly identified Windmill target.

-- https://www.globenewswire.com/NewsRoom/AttachmentNg/a0de2ed8-e2d3-40d3-a07d-0c7c63bd3ba0

About Sandman

In December 2020, Gold Bull purchased the

Sandman Project from Newmont. Gold mineralization was first

discovered at Sandman in 1987 by Kennecott and the project has been

intermittently explored since then. There are four known pit

constrained gold resources located within the Sandman Project,

consisting of 21.8Mt @ 0.7g/t gold for 494,000 ounces of gold;

comprising of an Indicated Resource of 18,550kt @ 0.73g/t gold for

433kozs of gold plus an Inferred Resource of 3,246kt @ 0.58g/t gold

for 61kozs of gold. Several of the resources remain open in

multiple directions and the bulk of the historical drilling has

been conducted to a depth of less than 100m. Sandman is

conveniently located circa 25-30 km northwest of the mining town of

Winnemucca, Nevada.

Qualified Person

Cherie Leeden, B.Sc Applied Geology (Honours),

MAIG, a “Qualified Person” as defined by National Instrument

43-101, has read and approved all technical and scientific

information contained in this news release. Ms. Leeden is the

Company’s Chief Executive Officer. Cherie Leeden relied on resource

information contained within the Technical Report on the Sandman

Gold Project, prepared by Steven Olsen, a Qualified Person under NI

43-101, who is a Qualified Persons as defined by the National

Instrument NI 43-101. Mr Olsen is an independent consultant and has

no affiliations with Gold Bull except that of an independent

consultant/client relationship. Mr Olsen is a member of the

Australian Institute of Geoscientists (AIG) and is the Qualified

Person under NI 43-101, Standards of Disclosure for Mineral

Projects.

Private Placement –Further Details

Further to the Company’s news release of

November 22, 2021 and the closing of its private placement for

gross proceeds of $6,140,500, the Company wishes to confirm the

insider participation in such financing. Two directors of the

Company subscribed in the aggregate for 600,000 units of the

Company for gross proceeds to the Company of $120,000. The

participation of such directors is considered a related party

transaction under MI 61-101. The participation is exempt from

formal valuation requirements under subsection 5.5(b) of MI 61-101

because the Company’s shares trade on the TSXV. Further, the

participation is exempt from the minority shareholder approval

requirements under subsection 5.7(1)(b) of MI 61-101 because the

participation of each of the directors is under the $2.5M threshold

for the exemption.

The Company also confirms that of the 688,800

finder warrants issued and $140,760 cash commissions paid as

compensation in connection with the private placement, such fees

were paid to dealer firms as follows: Haywood Securities Inc.

(489,000 finder warrants and $97,800); PI Financial Corp. (36,000

finder warrants and $7,200); Canaccord Genuity Corp. (118,800

finder warrants and $23,160); Red Cloud Securities Inc. (39,000

finder warrants and $11,400) and Richardson Wealth Limited (6,000

finder warrants and $1,200).

About Gold Bull Resources Corp.

Gold Bull’s mission is to grow into a US focused

mid-tier gold development Company via rapidly discovering and

acquiring additional ounces. The company’s exploration hub is based

in Nevada, USA, a top-tier mineral district that contains

significant historical production, existing mining infrastructure

and an established mining culture. Gold Bull is led by a Board and

Management team with a track record of exploration and acquisition

success.

Gold Bull’s core asset is the Sandman Project,

located in Nevada which has a 494,000 oz gold

resource as per 2021 43-101 Resource Estimate. Sandman is located

23 km south of the Sleeper Mine and boasts excellent large-scale

exploration potential. Drilling at Sandman is currently

underway.

Gold Bull is driven by its core values and

purpose which includes a commitment to safety, communication &

transparency, environmental responsibility, community, and

integrity.

Cherie LeedenPresident and CEO, Gold

Bull Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca or

email admin@goldbull.ca.

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop its projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the ability of the Company to obtain the necessary

permits and consents required to explore, drill and develop the

projects and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

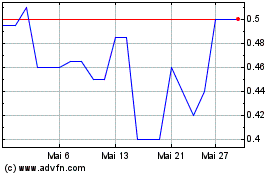

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024