Fredonia Mining Inc. (the

“Company” or

“Fredonia”) (TSXV: FRED), is pleased to announce

that it has received the remaining assays from the recently

completed drilling programme at the Company’s El Dorado Monserrat

(

“EDM”) property, located in Santa Cruz,

Argentina.

As previously reported, 10 HQ diamond drill core

holes were drilled at LH, with a further drill hole on the ‘Gladys’

prospect, 4.5 km to the northwest. In total 11 holes were drilled

for 2,482.80m.

"We are extremely

pleased and encouraged with the results obtained in the recent

drilling campaigns,” commented Estanislao Auriemma, CEO of

Fredonia. “The drilling results confirm the presence of high grades

and the possibility for increases in both the strike and depth

potential at La Herradura; especially at depth confirming and

further increasing the economic potential of La Herradura. We

anticipate that drilling will recommence in October and will focus

on confirming the extensions of the prospect's mineralization and

grades. Drilling in October is also designed to test other

prospective areas within EDM. The primary objective remains to

confirm and increase the overall potential of the El Dorado

Monserrat property and advance LH and the Main Veins to a compliant

maiden resource.”

Table of the completed June 2022 drill

program

|

|

Easting |

Northing |

Azimuth |

Dip |

EOH |

|

HDDH035 |

2532104 |

4632889 |

8 |

-45 |

175.00 |

|

HDDH036 |

2532272 |

4632780 |

10 |

-45 |

250.00 |

|

HDDH037 |

2532089 |

4632829 |

10 |

-45 |

278.50 |

|

HDDH038 |

2532252 |

4632729 |

10 |

-50 |

338.50 |

|

HDDH039 |

2532252 |

4632728 |

190 |

-70 |

200.00 |

|

HDDH040 |

2532380 |

4632820 |

10 |

-60 |

305.00 |

|

HDDH041 |

2532468 |

4632796 |

8 |

-60 |

292.80 |

|

HDDH042 |

2531906 |

4632716 |

180 |

-60 |

152.00 |

|

HDDH043 |

2532583 |

4632833 |

8 |

-50 |

212.50 |

|

HDDH044 |

2531871 |

4632640 |

0 |

-45 |

68.50 |

|

GLDDH001 |

2530352 |

4636731 |

30 |

-60 |

210.00 |

|

Total |

|

|

|

|

2482.80 |

The Fredonia technical team is now focussed on

the interpretation of the drill sections and the assimilation of

this information with the assays in order to plan a further drill

programme targeting the potential high grade extensions.

The Company anticipates drilling at LH will

recommence in October. Preparations are already underway for this

2,500m follow-up drilling phase, which will also include further

exploration drilling on other areas considered prospective targets

on the EDM property.

Drill holes have intercepted hydrothermal

breccias, veins and stockworks, hosted in a phreatomagmatic

breccias, felsic domes and dykes that intrude the andesite flows

which form the country rock.

The geological model for the mineralisation

being developed by the exploration team is constantly being refined

as drilling and mapping information is integrated. The data

continues to support the presence of a potential diatreme

surrounded by an extensive brecciated host system, the dimensions

of which are as yet undefined being geologically open in all

directions. The Fredonia geological team believe further drilling

is warranted to define this model and extend the zone of known

mineralisation.

The final assay results for all the drill holes

at LH are now available. The significant intersections are tabled

below. The drilling has added additional credibility that the

potential for a large tonnage Au-Ag occurrence with included high

grade zones exists at LH.

The results to date further support and indicate

the geological model of a low sulphidation epithermal Au-Ag

mineralised system within an extensive lower grade breccia halo

hosted in a predominantly andesitic, variably brecciated

formation.

Table of best intersections

|

Hole ID |

From |

To |

Interval |

Au Eq g/t |

Au g/t |

Ag g/t |

|

HDDH035 |

99.7 |

101 |

1.3 |

2.09 |

1.93 |

13.62 |

|

HDDH035 |

120 |

120.5 |

0.5 |

3.71 |

3.28 |

37.59 |

|

HDDH036 |

66.8 |

105 |

38.2 |

0.42 |

0.34 |

6.76 |

|

including |

77.7 |

78.2 |

0.5 |

3.78 |

3.55 |

19.81 |

|

HDDH036 |

180.6 |

181.2 |

0.6 |

2.23 |

1.65 |

50.99 |

|

HDDH036 |

220.4 |

221.5 |

1.1 |

3.27 |

2.52 |

65.37 |

|

HDDH036 |

224 |

225 |

1 |

5.39 |

4.89 |

43.40 |

|

including |

224 |

224.5 |

0.5 |

9.40 |

8.54 |

75.61 |

|

HDDH037 |

162 |

176.5 |

14.5 |

1.06 |

0.91 |

12.69 |

|

including |

163.1 |

164.2 |

1.1 |

2.29 |

1.91 |

33.16 |

|

and |

166 |

166.5 |

0.5 |

8.33 |

7.57 |

66.19 |

|

and |

176 |

176.5 |

0.5 |

6.94 |

6.26 |

59.39 |

|

HDDH037 |

189 |

190 |

1 |

1.98 |

1.73 |

21.59 |

|

HDDH038 |

34 |

55 |

21 |

0.99 |

0.91 |

7.43 |

|

including |

42 |

42.6 |

0.6 |

4.70 |

4.53 |

14.53 |

|

and |

51.5 |

54 |

2.5 |

3.01 |

2.91 |

8.42 |

|

HDDH038 |

92 |

124.15 |

32.15 |

0.91 |

0.81 |

8.83 |

|

including |

101 |

102 |

1 |

2.27 |

2.10 |

14.70 |

|

and |

114 |

114.5 |

0.5 |

7.24 |

6.49 |

65.29 |

|

and |

116 |

116.64 |

0.64 |

13.61 |

12.83 |

68.39 |

|

and |

123.6 |

124.15 |

0.55 |

2.22 |

2.12 |

9.04 |

|

HDDH038 |

216 |

260 |

44 |

0.85 |

0.73 |

10.62 |

|

including |

234.5 |

235.1 |

0.6 |

6.34 |

5.85 |

42.88 |

|

and |

244.8 |

246.5 |

1.7 |

5.26 |

4.35 |

79.95 |

|

and |

248 |

249.3 |

1.3 |

2.98 |

2.93 |

4.76 |

|

HDDH038 |

251 |

251.5 |

0.5 |

4.93 |

4.87 |

5.33 |

|

Not previously reported |

|

HDDH039 |

107.5 |

108 |

0.5 |

1.58 |

1.52 |

5.61 |

|

HDDH040 |

99 |

104.5 |

5.5 |

0.87 |

0.59 |

24.53 |

|

HDDH040 |

131.5 |

164.6 |

33.1 |

0.45 |

0.35 |

9.21 |

|

including |

157 |

157.5 |

0.5 |

4.20 |

3.68 |

45.49 |

|

HDDH040 |

168.8 |

191 |

22.2 |

1.75 |

1.58 |

14.72 |

|

including |

174 |

175 |

1 |

9.79 |

9.53 |

22.39 |

|

and |

177.3 |

178 |

0.7 |

9.19 |

8.75 |

38.14 |

|

and |

180 |

180.65 |

0.65 |

5.57 |

4.69 |

77.30 |

|

and |

184 |

187 |

3 |

3.80 |

3.43 |

32.60 |

|

HDDH040 |

198 |

200 |

2 |

3.75 |

2.72 |

90.36 |

|

HDDH040 |

207 |

212 |

5 |

0.78 |

0.75 |

2.65 |

|

including |

209 |

210 |

1 |

3.04 |

2.96 |

7.16 |

|

HDDH040 |

219.5 |

227 |

7.5 |

0.49 |

0.45 |

3.23 |

|

including |

226 |

227 |

1 |

2.54 |

2.44 |

8.66 |

|

HDDH040 |

255 |

262 |

7 |

1.91 |

1.88 |

2.57 |

|

including |

255.5 |

255.9 |

0.4 |

26.70 |

26.47 |

20.16 |

|

HDDH041 |

40.5 |

63.7 |

23.2 |

0.35 |

0.29 |

5.18 |

|

including |

59.9 |

60.8 |

0.9 |

1.62 |

1.52 |

9.01 |

|

HDDH041 |

98.5 |

99.2 |

0.7 |

3.25 |

3.01 |

20.70 |

|

HDDH041 |

103.4 |

110.6 |

7.2 |

0.41 |

0.37 |

3.80 |

|

including |

110 |

110.6 |

0.6 |

2.70 |

2.57 |

11.11 |

|

HDDH041 |

116.8 |

121 |

4.2 |

0.75 |

0.70 |

3.99 |

|

HDDH043 |

161.6 |

163.4 |

1.8 |

0.37 |

0.30 |

5.83 |

|

HDDH044 |

60.5 |

62.5 |

2 |

0.53 |

0.49 |

3.28 |

1. Reported interval length are down hole widths

and not true widths.

2. Gold equivalent (“AuEq”) is calculated using

metal prices of US$ 1,750/oz for Au and US$ 20/oz for Ag. The

equation used is: AuEq g/t = Au g/t + (Ag g/t ÷ 87.5).

3. AuEq assumes Au recovery of 90%. The limited

metallurgical studies by Fredonia (selective Bottle rolls from Main

Veins material) have indicated high (>90%) recovery of gold in

oxide material. The Cerro Vanguardia mine to the east of EDM with

similar mineralisation reports recoveries in the high 90% for

Au.

The recent drilling continues to enhance the

resource potential at LH and the assays have confirmed the presence

of wide intersections of mineralised material with higher grade

inclusions. This is specifically evident in hole HDDH 40 with 7m @

1.88g/t Au with an included 0.4m @ 26.4g/t Au.

Historical drillholes in the same prospect area,

including previous drilling by Fredonia are:

Table of (selected) historic drill

intersections, La Herradura

|

Hole ID |

From |

To |

Interval |

Au g/t |

Ag g/t |

|

HDDH001 |

124.00 |

140.00 |

16.00 |

0.61 |

29.7 |

|

HDDH007 |

83.00 |

92.00 |

9.00 |

1.17 |

12.7 |

|

HDDH011 |

126.50 |

128.10 |

1.60 |

5.49 |

3.8 |

|

HDDH011 |

147.70 |

199.00 |

51.30 |

1.11 |

45.8 |

|

including |

174.00 |

177.00 |

3.00 |

3.29 |

93.1 |

|

HDDH013 |

68.00 |

163.70 |

95.70 |

0.90 |

10.3 |

|

including |

68.00 |

77.00 |

9.00 |

7.43 |

51.7 |

|

and |

149.70 |

180.00 |

30.30 |

0.72 |

32.9 |

|

HDDH015 |

139.00 |

153.50 |

14.50 |

0.86 |

20.5 |

|

HDDH022 |

150.00 |

168.00 |

18.00 |

1.16 |

14.7 |

|

HDDH023 |

109.80 |

110.50 |

0.70 |

9.26 |

70.4 |

|

HDDH027 |

216.00 |

229.00 |

13.00 |

1.38 |

83.7 |

Gold mineralisation is related to a quartz +

sericite alteration and minor bladed calcite and adularia,

interpreted as evidence of a boiling zone in an epithermal system.

The shallow and distal zones show a chlorite + hematite + pyrite

alteration, while in the deeper sections there are veins of platy

calcite + fluorite. Superimposed on the system is an alteration

halo of kaolinite + alunite and vuggy quartz, which occurs in

shallow and medium-deep sectors.

Drill hole (geological) interpretations are now

underway and once completed the updated interpretations of the LH

drill sections will assist in determining the hole by hole detail

of the next phase of drilling at LH. The objective of the follow-up

programme remains to advance LH towards a maiden resource

estimate.

The drill programme was primarily to target the

extensions, both down dip and along strike of the high grade

intervals in drill holes HDDH013 and HDDH011 and their potential

depth extensions. These historic drill holes are about 250m apart

along a defined roughly west – east strike of the mineralised trend

identified to date. The drill holes drilled further along strike to

the east, including HDDH40, 41 and 43 have geologically and

geochemically extended the mineralised trend by potentially 300m to

the east and remains open. Mineralisation is also identified to

depths of >200m.

The interpretation of the geological

intersections in holes HDDH 41 and 43 and the low ratio of Ag:Au

relative to the higher grades and ratios in HDDH40 may indicate

that there is potential at depth. If this is conclusive, step-backs

to HDDH41 and 43 are warranted as well as further deeper drilling

to the east. The IP survey conducted over the area last year also

indicates deeper IP anomalies to the east of drill hole HDDH40.

These vectors point to significant potential to the east and down

plunge.

Based on drill intersections to date the

mineralised system is interpreted to remain open in all directions

and Fredonia believes more drilling is warranted.

Drilling the southwest area of LH, specifically

holes DHHD39 and 44 has proved gold (and silver) mineralisation is

both present and remains open in the southern LH block, an area

which has not previously been targeted. This mineralisation hosted

in andesitic rock represents a new area for discovery.

A single drill hole, GLDDH001, targeted the

Gladys vein which outcrops over 1km located near the Abanico veins

which are a southern continuation of the Main Veins. Gladys

occupies a regional west northwest transtensional shear corridor. A

historical barite pit of 100m long and 8m wide, shows a dacitic

dike intruding in andesites, related to hydrothermal breccias and

veins, thickness up to 2.4m. Previous exploration

included sawn channel samples, which were anomalous in gold and

silver.

GLDDH001 is the first drilling carried out in

this corridor, and intercepted, from 86.0m, 4.0m@ 16.94g/t Ag, in a

fault zone filled with gouge, clays and chalcedonic clasts with

poor drill core recovery, gold values were generally low to below

level of detection.

Quality Assurance/Quality

Control

All core samples were submitted to the principal

Alex Stewart Laboratories in San Julián city for preparation, and

in Mendoza city for the analysis. Alex Stewart Laboratories is

independent of Fredonia. All samples were analysed for Au and Ag by

fire assay/ AA finish 50 g, plus a 39-element ICP-AR finish.

Fredonia followed industry standard procedures for the work with a

quality assurance/quality control (QA/QC) program. Blanks and

reference material of High grade/ Low grade Gold and High grade/

Low grade Silver standards were included with all sample shipments

to the principal laboratory. Field duplicates were made from coarse

reject. Fredonia detected no significant QA/QC issues during review

of the data. Mr. Marc J. Sale, is an independent qualified person

as defined by Canadian National Instrument 43-101 and has read and

approved the technical contents of this release.

Data Verification

Mr. Sale has previous experience with the EDM

property and the historical QA/QC procedures undertaken for the

preparation of previous results, and has previously conducted the

verification activities on drilling and sampling results described

in Fredonia’s technical report entitled “Technical Report on the El

Dorado-Monserrat Property In Santa Cruz Province, Argentina” dated

February 15, 2021 (the “EDM Technical Report”),

subject to the limitations described therein. Mr. Sale was not

physically present to inspect and take verification samples from

drill core in the most recent drilling campaign, but did conduct

desktop-based verification of drill results against data-base

information provided by management to ensure the assays results

presented are those in the database. Digital ‘original’ final assay

reports (certificates) were provided to the QP at the time of

disclosure for verification.

About Fredonia

Fredonia indirectly owns a 100% interest in

certain license areas (totalling approximately 18,300 ha.)

(collectively, the “Project”), all within the

Deseado Massif geological region in the Province of Santa Cruz,

Argentina, including the following principal areas: El Aguila,

approx. 9,100ha, Petrificados, approx. 3,000ha, and the flagship,

advanced El Dorado-Monserrat property covering approx. 6,200ha

located close to Anglo Gold Ashanti’s Cerro Vanguardia mine,

subject to a 1.5% net smelter return royalty on the EDM project,

0.5% net profits interest on Winki II, El Aguila I, El Aguila II

and Hornia (ex Petrificados).

For further information: Please

visit the Company website www.fredoniamanagement.com or contact:

Omar Salas, Chief Financial Officer, Direct: +1-416-846-7807,

Email: omar.salas@icloud.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain

“Forward-Looking Statements” within the meaning of applicable

securities legislation relating to the Company and the EDM project,

including statements regarding the prospectivity of the EDM project

for gold and silver mineralization, including the potential for

metal recoveries from any mineral processing activity, the

potential for a mineral resource estimate at the Project, and the

Company’s future exploration plans. Words such as “might”, “will”,

“should”, “anticipate”, “plan”, “expect”, “believe”, “estimate”,

“forecast” and similar terminology are used to identify forward

looking statements and forward-looking information. Such statements

and information are based on assumptions, estimates, opinions and

analysis made by the Company in light of its experience, current

conditions and its expectations of future developments as well as

other factors which it believes to be reasonable and relevant.

Forward-looking statements and information involve known and

unknown risks, uncertainties and other factors, including, without

limitation, the factors described in the Company’s filing statement

dated June 22, 2021 available on SEDAR at www.sedar.com under the

heading “Risk Factors” that may cause actual results to differ

materially from those expressed or implied in the forward-looking

statements and information and accordingly, readers should not

place undue reliance on such statements and information and the

Company can give no assurance that they will prove to be correct.

The statements in this press release are made as of the date of

this release. The Company undertakes no obligation to update

forward-looking statement made herein, or comment on analyses,

expectations or statements made by third parties in respect of the

Company or its securities, other than as required by law.

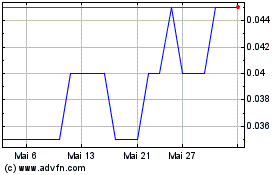

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Nov 2023 bis Nov 2024